- Home

- »

- Consumer F&B

- »

-

Coffee Beans Market Size & Share, Industry Report, 2030GVR Report cover

![Coffee Beans Market Size, Share & Trends Report]()

Coffee Beans Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Arabica, Robusta), By Application (Pharmaceuticals, Food, Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-299-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coffee Beans Market Summary

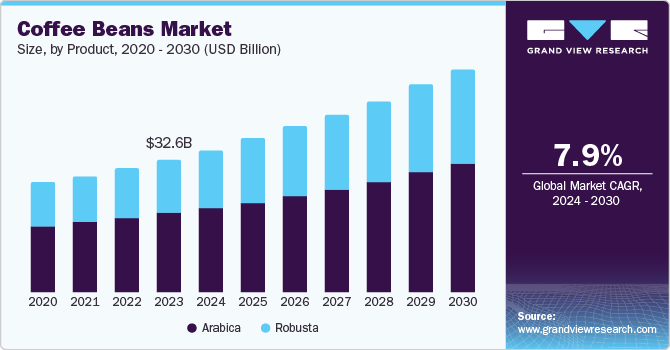

The global coffee beans market size was valued at USD 32.6 billion in 2023 and is projected to reach USD 55.0 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. Increasing trend of coffee consumption among youth globally, the increasing advent and penetration of franchise outlets such as Starbucks in economies of the Asia Pacific region and other developing countries, rising disposable income of the young generation, and a variety of drinks offered by cafes and restaurants are major market drivers.

Key Market Trends & Insights

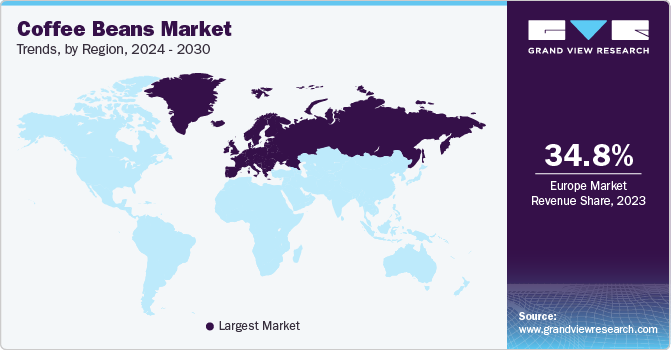

- Europe accounted for the highest revenue share of 34.8% in global coffee bean market in 2023.

- The U.S. coffee beans market experienced a substantial growth in 2023.

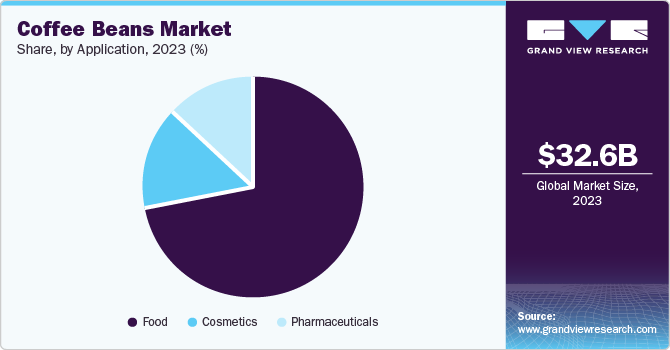

- By application, the food sector accounted for a significant revenue share of 72.2% in 2023.

- By product, the Arabica beans accounted for a largest revenue share of 59.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 32.6 Billion

- 2030 Projected Market Size: USD 55.0 Billion

- CAGR (2024-2030): 7.9%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

The application of coffee beans is not just confined to food and beverages sectors, but finds relevance in the pharmaceutical sector as well, as it contains antioxidants and is considered to help in weight management. Additionally, the cosmetics sector finds innovative usage applications of coffee beans, which is expected to further drive market growth by 2030.Asia Pacific economies are witnessing a surge in popularity of coffee among the youth population. This demographic is rapidly shifting its preference from tea to coffee. For instance, Starbucks and Café Coffee Day (CCD) are some famous coffee outlets fulfilling the growing demand for this beverage from younger Indians, especially college students and working professionals. Looking at the growth prospects, new players are entering the market every year. Increasing disposable income is a prime factor contributing to this demand, especially for premium-priced beverages. The growing urbanization and influence of Western culture via social media platforms have resulted in cross-cultural adaptation, further boosting industry expansion.

Coffee contains caffeine and tannin. The consumption of caffeine leads to feeling of enhanced alertness, due to the suppression of adenosine receptors. Tannin contains some antioxidants, which fight off free radicals and prevent diseases. Increasing awareness about benefits of coffee through various advertising campaigns has led to increased awareness among the global population about its health benefits. Unlike tea, coffee is served in a variety of types and combinations, such as cold coffee, hot coffee, Americano, Cappuccino, Latte, Mocha, and espresso. This variety caters to needs of a wide range of population, which in turn increase its demand.

Product Insights

Arabica beans accounted for a largest revenue share of 59.8% in 2023 attributed to specific qualities associated with Arabica. For instance, Arabica coffee has a sweeter, smoother taste with flavor notes of chocolate and sugar. The caffeine content in it is also lesser compared to Robusta, which is generally bitter due to extra caffeine content. Arabica cultivation is comparatively difficult and is sold at a premium price in comparison to Robusta, resulting in its larger share in global coffee production.

Robusta beans are expected to advance at a faster CAGR of 8.6% over the forecast period. Robusta beans contain more caffeine, less natural sugars, and lipids than Arabica, making them a preferred choice for morning coffee drinkers. They are comparatively easy to harvest, sturdy, resistant to pests and diseases, and require fewer resources than Arabica. They are mainly grown in Africa, Indonesia, Vietnam, and India. They are preferred for making pre-ground, instant coffee powders. Café owners generally use a blend of both types of coffee beans to make beverages. This results in a combination of good properties of both types, making for a balanced beverage.

Application Insights

The food sector accounted for a significant revenue share of 72.2% in 2023 owing to the large consumption of coffee beans in beverages. These beans are also used in cakes, candies, cookies, and muffins, which is expected to impact market growth positively. Health-conscious consumers prefer black coffee, which is made with hot water and espresso. It contains no added sugar or milk and has a high concentration of caffeine, which triggers attentiveness. Cold coffee is made with additions into espresso in terms of frothy milk, added sugar, and various customizations. With increased penetration of fast-food chains, coffee consumption is expected to increase in the near future, which will cause a surged demand for coffee beans.

The pharmaceuticals sector is poised to advance at the fastest CAGR of 10.9% during the forecast period. This is attributed to increased awareness regarding the health benefits of coffee consumption. For instance, green coffee beans with high amounts of antioxidants are consumed to manage weight and enhance metabolism, which is expected to fuel their demand. Studies have proved that Type 2 diabetes can be lowered by consumption of coffee in the long run. Brain-related diseases such as Alzheimer’s and Parkinson’s can be effectively controlled by consumption of coffee. Additionally, liver and heart health can be managed by consuming an optimum amount of coffee regularly.

Regional Insights

Europe accounted for the highest revenue share of 34.8% in global coffee bean market owing to Europe’s deep-rooted coffee culture. Coffee was introduced in Europe as early as seventeenth century. The coffee culture has proliferated to different parts of Europe since then, making it a part of the daily life of Europeans. A significantly high disposable income and wide network of cafes have made way for specialty coffee and sophisticated brewing methods. This in turn makes Europe a promising market for coffee beans.

The UK was first European nation to embrace the culture of coffee drinking on a commercial basis as early as 17th century. First coffeehouse in the UK was opened in Oxford in 1652. Since then the coffee culture has gained popularity across the nation. Costa, Starbucks, and Tim Hortons are some of the most popular café brands in the UK. The British Coffee Association (BCA) lobbies the UK government and media to create a favorable environment for the coffee trade. They address regulatory issues, sustainability concerns, and anything that might impact the industry's health.

North America Coffee Beans Market Trends

North America accounted for a significant market share in 2023 attributed to the presence of a large number of chains of restaurants and cafes offering coffee to customers. For instance, Starbucks, Dunkin’, and Tim Hortons are the major chain of cafes in North America. Additionally, growing demand for coffee vending machines at public places, railway stations, and airports, and surging demand from the college going youth and working population, are anticipated to further drive market growth.

U.S. Coffee Beans Market Trends

The U.S. coffee beans market experienced a substantial growth in 2023 owing to an increasing disposable income and growing young population. The U.S. is home to the largest chain of restaurants and cafes. The fast food culture in the nation further elevates the demand for beverages. Coffee, being one of the favorite among youth while having food, has huge sales volume in U.S. The shifting focus on organic and naturally grown coffee concerning health benefits is expected to propel segment demand. Researches for finding newer applications of coffee in cosmetics are in progress at a rapid pace and this is expected to positively impact the market.

Asia Pacific Coffee Beans Market Trends

The Asia Pacific market has been identified as one of the fastest growing at a CAGR of 10.0% during the forecast period attributed to the budding café culture in India and China. Globalization has led to cross-cultural exchange, and the youth in regional economies are increasingly adopting Western culture in their food and drinking habits. A significant volume of coffee beans is produced in these countries and a large amount is exported to other countries, contributing to their forex reserves.

Café Coffee Day, Barista, and Starbucks have well-established café networks in India. CCD leads the market with over 1300 outlets throughout the country. Karnataka state is largest producer of high-quality coffee beans in India. With rising income levels and rapid urbanization, youth in India are shifting their preferences from tea to coffee, translating to surged demand for coffee in urban areas. The status symbol associated with drinking high-priced coffee from premium café is further propelling the demand.

Key Coffee Beans Company Insights

Some of the key companies involved in the coffee beans market include Hawaii Coffee Company; Death Wish Coffee; and illycaffè S.p.A.

-

Hawaii Coffee Company is based in Hawaii, specializing in high-quality coffee blends made with only Arabica beans and distinctive Hawaiian-inspired flavors. The company offers a range of coffee products, including variety of roasts, flavored coffees, cold brews, and subscriptions. The brands associated with Hawaii Coffee Company are Lion Coffee, Royal Kona, and Hawaiian Isles.

-

illycaffè S.p.A., also known as illy, is an Italian coffee company. The company makes coffee from nine varieties of Arabica beans. It also offers coffee machines, designer cups (the illy Art collection), and accessories. Globally, they market their coffee in red and silver cans, preserving the authentic taste of coffee.

Key Coffee Beans Companies:

The following are the leading companies in the coffee beans market. These companies collectively hold the largest market share and dictate industry trends.

- La Colombe Torrefaction, Inc.

- Hawaii Coffee Company

- Death Wish Coffee

- illycaffè S.p.A.

- Coffee Bean International, Inc.

- The Bean Coffee Company

- Luigi Lavazza S.p.A.

- Caribou Coffee

- Peet's Coffee, Inc.

- Kicking Horse Coffee Co. Ltd.

Recent Developments

-

In May 2024, Italian coffee company Lavazza announced the acquisition of Stirlingshire Vending (Scotland) Limited. The deal is expected to strengthen the coffee vending machine business of Lavazza Professional, the coffee machine business unit of Luigi Lavazza S.p.A.

-

In April 2024, Italian coffee company Lavazza announced the imminent acquisition of vending machine maker IVS. With this, Lavazza plans to strengthen the vending machine business of IVS in the European market.

Coffee Beans Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.9 billion

Revenue Forecast in 2030

USD 55.0 billion

Growth Rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Kicking Horse Coffee Co. Ltd.; Death Wish Coffee; The Bean Coffee Company; La Colombe Torrefaction, Inc.; Coffee Bean International, Inc.; illycaffè S.p.A.; Luigi Lavazza S.p.A.; Caribou Coffee; Hawaii Coffee Company; Peet's Coffee, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Beans Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coffee beans market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Arabica

-

Robusta

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Food

-

Cosmetics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.