- Home

- »

- Advanced Interior Materials

- »

-

Aluminum Alloys Market Size, Share & Trends Report, 2030GVR Report cover

![Aluminum Alloys Market Size, Share & Trends Report]()

Aluminum Alloys Market Size, Share & Trends Analysis Report By End Use (Transportation, Construction, Packaging, Electrical, Consumer Durables); By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-330-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Aluminum Alloys Market Size & Trends

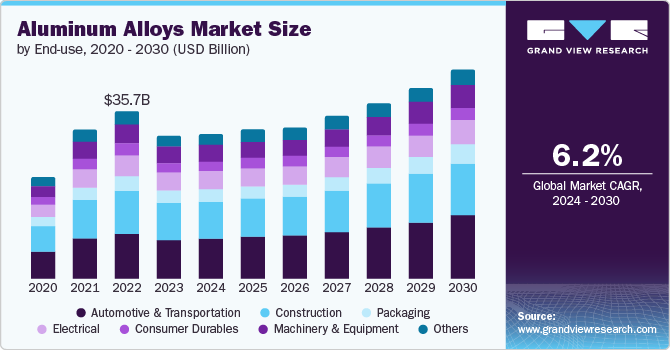

The global aluminum alloys market size was estimated at USD 233.75 billion in 2023 and is estimated to grow at a CAGR of 6.2% from 2024 to 2030. Rising penetration of aluminum alloys in vehicles is expected to fuel the market growth. Vehicle manufacturers are extremely focused on the improvement of fuel efficiency by reducing the weight of vehicles. Aluminum is a key lightweight material that helps to reduce the weight of vehicles significantly.

There are different grades of aluminum alloys that are widely used in the automotive industry. For applications like heat insulators and license plates, grade series 1xxx is used. Aluminum grade series 2xxx is used in products such as ABS, motorbike handles, shock absorbers, brake components, pistons, conrods, compressor wheels, and valves among others. Other grades such as 4xxx, 5xxx, 6xxx, and 7xxx also have numerous applications in the automotive industry.

Drivers, Opportunities & Restraints

Rising interest in aluminum lightweight auto components is likely to boost demand for aluminum alloys. In April 2024, Craftsman Automation announced signing an agreement with Rajasthan State Industrial Development and Investment Corporation to construct a plant in Rajasthan, India. This plant is expected to produce lightweight aluminum parts for domestic companies such as Mahindra Group and Tata Group.

Rising adoption of 3D printing for metal components is anticipated to provide opportunity for the market vendors. Aluminum is one of the ideal material used in 3D printing process. Ability of 3D printing to produce complex geometry parts with less time and less waste is projected to benefit expansion of market. Currently alloys such as AlSi10Mg, AlSi7Mg, and Al5X1 are used in for 3D printed parts for aerospace, automotive and medical industries.

Availability of substitute materials such as carbon fiber and thermoplastics along with price fluctuations act as restraining factors for the market. Carbon fiber composites has allowed design engineers flexibility that cannot be achieved with conventional metals such as aluminum and steel. These materials also have enhanced and customizable properties, and can be changed according to specific application.

Price Trends of Aluminum Alloys

The U.S. was one of the largest importer of aluminum alloys. The import price of aluminum alloys in the U.S. declined to USD 3,044.3 per ton in 2023 compared to USD 3,662.8 per ton in 2022. Sluggishness in demand from China and Europe resulted in a significant drop in aluminum alloy demand in 2023. The demand was impacted mainly due to a slowdown of the housing and infrastructure market in China.

Another factor that affected the prices was energy constraints in China owing to the focus on emission reduction policies and rising coal prices. This led to production cuts in the Chinese aluminum industry and thus affected global supply. However, with production recovered to some extent, existing inventory, and reduced demand impacted price trends.

Market Concentration & Characteristics

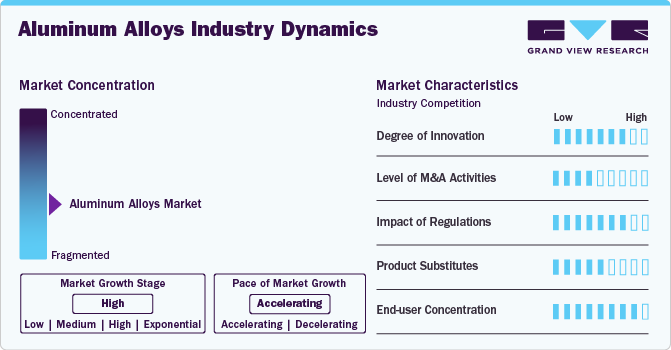

The global aluminum alloys market is observing high growth at an accelerating pace. The degree of innovation remains moderate to high in the market, as companies are focused on developing new alloys specific to high-end applications in aerospace, medical, automotive, and energy industries.

The market is highly influenced by the impact of regulations, several government bodies are developing new regulations to reduce the emissions from metals and mining industries. There are few substitutes available to aluminum alloys, products such as steel and carbon fiber composites can be alternatively used in different applications.

End-use concentration is high, as the product is easily available in the market and used in multiple applications. The product can be used in end use industries such as aerospace, automotive, consumer durables, medical, packaging, construction, machinery and many more. Thus with a large end-user base, the concentration is expected to remain high over the coming years.

End Use Insights

“Automotive & Transportation held the largest revenue share of over 26% in 2023.”

The automotive & transportation end use industry is anticipated to continue its dominance over the forecast period. The investments in the industry are projected to attract the aluminum alloy demand over the coming years. For instance, in March 2024, Toyota announced an investment of USD 2.2 billion in Brazil for the production of vehicles. The company plans tovehicles new hybrid flex vehicles by 2025 specially catering to the Brazilian market.

Machinery & equipment, aerospace, and automotive industries are anticipated to attract a significant demand for aluminum alloys over the forecast period. This has resulted in significant investment in aluminum production facilities. For instance, in March 2024, Vista Metals announced an investment of USD 60 million to produce specialty aluminum products for aerospace industries. This facility will support downstream processing and is expected to serve aerospace forging, extrusion, and rolling markets.

The growing interest in the generation of energy using solar technology is projected to provide a boost to market. Aluminum is a key material required in solar photovoltaic components such as mounting structures and frames. The rising interest from governments for clean energy and subsidies is likely to boost market growth. For instance, as of 2023, among overall renewable energy generation installed capacity in India, solar is the leading technology with a capacity of around 81.81 GW.

Regional Insights

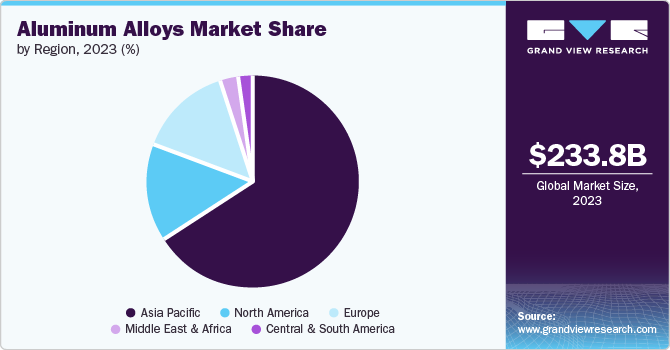

North America aluminum alloys market dominated the market in 2023. The focus on lightweight vehicles along with investments in recycling aluminum are likely to play a key role in the expansion of the aluminum alloys market. The governments in this region have made stringent emission regulations, which have fueled the growing usage of aluminum alloys.

U.S. Aluminum Alloys Market Trends

The aluminum alloys market in the U.S. is mainly dominated by the automotive & transportation, construction, and packaging industries. As of 2023, all three industries accounted for a revenue share of over 73%. Automotive & transportation are likely to grow at the fastest rate over the coming years, as automakers are increasingly focused on the deployment of aluminum components in vehicles.

Asia Pacific Aluminum Alloys Market Trends

“China held over 64% revenue share of the overall Asia Pacific aluminum alloys market.”

Asia Pacific aluminum alloys market dominated the global industry and accounted for over 66.0% revenue share in 2023. Asia Pacific is characterized by the presence of some of the world’s fastest growing economies in the world such as India, Indonesia, and the Philippines. The rising investment in these countries along with the expansion of manufacturing industries is likely to boost demand for aluminum alloys.

The aluminum alloys market in China is the largest consumer and producer of aluminum and related products. As reported by the National Bureau of Statistics, China’s domestic aluminum production reached a record high with production of 41.59 million tons in 2023, with y-o-y growth of 3.7%. This mainly benefited from strong performance in key producing regions of China.

Europe Aluminum Alloys Market Trends

Europe aluminum alloys market holds a significant share of the overall market. The region is focused on the production of aluminum via recycling rather than import from foreign countries. As per European Aluminum, the region plans to reduce the CO2 emission from aluminum production to 880 million tons by 2050 from 1500 million tons in 2020.

The aluminum alloys market in Germany is expected to grow at a CAGR of 6.6% from 2024 to 2030. In 2023, the German industry faced aluminum supply changes along with energy prices. This has resulted in low production capacities and a cut down of jobs.

Central & South America Aluminum Alloys Market Trends

Central & South America aluminum alloys market is expected to benefit from rising investments in the automotive industry and thus demand for aluminum-related products in the region. Brazil is expected to provide multiple opportunities for market vendors.

Key Aluminum Alloys Company Insights

Some key players operating in the market include Hydro, Hindalco, and Aluminum Corporation of China.

-

Hydro is the leading player in the aluminum industry value chain. The company has a presence at 140 locations in 40 countries with over 33,000 employees. The company is engaged in the production of bauxite, alumina, and aluminum along with the production of extruded and recycled aluminum.

-

Hindalco is a leading metals & mining company in India with businesses focused on aluminum, copper, chemicals, fertilizers, etc. The aluminum business of the company serves industries such as automotive & transportation, building & construction, electrical electronics, and pharma & packaging, etc.

-

Aluminum Corporation of China is engaged in the production of alumina, fine alumina, aluminum, and high-purity aluminum. The company caters to markets such as construction, automotive & transport, packaging, consumer durables and electrical & electronics.

Key Aluminum Alloys Companies:

The following are the leading companies in the aluminum alloys market. These companies collectively hold the largest market share and dictate industry trends.

- Alcoa Corporation

- AluminIum BahraIn B.S.C. (Alba)

- Aluminum Corporation of China

- Hindalco

- Hydro

- National Aluminum Company Limited

- Novelis

- Press Metal

- RusAL

- UACJ Corporation

Recent Developments

-

In June 2024, Bharat Forge announced an investment of USD 40 million for its subsidiary BFA in the U.S., which focused on aluminum components for the automotive industry. With this investment, the company plans to increase its capital expenditure and improve its footprint in the U.S.

-

In May 2024, a team of scientists in China developed a heat-resistant aluminum alloy that can be used in transportation and aerospace. This new aluminum alloy has six times the strength compared to traditional alloy at 500 degrees Celsius.

-

In February 2024, Hydro announced an investment of USD 193 million for the construction of a new recycling plant in Torjia, Spain. The company aims to supply aluminum billets to industries such as automotive, consumer durables, and energy in the Europe region.

Aluminum Alloys Report Scope

Report Attribute

Details

Market size value in 2024

USD 236.55 billion

Revenue forecast in 2030

USD 340.12 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End Use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East, Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Russia; China; India; Japan; ASEAN; South Korea; Brazil; GCC; South Africa

Key companies profiled

Alcoa Corporation; AluminIum BahraIn B.S.C. (Alba); Aluminum Corporation of China; Hindalco; Hydro; National Aluminum Company Limited; Novelis; Press Metal; RusAL; UACJ Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aluminum Alloys Market Report Segmentation

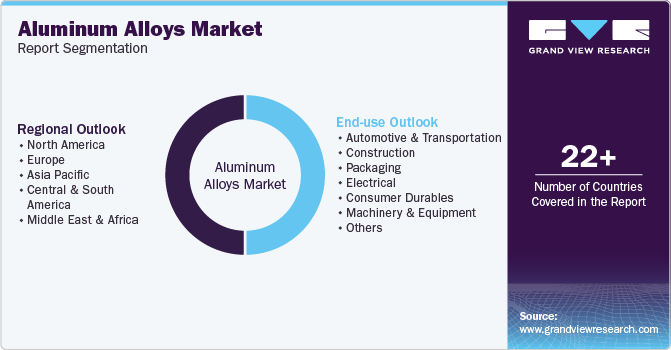

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aluminum alloys market report based on the end use, and region.

-

End Use Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Construction

-

Packaging

-

Electrical

-

Consumer Durables

-

Machinery & Equipment

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

ASEAN

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aluminum alloys market size was estimated at USD 233.75 billion in 2023 and is expected to reach USD 236.55 billion in 2024.

b. The global aluminum alloys market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 340.12 billion by 2030.

b. By end use, automotive & transportation dominated the market with a revenue share of over 27.0% in 2023.

b. Some of the key vendors of the global aluminum alloys market are Alcoa Corporation, AluminIum BahraIn B.S.C. (Alba), Aluminum Corporation of China, Hindalco, Hydro, National Aluminum Company Limited, Novelis, Press Metal, RusAL and UACJ Corporation among others.

b. The key factor driving the growth of the global aluminum alloys market is the increasing aluminum weight in vehicles supported along with rising awareness to reduce the emissions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."