- Home

- »

- Consumer F&B

- »

-

Cold Brew Coffee Market Size & Share, Industry Report, 2030GVR Report cover

![Cold Brew Coffee Market Size, Share & Trends Report]()

Cold Brew Coffee Market (2024 - 2030) Size, Share & Trends Analysis Report By Preparation Mode (Drip Coffee Makers, Single Cup Brewers, Cold Brewing, Espresso, Others), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-937-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Brew Coffee Market Summary

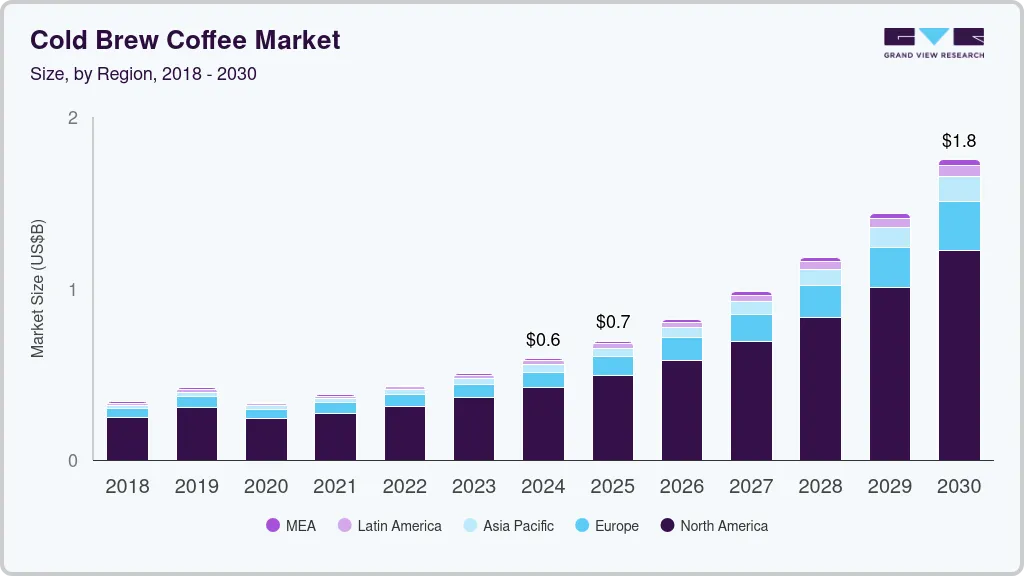

The global cold brew coffee market size was estimated at USD 506.1 million in 2023 and is projected to reach USD 1,751.6 million by 2030, growing at a CAGR of 19.9% from 2024 to 2030. Manufacturers have adopted marketing strategies to expand their global reach and offer opportunities for growth.

Key Market Trends & Insights

- North America region dominated the market in 2023 with a revenue share of 71.4%.

- The U.S. cold brew coffee market is expected to witness significant growth over the forecast period.

- By preparation mode, drip coffee makers dominated the market and accounted for a share of 40.9% in 2023.

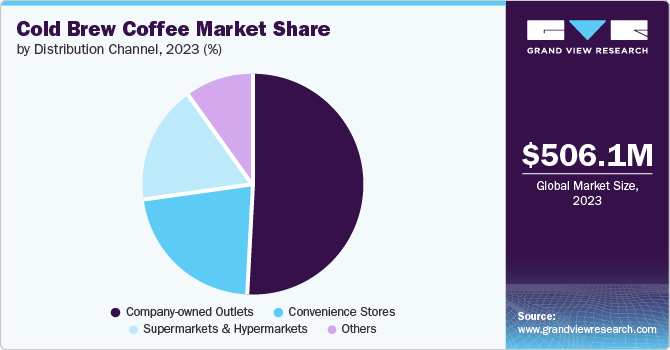

- By distribution channel, company-owned outlets accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 506.1 Million

- 2030 Projected Market Size: USD 1,751.6 Million

- CAGR (2024-2030): 19.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Brands leverage social media platforms to engage with consumers and build brand loyalty. Influencer partnerships and targeted digital marketing campaigns have increased demand for cold brew coffee. The demand for ready-to-drink beverages has increased significantly, contributing to the growth of the cold-brew coffee market. Consumers are increasingly adopting ready-to-drink beverages as they provide convenience and ease of consumption. This trend has led to an increase in the sales of cold-brew coffee, as it is often packaged in convenient formats such as cans and bottles. To cater to this demand, manufacturers are launching new product lines. For instance, in July 2024, Bones Coffee Co. introduced its ready-to-drink (RTD) cold brew lattes, including flavors such as Holy Cannoli, Sinn-O-Bun, Smorey Time, French Toast, and Electric Unicorn, which are available in Walmart stores. The products are made with 100% cold-brewed coffee beans sourced from Brazil.

Consumers increasingly pursue beverages with a smoother, less acidic taste profile, which cold brew coffee provides. Cold brew is made by steeping coffee beans in cold water for an extended period. This process produces a naturally sweeter and more flavor, demanding a wide range of coffee drinkers. Additionally, the versatility of cold brew, enjoyed black, with milk, or flavored, caters to diverse taste preferences and experiences.

As coffee shops expand in urban areas worldwide, they increasingly offer cold brew as a staple menu item. This increases consumer exposure to cold brew and educates them on its unique qualities compared to other coffee beverages. The café experience, often associated with relaxation, socialization, and a premium coffee experience, enhances cold brew consumption. For instance, in February 2024, China's Cotti Coffee launched in Australia with a new outlet in Sydney's Cabramatta district. The outlet is a small-format takeaway site that offers flavored coffee beverages, including Rice Milk and Pampas Blue lattes, coconut-infused coffee, and Grapefruit Sparkling Cold Brew.

Preparation Mode Insights

Drip coffee makers dominated the market and accounted for a share of 40.9% in 2023. Drip coffee makers allow complete extraction of the aromas and flavors of coffee beans, making them the most prevalent method of brewing coffee and contributing to the growing demand. They automate the coffee brewing process, allowing users to prepare multiple cups of coffee with minimal effort. Many drip coffee makers offer customizable settings, such as strength control and temperature adjustment, allowing users to change the coffee according to their preferences. The combined factors drive the demand for drip coffee makers.

The cold brewing segment is expected to witness the fastest CAGR over the forecast period. Cold brew coffee offers numerous benefits, such as its higher caffeine content, which aids in weight loss, sharpens mental capacity, and keeps consumers alert for extended periods. Additionally, cold brew coffee is an alternative for consumers with acid reflux and sensitive stomachs. Its smooth, low-acid profile makes it suitable for various uses, such as cocktails, desserts, and other recipes. To cater to this demand, manufacturers are introducing new products. For instance, in May 2024, De'Longhi launched the Eletta Explore coffee machine with cold brew capabilities. This machine provides users various hot, cold, and cold brew coffee drinks at home. Its cold extraction technology allows it to prepare cold brew in less than five minutes.

Distribution Channel Insights

Company-owned outlets accounted for the largest market revenue share in 2023. These outlets have the ability to maintain strict control over the brand image, product quality, and customer experience. By owning and operating their outlets, companies ensure that their cold brew coffee is prepared and served to exact specifications, maintaining consistency across all locations. Company-owned outlets produce freshly prepared food and beverages that match consumer preferences for fresh products. This ensures that the cold brew coffee is always fresh and of high quality. These factors combined are fueling the demand for company-owned outlets

Online distribution channel is expected to register the fastest CAGR of during the forecast period. Online platforms allow customers to purchase cold brew coffee from the comfort of their homes or workplaces without visiting physical stores. This convenience is especially suitable for busy consumers. Additionally, e-commerce platforms offer an extensive range of brands, flavors, and formats. This wide variety allows consumers to explore and discover new products and options that cater to different tastes and preferences, enhancing the overall shopping experience and driving demand. For instance, in May 2024, Subculture Delta Beverages Inc., a joint venture of Diesel Beverages and Subculture Coffee, launched shelf-stable THC-infused cold brew coffee offered through the Subculture Coffee locations and online website.

Regional Insights

North America region dominated the market in 2023 with a revenue share of 71.4%. Coffee shops and cafes have become prevalent social hubs where people gather to work, relax, and socialize. These establishments often feature cold brew coffee on their menus, increasing the consumers of the product. Effective marketing and branding efforts have played a crucial role in the growth of the cold brew coffee market in North America. Brands leverage social media, influencer partnerships, and targeted advertising to create awareness and drive consumer interest and demand.

U.S. Cold Brew Coffee Market Trends

The U.S. cold brew coffee market is expected to witness significant growth over the forecast period. Cold-brew coffee is a healthier choice due to its lower acidity and ease of digestion on the stomach and teeth. Along with its lower calorie content when consumed without additional sugars or creams, it is essential for health-conscious consumers and fitness enthusiasts who are mindful of their caloric intake. The growing preference for healthier lifestyles has significantly increased the demand for cold brew coffee. For instance, the United States, importing the second-largest amount of coffee beans globally, is expected to increase its imports by 900,000 bags to 24.5 million bags, driven by rising consumption trends.

The Canada cold brew coffee market is expected to witness significant growth over the forecast period. Canadian coffee companies and roasters are innovating with new flavors, brewing techniques, and packaging formats essential to diverse consumer preferences. Innovations such as flavored cold brew varieties, nitro cold brew, and cold brew concentrate options provide consumers with various choices to suit their tastes and lifestyles. This product diversity increases new consumers and encourages existing customers to experiment with different cold brew offerings.

Asia Pacific Cold Brew Coffee Market Trends

Asia Pacific cold brew coffee market is expected to witness the fastest CAGR over the forecast period. Coffee shops and cafes have become prevalent social hubs where consumers gather to socialize, work, and relax. The presence of cold brew coffee on cafe menus, often positioned as a premium offering, has introduced more consumers to the product. Additionally, cold brew coffee manufacturers are innovating with convenient packaging options to cater to consumers busy lifestyles. Ready-to-drink cold brew coffee in cans and bottles is becoming increasingly prevalent, allowing consumers to experience a premium coffee on the go.

China cold brew coffee market is anticipated to witness significant growth over the forecast period. Environmental awareness and sustainability considerations are gaining prominence among Chinese consumers, influencing their purchasing decisions in the cold brew coffee market. Many brands emphasize sustainable sourcing practices, ethical production methods, and eco-friendly packaging for environmentally conscious consumers.

India cold brew coffee market is anticipated to witness significant growth over the forecast period. Coffee companies and roasters are innovating new flavors, brewing techniques, and packaging formats to cater to diverse consumer preferences and regional tastes. Additionally, ready-to-drink cold brew formats in bottles and cans cater to busy urban lifestyles where convenience and quick consumption are essential. The portability and ease of ready-to-drink cold brew coffee make it a prevalent choice among commuters, office workers, and students pursuing convenient refreshment solutions. To cater to this demand, companies are starting new product lines. For instance, in June 2024, Tata Consumer Products launched Tata Coffee Gold- Cold Brew, a Ready to Drink Cold Coffee. It is free from artificial flavors and is available in variants such as Classic, Mocha, and Hazelnut. It is available at selected retail outlets nationwide.

Europe Cold Brew Coffee Market Trends

Europe cold brew coffee market is expected to witness significant growth over the forecast period. Online platforms offer various cold brew coffee products, making it easy for consumers to explore and purchase different brands and flavors. The convenience of online shopping and the possibility to read reviews and compare products have driven the demand for cold brew coffee through e-commerce channels. Additionally, subscription services for cold brew coffee have enabled consumers to receive regular deliveries of their favorite beverages directly to their doorstep.

Germany cold brew coffee market is expected to witness significant growth over the forecast period. Brands leverage social platforms such as Instagram, Facebook, and TikTok to showcase their cold brew products, engage with coffee enthusiasts, and increase brand visibility. Influencers and coffee enthusiasts share their experiences, reviews, and creative recipes featuring cold brew coffee, effectively promoting trends and encouraging the community around the beverage. Social media platforms aid in educating consumers about the brewing process, flavor profiles, and potential health benefits of cold brew coffee through digital platforms, tastings, and promotional events.

Key Cold Brew Coffee Company Insights

Some of the key companies in the cold brew coffee market include Starbucks Coffee Company, Nestlé, Califia Farms, LLC, JAB Holding Company, HighBrewCoffee, and Kohana Coffee. These companies are focusing on increasing their customer base to gain a competitive edge in the industry. Companies are taking several strategic initiatives, such as mergers, acquisitions, and partnerships with other major companies.

-

Starbucks Coffee Company offers an extensive range of beverages and food items. The company has expanded internationally, operating thousands of locations worldwide. Their product offerings include a diverse selection of hot and cold beverages, with a prominent presence in the cold brew coffee market.

-

RISE Brewing Co. specializes in producing nitro cold brew coffee, offering a range of flavors and varieties that cater to health-conscious consumers seeking premium coffee experiences. Their product lineup includes original nitro cold brew, oat milk lattes, and various flavored nitro cold brews, all packaged in eco-friendly cans.

Key Cold Brew Coffee Companies:

The following are the leading companies in the cold brew coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Starbucks Coffee Company.

- Nestlé

- Califia Farms, LLC

- JAB Holding Company

- HighBrewCoffee

- Kohana Coffee

- La Colombe Coffee Roasters.

- RISE Brewing Co..

- Heartland Food Products Group.

- Sleepy Owl Coffee

Recent Developments

-

In May 2024, Starbucks Coffee Company. launched NEW Starbucks Iced Coffee blends along with the debut of NEW Starbucks Cold Brew Concentrates - Dark Chocolate Hazelnut and Sweetened Black, which is the first at-home blend that allows consumers to enjoy Starbucks café-quality iced coffee at home.

-

In May 2024, Nescafé launched Nescafé Espresso Concentrate, which is available in flavors such as sweet vanilla and Espresso Black. It is customizable with milk, water, or juice.

Cold Brew Coffee Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 589.8 million

Revenue forecast in 2030

USD 1,751.6 million

Growth Rate

CAGR of 19.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Preparation mode, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, Italy, Spain, Poland, China, Japan, India, Brazil

Key companies profiled

Starbucks Coffee Company.; Nestlé; Califia Farms, LLC; JAB Holding Company; HighBrewCoffee; Kohana Coffee; La Colombe Coffee Roasters.; RISE Brewing Co..; Heartland Food Products Group.; Sleepy Owl Coffee

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Brew Coffee Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cold brew coffee market report based on preparation mode, distribution channel and region.

-

Preparation Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Drip Coffee Makers

-

Single Cup Brewers

-

Cold Brewing

-

Espresso

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Company-owned Outlets

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

Spain

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.