- Home

- »

- Next Generation Technologies

- »

-

Cognitive Electronic Warfare Market Size Report, 2033GVR Report cover

![Cognitive Electronic Warfare Market Size, Share & Trends Report]()

Cognitive Electronic Warfare Market (2025 - 2033) Size, Share & Trends Analysis Report By Function (Electronic Attack, Electronic Support), By Component (Hardware, Software), By Platform (Land, Airborne), By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-714-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cognitive Electronic Warfare Market Summary

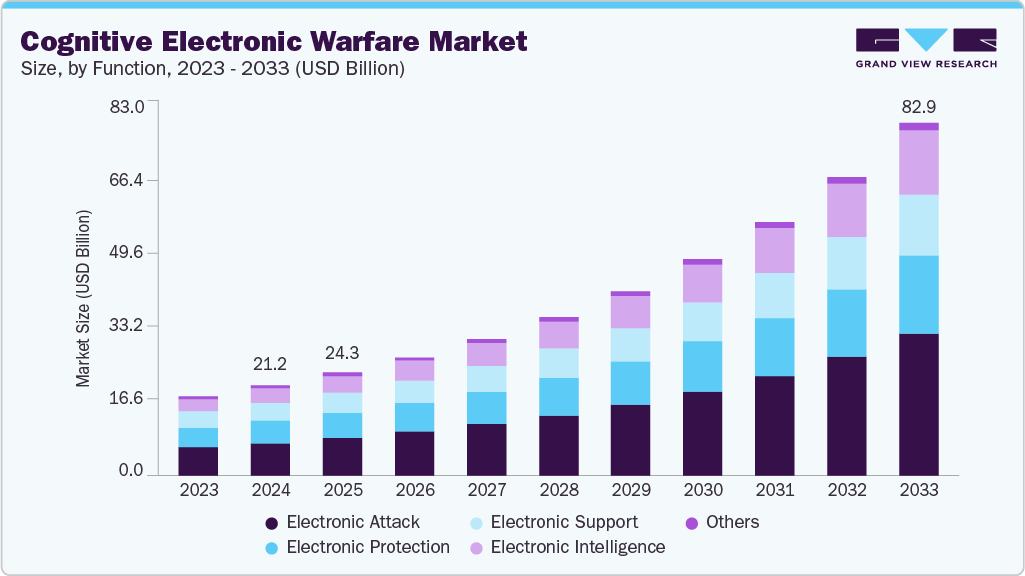

The global cognitive electronic warfare market size was estimated at USD 21.24 billion in 2024 and is projected to reach USD 82.99 billion by 2033, growing at a CAGR of 16.6% from 2025 to 2033. This growth is driven by the rising adoption of Artificial Intelligence (AI) and Machine Learning (ML), the growing need for enhanced situational awareness in complex and contested environments, and growth in multi-domain operations requiring seamless interoperability.

Key Market Trends & Insights

- North America dominated the global cognitive electronic warfare industry with the largest revenue share of 39.4% in 2024.

- The cognitive electronic warfare industry in the U.S. led the North America market and held the largest revenue share in 2024.

- By function, electronic attack led the market, holding the largest revenue share of 36.5% in 2024.

- By component, the hardware segment held the dominant position in the market in 2024.

- By platform, the airborne segment held the dominant position in the market in 2024.

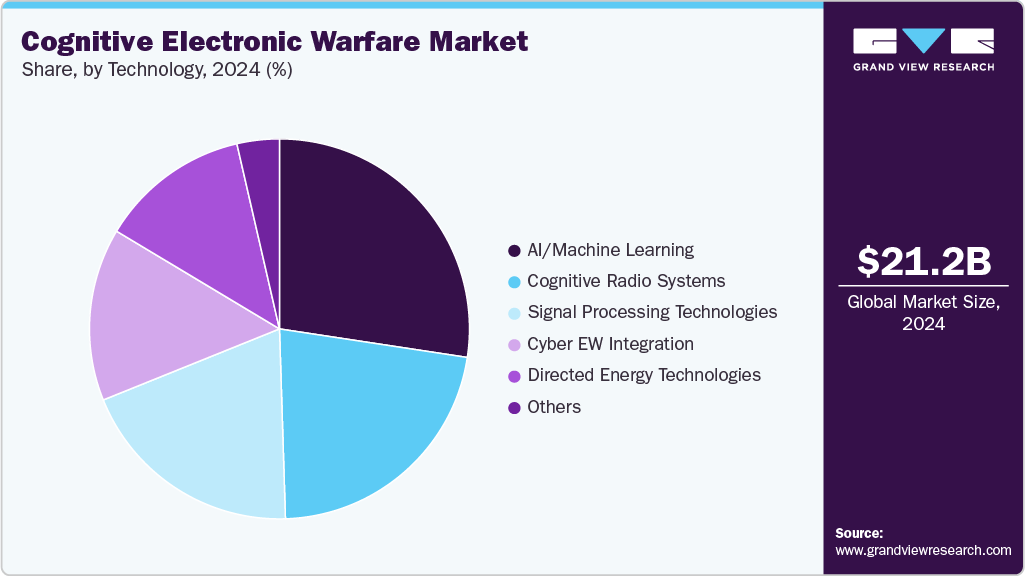

- By technology, AI/ML led the market in 2024.

- By end use, the defense & military segment held the dominant position in the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.24 Billion

- 2033 Projected Market Size: USD 82.99 Billion

- CAGR (2025-2033): 16.6%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The market for cognitive electronic warfare is primarily driven by the increasing complexity and advancement of electronic threats in modern warfare. As adversaries deploy advanced jamming, spoofing, and cyber-electronic attacks, traditional electronic warfare systems struggle to sustain market alignment. Cognitive EW systems, powered by artificial intelligence and machine learning, offer adaptive and autonomous capabilities that enable real-time threat detection, analysis, and response. This enhanced agility is crucial for maintaining electromagnetic superiority on the battlefield, prompting defense organizations worldwide to prioritize the adoption of cognitive EW technologies.

Another significant driver is the accelerating investment by governments and defense agencies in modernizing their electronic warfare infrastructure. Heightened geopolitical tensions and the emergence of hybrid warfare have intensified the need for integrated EW solutions that combine cyber and electronic domains. Defense modernization programs, particularly in technologically advanced nations such as the U.S., China, and NATO members, are channeling substantial budgets toward the development and deployment of next-generation cognitive EW platforms across land, airborne, naval, and space domains. This sustained funding inflow fuels innovation and market expansion.

Technological advancements in complementary areas such as directed energy weapons, signal processing, and software-defined radios further propel the market growth. These innovations enhance precision, and efficiency EW systems, enabling seamless electronic attack and protection strategies. The integration of cognitive capabilities with emerging technologies broadens operational effectiveness and extends the lifecycle and scalability of EW assets. Consequently, industry players are investing heavily in research and development to deliver advanced solutions that meet defense requirements, driving competitive differentiation and accelerating market adoption.

Function Insights

The electronic attack segment led the market in 2024, accounting for over 36% of global revenue. The electronic attack segment is experiencing strong growth, driven by the rising need to neutralize adversary communication and radar systems in increasingly contested electromagnetic environments. Modern warfare strategies demand offensive EW capabilities that can disrupt, degrade, or completely deny enemy access to critical information channels. Cognitive EA systems, enhanced with AI and machine learning, enable more precise targeting, adaptive jamming, and faster countermeasure deployment against evolving signal threats. This ability to dynamically learn and respond in real time significantly enhances operational success, making EA a top investment priority for defense forces.

The electronic intelligence segment is predicted to experience the fastest growth in the forecast years. Rising geopolitical tensions and the increasing complexity of modern battlefields are prompting defense forces to invest in advanced ELINT systems capable of detecting, intercepting, and analyzing adversary electronic signals in real time. The growing adoption of AI and machine learning within CEW solutions enhances signal processing, enabling faster identification of threats and adaptive countermeasures. In addition, the need for situational awareness in contested electromagnetic environments, coupled with modernization programs and defense budgets in major economies, is accelerating electronic intelligence segment growth.

Component Insights

The hardware segment accounted for a prominent market revenue share in 2024, propelled by the growing demand for advanced, high-performance systems capable of operating in increasingly congested and contested electromagnetic environments. Defense agencies are prioritizing the procurement of robust EW hardware, such as antennas, transmitters, receivers, processors, and directed energy devices, that can deliver real-time signal interception, analysis, and countermeasure deployment. The need for rapid signal processing and high-speed data handling in mission-critical scenarios makes specialized hardware indispensable for enabling cognitive capabilities.

The software segment is anticipated to grow significantly during the forecast period, driven by the increasing reliance on artificial intelligence, machine learning, and advanced data analytics for real-time decision-making. Cognitive EW systems depend heavily on advanced software algorithms to process large volumes of electromagnetic spectrum data, identify threat patterns, and initiate adaptive countermeasures. As electronic threats become more dynamic and unpredictable, demand for agile, upgradable, and customized software solutions is rising significantly. Software-based solutions allow military forces to reconfigure system capabilities through updates rather than hardware replacements, reducing lifecycle costs and deployment timelines. This adaptability is essential for countering rapidly evolving signal environments and enables forces to maintain operational readiness without extensive physical system overhauls. In addition, open-architecture software frameworks are promoting interoperability between platforms and allied forces, further boosting adoption.

Platform Insights

The airborne segment accounted for the largest market revenue share in 2024 driven by the rising need for spectrum dominance, mission survivability, and rapid adaptation against advanced adaptive threats such as frequency-hopping and low-probability-of-intercept emitters. Advances in AI, software-defined radios, and miniaturized components enable integration of CEW systems across fighters, transport aircraft, helicopters, and UAVs without significant SWaP penalties. Growing adoption of unmanned platforms and manned-unmanned teaming expands operational scenarios, while sensor fusion and interoperability enhance multi-mission effectiveness in network-centric warfare. Defense forces prioritize airborne CEW for its ability to deliver stand-off detection, real-time countermeasures, and upgradeable, software-driven capabilities, making it a crucial investment area in modernizing air combat and electronic protection strategies.

The space segment is expected to grow at the fastest CAGR during the forecast period due to the rising reliance on satellites for communications, ISR, and navigation, coupled with increasing threats such as jamming, spoofing, and signal interception. Proliferation of cost-effective small satellites and modular payloads enables rapid deployment of adaptive EW systems. Advances in AI/ML empower autonomous threat detection and spectrum management on-orbit, reducing dependence on ground control. Geopolitical tensions and defense cooperation are accelerating investment in space resilience. Increasing congestion in low-Earth orbit and spectrum crowding further boost demand for cognitive EW solutions that ensure operational continuity and protect high-value space assets.

End Use Insights

The defense & military segment accounted for the largest market revenue share in 2024 due to the increasing need for advanced threat detection and response capabilities in modern combat. Rising geopolitical tensions and evolving warfare tactics demand advanced EW systems that can autonomously analyze, learn, and adapt to dynamic electronic threats in real time. Cognitive EW enhances situational awareness by integrating AI and machine learning to detect, deceive, and counter adversarial electronic attacks effectively. Governments are investing heavily in upgrading their military assets with these technologies to maintain strategic superiority. In addition, the push for network-centric warfare and multi-domain operations further fuels demand, making the defense and military segment the largest and fastest-growing market for cognitive EW solutions worldwide.

The government intelligence agency segment is anticipated to grow at the fastest CAGR during the forecasted period due to the rising need for advanced signal intelligence, electronic surveillance, and threat detection capabilities to counter evolving cyber-electronic threats. Governments are increasingly investing in AI-powered cognitive systems to enhance decision-making, automate signal analysis, and improve real-time situational awareness. These agencies face growing challenges from advanced adversaries employing stealth and jamming techniques, prompting the adoption of adaptive EW solutions. In addition, integration with big data analytics and machine learning enables predictive threat assessment, while geopolitical tensions and cross-border security threats further accelerate demand for advanced cognitive electronic warfare technologies.

Technology Insights

The AI/ML segment accounted for the largest market revenue share in 2024 driven by the increasing need for early detection of vulnerabilities within the software development lifecycle. As organizations adopt DevSecOps and agile methodologies, integrating SAST enables developers to identify and remediate security vulnerabilities during the coding phase, reducing costs and risks associated with post-deployment fixes. Compliance mandates such as OWASP, GDPR, and HIPAA emphasize secure coding practices, further accelerating SAST adoption. In addition, advancements in automation and AI-powered analysis improve SAST accuracy and efficiency. Growing awareness about the importance of securing source code and proprietary intellectual property fuels demand for robust static testing solutions across industries.

The directed energy technologies segment is expected to grow significantly over the forecast period driven by the growing need for precise, rapid-response, and non-kinetic defense solutions capable of neutralizing advanced electronic threats without collateral damage. Increasing adoption of high-energy lasers (HEL) and high-power microwave (HPM) systems is fueled by their ability to disrupt or disable adversary communication, radar, and sensor systems at the speed of light. Rising threats from swarms of unmanned aerial systems (UAS) and sophisticated jamming tactics are accelerating R&D investments. In addition, military modernization programs, combined with advances in AI-driven targeting and power management, are expanding operational efficiency and deployment feasibility for directed energy systems.

Regional Insights

North America cognitive electronic warfare industry dominated globally with a revenue share of over 39% in 2024, driven by increasing defense budgets and strategic modernization programs aimed at upgrading military electronic systems. The growing complexity of electronic threats, including advanced cyber-attacks, compels armed forces to adopt advanced cognitive EW technologies that leverage AI and machine learning for real-time threat detection and adaptive countermeasures. In addition, rising geopolitical tensions and the need to maintain technological superiority in defense capabilities fuel market growth. Strong government investments in research and development, along with collaborations between defense contractors and technology firms, further accelerate innovation. Moreover, the expanding use of unmanned systems and autonomous platforms in military operations boosts demand for cognitive EW solutions to ensure secure and effective communication and mission success.

U.S. Cognitive Electronic Warfare Market Trends

The U.S. cognitive electronic warfare industry is expected to grow significantly in 2024, primarily driven by significant defense modernization programs aimed at enhancing electronic warfare capabilities amid evolving global threats. Increased military spending and government initiatives to develop advanced AI-powered cognitive EW systems boost market growth. The need to counter electronic attacks and ensure superiority in electronic spectrum operations further accelerates adoption. In addition, rising geopolitical tensions and focus on strengthening national security drive investments in EW technologies. The U.S. also benefits from a strong R&D infrastructure and collaboration between government agencies and private defense contractors, facilitating rapid innovation. Moreover, integration of cognitive EW with other defense systems such as, drones and cyber defense, enhances operational efficiency, fueling market expansion in the country.

Europe Cognitive Electronic Warfare Market Trends

The cognitive electronic warfare industry in Europe is expected to grow significantly over the forecast period, driven by increasing defense budgets aimed at modernizing military capabilities amid rising regional security concerns. Growing geopolitical tensions, especially due to proximity to conflict zones, push European nations to invest in advanced EW systems for enhanced threat detection and electronic spectrum dominance. The emphasis on integrating artificial intelligence and machine learning in EW solutions improves real-time decision-making and adaptability against increasing electronic attacks. Collaborative defense initiatives within the European Union and NATO foster joint development and deployment of cognitive EW technologies. In addition, stringent regulatory frameworks and increasing demand for protecting critical infrastructure and communication networks further stimulate market growth across Europe. Overall, the focus on technological innovation and enhanced defense preparedness are key market drivers in the region.

Asia Pacific Cognitive Electronic Warfare Market Trends

The cognitive electronic warfare industry in the Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period, driven by increasing defense budgets among various countries such as, China, India, Japan, and South Korea, aiming to modernize their military capabilities. Rising geopolitical tensions and territorial disputes in the region prompt the adoption of advanced EW technologies to gain a strategic advantage. Growing investments in AI and machine learning for cognitive EW systems enhance real-time threat detection and electronic countermeasures. In addition, the expansion of unmanned systems and network-centric warfare boosts demand for cognitive EW solutions. The region’s focus on upgrading legacy defense infrastructure and increasing collaborations between governments and defense vendors further accelerates market growth. Rapid technological advancements and the need to protect critical communication networks also support the Asia Pacific cognitive EW market expansion.

Key Cognitive Electronic Warfare Company Insights

Some key companies in the cognitive electronic warfare industry are BAE Systems and Lockheed Martin Corporation.

-

BAE Systems leads the cognitive electronic warfare industry due to its advanced AI-driven EW solutions, extensive defense expertise, and strong global partnerships. The company invests heavily in R&D to develop adaptive, real-time threat detection and electronic attack technologies. Its broad product portfolio spans land, air, and naval platforms, providing integrated cognitive EW capabilities. In addition, BAE System’s collaborations with governments and militaries worldwide enhance its market reach and innovation, solidifying its position in the cognitive electronic warfare systems.

-

Lockheed Martin Corporation is a key player in cognitive electronic warfare due to its advanced AI-driven EW systems that enhance threat detection and response capabilities. Its strong defense contracts, continuous innovation, and integration of cognitive technologies into next-gen platforms such as, fighter jets and unmanned systems reinforce its dominance. The company’s extensive R&D investments and strategic partnerships with government agencies enable rapid development and deployment of advanced EW solutions, addressing evolving electronic threats effectively and maintaining battlefield superiority.

Key Cognitive Electronic Warfare Companies:

The following are the leading companies in the cognitive electronic warfare market. These companies collectively hold the largest market share and dictate industry trends.

- BAE Systems

- Lockheed Martin Corporation

- Northrop Grumman

- RTX

- L3Harris Technologies, Inc.

- Thales

- Leonardo S.p.A.

- Hensoldt AG

- Elbit Systems Ltd.

- Rohde & Schwarz

Recent Developments

-

In May 2025, Leonardo UK Ltd, a defense and security company, partnered with Faculty AI, an AI company, to expedite the movement of AI-based defense technologies, such as Electronic Warfare and Cognitive Intelligent Sensing, from the development phase to active use by the armed forces. The collaboration will further investigate how AI can improve the performance of countermeasures and electronic warfare payloads for combat aircraft, building on the worldwide success of Leonardo UK Ltd’s BriteStorm jamming and BriteCloud decoy systems.

-

In February 2025, L3Harris Technologies, Inc., collaborated with Shield AI, a defense technology company, to conduct electronic warfare (EW) using AI-powered unmanned systems capable of sensing, adapting, and responding while carrying out both physical and electromagnetic actions. Central to this approach is L3Harris Technologies’ Distributed Spectrum Collaboration and Operations (DiSCO), a software-based Electromagnetic Battle Management system designed to identify, gather, and analyze threat signals quickly. This collaboration integrates DiSCO with Shield AI’s Hivemind platform.

-

In February 2025, RTX successfully conducted flight tests of the AI/ML enabled fourth generation based Radar Warning Receiver (RWR) system designed aircraft. The Cognitive Algorithm Deployment System (CADS) integrates an Embedded Graphics Processing Unit with Deepwave Digital’s computing framework, allowing AI models to be embedded directly within Raytheon’s existing RWR platforms for on-sensor AI/ML processing.

Cognitive Electronic Warfare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.26 billion

Revenue forecast in 2033

USD 82.99 billion

Growth rate

CAGR of 16.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, component, platform, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

BAE Systems; Lockheed Martin Corporation; Northrop Grumman; RTX; L3Harris Technologies, Inc.; Thales; Leonardo S.p.A.; Hensoldt AG; Elbit Systems Ltd.; and Rohde & Schwarz

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cognitive Electronic Warfare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cognitive electronic warfare market report based on function, component, platform, technology, end use, and region:

-

Function Outlook (Revenue, USD Billion, 2021 - 2033)

-

Electronic Attack

-

Electronic Protection

-

Electronic Support

-

Electronic Intelligence

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Platform Outlook (Revenue, USD Billion, 2021 - 2033)

-

Land

-

Airborne

-

Naval

-

Space

-

-

Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

AI/Machine Learning

-

Cognitive Radio Systems

-

Signal Processing Technologies

-

Directed Energy Technologies

-

Cyber EW Integration

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Defense & Military

-

Government Intelligence Agency

-

Homeland Security

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cognitive electronic warfare market size was estimated at USD 21.24 billion in 2024 and is expected to reach USD 24.26 billion in 2025.

b. The global cognitive electronic warfare market is expected to grow at a compound annual growth rate of 16.6% from 2025 to 2033 to reach USD 82.99 billion by 2033.

b. North America dominated the cognitive electronic warfare market with a share of 39.4% in 2024. This is attributable to the increasing defense budgets and strategic modernization programs aimed at upgrading military electronic systems.

b. Some key players operating in the cognitive electronic warfare market include BAE Systems; Lockheed Martin Corporation; Northrop Grumman; RTX; L3Harris Technologies, Inc.; Thales ; Leonardo S.p.A.; Hensoldt AG; Elbit Systems Ltd.; and Rohde & Schwarz.

b. Key factors that are driving the cognitive electronic warfare market growth include the rising adoption of Artificial Intelligence (AI) and Machine Learning (ML), the growing need for enhanced situational awareness in complex and contested environments, and the growth in multi-domain operations requiring seamless interoperability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.