- Home

- »

- Medical Devices

- »

-

Collagen Dressing Market Size, Share & Growth Report 2030GVR Report cover

![Collagen Dressing Market Size, Share & Trends Report]()

Collagen Dressing Market (2023 - 2030) Size, Share & Trends Analysis Report By Form (Gels, Powder), By Source (Bovine, Equine), By Type, By Application (Chronic, Acute), By End-use (Hospitals, Home Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-118-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global collagen dressing market size was valued at USD 389.27 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.96% from 2023 to 2030. The demand for collagen dressing is driven by the rise in number of chronic disease patients worldwide. Additionally, an increase in the number of elderly populations is anticipated to boost the market as the geriatric population shows sedate healing ability. For instance, according to the U.S. Census Bureau, the number of people aged 65 and above was approximately 46.2 million in 2014 and is expected to reach over 98 million by 2060. Similarly, as per the United Nations Population Fund (UNFPA) Asia and the Pacific, by 2050, around one in every fourth person in the Asia Pacific region is expected to be above the age of 60, which is expected to fuel the market for collagen dressing over the period.

The collagen dressing helps manage chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers, among others. There has been an increase in the number of diabetic patients globally, which in turn is increasing the number of diabetic foot ulcer patients. For instance, according to the International Diabetes Federation, diabetic foot ulcers affect approximately 40-60 million people with diabetes globally. The collagen dressing allows rapid healing of wounds, and as a result, many healthcare professionals use collagen dressing, which is further anticipated to impel the use of collagen dressing during the forecast period.

Moreover, a rise in the obese population is expected to increase the number of venous leg ulcer patients, which in turn is expected to drive the market for collagen dressing. For instance, as per Europa, around 53% people in Europe were overweight, out of which 17% were declared obese. Similarly, according to Molnlycke Health Care AB, approximately 10% of the total population in North America & Europe suffer from venous valvular incompetence, while 0.2% develop venous leg ulcers. Additionally, as per a similar source, at any given time, 70,000 - 190,000 individuals in the U.K. suffer from venous leg ulcers. Thus, aforementioned factors are predicted to help the market grow over the forecast duration.

The COVID-19 pandemic was predicted to lower the use of collagen dressing to a certain extent, thereby restraining the growth of the market. However, as the COVID-19 cases have decreased, the restrictions have been revoked, which is expected to help the market gain significant market share in upcoming years. Moreover, to capture the post-pandemic market, many companies are adopting strategies such as mergers, acquisitions & geographic expansion. For instance, in October 2021, to build a new distribution center in Kansas, Medline Industries announced an investment of USD 77.5 million. This was intended to increase consumer reach during the post-COVID-19 period. Similarly, in April 2022, Sanara Medtec Inc. announced a merger to acquire Precision Healing Inc. This is expected to help the company provide chronic wound care products to their customers and improve patient outcomes.

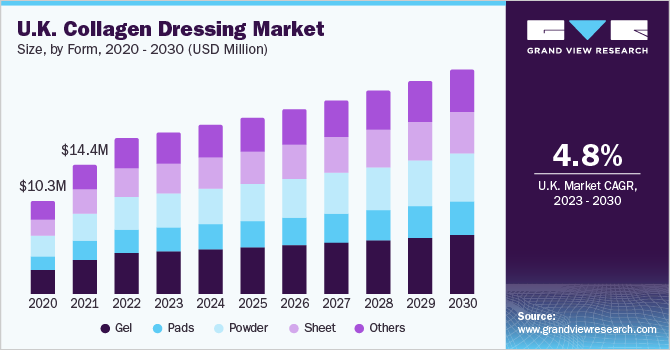

Form Insights

Based on form, the gel segment dominated the market with a revenue share of 26.40% in 2022. The dominance can be attributed to the increasing number of partial and full-thickness wounds such as surgical wounds due to rise in number of surgical cases. For instance, as per a study published by NCBI in 2020, approximately 310 million surgical cases were performed globally. Similarly, as per Australian Institute of Health and Welfare, around 352,000 admissions involved surgeries, whereas 2.2 million admissions involved elective surgeries. Thus, due to aforementioned factor, the segment is expected to dominate the collagen gel market.

However, the sheet segment is projected to witness the fastest growth rate of CAGR 5.05% over the forecast period. The growth can be accredited to rising number of traumatic accidents and burn incidents. For instance, according to CDC, every year in the U.S., approximately, 1.1 million burn related injuries require medical attention. Similarly, as per a study by NCBI in 2017, the incidence rate of annual burn cases in India was approximately 6 - 7 million cases per year. Moreover, as per WHO, the lifetime incidence rate of severe burn is 1%, as a result around 300,000 people die annually. Thus, due to above mentioned factors the sheet segment is expected to have the fastest growth rate over the forecast period.

Source Insights

Based on source, the bovine segment dominated the market with a market share of 41.76% in 2022 and is further expected to continue its dominance over the forecast period. The dominance can be accredited to availability of various collagen dressings made of bovine. Moreover, most of the companies operate in the bovine collagen dressing segment, thereby increasing the availability of the product. Furthermore, these are used routinely as a wound dressing for severe burns, donor sites infections, pressure sores, or leg ulcers. Therefore, rising cases of such wounds is expected to help the segment growth. For instance, as per The American Society of Plastic Surgeons Wolter Kluwer Health, Inc, over 160,000 skin grafts are performed every year in every one out of three burn hospitalizations. Thus, increasing cases of skin grafts & burns is further expected to help the bovine segment impel over the forecast period.

The equine segment is anticipated to witness significant growth rate of CAGR 4.93% during the forecast period. This can be attributed to rising cases of diabetes and diabetic foot ulcers worldwide. For instance, as per International Diabetes Federation, around 4.7 million people in the U.K. suffer from diabetes. This number further increase to 9.5 million adults in Germany. Increase in number of people suffering from diabetes increases the risk of diabetic foot ulcers, thereby impelling the segment growth over the forecast period.

Type Insights

The antimicrobial collagen dressing segment dominated the market with a market share of 45.89% in 2022. The dominance can be attributed to rising case of various wound infections. For instance, as per an article in NCBI, around 8.2 million people had wounds with infections. Similarly, rising cases of surgical sit infections is expected to help the segment impel further. For instance, as per the National Healthcare Safety Network (NHSN) Surgical Site Infection Surveillance in 2018, around 157,500 cases of SSIs are reported every year in the U.S. Similarly, as per the CDC surgical site infections accounts for nearly 3.2 billion annually. Thereby helping the segment grow.

Alginate collagen dressing segment is projected to witness the highest growth rate of 5.06% during the forecast years. These dressings have gel forming ability owing to which they are also preferred for bleeding wounds as well and, are majorly used to treat pressure ulcers in geriatric patients. The growth can be accredited to increasing number of geriatric populations. For instance, according to Ageing Asia, as of 2019, more than 1.2 million Cambodians were aged over 60, and this population group has increased by more than 40% since the last census in 2008.

Application Insights

Based on application, the acute wound segment dominated the collagen dressing industry, with a market share of 59.63% in 2022. Increasing number of traumatic accidents and burn cases globally is expected to impel the market for collagen dressing. For instance, as per NCBI, around 78.2 million people are injured due to road accidents every year. This number is expected to propel by around 65% in the next 20 years. Additionally, global incidence of firearm wound is increasing. For instance, as per UC Davis Health, an estimated of 15,000 non-fatal firearm injuries were recorded in the U.S. alone. Thus, due to aforementioned factors, the acute wound segment is expected to dominate the market.

However, the chronic wound segment is expected to witness the fastest growth of CAGR 5.10% over the forecast period. This growth can be credited to rise in population suffering due to pressure ulcers. For instance, as stated by the Agency for Healthcare Research and Quality, over 2.5 million individuals in the United States experience the development of pressure ulcers annually. Likewise, as reported by NCBI, the occurrence of pressure ulcers within a clinical environment can vary between 4% and 38%. In addition, according to a similar source, the mortality rate due to pressure ulcers and associated disorder is estimated to be approximately 68% in adults. Similarly, increasing various chronic wounds such as arterial ulcers, postsurgical wounds & venous stasis ulcers is expected to further impel the segment growth.

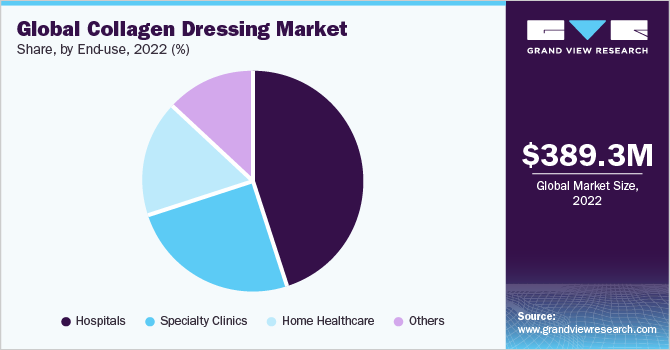

End-use Insights

On the basis of end-use, the hospitals segment held the largest share of 45.12% in 2022. Increasing number of surgical procedures, rising incidence of diabetic foot ulcers, and increasing number of hospitals are among major factors driving segment growth. For instance, according to the Australian Institute of Health and Welfare, the number of hospitalizations in Australia, has increased. For instance, in 2019 - 2020, 11.1 million people were hospitalized in Australia, out which 6.7 million were hospitalized in public hospital, whereas, 4.4 million in private hospitals. Moreover, as per latest survey by the American Hospital Association, the total number of hospitals in the U.S. were counted to 6,093 in 2022. Similarly, as per reports, there has been constant increase in number of hospitals in the U.K., as the number of hospitals has increased to 1,978 in 2019. Thus, such factors may increase the number of surgeries, and therefore may surge the segment growth over the forecast period.

However, the home healthcare segment is expected to have the fastest growth rate of CAGR of 5.67% over the forecast duration. Home healthcare settings have been increasing in many countries. Most of the surgeries require prolonged recovery period, leading to frequent changing of dressings. Furthermore, the geriatric and bariatric demographic, along with individuals dealing with chronic wounds, exhibit a preference for receiving care at home rather than staying in a hospital. Conditions like diabetic foot ulcers, venous leg ulcers, and surgical wounds typically demand extended hospitalization periods, a situation that can pose considerable challenges for older patients. Collagen dressings are majorly used for home care settings, as these products provide required ease for ulcer wounds. Hence, such factors are anticipated to boost segment growth over the forecast period.

Regional Insights

Based on region, North America dominated the collagen dressing market in 2022, with a market share of 45.34%. The dominance can be accredited to presence of target population base, such as people with various chronic and acute wounds. For instance, information provided by the Inter Mountain Healthcare Organization indicates that roughly 6.5 million individuals in the U.S. grapple with enduring wounds. Moreover, rise in number of surgical procedures performed is increasing the number of acute wounds, as a result, the demand for collagen dressing is expected to increase over the duration.

However, the Asia-Pacific region is projected to witness the fastest growth rate of CAGR 5.55% during the forecast duration. The growth rate can be accredited to rise in number of patients suffering from diabetes and related disorders. For instance, as per diabetes.co.uk, around 1 in every 10 people in China is estimated to be suffering form diabetes. The rising number of diabetic populations, poses a threat of diabetic foot ulcers, as a result the use of collagen dressing may increase.

Similarly, rise in number of surgeries in this region is further expected to propel the market growth. For instance, as per Business Insider, South Korea is responsible for the highest number of cosmetic surgeries globally. Therefore, due to above mentioned factors, the market is anticipated to witness fastest growth rate in the Asia-Pacific region.

Key Companies & Market Share Insights

Major market participants within the market is enacting a range of strategies, which encompass forming partnerships via mergers and acquisitions, extending their geographic reach, launching new products, securing government approvals, and fostering strategic collaborations. These endeavours are aimed at broadening their market footprint and enhancing their market presence. For instance, in August 2023, Sanara MedTech Inc. acquired a number of assets related to its collagen products business, which include:

-

All rights and ownership for four 510(k) cleared collagen-based wound care products, including CellerateRX Surgical Powder and Gel (CellerateRX Surgical) and HYCOL Hydrolyzed Collagen (HYCOL).

-

All rights and ownership for three new collagen-based products now in development (for human wound care usage).

Hence, driven by the array of strategies implemented by market participants, the market is projected to gain momentum over the forecast period. Some of the key players in the global collagen dressing market include:

-

Smith & Nephew

-

Paul Hartmann

-

Sanara MedTech Inc.

-

3M

-

Lohmann & Rauscher

-

Derma Rite Industries

-

Integra LifeSciences

-

Coloplast Corp.

-

McKesson Corporation

-

Medline Industries

-

Johnson & Johnson (Ethicon)

Collagen Dressing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 406.31 million

Revenue forecast in 2030

USD 570.06 million

Growth Rate

CAGR of 4.96% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, source, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; and UAE.

Key companies profiled

Smith & Nephew; Paul Hartmann; Sanara MedTech Inc.; 3M; Lohmann & Rauscher; Derma Rite Industries; Integra LifeSciences; Coloplast Corp.; McKesson Corporation; Medline Industries; Johnson & Johnson (Ethicon)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Collagen Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global collagen dressing market based on form, source, type, application, end-use, and region:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Gel

-

Pads

-

Powder

-

Sheet

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Equine

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Antimicrobial Collagen Dressing

-

Hydrogel Collagen Dressing

-

Alginate Collagen Dressing

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic foot ulcers

-

Pressure ulcers

-

Venous leg ulcers

-

Other chronic wounds

-

-

Acute Wounds

-

Surgical & traumatic wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Colombia

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global collagen dressing market is expected to grow at a compound annual growth rate of 4.96% from 2023 to 2030 to reach USD 570.06 million by 2030.

b. North America dominated the collagen dressing market with a share of 45.34% in 2022. This can be attributable to the high prevalence of chronic diseases, rising number of surgical procedures, and the presence of market players in this region.

b. Key players in the collagen dressing market Smith & Nephew, Paul Hartmann, Sanara MedTech Inc., 3M, Lohmann & Rauscher, Derma Rite Industries, Integra LifeSciences, Coloplast Corp., McKesson Corporation, Medline Industries, Johnson & Johnson (Ethicon)

b. Key factors driving the global collagen dressing market include global increase in prevalence of chronic diseases, increasing number of traumatic accidents, rising geriatric population

b. The global collagen dressing market size was estimated to be USD 389.27 million in 2022 and is expected to reach USD 406.31 million in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.