- Home

- »

- Beauty & Personal Care

- »

-

Spa Services Market Size And Share, Industry Report, 2033GVR Report cover

![Spa Services Market Size, Share & Trends Report]()

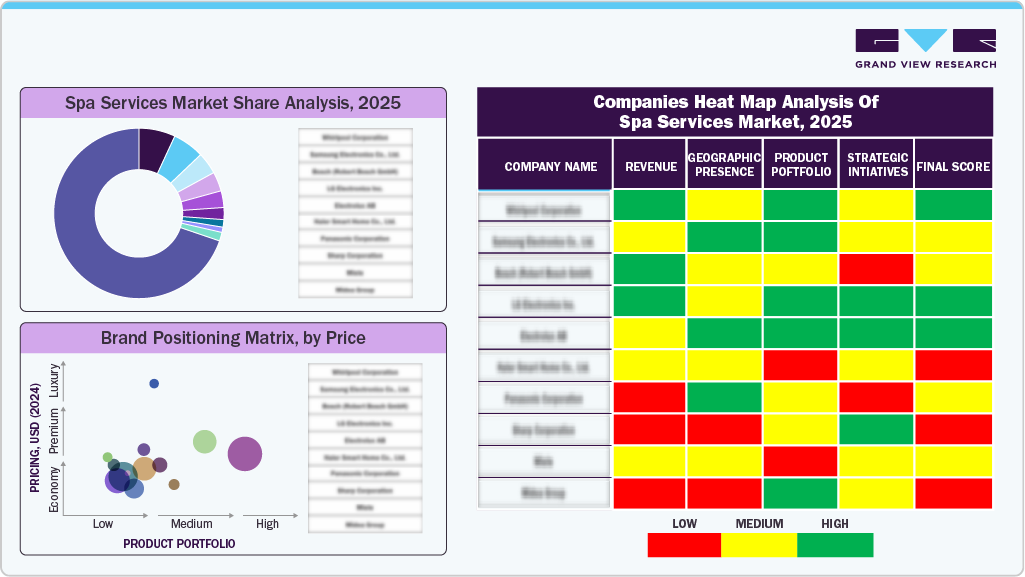

Spa Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Spa Type (Hotel/Resort Spa, Destination Spa,Day/Salon Spa, Medical Spa, Thermal/Mineral Spring Spa), By Service, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-373-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Spa Services Market Summary

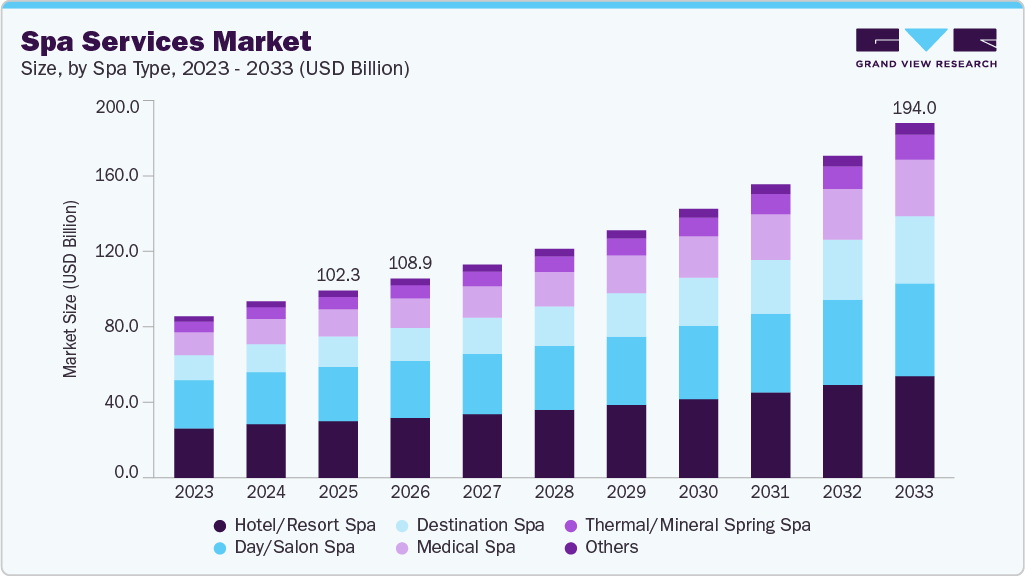

The global spa services market size was estimated at USD 102.32 billion in 2025 and is projected to reach USD 194.02 billion by 2033, growing at a CAGR of 8.6% from 2026 to 2033. The industry has experienced significant growth due to an increasing awareness of the importance of wellness and self-care.

Key Market Trends & Insights

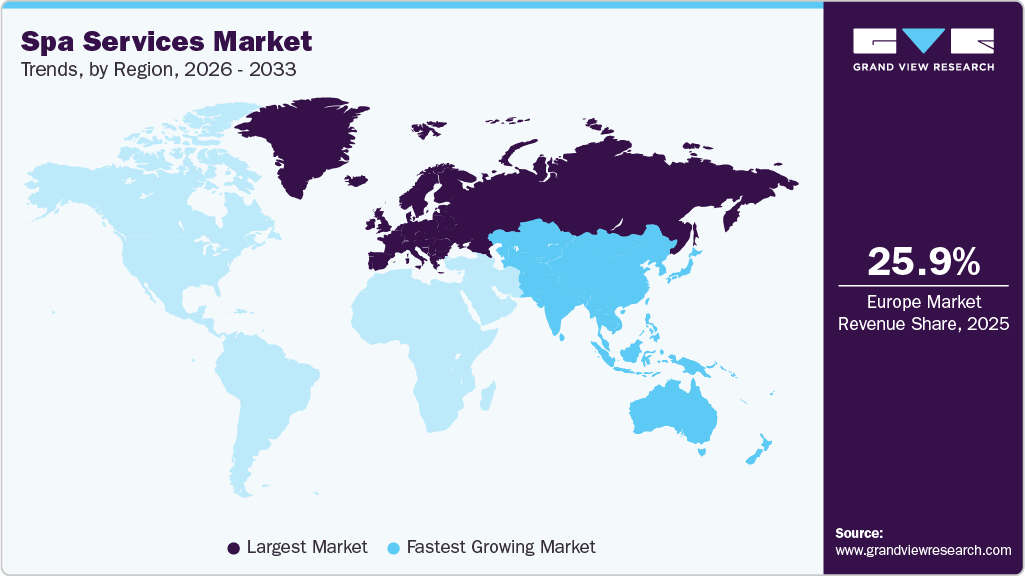

- The Europe spa services market held the largest global revenue share of 25.9% in 2025.

- The U.S. spa services industry led North America, with a dominant share of 83.2% in 2025.

- The Asia Pacific market for spa services is set to grow at a CAGR of 9.7% from 2026 to 2033.

- By spa type, the hotel/resort spa segment held a revenue share of 30.3% in 2025.

- By service, the massage therapies segment held a revenue share of around 41.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 102.32 Billion

- 2033 Projected Market Size: USD 194.02 Billion

- CAGR (2026-2033): 8.6%

As people become more focused on improving their physical, mental, and emotional well-being, the demand for spa treatments has risen. The growing popularity of massage therapies is a key growth driver for the spa services industry. According to the 2025 survey by the American Massage Therapy Association (AMTA), 91% of individuals consider massage beneficial to their overall health. In addition, Consumers received an average of 2.7 massage sessions over the past 12 months, and 24% of respondents had received a recommendation from their medical provider to seek massage therapy, which further highlights the growing appeal of wellness-focused spa services. One major trend in the spa services industry is the increasing demand for male-specific treatments.

Luxury hotels and resorts are increasingly partnering with renowned wellness brands to enhance their spa offerings, elevating the quality and exclusivity of their services. For example, Bvlgari Hotels & Resorts collaborated with Augustinus Bader to launch the "Bvlgari Exclusive Facial" in Paris. These partnerships enable luxury hotels to differentiate their spa services and attract high-end travelers seeking personalized wellness experiences. Such collaborations are a strategic response to the evolving preferences of wellness tourists, who prioritize health-focused vacations and expect top-tier spa services during their stays. The increasing prominence of wellness tourism is contributing to the expansion of the spa services industry.

The growing popularity of wellness tourism has also contributed to the expansion of the spa services market, attracting high-end international travelers. Wellness tourists tend to spend 41% more than regular tourists, with an average of USD 1,764 per trip in 2022, according to the GWI. As wellness tourism continues to capture a larger share of the overall travel market, projected to reach 7.8% of all tourism trips, the market is expected to continue benefiting from this trend.

Consumer Insights

Consumer demand for spa services in the global market varies significantly across different age groups. Younger consumers, particularly those aged 18-34, are more inclined toward spa services that offer relaxation, stress relief, and lifestyle wellness, such as massages, facials, and express treatments. This group values convenience, digital booking options, promotional pricing, and social media influence when choosing spa services. In contrast, older consumers tend to prefer therapeutic, medical, and wellness-oriented treatments focused on pain management, rehabilitation, and long-term health benefits. Differences in lifestyle, disposable income, and health priorities across age groups directly influence service preferences and frequency of spa visits.

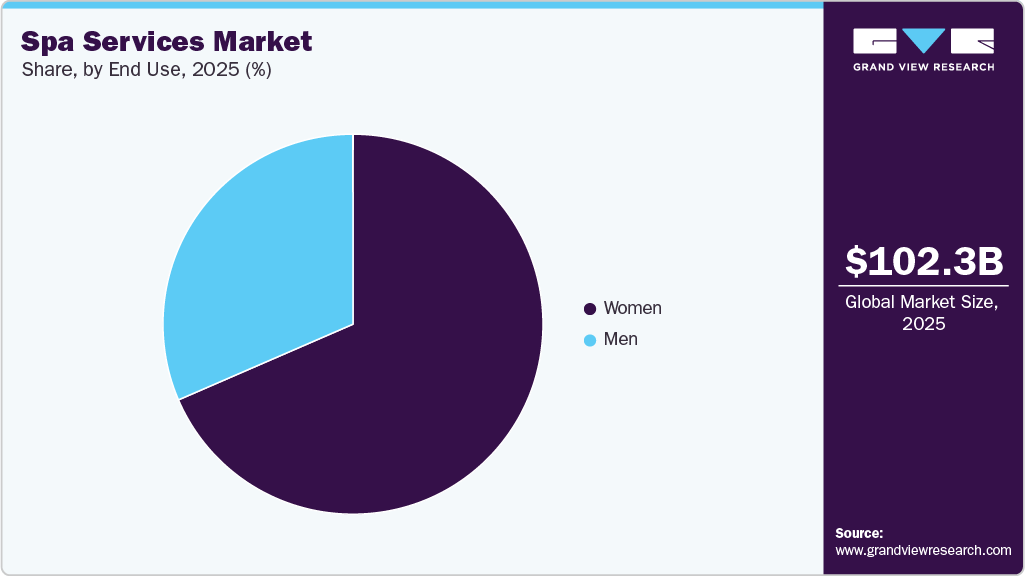

Gender has a significant impact on how people use spa services. Women make up the majority of spa customers, often seeking treatments that focus on beauty, skincare, and wellness. They tend to value service quality, cleanliness, personalized care, and the overall experience. More men are starting to use spa services, especially for stress relief, sports recovery, and medical treatments; however, they tend to be more price-conscious and visit spas less frequently. As more people become aware of wellness and attitudes change, the gap between men and women is closing. This shift presents spa businesses with an opportunity to offer more inclusive services and develop marketing strategies that appeal to a broader audience.

Urbanization and changing lifestyles continue to drive the growth of the global spa services market. Rapid urban development has increased consumer exposure to organized wellness facilities, higher disposable incomes, and a growing focus on achieving a work-life balance. Urban consumers increasingly seek convenient, premium, and experience-driven spa services as part of their wellness routines. The adoption of digital platforms for bookings, memberships, and cashless payments further enhances accessibility and consumer engagement. According to the World Bank Group, the global urban population rose from 56.0% of the total population in 2020 to 58.0% by 2024. These trends create favorable conditions for sustained demand growth in spa services.

Spa Type Insights

The hotel/resort spa segment led the spa services market, accounting for the largest revenue share of 30.3% in 2025. The segment is experiencing significant growth, driven by the evolving traveler expectations and the increasing integration of wellness offerings. According to the Wellness Real Estate Report 2024 by RLA Global, hotels with wellness elements saw a 26% increase in average total revenue per available room (TRevPAR) in 2023, driven by higher prices and a 10% rise in occupancy. Spa treatment revenue also grew by 30-35% compared to 2019 levels, as reported by Truist in April 2023. Additionally, emerging trends such as IV therapy, cryotherapy, and medical-themed services are expanding spa offerings, further contributing to the market's growth.

The destination spas segment is projected to grow at a CAGR of 10.7% from 2026 to 2033. Destination spas are set to rise in popularity as they cater to the growing demand for mental wellness and relaxation. With stress levels increasing, these spas are incorporating neuroscience and psychotherapy into their programs alongside mainstream meditation. Technology-based services also enhance rejuvenation experiences, appealing to high-income individuals seeking exclusivity and personalization. According to the U.S. Spa Industry Study 2023, luxury destinations in places like Switzerland and the Maldives report significant demand for wellness retreats, offering a blend of advanced therapies and leisure activities.

Service Insights

The massage therapies segment held the largest share of the spa services industry in 2025. Massage services are increasingly gaining popularity in the market, driven by their health benefits and growing consumer demand. According to the AMTA's 2025 Massage Profession Research Report, people with higher household incomes are more likely to get massages. Last year, 33% of those earning USD 100,000 or more had a massage, compared to just 17% of those earning USD 50,000 or less. In addition, spas are embracing innovative technologies to enhance massage experiences, such as touchless wellness loungers and advanced hydrotherapy systems. These modern offerings, such as those from JK Products & Services and Living Earth Crafts, elevate the spa experience, attracting consumers who seek both traditional and tech-driven rejuvenation.

Demand for body treatments is projected to grow at the fastest CAGR over the forecast period. Body treatments at spas are gaining popularity as people seek holistic, non-medical solutions to improve their physical and mental well-being. These treatments, which range from massages and scrubs to detoxifying wraps and electromagnetic pulses, cater to various needs like stress relief, skin hydration, muscle relaxation, and body shaping. With growing awareness of the benefits of self-care, people are increasingly turning to body treatments to rejuvenate, detoxify, and improve their overall well-being. The combination of relaxation and invigoration makes these treatments a sought-after choice in wellness-focused spa experiences.

End Use Insights

Women accounted for the largest share of the spa services market in 2025. Women continue to dominate the spa industry, with a notable trend towards a younger population seeking non-surgical aesthetic treatments. Younger women, particularly those in their 20s and 30s, are increasingly investing in beauty and wellness services, embracing procedures that promote anti-aging and skin rejuvenation. As a result, spas are expanding their offerings to cater to this age group, focusing on treatments that deliver both immediate and long-term results. Women are also gravitating toward personalized experiences, seeking treatments that align with their specific aesthetic goals and overall wellness.

Demand for spa services among men is expected to grow at the fastest CAGR from 2026 to 2033. Awareness of wellness, stress management, and self-care is growing. There is a growing demand for professional spa services in the market, as younger men are becoming increasingly open to incorporating spa treatments into their healthy lifestyle, rather than just viewing them as a luxury. As social views shift and more wellness content becomes available online, men are increasingly incorporating spa services into their routines. In February 2023, a Skin Inc. poll found that 79% of spa professionals are handling more male clients, especially millennial men. Men are increasingly visiting spas for grooming, skincare, and self-care, reflecting a broader trend of incorporating wellness into daily life. These changes in attitudes are likely to drive steady growth in male spa service use in the coming years.

Regional Insights

The North America spa services market is expected to experience strong growth over the forecast period. The industry here thrives due to the rising consumer demand for wellness and cosmetic treatments. The medical spa sector, in particular, has seen significant growth. The industry's growth is fueled by shifting consumer attitudes, particularly among millennial men, who are increasingly spending on aesthetic services. Social media has played a pivotal role in normalizing cosmetic procedures, while innovations like body contouring and biostimulators further drive demand.

U.S. Spa Services Market Trends

The U.S. spa services industry held the largest share of North America in 2025. Spa services in the U.S. are on the rise due to increasing awareness of their health benefits, including stress reduction, improved circulation, and mental wellness. As medical providers recommend massage therapy, more individuals are prioritizing self-care. The demographic of spa-goers is broadening, with both men and younger generations seeking personalized wellness experiences. Technological innovations, such as hydrotherapy and cryotherapy, are enhancing treatments, while economic resilience ensures steady growth. The wellness movement continues to expand, attracting a wider clientele and fostering market growth in both established and emerging markets.

Europe Spa Services Market Trends

The Europe spa services industry accounted for the largest share of 25.9% in 2025. Spa services in Europe are experiencing significant growth due to increasing consumer demand for wellness experiences, particularly thermal treatments such as saunas. The pandemic sparked a renewed focus on mental and physical health, with many individuals eager to return to spas. In July 2023, the State of Spa Report 2023 from The Good Spa Guide, which surveyed 8,827 UK spa-goers, revealed that an increasing number of people are seeking sauna and thermal room experiences. Around 58% of those surveyed stated that thermal facilities, especially saunas, are important when selecting a spa, highlighting an increasing consumer interest in sauna-led wellness offerings. Major hotel chains, such as Disneyland in Paris, are also investing in luxurious spa facilities, further driving the growth of the wellness sector across Europe.

Asia Pacific Spa Services Market Trends

The Asia Pacific spa services industry is set to grow at the fastest CAGR of 9.7% from 2026 to 2033. This growth can be attributed to a combination of factors, including increasing disposable income, urbanization, and a growing emphasis on wellness. For instance, according to the Government of India, the per capita Gross National Disposable Income increased from USD 1,941.91 in 2021‑22 to USD 2,376.12 in 2023‑24. As urban stress levels rise, more individuals are seeking relaxation through spa services. The region's affluent youth, who view middle age as the prime of their lives, are leading this trend by embracing wellness and luxury experiences, such as destination spas. With the rise in ultra-wealthy individuals and their interest in health and self-care, the demand for high-end spa treatments, including adventure activities and wellness retreats, continues to grow.

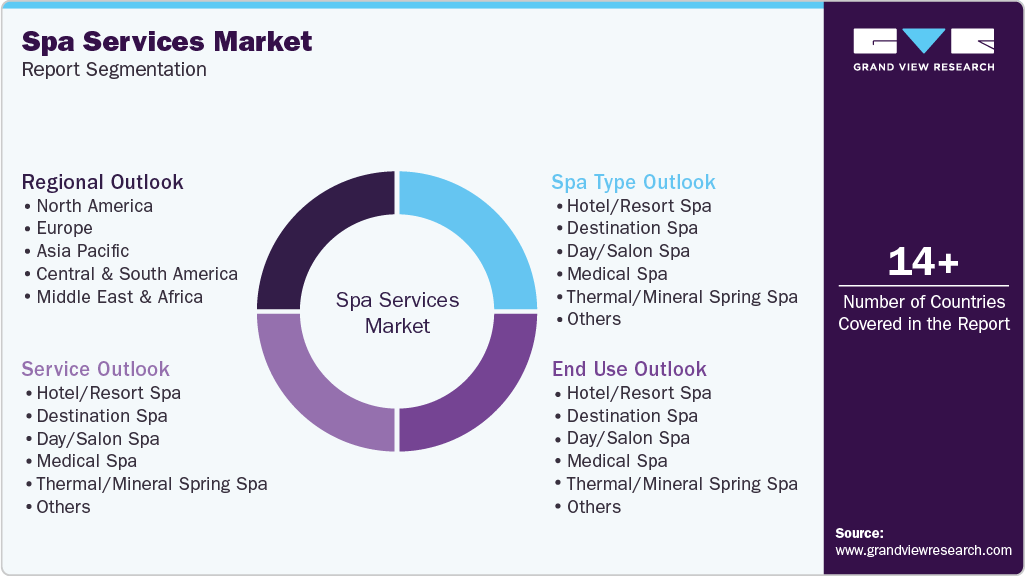

Key Spa Services Company Insights

Some of the key players in the spa services market include Aman Group S.a.r.l. and The Ritz-Carlton Hotel Company, L.L.C.

-

Aman Group S.a.r.l. currently operates 36 hotels, resorts, and residences across 20 countries, including 15 properties located near or within UNESCO-protected sites. The company has announced an additional ten projects as part of its growth pipeline.

Key Spa Services Companies:

The following are the leading companies in the spa services market. These companies collectively hold the largest market share and dictate industry trends.

- Aman Group S.a.r.l.

- The Ritz-Carlton Hotel Company, L.L.C.

- Mandarin Oriental Hotel Group Limited

- Four Seasons Hotels Limited

- AYANA

- Miraval (Hyatt Corporation)

- HSH Management Services Limited. (The Peninsula Hotels)

- Fairmont (Accor)

- Kempinski Hotels

- Marriott International, Inc.

- Woodhouse Spas

- Hand & Stone Franchise Corp

- Banyan Tree Hotels & Resorts

- Royal Champagne Hotel & Spa

- Rescue Spa

- Raffles Hotels & Resorts

Recent Developments

-

In June 2025, Bamboo Luxury Spa launched its operations on Juhu Tara Road, Mumbai, offering premium wellness services. The spa focuses on holistic therapies and nature-inspired designs to meet the rising demand for urban wellness experiences.

-

In November 2024, Woodhouse Spa introduced a new range of treatments, including the Glacial Gloss facial, advanced red light therapy, and cryo-facials, combining modern skincare technology with luxury relaxation.

-

In November 2024, the company expanded its footprint by converting 30 LaVida Massage locations across seven states, including Arkansas, Georgia, and Michigan. This move marked Hand & Stone's entry into Arkansas with its Bentonville location, increasing its total spa count from 39 to 40. The conversion strategy included comprehensive training and support for new franchisees and staff, ensuring a seamless transition into the Hand & Stone brand.

-

In November 2024, Çırağan Palace Kempinski Istanbul unveiled its redesigned spa and wellness center, managed by Sanitas Spa & Wellness. The renovated spa featured a VIP Turkish bath, massage rooms, a fitness center, an indoor pool, and more. Signature treatments included the "Sultan’s Bath" and the "Sanitas Signature Massage," alongside offerings such as the Thai Blend Massage for muscle pain and Shirodhara for detoxification and body harmony.

Spa Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 108.95 billion

Revenue forecast in 2033

USD 194.02 billion

Growth rate

CAGR of 8.6% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Spa type, service, end use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Indonesia; Thailand; Singapore; South Korea; Brazil; Argentina; South Africa; UAE; Qatar

Key companies profiled

Aman Group S.a.r.l.; The Ritz-Carlton Hotel Company, L.L.C.; Mandarin Oriental Hotel Group Limited; Four Seasons Hotels Limited; AYANA; Miraval (Hyatt Corporation); HSH Management Services Limited (The Peninsula Hotels); Fairmont (Accor); Kempinski Hotels; Marriott International, Inc.; Woodhouse Spas; Hand & Stone Franchise Corp; Banyan Tree Hotels & Resorts; Royal Champagne Hotel & Spa; Rescue Spa; Raffles Hotels & Resorts

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Spa Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the spa services market report based on spa type, service, end use, and region:

-

Spa Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hotel/Resort Spa

-

Destination Spa

-

Day/Salon Spa

-

Medical Spa

-

Thermal/Mineral Spring Spa

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hotel/Resort Spa

-

Massage Therapies

-

Body Treatments

-

Salon Services

-

Others

-

-

Destination Spa

-

Massage Therapies

-

Body Treatments

-

Salon Services

-

Others

-

-

Day/Salon Spa

-

Massage Therapies

-

Body Treatments

-

Salon Services

-

Others

-

-

Medical Spa

-

Massage Therapies

-

Body Treatments

-

Salon Services

-

Others

-

-

Thermal/Mineral Spring Spa

-

Massage Therapies

-

Body Treatments

-

Salon Services

-

Others

-

-

Others

-

Massage Therapies

-

Body Treatments

-

Salon Services

-

Others

-

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hotel/Resort Spa

-

Women

-

Men

-

-

Destination Spa

-

Women

-

Men

-

-

Day/Salon Spa

-

Women

-

Men

-

-

Medical Spa

-

Women

-

Men

-

-

Thermal/Mineral Spring Spa

-

Women

-

Men

-

-

Others

-

Women

-

Men

-

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Thailand

-

Singapore

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Qatar

-

-

Frequently Asked Questions About This Report

b. Europe dominated the spa services market in 2024 with a share of about 36%. The industry here is booming due to growing consumer demand for wellness experiences, particularly thermal treatments like saunas.

b. The spa services market was estimated at USD 96.51 billion in 2024 and is expected to reach USD 102.32 billion in 2025.

b. The spa services market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 147.11 billion by 2030.

b. Massage therapies held a market share of about 39% in the overall spa services market in 2024. These are popular due to their proven health benefits and the increasing consumer demand for wellness and relaxation services.

b. Key players in the spa services market are Aman Group S.a.r.l.; The Ritz-Carlton Hotel Company; Mandarin Oriental Hotel Group; Four Seasons Hotels Limited; AYANA Hospitality; Miraval; The Peninsula Hotels; Hyatt Hotels Corporation; Fairmont Hotels & Resorts; Kempinski Hotels; Marriott International, Inc.; Mandara Spa; Woodhouse Spas; Hand & Stone Franchise Corp.; Banyan Tree Hotels & Resorts; Royal Champagne Hotel & Spa; Raffles Hotels & Resorts; Rescue Spa; Uka Spa; Palaispa.

b. Key factors that are driving the spa services market growth include rising wellness tourism, increasing health awareness, demand for personalized experiences, and a focus on mental well-being.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.