- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Cold Gas Spray Coating Market Size & Share Report, 2030GVR Report cover

![Cold Gas Spray Coating Market Size, Share & Trends Report]()

Cold Gas Spray Coating Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (High Pressure, Low Pressure), By End-use (Transportation, Medical), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-093-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

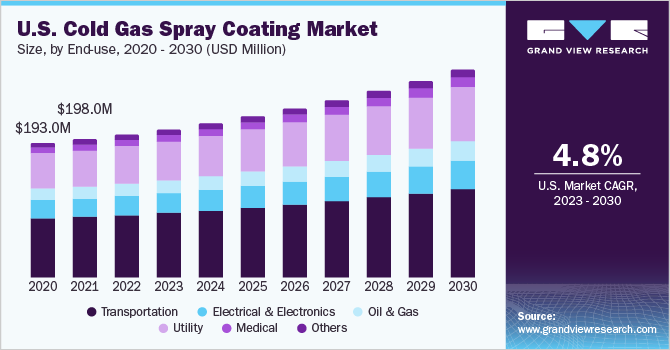

The global cold gas spray coating market size was valued at USD 1.0 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. The rising adoption of cold gas spray coating in aerospace and automotive aftermarket repair and maintenance activities is projected to assist the growth of the market over the forecast period. Cold gas spray coatings, used for decades as coatings, have recently revolutionized component repair in various industries, especially in the aerospace industry. These coatings have a significant impact on reducing the sustainment costs in the aerospace industry, thereby gaining the attention of manufacturers and end users in the market. The high replacement costs of damaged and corroded aircraft components and the long lead times associated with their replacement have resulted in a growing preference for repairing aircraft components to reduce their maintenance costs.

Cold gas spray coatings had a profound impact on reducing sustainment costs in the aerospace industry, thus gaining the attention of manufacturers and end-users in the market. The growing application of the product in a wide range of materials for specific applications, including repair and surface finishing, is expected to drive the product demand in the coming years. In addition, the growing demand for consumer electronics owing to the factors, such as increasing disposable income, rapid urbanization, expanding middle class, and shifting spending priorities of consumers in the emerging countries, such as China and India, is further expected to propel the product demand in the coming years.

Furthermore, the rising application of advanced nanostructured and amorphous materials in various end-use industries, including electrical and electronics and medical, is expected to create lucrative growth opportunities for the manufacturers of cold gas spray coatings. Since nano-crystalline materials are temperature-sensitive, the cold gas spray coating can effectively be used without hampering their beneficial microstructure. These materials are now being widely used for manufacturing various advanced electrical equipment, such as sensors, electric boards, and data management systems.

The prices of raw materials used for developing cold gas spray coatings are impacted by the high costs of ore extraction processes and the presence of several stringent government regulations related to the metals and mining industries. This acts as a major restraint for the growth of cold gas spray coating market. Moreover, several import tariffs imposed by the Government of the U.S. owing to its ongoing trade war with China are expected to bring further volatility in the prices of raw materials in the coming years. All these factors are expected to restrain the growth of cold spray coating market over the forecast period.

End-use Insights

The transportation end-use dominated the market with a revenue share of more than 44.2% in 2022. This is attributable to the growing demand for cold gas spray coatings for application in coating and repairing of various components in the aerospace and automotive industries. Cold gas spray coatings offer low porosity, excellent bonding, and oxide-free coating in the solid-state as well as at low temperatures, which make them suitable for application in the automotive and aerospace industries.

In addition, it helps increase the service life as well as improve the vehicle's performance by protecting the parts against wear, corrosion, fretting, and erosion. Most automotive manufacturers use cold gas spray coating as an alternative method to offer a high level of reliability, quality, and durability in low-cost base materials.

The rising demand for lightweight and high-performance materials in the automotive industry is projected to boost product demand over the forecast period. In addition, favorable government regulations regarding the application of lightweight materials to improve fuel efficiency are expected to drive the product demand in the automotive industry.

In recent years, the cold gas spray coating technology has witnessed significant demand in the restoration and repair of housings for Integrated Drive Generators (IDG), which are used in commercial aircraft, such as Boeing 747, 737NG, and 777 and Airbus A330, A320, and A340. This is attributed to the high feasibility and economic viability of the cold gas spray coating technology in complexly designed components made of magnesium or aluminum alloys.

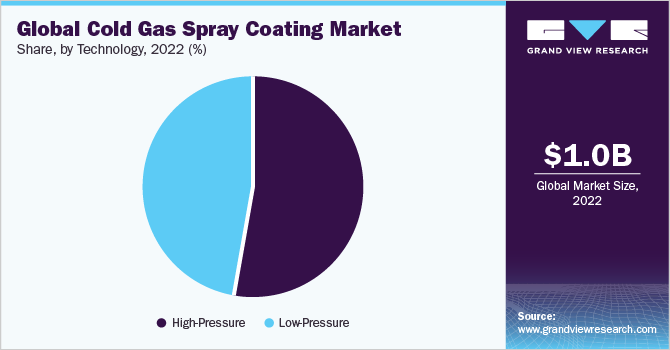

Technology Insights

High-pressure technology dominated the market with a revenue share of more than 52.9% in 2022. This is attributable to its wide usage as a surface repair and coating technology in a broad range of industries, such as aerospace, automotive, and electronics. It is majorly used in repairing metallic components to improve the performance and extend the working life of equipment in the aforementioned industries. High-pressure cold gas spray coating technology utilizes the pressure of up to 50 bar with an axial injection of feedstock particles that are heated to a temperature of 11000 C, which allows higher metal deposition rate with exceptionally low oxide and porosity levels during the material build-up process.

High pressure cold gas spray coatings offer a range of advantages over other coating processes. The process operates at relatively low temperatures, reducing the risk of substrate distortion or damage. The coatings produced by this process are dense and offer excellent mechanical properties due to the high-speed impact of the powder particles. The high-speed impact also creates a strong bond between the coating and the substrate, resulting in improved adhesion. Additionally, the process can be used to deposit a wide range of materials, making it versatile and suitable for use in various industries, including aerospace, automotive, biomedical, and electronics.

Low-pressure cold gas spraying is a coating technique, which is generally considered for repairing light and high-ductile metallic components used in various end-use industries. It utilizes ambient air as the propellant and operates at low pressure and low operating temperature conditions. These features make it a low-cost surface repair and coating technology and provide a competitive edge from the high-pressure cold gas spray technology. However, the rising usage of metal alloys and low-ductile components in the aerospace and automotive industries is expected to limit the growth of the low-pressure cold gas spray technology in the coming years.

Regional Insights

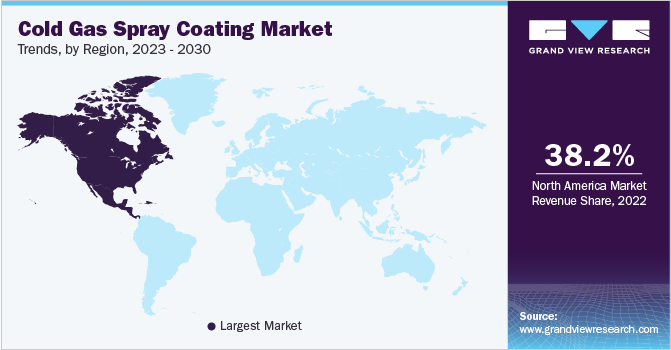

North America dominated the market with a revenue share of 38.2% in 2022. Favorable government regulations pertaining to the use of a lightweight and high-performance components in the automotive sector as an alternative to alloys and metals are expected to drive the regional demand for cold gas spray coatings over the forecast period. However, the shifting of manufacturing industries, such as the electrical and electronics industry, to the Asian countries with low wages, especially India and China, has hampered the regional demand, particularly in non-automotive end-use sectors.

Europe emerged as a significant region for the cold gas spray coatings market owing to the presence of major countries with high military and defense spending, such as Russia, Germany, France, and the U.K., especially for protection purposes of aircraft and satellite components. This is likely to create significant opportunities for the manufacturers of cold gas spray coatings in the region.

In the Asia Pacific region, the increase in the use of cold gas spray coating in the medical and transportation industries is the primary driving force. The mounting demand for lightweight components in various industries such as aerospace, electrical and electronics, and medical, backed by the secure production infrastructure of the automotive industry in China, Japan, and India, represents new opportunities for growth among cold gas spray coating manufacturers in the region. They are utilized primarily for the repair and coating of metal and polymer components and for extending their operational life and durability. Thus, due to the increasing adoption of lightweight components in the automotive and aerospace sectors, a surge in demand for cold gas spray coating products is likely in the forecast period.

Key Companies & Market Share Insights

The global market is found to be consolidated owing to the presence of a limited number of manufacturers across the globe. Companies in the market are actively indulged in the development of new material systems with improved properties, including a broad range of essential surface functionalities. The growing cases of mechanical failure of components in the aerospace industry, coupled with rising aftermarket repair and maintenance activities in the OEM market, are expected to offer significant growth opportunities for the product manufacturers in the coming years. Some of the prominent players in the global cold gas spray coating market include:

-

Plasma Giken Co., Ltd.

-

VRC Metal Systems, LLC

-

Curtiss-Wright Surface Technologies

-

Bodycote

-

Praxair S.T. Technology, Inc.

-

ASB Industries, Inc.

Cold Gas Spray Coating Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.04 billion

Revenue forecast in 2030

USD 1.42 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Brazil; Argentina, GCC Countries, South Africa

Key companies profiled

Plasma Giken Co., Ltd.; VRC Metal Systems, LLC; Curtiss-Wright Surface Technologies; Bodycote; Praxair S.T. Technology, Inc.; ASB Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Gas Spray Coating Market Report Segmentation

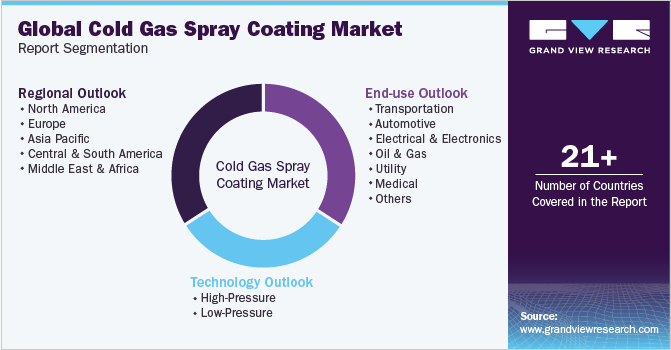

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cold gas spray coating market report on the basis of technology, end-use, region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High Pressure

-

Low Pressure

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Aerospace

-

Jet Engine Parts

-

Rocket Motor Nozzles

-

Exhaust Systems

-

Pumps

-

Structured Elements

-

Satellites

-

Gearboxes

-

Landing Gears

-

Automotive

-

Exhaust Systems

-

Manifolds

-

Pistons and Cylinders

-

Piston Ring Heat Exchangers

-

Break

-

Bearing

-

Crank Shafts

-

Valve Seats

-

Heated glass

-

-

Electrical & Electronics

-

Power Electronic Heat Sinks

-

Refrigeration Units

-

Circuit Boards

-

Electrical Contacts

-

Electric Motors & Generators

-

Transformers

-

Semiconductors & Displays

-

Electro-plating

-

Bus bars Fluid Handling

-

-

Oil & Gas

-

Drilling Components

-

Gate Valves

-

-

Utility

-

Power Boilers

-

Gas and Hydro-Steam Turbine

-

Turbochargers

-

Solar Heat & Solar Energy Components

-

Nuclear

-

-

Medical

-

Orthopedic Prostheses

-

Dental Implants

-

Others

-

-

Others

-

Agriculture

-

Agricultural Harvesting Components

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cold gas spray coating market size was estimated at USD 1.0 billion in 2022 and is expected to reach USD 1.04 billion in 2023.

b. The cold gas spray coating market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 1.42 billion by 2030.

b. North America dominated the cold gas spray coating market with a share of 38.2% in 2022. This is attributable to strong demand from the aerospace and automobile industry as well as from other end-use industries such as utility and oil and gas.

b. Some of the key players operating in the global cold gas spray coating market include Plasma Giken Co., Ltd., VRC Metal Systems, LLC, Flame Spray Technologies B.V., Curtiss-Wright Surface Technologies, Rus Sonic Technology, Inc., Bodycote, Praxair S.T. Technology, Inc., and ASB Industries, Inc.

b. Key factors driving the cold gas spray coating market growth include rising adoption of cold gas spray coating in aerospace aftermarket repair & maintenance activities and the growing electrical & electronics industry in the Asia Pacific region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.