- Home

- »

- Consumer F&B

- »

-

Coffee Pods Market Size, Share And Trends Report, 2030GVR Report cover

![Coffee Pods Market Size, Share & Trends Report]()

Coffee Pods Market (2025 - 2030) Size, Share & Trends Analysis Report By Category (Caffeinated, Decaffeinated), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-474-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coffee Pods Market Summary

The global coffee pods market size was estimated at USD 40.49 billion in 2024 and is projected to reach USD 58.19 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The rising demand and consumption of coffee pods can be attributed to several key factors, with convenience and time-saving being at the forefront.

Key Market Trends & Insights

- Europe coffee pods market accounted for a revenue share of 39.1% in 2023.

- The coffee pods market in the U.S. is exoected to grow at a significant CAGR over the forecast period.

- By category, the caffeinated coffee pods segment accounted for a revenue share of 76.5% in 2023.

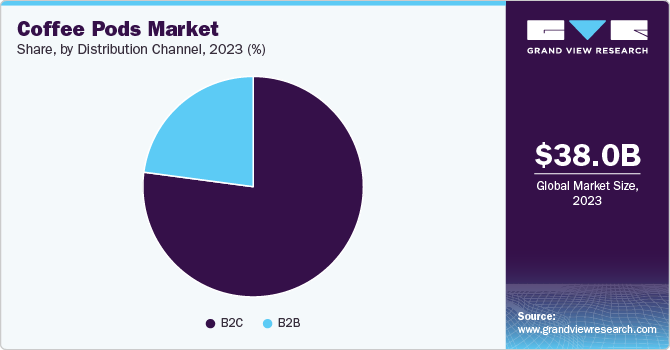

- By distribution channel, the B2C segment accounted for a revenue share of 77.1% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 40.49 Billion

- 2030 Projected Market Size: USD 58.19 Billion

- CAGR (2025-2030): 6.1%

- Europe: Largest market in 2023

Coffee pods offer a quick, hassle-free way to brew a single cup of coffee, making them ideal for busy consumers who prioritize efficiency. In today’s fast-paced lifestyle, the ability to prepare coffee within seconds without the need for measuring or grinding coffee beans is highly appealing. This ease of use has become a major driver of coffee pod adoption, particularly among individuals who seek convenience in their daily routines.Another important factor is the consistent quality that coffee pods provide. Each pod is pre-measured and sealed, ensuring that every cup has the same flavor and aroma, which can be difficult to achieve with traditional coffee brewing methods. This consistency in taste and quality gives consumers confidence in their choice, making coffee pods a reliable option. Moreover, the variety of flavors and options available through pod systems is extensive. From espresso to decaf and flavored coffee options, consumers enjoy the ability to experiment with different types of coffee, offering a customizable experience that feels such as a café-style treat at home.

The growing trend of home-brewing has also contributed to the increasing popularity of coffee pods. With more people working from home or preferring to brew coffee at home, there has been a significant rise in the use of coffee pod machines. These machines are now seen as an investment to replicate the café experience. In addition, technological advancements in coffee pod machines have enhanced the overall brewing experience, offering features such as temperature control and frothing, appealing to coffee enthusiasts who value precision and quality in their coffee-making process.

In addition, sustainability efforts have played a role in increasing demand. Some coffee brands have responded to environmental concerns by introducing recyclable or biodegradable coffee pods, attracting eco-conscious consumers. The expanding global coffee culture has also fueled the demand for premium coffee experiences, further driving the adoption of coffee pods among consumers looking for gourmet coffee that’s quick and easy to prepare at home. Overall, the combination of convenience, variety, quality, and evolving consumer preferences continues to drive the growth of the coffee pod market.

Category Insights

Caffeinated coffee pods accounted for a revenue share of 76.5% in 2023. With the rise of coffee culture globally, especially in urban areas, more consumers are adopting coffee pods as a way to enjoy a premium coffee experience at home. Caffeinated options are popular as they offer the energy boost people seek in their daily routines. Caffeinated coffee pods offer a quick, easy, and mess-free brewing option. Busy consumers appreciate the convenience of making a single cup of coffee in just a few minutes without the need for grinding beans or cleaning up.

Decaffeinated coffee pods market is expected to grow at a CAGR of 6.7% from 2024 to 2030. As coffee becomes a more versatile beverage, decaffeinated options allow people to enjoy it at any time of day without worrying about disrupting their sleep or increasing anxiety, making it appealing for evening or late-night consumption. Many coffee brands now offer decaffeinated pods in a wide range of flavors, blends, and single-origin options, making them more appealing to consumers who prefer premium coffee experiences but want to avoid caffeine.

Distribution Channel Insights

B2C accounted for a revenue share of 77.1% in 2023 in the coffee pods market. With the growth of co-working spaces and shared office environments, coffee pods have become an increasingly popular choice due to their versatility, ease of use, and ability to cater to varying preferences among users in such environments. Coffee pods offer a quick and efficient way to provide high-quality coffee in office environments without the need for extensive brewing equipment or barista services. Businesses appreciate the time-saving benefits and ease of use, especially in busy work settings.

B2B is expected to grow with a CAGR of 5.6% from 2024 to 2030. Coffee pods provide an easy, quick, and mess-free way for consumers to enjoy high-quality coffee at home. With a busy lifestyle, many individuals prefer the simplicity of single-serve pods over traditional brewing methods, making them a popular choice in households. The rise of online retail and subscription services allows consumers to purchase coffee pods with ease and convenience. Subscription models often offer regular deliveries and discounts, driving increased consumption through direct-to-consumer channels.

Regional Insights

North America coffee pods market is expected to grow at a CAGR of 6.1% from 2024 to 2030. Many North American consumers lead fast-paced lives and prefer the convenience that coffee pods offer. With the ability to brew a quick, mess-free cup of coffee in minutes, pods cater to the need for efficiency without compromising on taste. The widespread adoption of single-serve coffee machines, such as Keurig and Nespresso, in homes and offices across North America has fueled the demand for coffee pods. These machines make it easy for consumers to enjoy high-quality coffee with minimal effort.

U.S. Coffee Pods Market Trends

The coffee pods market in the U.S. is growing. As the coffee culture grows in North America, consumers are looking to replicate the café experience at home. Coffee pods offer a wide range of premium options, including specialty roasts and flavors, which appeal to coffee enthusiasts seeking variety and quality. With the growth of co-working spaces and shared office environments, coffee pods have become an increasingly popular choice due to their versatility, ease of use, and ability to cater to varying preferences among users in such environments.

Europe Coffee Pods Market Trends

Europe coffee pods market accounted for a revenue share of 39.1% in 2023. Europe has a long-standing tradition of coffee consumption, with a strong café culture in countries such as Italy, France, and Spain. Coffee pods allow consumers to replicate the high-quality, barista-style coffee experience at home, fueling demand for premium and specialty coffee options in a convenient format. In addition, European consumers are increasingly discerning about the quality of their coffee. Coffee pods offer a wide range of options, from single-origin to organic and fair-trade varieties, catering to the growing demand for premium, artisanal coffee experiences in the comfort of home.

Asia Pacific Coffee Pods Market Trends

Asia Pacific coffee pods market is expected to grow at a CAGR of 6.9% from 2024 to 2030. Traditionally a tea-drinking region, parts of Asia Pacific, especially countries such as China, Japan, and South Korea, are witnessing a growing coffee culture. As coffee becomes more popular in daily life, consumers are turning to coffee pods for the convenience and variety they provide, catering to both casual drinkers and coffee enthusiasts.

Key Coffee Pods Company Insights

The coffee pods market is characterized by dynamic competitive dynamics shaped by a combination of factors including category innovation, regional production+ capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality category.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the types used while strictly adhering to international regulatory standards.

Key Coffee Pods Companies:

The following are the leading companies in the coffee pods market. These companies collectively hold the largest market share and dictate industry trends.

- Keurig Dr Pepper Inc.

- Nestlé S.A.

- The Kraft Heinz Company

- Starbucks Corporation

- Peet's Coffee

- JDE Peet's

- Illycaffè S.p.A.

- Caffè Nero

- Costa Coffee

- Tim Hortons

Recent Developments

-

In April 2024, Nestlé launched its Nespresso brand in India to cater to the growing consumer demand for single-serve coffee, marking India as one of its fastest-growing coffee markets. The launch will begin with a core range of Nespresso products available through e-commerce channels and a branded boutique in Delhi, with plans for additional physical stores in other cities.

Coffee Pods Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.18 billion

Revenue forecast in 2030

USD 58.19 billion

Growth rate (Revenue)

CAGR of 6.1% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Keurig Dr Pepper Inc.; Nestlé S.A.; The Kraft Heinz Company; Starbucks Corporation; Peet's Coffee; JDE Peet's; Illycaffè S.p.A.; Caffè Nero; Costa Coffee; Tim Hortons

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Pods Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global coffee pods market report on the basis of category, distribution channel, and region.

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Caffeinated

-

Decaffeinated

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

Cafes

-

Hotels & Restaurants

-

Offices

-

Bakeries and coffee shops

-

Others

-

-

B2C

-

Grocery Stores/Supermarkets

-

Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Online Direct-to-Consumer (DTC)

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global coffee pods market size was estimated at USD 38.01 billion in 2023 and is expected to reach USD 40.49 billion in 2024.

b. The global coffee pods market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 58.19 billion by 2030.

b. Decaffeinated coffee pods are expected to growth with a CAGR of 6.7% from 2024 to 2030. Many consumers are becoming more health-conscious and looking to reduce their caffeine intake, especially in the evenings or for medical reasons. Decaffeinated coffee allows them to enjoy the taste and experience of coffee without the stimulating effects of caffeine.

b. Some key players operating in coffee pods market include Keurig Dr Pepper Inc., Nestlé S.A., The Kraft Heinz Company, Starbucks Corporation, and others.

b. Key factors that are driving the market growth include rising coffee consumption and increasing café culture among youngsters

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.