- Home

- »

- Beauty & Personal Care

- »

-

Coffee Beauty Products Market Size & Share Report, 2030GVR Report cover

![Coffee Beauty Products Market Size, Share & Trends Report]()

Coffee Beauty Products Market Size, Share & Trends Analysis Report By Product (Skincare, Haircare), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-302-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Coffee Beauty Products Market Trends

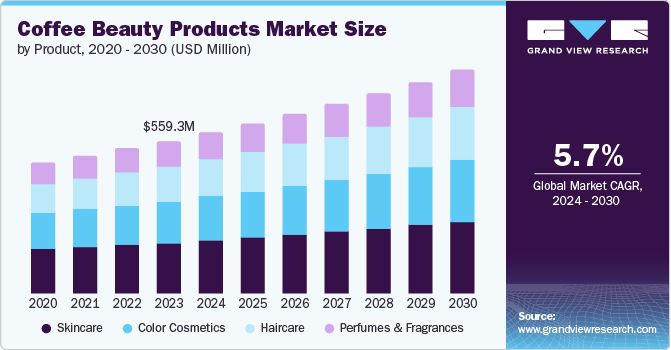

The global coffee beauty products market size was valued at USD 559.3 million in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The increasing awareness among consumers about natural and organic skincare products, the benefits of caffeine for the skin, and the anticipated advantages of coffee bean extract are some of the key growth factors for this industry. Growing awareness regarding the benefits of coffee-based beauty products in combating early aging signs, wrinkles, and environmental damage has driven the demand for coffee beauty products.

Coffee beauty products are available in various forms, such as balms, oils, creams, lotions, and others. Some of the key ingredients used in the formulation of these products are coffee grounds, coconut oil, caffeine, hyaluronic acid, and vitamins. Ease of availability, enhanced branding strategies embraced by the key companies in the market, endorsements by social media influencers and celebrities, efficient distribution strategies adopted by the brands, and an increase in awareness regarding skin care are some of the factors that are expected to generate greater demand for the company.

The growing demand for natural and organic beauty-care products, rising mindfulness regarding ill-effects caused by the chemicals used in cosmetics, and the emergence of online platforms by cosmetic companies and e-commerce businesses are projected to propel growth for the market during the forecast period. Easy accessibility through pharmacies, supermarkets, hypermarkets, specialty stores, and convenience stores has also contributed to the market's growth.

Product Insights

The skincare segment dominated the global market and accounted for a share of 33.7% in 2023. Growth of this segment is attributed to a rise in awareness regarding skin-care regimes, a growing number of users adopting personal care practices, and a diverse range of products offered by the key brands operating in the category. The rapid increase in demand for personalized and natural beauty products is also shaping the rise in demand for this segment.

Haircare segment is expected to experience the fastest CAGR of 6.3% from 2024 to 2030. Changed lifestyles, growing air pollution levels and water pollution levels in urbanized areas, and damages developed by environmental changes have led to increased demand for haircare products. However, in recent years, consumers have preferred organic & natural haircare products, such as coffee-based hair care products such as shampoos, hair fall control kits, and hair masks. This trend coupled with a diverse range of coffee-based haircare products offered by the key market participants is expected to drive growth for this market.

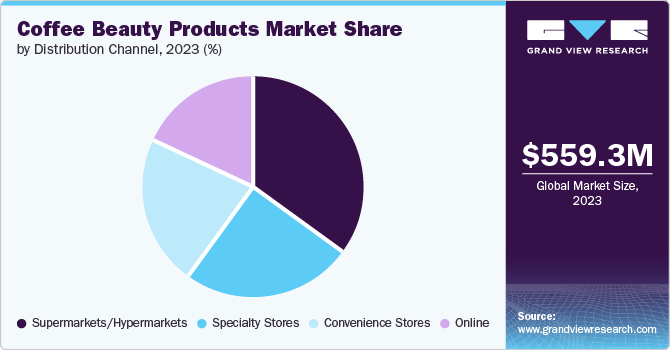

Distribution Channel Insights

Supermarkets/hypermarkets segment accounted for the largest revenue share in 2023. This is attributed to the growing prominence of private brand offerings and promotions. The brands are increasingly choosing offline channels such as supermarkets to attain enhanced brand visibility. The unmatched footfall experienced by the supermarkets/hypermarkets, easy accessibility, discounts and offers provided by the retail store brands are some of the main aspects that have contributed to the growth of this segment in recent years.

Online segment is expected to experience the fastest CAGR during the forecast period. The presence of multiple online brand stores and multiple e-commerce websites have been driving growth for the cosmetics industry across the world. The online shopping experience is preferred by many consumers due to several additional services provided by the online retail platforms such as doorstep delivery, refund & return policy, display of detailed product descriptions, availability of reviews posted by previous users, multiple payment alternatives and heavy discount offers. These aspects are expected to generate greater demand for this segment in the approaching years.

Regional Insights

North America coffee beauty products market dominated the market in 2023 with a revenue share of 32.8%. Some of the key growth drivers for this regional market are the growing adoption of natural and organic beauty products, increasing availability of coffee-based beauty products offered by global cosmetic brands, a rise in a number of skin and hair health problems caused by changed lifestyles, and presence of major market participants in the region.

U.S. Coffee Beauty Products Market Trends

The U.S. held a significant revenue share of the regional coffee beauty products market in 2023. This market is primarily driven by factors such as changing lifestyles leading to higher demand for natural skincare products and a rising number of health practitioners and skin health specialists recommending the use of organic products over ones with synthetic ingredients. Additionally, ease of availability achieved through convenience stores and supermarkets, entry of multiple international brands in the domestic marketplace, endorsements by celebrities and impactful marketing strategies adopted by the key brands are expected to drive growth for this market.

Europe Coffee Beauty Products Market Trends

Europe coffee beauty products market was identified as a lucrative region in 2023. Presence of multiple key brands from the cosmetic industry in the region has developed a trend of early adoption. The enhanced awareness regarding personal care practices, rising adoption of skincare regimes, availability of multiple coffee beauty products in the region, new product launches by the major players, and growing penetration of the online platforms are some of the aspects that are expected to drive demand for this regional industry in upcoming years.

The coffee beauty products market in the UK is projected to experience a noteworthy CAGR during the forecast period. This market is primarily driven by factors such as the presence of numerous cosmetics manufacturers in the Europe region, growing adoption of organic products for haircare and skincare, rising disposable income, and ease of accessibility.

Asia Pacific Coffee Beauty Products Market Trends

Asia Pacific coffee beauty products market is anticipated to witness significant growth from 2024 to 2030. This growth is attributed to factors such as the increasing population of millennials, growing expenditure on personal care, rising income levels, entry of multiple international cosmetic brands, increasing penetration of online platforms, and growing awareness regarding the use of natural or organic products.

China coffee beauty products market held a substantial revenue share in 2023. This market is mainly driven by the changing lifestyles, growing expenditure on personal care and cosmetic products, presence and availability of numerous global brands operating in the industry, ease of availability, rising awareness about skin care and wellbeing, and diverse range of products offered by the major market participant.

Key Coffee Beauty Products Company Insights

Some of the key companies in the coffee beauty products market include L’Oreal Paris(L'Oréal S.A.), Ogx (Vogue International LLC), mcaffeine (PEP Technologies Pvt. Ltd.), The Estée Lauder Companies Inc., and others. Owing to the competition landscape of the industry, the key brands have been adopting strategies such as collaboration, innovation backed by improved research & development, new product launches, collaborations, portfolio expansions, and effective distribution.

-

L'Oreal Paris, one of the prominent brands by L'Oréal S.A., offers wide range of products including skincare, hair care, hair color, makeup, vital beauty tools, and others. The coffee beauty portfolio of the company includes L'Oreal Paris Pure-Sugar Coffee Scrub for Rough Skin and the L'Oreal Paris Wake-Up Coffee Face and Lip Scrub.

-

Ogx, a brand by Vogue International LLC plays vital role in hair care industry. The prime offerings of the brand are shampoo, conditioner, treatments, stylers, body wash and body lotion. Coffee beauty portfolio of the brand includes Coconut Coffee Body Cream and Coconut Coffee Body Scrub.

Key Coffee Beauty Products Companies:

The following are the leading companies in the coffee beauty products market. These companies collectively hold the largest market share and dictate industry trends.

- L’Oreal Paris(L'Oréal S.A.),

- Ogx (Vogue International LLC),

- mcaffeine (PEP Technologies Pvt. Ltd.)

- The Estée Lauder Companies Inc.

- Avon Products

- The Body Shop

- The Beauty Co. India

- Java Skin Care

- Bean Body

- BioCare Ltd.

Recent Developments

-

In June 2024, The Estée Lauder Companies Inc. completed acquisition of a Canada-based, multi-brand company; DECIEM Beauty Group Inc. The Estée Lauder Companies Inc. started investing in DECIEM in 2017, increased its stake in 2021 and in 2024 exercised its choice to acquire the remaining stake.

Coffee Beauty Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 589.1 million

Revenue forecast in 2030

USD 819.8 million

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, South Africa

Key companies profiled

L’Oreal Paris(L'Oréal S.A.); Ogx (Vogue International LLC); mcaffeine (PEP Technologies Pvt. Ltd.); The Estée Lauder Companies Inc.; Avon Products; The Body Shop; The Beauty Co. India; Java Skin Care; Bean Body; BioCare Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Beauty Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coffee beauty products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skincare

-

Haircare

-

Perfumes & Fragrances

-

Color Cosmetics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."