- Home

- »

- Pharmaceuticals

- »

-

Cold Pain Therapy Market Size, Share & Growth Report 2030GVR Report cover

![Cold Pain Therapy Market Size, Share & Trends Report]()

Cold Pain Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Orthopedic Conditions, Post-operative Therapy, Sports Medicine), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-379-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Pain Therapy Market Size & Trends

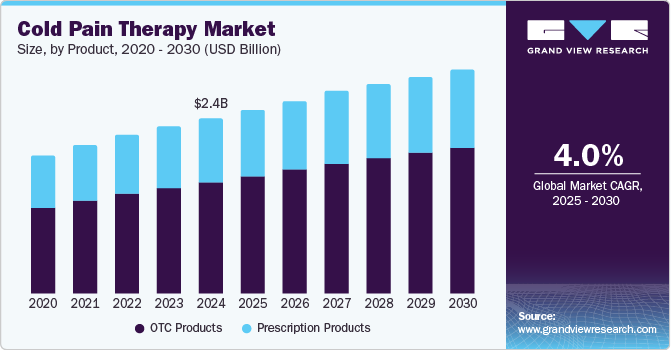

The global cold pain therapy market size was estimated at USD 2.44 billion in 2024 and is projected to grow at a CAGR of 4.0% from 2025 to 2030. According to the CDC, approximately 54 million adults in the U.S. are diagnosed with arthritis, a leading condition within this category. With osteoarthritis, rheumatoid arthritis, and joint pain becoming increasingly prevalent-especially among the aging population-there is a critical need for innovative and effective treatments. The growing recognition of cold therapy as a viable pain management option bolsters its market presence, as patients seek effective remedies for chronic conditions that compromise their quality of life.

According to the Australian Institute of Health and Welfare, approximately 60,000 individuals over the age of 15 were hospitalized annually due to sports injuries, underscoring the urgent need for effective pain relief methods such as cold therapy. As sports participation rises, so do the incidents of injuries, with millions being treated every year. Cold therapy is recognized for its efficacy in managing acute injuries and reducing inflammation, establishing itself as a reliable and non-invasive method for athletes and active individuals who seek to recover swiftly without resorting to pharmaceuticals.

Moreover, the aging population further contributes to the increasing demand for cold pain therapy products. By 2030, it is projected that 1 in 5 Americans will be aged 65 and older, resulting in an increased prevalence of chronic pain conditions. This demographic shift globally highlights the necessity for effective pain management strategies tailored to older adults, of whom many are seeking non-invasive options including cold therapy. The increasing prevalence of chronic pain within this segment serves as a substantial driver for market expansion.

Furthermore, awareness and acceptance of non-pharmacological treatments are on the rise, supported by a BMC Medicine study indicating that over 70% of healthcare providers in Europe are recommending non-invasive pain management solutions, including cold therapy. As both patients and practitioners become more educated on the benefits of these alternatives, the adoption of cold therapy products is accelerating. Coupled with technological advancements in cold therapy devices-such as motorized and non-motorized options-these drivers collectively contribute to a robust growth trajectory for the cold pain therapy market.

Product Insights

OTC products dominated the market with a revenue share of 63.7% in 2024. These products, encompassing cold packs, gels, and sprays, are available over-the-counter, offering consumers convenient access to immediate pain relief. The increasing incidence of sports injuries and musculoskeletal disorders drives demand, as individuals seek non-invasive, drug-free pain management solutions, aided by heightened awareness and expanded e-commerce accessibility.

Prescription products are expected to grow at a significant rate over the forecast period. These products typically feature higher concentrations of active ingredients, ensuring enhanced relief for severe pain. Healthcare providers often prescribe these targeted therapies for patients unresponsive to over-the-counter alternatives. As the population ages and musculoskeletal disorders increase, the demand for effective prescription-strength topical analgesics continues to rise significantly.

Application Insights

Orthopedic conditions led the market and accounted for a share of 49.9% in 2024, driven by the rising prevalence of musculoskeletal disorders, including osteoarthritis and rheumatoid arthritis. The aging population leads to increased joint pain, driving the demand for effective pain management. Cold therapy is favored for its inflammation reduction and effectiveness in recovery from orthopedic surgeries and sports injuries.

Post-trauma therapy is expected to register the fastest CAGR of 4.4% over the forecast period. Cold therapy is well-regarded for its effectiveness in reducing swelling, inflammation, and pain after injuries. As awareness of its benefits for expediting recovery increases, healthcare providers are recommending it more in post-trauma rehabilitation. The growing incidence of sports injuries and accidents further boosts demand for cold pain therapy products.

Distribution Channel Insights

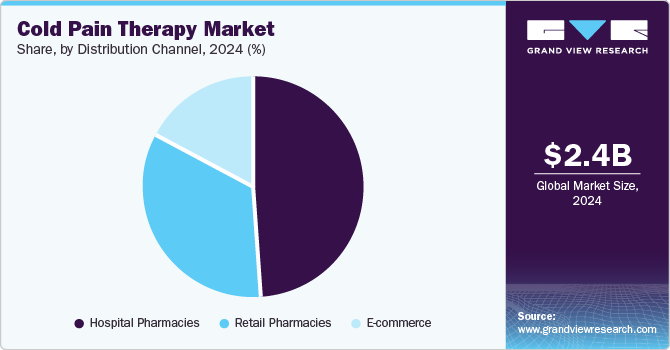

Hospital pharmacies held the largest market share of 48.9% in 2024, supported by the essential role of hospital pharmacies in offering specialized pain management solutions. They provide access to a diverse array of cold therapy products, ensuring adherence to stringent safety and efficacy standards. As healthcare providers acknowledge cold therapy’s benefits for post-surgery and injury recovery, demand for these products continues to rise.

The e-commerce segment is projected to witness the fastest growth of 4.8% over the forecast period. Online platforms enable customers to conveniently browse and purchase a diverse selection of cold therapy products from home. The COVID-19 pandemic accelerated this trend, enhancing digital shopping’s appeal with competitive pricing, comprehensive product information, and swift delivery options, thus driving sustained growth in this market segment.

Regional Insights

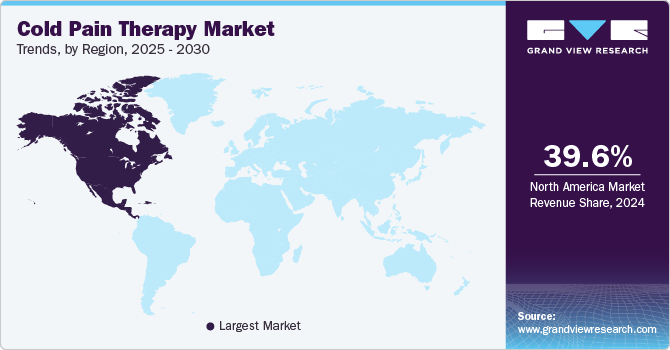

North America cold pain therapy market dominated the global market with a revenue share of 39.6% in 2024. The region exhibits a high prevalence of musculoskeletal disorders, including arthritis and back pain, effectively managed by cold therapy. An aging population, combined with an active lifestyle and sports culture, heightens demand. Furthermore, the introduction of advanced products and increased awareness among healthcare providers further bolster cold therapy’s popularity.

U.S. Cold Pain Therapy Market Trends

The cold pain therapy market in U.S. dominated the North America cold pain therapy market with a revenue share of 90.6% in 2024. There is a significant demand for effective pain management solutions in the country. The cultural emphasis on sports and fitness results in a higher incidence of sports-related injuries, reinforcing the need for cold therapy products. Moreover, the availability of innovative therapies and increased consumer awareness further enhances the popularity of cold pain therapy.

Europe Cold Pain Therapy Market Trends

Europe cold pain therapy market held substantial market share in 2024 due to a rising prevalence of chronic pain and musculoskeletal disorders. Enhanced awareness of non-invasive pain management options has encouraged adoption of cold therapy among patients and healthcare providers. Moreover, in 2023, 70% of EU individuals aged 16-74 engaged in e-commerce, with significant penetration in the Netherlands, Sweden, and Denmark. Amazon led the market, and France’s e-commerce revenue grew by 10.5%, reflecting strong consumer demand. An aging demographic and expanded e-commerce platforms improve access to cold therapy products across Europe.

The cold pain therapy market in Germany is expected to grow in the forecast period, fueled by an advanced healthcare system and a focus on innovative medical technologies. A high prevalence of musculoskeletal disorders drives demand for effective pain management solutions such as cold therapy, as increased awareness among professionals facilitates greater adoption and supports ongoing research and development efforts.

Asia Pacific Cold Pain Therapy Market Trends

Asia Pacific cold pain therapy market is expected to register the fastest CAGR of 5.2% in the forecast period. Rising awareness of non-pharmacological pain management among consumers and healthcare providers is boosting demand for cold therapy products. The expanding middle class with greater disposable incomes enhances access to advanced devices, while government initiatives promoting health and wellness support their adoption in markets such as China, India, and Australia.

The cold pain therapy market in Japan dominated the Asia Pacific cold pain therapy market in 2024. Japan’s aging population increasingly experiences chronic pain conditions such as arthritis, driving demand for advanced cold therapy products. The country’s emphasis on innovative healthcare solutions and cultural preference for non-invasive therapies facilitate adoption among patients and medical professionals. A robust healthcare infrastructure ensures widespread availability of these products.

Key Cold Pain Therapy Company Insights

Some key companies operating in the market include Beiersdorf; Breg, Inc.; DJO Global (Enovis Corporation); Johnson & Johnson Services, Inc.; Össur; among others. Strategic initiatives prioritize product innovation, regional expansion, and e-commerce enhancement. Companies invest in research and development for advanced cold therapy solutions, while collaborations aim to improve distribution networks and market reach.

-

Breg, Inc. specializes in orthopedic bracing and cold therapy products, including the Polar Care Wave system, which integrates cold therapy and compression for superior pain relief. The company enhances patient access to rehabilitation equipment through innovative eCommerce solutions.

-

Enovis Corporation, via its subsidiary DJO Global, develops and manufactures various medical devices, including cold therapy products aimed at pain management and recovery post-injury or surgery, emphasizing technological advancements to enhance treatment efficacy and improve patient outcomes.

Key Cold Pain Therapy Companies:

The following are the leading companies in the cold pain therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Beiersdorf

- Breg, Inc.

- DJO Global (Enovis Corporation)

- Johnson & Johnson Services, Inc.

- Össur

- Performance Health

- ROHTO Pharmaceutical Co.,Ltd.

- Romsons Group of Industries

- Medline Industries, LP.

- Unexo Life Sciences Pvt. Ltd.

Recent Developments

-

In March 2023, HealthMe and Breg, Inc. announced a partnership to launch a direct-pay eCommerce solution, enhancing patient access to orthopedic cold therapy products through a streamlined, automated payment process.

Cold Pain Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.56 billion

Revenue forecast in 2030

USD 3.12 billion

Growth rate

CAGR of 4.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Beiersdorf; Breg, Inc.; DJO Global (Enovis Corporation); Johnson & Johnson Services, Inc.; Össur; Performance Health; ROHTO Pharmaceutical Co.,Ltd.; Romsons Group of Industries; Medline Industries, LP.; Unexo Life Sciences Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Pain Therapy Market Report Segmentation

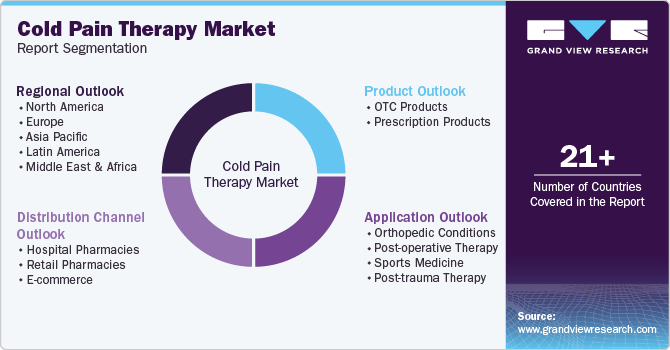

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cold pain therapy market report based product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC Products

-

Gels, Ointments & Creams

-

Sprays & Foams

-

Patches

-

Roll-ons

-

Cold Packs

-

Others

-

-

Prescription Products

-

Motorized Devices

-

Non-motorized Devices

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Conditions

-

Post-operative Therapy

-

Sports Medicine

-

Post-trauma Therapy

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.