- Home

- »

- Homecare & Decor

- »

-

Cold Plunge Tub Market Size, Share & Trends Report, 2030GVR Report cover

![Cold Plunge Tub Market Size, Share & Trends Report]()

Cold Plunge Tub Market Size, Share & Trends Analysis Report By Application (Commercial, Residential), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-955-7

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Cold Plunge Tub Market Size & Trends

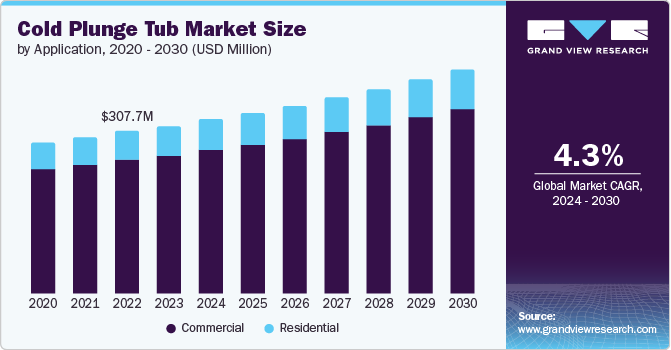

The global cold plunge tub market size was estimated at USD 318.63 million in 2023 and is expected to grow at a CAGR of 4.3% from 2024 to 2030. The need to treat the increasing number of cases of inflammation, discomfort, and muscle soreness among athletes and in sports training facilities is one of the primary factors fueling market growth. Many sportsmen have a routine of dipping into an ice bath after a workout. It is used for quicker recovery and reducing muscular stiffness and soreness after intense training sessions or contests and is also known as cold water immersion. Patients and athletes are becoming more aware of hydrotherapy due to the treatment's increased attention, and it has gained prominent focus among sportspersons and athletes.

The cold plunge tub market is witnessing a significant surge in demand, driven largely by the increasing product popularity in corporate and social networking events. Companies like Grand Dynamics, which specializes in executive retreats and team-building activities, report that in 2024, more than half of their clients request cold immersion experiences. This trend highlights the growing appreciation for cold plunge activities as an effective method for team bonding and stress relief, leading to its adoption in various professional settings.

Customers prefer therapeutic spas to reduce their stress and anxiety. According to the International Spa Association (ISPA), the U.S. spa industry revenue reached USD 18.1 billion in 2021, increasing by 49.4% from USD 12.1 billion in 2020. Similarly, according to the Global Wellness Institute (GWI), in 2019, the spa industry reached USD 110.7 billion in spa revenue and 165,714 spa establishments. This marked an 8.7% yearly revenue rise, which was primarily driven by rising consumer earnings, continuing tourism expansion, and a rising tendency to spend on all things wellness-related.

The use of ice-cold water has been popularized owing to its ability to remove heat, alter blood flow, and reduce core and tissue temperatures. Secondary effects on human physiologies that have positive outcomes include a decreased perception of pain or analgesia and an increased sense of well-being. These advantages have propelled the market growth.

The surge in popularity of cold plunge tubs can be largely attributed to the influential presence of celebrities and social media platforms like TikTok. High-profile celebrities have prominently featured their cold plunging routines, garnering widespread attention and millions of views.

Cold-water immersion (CWI) is also used sporting recovery purposes, which is further accelerating the growth of the cold plunge tub market. In September 2021, a systematic review was conducted to study the impact of cold-water immersion compared with passive recovery following a single bout of strenuous exercise on athletic performance in physically active participants. The review showed that CWI improved the recovery of muscular power 24 hours after eccentric exercise and after high-intensity exercise. CWI also improved muscle soreness and perceived feelings of recovery 24 hours after high-intensity exercise.

Healthcare and fitness facilities have traditionally been the primary venues for cold plunge tubs, but the rising corporate interest is diversifying the market. Social wellness clubs like Remedy Place in New York and Los Angeles and Othership in Toronto are emerging as key players, offering businesspeople opportunities to network while engaging in wellness practices such as ice baths and cryotherapy. This trend reflects a wider acceptance and integration of wellness into everyday professional life, fostering a robust market growth for cold plunge tubs in both health-centric and business environments.

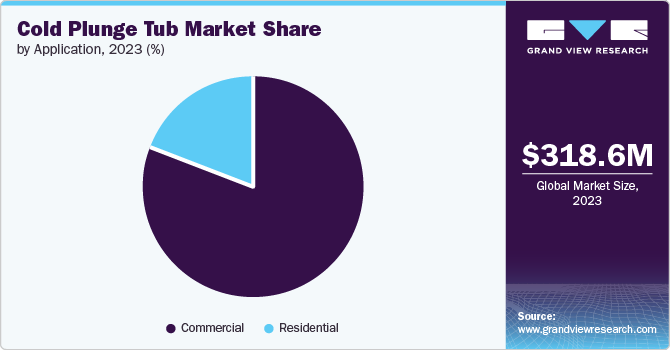

Application Insights

Commercial application of cold plunge tubs accounted for a market share of about 81% in 2023. Cold plunge tubs have gained immense popularity across a wide range of users, from elite athletes and celebrities to wellness enthusiasts and even corporate leaders. For instance, LeBron James, Naomi Osaka, Klay Thompson, and J.J. Watt are among some of the elite athletes using cold plunge tubs as part of their rigorous recovery routine to enhance performance. As elite athletes, celebrities, and influencers openly endorse the benefits of cold water immersion, the demand for cold plunge tubs is expected to surge in commercial applications.

In residential applications, the demand for cold plunge tubs is expected to rise at a CAGR of about 3.6% from 2024 to 2030. According to an article published by the Club Industry in December 2022, a premier source of trending news related to fitness and wellness, 48.2% of Americans have increased their prioritization of wellness over the past two to three years owing to the pandemic crisis. Homeowners are increasingly investing in cold plunge tubs to integrate into their personal wellness spaces, including home gyms, spas, and outdoor settings. Companies like Plunge and RENU Therapy are catering to this growing market demand by offering stylish, compact, and easy-to-install models that fit seamlessly into a home environment.

Regional Insights

The cold plunge tub market in North America accounted for a market share of around 38% in 2023 in the global market. The demand for cold plunge baths and an increase in the popularity of residential spas have positively affected the number of innovative product launches by businesses. For instance, in June 2022, Santa Ana-based Renu Therapy LLC revealed the benefits of cold plunging. The report compiled by the company’s experts focused on the health benefits of a daily home cold plunge. In addition, COLDTUB’s unique technologies and design focus on minimal energy consumption and reduced water waste, allowing users to recover faster without hurting the environment. These strategic initiatives have provided a competitive edge for companies in the North American market.

U.S. Cold Plunge Tub Market Trends

The cold plunge tub market in the U.S. accounted for a market share of around 81% in 2023 in the North American market. The growing trend of glamping in the country is likely to offer manufacturers of cold plunge tubs opportunities to scale production and enhance revenue. For instance, PLUNGE, a California-based manufacturer, provides a cold plunge tub equipped with powerful cooling and filtration systems. This tub offers a superior experience compared to traditional ice baths or chest freezers. It is designed for both indoor and outdoor use, comes in a standard size, and is easy to install.

Asia Pacific Cold Plunge Tub Market Trends

The cold plunge tub market in Asia Pacific is anticipated to grow at a CAGR of about 5.2% from 2024 to 2030. The market is expected to grow progressively during the forecasted period due to the rapidly expanding health, fitness, and wellness centers and populations’ increasing preferences towards health and mental wellness activities. Furthermore, wellness centers collaborate with hotels and resorts to extend their offerings in wellness tourism activities for guests. These partnerships will create lucrative opportunities for the wellness tourism sectors in the Asia Pacific region. For instance, in Oct 2022, Thailand-based BDMS Wellness Clinic collaborated with Minor Hotels to launch the BDMS Wellness Clinic Retreat at Anantara Riverside Bangkok Resort to add value to Thailand’s tourism industry.

Key Cold Plunge Tub Company Insights

The market for cold plunge tubs is consolidated. Many brands have recognized the presence of untapped opportunities in their product offerings and have been adopting strategies such as marketing campaigns, technological innovations, and product launches to gain market share.

Key Cold Plunge Tub Companies:

The following are the leading companies in the cold plunge tub market. These companies collectively hold the largest market share and dictate industry trends.

- Plunge

- COLDTUB

- Renu Therapy

- Edge Theory Labs, Inc.

- BlueCube Cold Plunge Tubs & BlueCube Wellness LLC

- iCool (Australia) Pty Ltd

- Brass Monkey Health Ltd

- Morozko Forge

- Ice Barrel Inc.

- The Ice Bath Co.

- Odin Ice Baths Pty Ltd

Recent Developments

-

In June 2024, Renu Therapy, a leader in water immersion therapy tanks, introduced the Cold Stoic 3.0, a significant upgrade from the Cold Stoic 2.0. This new model enhances the cold water immersion experience with advanced features and improvements, setting a new benchmark for performance, convenience, and durability in cold plunge therapy.

-

In April 2024, Plunge, a pioneer in home and spa wellness solutions, launched the Evolve Series, introducing four new products designed to make cold water immersion more accessible. This new lineup, which includes an inflatable cold plunge tub and a compact chiller, leverages Plunge's advanced technology to offer an easy and customizable way for individuals to experience the benefits of cold water immersion in 2024.

-

In December 2022, Brass Monkey launched a new app that connects with the Brass Monkey Gen2 bath and plunge. There are some basic functions in the app to control the ice bath remotely, such as manually manipulating the temperature and scheduling a bath.

Cold Plunge Tub Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 330.58 million

Revenue forecast in 2030

USD 426.79 million

Growth rate

CAGR of 4.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Plunge; COLDTUB; Renu Therapy; Edge Theory Labs, Inc; BlueCube Cold Plunge Tubs & BlueCube Wellness LLC; iCool (Australia) Pty Ltd; Brass Monkey Health Ltd; Morozko Forge; Ice Barrel Inc.; The Ice Bath Co.; Odin Ice Baths Pty Ltd

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Cold Plunge Tub Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the cold plunge tub market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Wellness Centers/Gyms/Spas

-

Hotels/Hospitality

-

Hospitals/Medical Centers

-

Institutional

-

Others

-

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The cold plunge tub market was estimated at USD 318.63 million in 2023 and is expected to reach USD 330.58 million in 2024.

b. The cold plunge tub market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 426.79 million by 2030.

b. North America dominated the cold plunge tub market with a share of around 38% in 2023. The region’s advanced healthcare infrastructure and high adoption rate of wellness trends drive the demand for cold plunge tubs among homeowners and athletes.

b. Key players in the cold plunge tub market are Plunge; COLDTUB; Renu Therapy; Edge Theory Labs, Inc; BlueCube Cold Plunge Tubs & BlueCube Wellness LLC; iCool (Australia) Pty Ltd; Brass Monkey Health Ltd; Morozko Forge; Ice Barrel Inc.; The Ice Bath Co.; Odin Ice Baths Pty Ltd.

b. Key factors that are driving the cold plunge tub market growth include the growing awareness about the benefits of cold plunge therapy through educational content, research, and endorsements by health professionals and athletes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."