- Home

- »

- Consumer F&B

- »

-

Cold Pressed Oil Market Size, Share & Growth Report, 2030GVR Report cover

![Cold Pressed Oil Market Size, Share & Trends Report]()

Cold Pressed Oil Market Size, Share & Trends Analysis Report By Product (Coconut Oil, Palm Oil), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-939-2

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Cold Pressed Oil Market Size & Trends

The global cold pressed oil market size was estimated at USD 30.8 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. The market growth can be attributed to the shifting consumer preference for natural and minimally processed food products. Cold-pressed oils, which are extracted using hydraulic pressing techniques without the application of heat, retain more nutrients, flavors, and aromas compared to oils produced using conventional methods. As consumers become increasingly health-conscious, there is a growing tendency to seek out oils that offer health benefits and are free from chemical additives.

)

)This trend is further amplified by the expansion of organic and clean-label products, which resonate well with today's consumers, who are more informed about food sourcing and production processes.

One of the key demand drivers fueling market growth is the rising integration of these oils into diverse culinary practices and dietary patterns. The influence of cooking shows, social media influencers, and nutrition experts has significantly bolstered the popularity of healthier cooking alternatives, leading to a marked preference for cold-pressed oils such as olive, coconut, and almond. These oils are not only recognized for their health benefits but also play a crucial role in enhancing the flavor profiles of numerous dishes, thereby securing their strong presence in contemporary kitchens. In addition, the increasing adoption of cold-pressed oils by the expanding vegan and plant-based food sectors is further reinforcing their relevance and application in culinary contexts.

Cold-pressed oils are rich in phytochemicals, antioxidants, and healthy fats, making them an appealing choice for consumers aiming to improve their dietary intake. Moreover, the rising prevalence of lifestyle-related health issues, such as obesity and cardiovascular diseases, has spurred health-oriented consumers to explore cooking oils that can contribute positively to their overall well-being. This shift in consumer mentality has resulted in increased demand for cold-pressed oils, not only in households but also within the food service industry, where restaurants and cafes prioritize healthier ingredient sourcing.

The expansion of e-commerce and retail channels has facilitated greater accessibility for consumers, allowing them to explore a broader range of cold-pressed oil options. The convenience of online shopping, coupled with the ability to compare products, read customer reviews, and access educational content about the benefits of cold-pressed oils, has made digital channels an essential part of the purchasing journey. This shift is further accelerated by the rise of online shopping and social media marketing, allowing brands to engage with their audience and drive sales through targeted campaigns.

Technological advancements in the extraction and processing of cold-pressed oils have also played a crucial role in shaping market trends. Modern cold-press extraction machines utilize innovative designs and materials to enhance the efficiency and yield of oil extraction without compromising quality. Moreover, recent advancements in packaging technology have significantly enhanced the shelf life of cold-pressed oils, catering to health-conscious consumers who prioritize freshness. Techniques such as screw pressing and hydraulic pressing are becoming increasingly refined, allowing producers to lower production costs while ensuring consistent oil quality. In addition, the integration of automation and monitoring technologies in oil extraction processes is helping manufacturers maintain stringent quality controls and reduce waste.

Product Insights

The palm oil segment held a share of 42.5% of the global revenue in 2024. The versatility of cold pressed palm oil has fueled its popularity across various sectors, including food processing, cosmetics, and personal care products. Moreover, the rich fatty acid profile and stability of cold pressed palm oil make it particularly suitable for high-temperature cooking, which has contributed to its widespread usage in both household and commercial kitchens. The burgeoning food service industry, combined with the rising influence of plant-based diets and products, presents significant opportunities for cold pressed palm oil. Furthermore, as countries continue to impose regulations aimed at reducing unhealthy fats in food products, cold pressed palm oil is positioned to gain further traction in culinary applications and food processing, catering to a growing market that prioritizes health, sustainability, and ethical consumption.

The soybean oil segment is expected to grow at a CAGR of 5.3% from 2025 to 2030. Cold pressed soybean oil is increasingly gaining traction in the global market, primarily due to rising health trends and a growing preference for oil extraction methods that retain nutrients. Unlike refined oils, cold pressed soybean oil preserves the natural antioxidants, vitamins, and healthy fatty acids inherent in soybeans, making it a favorable choice for health-conscious consumers. The booming trend of plant-based diets and veganism has further contributed to this demand, as soybean oil is a staple ingredient in many vegetarian and vegan products. In addition, the rise of clean-label products, which emphasize minimal processing and transparency in ingredients, is boosting the appeal of cold pressed soybean oil among health-conscious consumers.

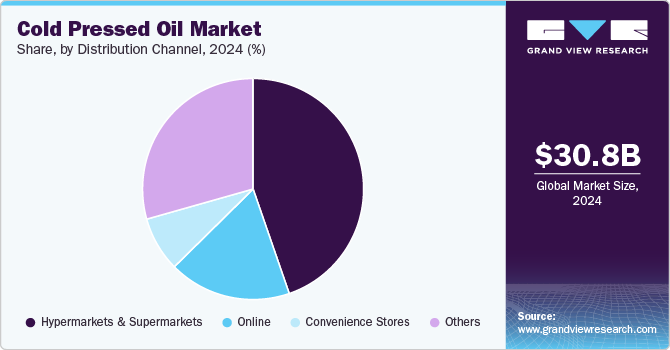

Distribution Channel Insights

The sales of cold pressed oil through hypermarkets & supermarkets held a share of 44.7% of the global revenue in 2024. These retail formats frequently offer a wide variety of brands and product variants, allowing consumers to easily compare prices and quality, which is considered to be a crucial factor in the selection of cold pressed oils. Furthermore, the strategic placement of these oils in the health food sections of stores, combined with in-store promotions and tastings, enhances visibility and encourages consumer trial. In addition, these stores often capitalize on the growing trend of promoting sustainable and locally sourced products, which resonates well with eco-conscious consumers.

The sales of cold pressed oil through online channels are expected to grow at a CAGR of 6.0% from 2025 to 2030. As digital-savvy consumers increasingly turn to e-commerce platforms for their grocery needs, cold pressed oils have found a receptive audience in this space. The convenience of browsing, selecting, and ordering products from the comfort of home has made online shopping an attractive option for many, particularly for those seeking specialty oils that may not be readily available in local stores. In addition, online retailers leverage technology to offer detailed product information, nutritional content, and customer reviews, enabling consumers to make informed decisions. The ability to access a broader range of brands, including boutique and artisanal cold pressed oils, further enhances the appeal of online shopping for consumers looking for quality and uniqueness in their cooking oils.

Regional Insights

The cold pressed oil market in North America captured a revenue share of over 14.8% of the market, primarily driven by an increasing consumer preference for natural and organic products. The trend towards healthy eating, substantiated by a surge in wellness-focused lifestyles, has catalyzed the demand for cold-pressed oils, particularly among health-conscious consumers. In addition, a rising awareness of the nutritional benefits associated with cold-pressed oils, such as high antioxidant content and essential fatty acids, has led to greater acceptance of these products in mainstream markets. The expanding availability of cold-pressed oils in grocery stores, health food shops, and online platforms has further fueled this demand, allowing consumers easier access to high-quality oils for cooking and dietary incorporation.

U.S. Cold Pressed Oil Market Trends:

The cold pressed oil market in the U.S. is expected to grow at a CAGR of 6.5% from 2025 to 2030, driven by an increasing consumer awareness of health and wellness. The American population is becoming more conscious of the nutritional benefits associated with cold-pressed oils, such as higher antioxidant levels and the absence of harmful chemicals. Health-conscious consumers are increasingly opting for organic and natural products, which has intensified the demand for cold-pressed oils, particularly olive, coconut, and avocado oils. Moreover, the trend of clean eating and the rise of plant-based diets further enhance the consumption of cold-pressed oils as essential ingredients for dressings, dips, and cooking applications.

Europe Cold Pressed Oil Market Trends

The cold pressed oil market in Europe is expected to grow at a CAGR of 5.3% from 2025 to 2030, largely attributed to a long-standing tradition of valuing high-quality cooking oils, particularly olive oil. Countries such as Italy, Greece, and Spain remain at the forefront, where the Mediterranean diet emphasizes the consumption of various cold-pressed oils. The European market benefits from a well-established infrastructure for both production and distribution, enabling consumers to access a wide range of cold-pressed oil products. Increasing health consciousness among European consumers, coupled with a growing focus on sustainability and eco-friendly production methods, has also enhanced the preference for cold-pressed oils, often viewed as healthier and more environmentally sustainable options.

The cold pressed oil market in Italy holds a prominent position in the global and European market, particularly due to its long-standing tradition of olive oil production. Italian cold-pressed olive oil is highly regarded not just for its flavorful attributes but also for its health benefits, which are steeped in the Mediterranean diet. As consumers, both domestically and globally, continue to embrace healthier eating patterns, the demand for high-quality cold-pressed olive oils from Italy remains strong. The country’s commitment to preserving traditional production methods also enhances the appeal of its cold-pressed oils, allowing Italy to capture a premium segment of the global market.

The Germany cold pressed oil market is witnessing a surge in demand, propelled by the popularity of Mediterranean diets, which have influenced cold-pressed oil consumption, heightening the demand for olive oil and other high-quality oils. The German consumer is particularly interested in high-quality, eco-friendly products, which translates to a growing demand for cold-pressed oils derived from locally sourced seeds and nuts.

The country's commitment to environmental responsibility, bolstered by government initiatives supporting organic farming, has paved the way for the proliferation of cold-pressed oils across various segments. Furthermore, the health trend resonates significantly with German consumers, who prioritize natural foods free from artificial additives, thus boosting the market for cold-pressed alternatives.

Asia Pacific Cold Pressed Oil Market Trends

The cold pressed oil market in Asia Pacific is expected to witness a CAGR of 5.9% from 2025 to 2030, fueled by rapid urbanization and a growing middle-class population. As lifestyles change, consumers in countries like India, China, Indonesia, and Australia are increasingly turning towards healthier cooking options. The traditional use of oils in Asian cuisine is evolving, with a marked shift towards cold-pressed varieties due to their perceived health benefits. Word of mouth regarding the nutritional advantages of cold-pressed oils—along with rising disposable incomes, has encouraged consumers to experiment with these oils, integrating them into their daily cooking.

The cold pressed oil market in China is expected to witness a CAGR of 6.4% from 2025 to 2030, fueled by shifting consumer preferences towards healthier dietary choices. An increasing middle class with disposable income has become more health-conscious, seeking products that are perceived as natural and beneficial. Cold-pressed oils, particularly varieties like sesame and walnut oil, are gaining traction for their health attributes and culinary versatility. Traditional practices, along with modern dietary trends, are fostering greater acceptance and consumption of cold-pressed oils in everyday cooking, especially within the urban population.

The India cold pressed oil market is poised for substantial growth, primarily due to a rising consciousness regarding health and wellness amidst a growing demographic of young, urban consumers. Traditional Indian cooking has long utilized cold-pressed oils like coconut, sesame, and mustard oil, and the renewed interest in these heritage techniques reinforces a cultural appreciation for high-quality, minimally processed oils. Considering the increasing incidence of lifestyle-related diseases, more Indian consumers are actively seeking out healthier cooking oils without the refined additives and chemicals found in conventional oils, leading to a resurgence in demand for cold-pressed varieties.

Latin America Cold Pressed Oil Market Trends

The cold pressed oil market in Latin America is expected to witness a CAGR of 4.0% from 2025 to 2030, driven by increasing interest in health and wellness among the population. Factors such as changing dietary patterns and a growing awareness of the health benefits of cold-pressed oils contribute to this growing market. Countries like Brazil and Argentina are witnessing a surge in demand as consumers embrace these oils for their high nutritional value, often seeking alternatives to conventional oils. The rising popularity of plant-based diets is further accentuating the interest in oils like coconut, palm, and avocado, aligning with regional agricultural practices.

Middle East & Africa Cold Pressed Oil Market Trends

The cold pressed oil market in the Middle East and Africa is witnessing a surge in demand, particularly in countries such as Egypt, Nigeria, and South Africa, where natural and minimally processed oil alternatives are increasingly becoming a matter of health and wellness. The perception of cold-pressed oils as healthier options rich in flavor is fostering a burgeoning interest among consumers who are more inclined to explore their culinary benefits. In addition, government initiatives aimed at promoting local agricultural practices and supporting small producers are providing incentives for the development of cold-pressed oil production in the region, thus contributing to sustainable economic growth and empowering local communities.

Key Cold Pressed Oil Insights

The global cold-pressed oil industry is witnessing significant growth, driven by an increasing consumer preference for natural and organic products. Key companies in this sector, such as Statfold Seed Oils Ltd., Archer Daniels Midland Company, Wilmar International Ltd, Bunge Limited, Cargill Inc., etc., are at the forefront of innovation, constantly adapting to market dynamics through strategic mergers and acquisitions. In pursuit of sustained growth, these companies are also heavily investing in research and development (R&D) to innovate new products that cater to health-conscious consumers and adapt to changing dietary trends.

Recent product launches have revealed a surge in varieties tailored for specific culinary applications, such as specialty oils for high-heat cooking or those infused with herbs and spices. Moreover, partnerships and collaborations have emerged as crucial strategies for growth within the cold pressed oil sector. Many companies are teaming up with local farmers and organic producers to source high-quality raw materials. This collaborative approach not only ensures the sustainability of production practices but also reinforces brand integrity and consumer trust.

Key Cold Pressed Oil Companies:

The following are the leading companies in the cold pressed oil market. These companies collectively hold the largest market share and dictate industry trends.

- Statfold Seed Oils Ltd.

- Wilmar International Ltd

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- Cargill Inc.

- China Agri-Industries Holdings Limited

- Naissance Natural Healthy Living

- Gramiyum Wood Pressed Oils

- Spectrum Organic Products LLC

- FreshMill Oils

Recent Developments

-

In March 2024, Australian Oilseed Investments (AOI), the owner of Cootamundra Oilseeds, merged with U.S.-based EDOC Acquisitions Corporation in a USD 190 million deal. Following the merger, EOC will become part of AOI, forming a new subsidiary named Australian Oilseeds Holdings (AOH). This merger aims to establish AOH as the leading producer of cold-pressed oils and meals in the Asia Pacific market. The consolidation will allow AOH to benefit from economies of scale and address the increasing demand in the industry.

-

In August 2023, Tata Consumer Products (TCP) launched the 'Tata Simply Better' brand, marking its entry into the premium cold-pressed oils market. This new range boasts 100% pure and unrefined oils, addressing the increasing demand for healthier cooking alternatives. By leveraging its strong brand reputation, TCP aims to appeal to health-conscious consumers and diversify its product offerings in line with emerging market trends. This initiative underscores TCP's dedication to adapting to evolving consumer preferences.

Cold Pressed Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 32.3 billion

Revenue forecast in 2030

USD 41.6 billion

Growth rate (Revenue)

CAGR of 5.2% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Russia; China; Japan; India; Indonesia; Australia & New Zealand; Brazil; Saudi Arabia

Key companies profiled

Statfold Seed Oils Ltd., Wilmar International Ltd, Archer Daniels Midland Company (ADM), Bunge Limited, Cargill Inc., China Agri-Industries Holdings Limited, Naissance Natural Healthy Living, Gramiyum Wood Pressed Oils, Spectrum Organic Products LLC, and FreshMill Oils

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Cold Pressed Oil Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cold pressed oil market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Coconut Oil

-

Palm Oil

-

Ground Nut Oil

-

Rapeseed Oil

-

Soybean Oil

-

Sunflower Oil

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

Indonesia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cold pressed oil market size was estimated at USD 30.8 billion in 2024 and is expected to reach USD 32.3 billion in 2025.

b. The global cold pressed oil market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 41.6 billion by 2030.

b. Asia Pacific dominated the cold pressed oil market with a share of 42.4% in 2024. This is attributed to the easy availability of raw material and lower labor cost. China, India, and Indonesia are largely contributing for the cold pressed oil market. The high nutritious value of cold pressed oil, along with better taste & aroma are led to large use of cold pressed oil in Asia Pacific.

b. Some key players operating in the cold pressed oil market include Statfold Seed Oils Ltd., Wilmar International Ltd, Archer Daniels Midland Company (ADM), Bunge Limited, Cargill Inc., China Agri-Industries Holdings Limited, Naissance Natural Healthy Living, Gramiyum Wood Pressed Oils, Spectrum Organic Products LLC, and FreshMill Oils

b. Key factors that are driving the cold pressed oil market growth include High demand for the cold pressed oils from several applications that include personal care, food and beverages, animal food, and others. Additionally, high nutritional value as well as improved flavor is majorly contributing to the expansion of the cold pressed oils market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."