- Home

- »

- Plastics, Polymers & Resins

- »

-

Collapsible Recycled Plastic Packaging Market Report, 2033GVR Report cover

![Collapsible Recycled Plastic Packaging Market Size, Share & Trends Report]()

Collapsible Recycled Plastic Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (rHDPE, rPP, rPET), By Product, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-802-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Collapsible Recycled Plastic Packaging Market Summary

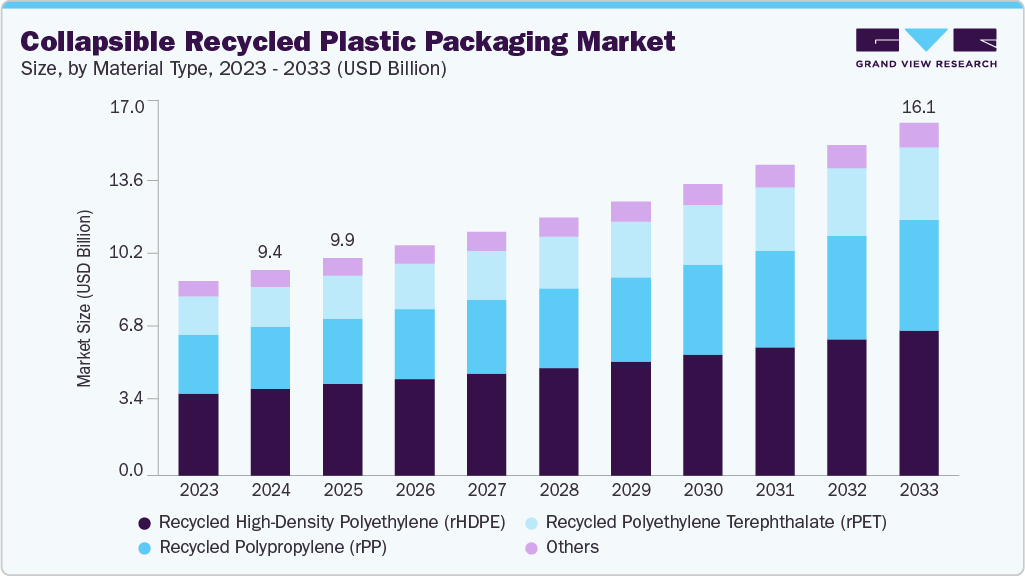

The global collapsible recycled plastic packaging market size was estimated at USD 9.38 billion in 2024 and is projected to reach USD 16.11 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The industry is driven by the growing emphasis on sustainability, circular economy initiatives, and the need to reduce logistics and storage costs.

Key Market Trends & Insights

- Asia Pacific dominated the collapsible recycled plastic packaging market with the largest revenue share of over 35.0% in 2024.

- The collapsible recycled plastic packaging industry in U.S. is expected to grow at a substantial CAGR of 5.1% from 2025 to 2033.

- By material, the recycled Polyethylene Terephthalate (rPET) segment is expected to grow at a considerable CAGR of 6.9% from 2025 to 2033 in terms of revenue.

- By product, the collapsible bottles & tubes segment is expected to grow at a considerable CAGR of 6.7% from 2025 to 2033 in terms of revenue.

- By end use, the e-commerce & retail distribution segment is expected to grow at a considerable CAGR of 6.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 9.38 Billion

- 2033 Projected Market Size: USD 16.11 Billion

- CAGR (2025-2033): 6.2%

- Asia Pacific: Largest Market in 2024

In addition, rising e-commerce, retail, and industrial supply chain activities are boosting demand for reusable and space-efficient packaging solutions. Governments, corporations, and consumers are increasingly prioritizing the reduction of plastic waste and the use of recycled materials. Recycled collapsible packaging solutions, such as foldable crates, bins, and totes, align perfectly with these objectives as they minimize material waste, reduce carbon emissions, and extend product lifecycles. For instance, companies such as CHEP and ORBIS Corporation have expanded their reusable plastic container programs made from post-consumer recycled (PCR) materials to help clients lower their environmental footprint and achieve sustainability goals. These initiatives reflect how environmental compliance and sustainability commitments are encouraging industries to adopt collapsible recycled packaging solutions.

The surge in e-commerce and retail logistics has significantly accelerated the adoption of collapsible recycled plastic packaging due to the sector’s demand for durable, reusable, and space-efficient solutions. Online retail giants such as Amazon, Walmart, and Alibaba handle millions of shipments daily, requiring packaging solutions that are both cost-effective and sustainable. Collapsible recycled plastic containers, crates, and pallets are gaining traction because they reduce volume during reverse logistics and can be reused multiple times, unlike single-use corrugated or stretch-wrapped alternatives. This not only helps reduce operational costs but also aligns with the sustainability mandates increasingly emphasized in e-commerce supply chains. The rapid expansion of e-commerce sales further underscores this trend. According to the U.S. Department of Commerce, U.S. retail e-commerce sales reached USD 304.2 billion in the second quarter of 2025, marking a 1.4% increase from the first quarter and accounting for 16.3% of total retail sales.

In retail logistics, space optimization is critical. Collapsible packaging allows retailers to transport and store goods efficiently by minimizing the volume of empty packaging on return trips. For instance, collapsible plastic crates can reduce storage space by up to 70% when folded, enabling companies to save significantly on warehousing and transportation costs. Retail chains such as Carrefour and Tesco have already incorporated reusable collapsible crates and bins in their distribution centers to handle fresh produce and other fast-moving goods. In Europe, where the e-commerce sector continues to expand despite macroeconomic challenges, the European E-commerce Report 2024 reveals that online retail sales reached USD 965.8 billion in 2023, a 3% increase over 2022. This steady growth, particularly in Southern (14%) and Eastern Europe (15%), reinforces the need for efficient and sustainable packaging systems such as collapsible recycled plastics that can support regional fulfillment networks and cross-border logistics.

The rapid adoption of Returnable Transport Systems (RTS) and pooling models has emerged as a key driver for the growth of the collapsible recycled plastic packaging industry. As global supply chains evolve toward circularity and efficiency, manufacturers, retailers, and logistics providers are seeking packaging solutions that can be reused multiple times without compromising product protection or performance. Collapsible recycled plastic containers, crates, bins, and pallets are ideal for RTS frameworks, as they can be folded flat when empty, reducing backhaul costs and storage space. These systems are gaining traction in industries such as food & beverage, automotive, retail, and pharmaceuticals, where repeated distribution cycles make reusability both environmentally and economically advantageous.

Market Concentration & Characteristics

The industry exhibits moderate to high technological intensity, driven by ongoing material innovations and advancements in recycling. Manufacturers are increasingly incorporating advanced recycling technologies, such as chemical recycling, near-infrared (NIR) sorting, and additive-enhanced resin formulations, to improve the mechanical strength, surface finish, and recyclability of packaging products. The integration of smart features, such as RFID tagging and IoT-based tracking, is further enhancing supply chain transparency and inventory management efficiency.

A key characteristic of the industry is its high functional and operational efficiency. Collapsible recycled plastic packaging is designed for space optimization, reducing storage and transportation costs through easy stacking and return logistics. Its durability and resistance to moisture, impact, and chemicals ensure long service life, making it a cost-effective and sustainable alternative to traditional materials like wood or cardboard.

Material Insights

The rHDPE segment recorded the largest market revenue share of over 42.0% in 2024. rHDPE offers high strength, moisture and chemical resistance, and durability-making it ideal for heavy-duty collapsible crates and bulk totes in food & beverage logistics and industrial transport. It’s easily sourced from post-consumer containers and maintains performance through multiple reuse cycles. Strong availability of recycled feedstock, durability for repeated use, and supportive recycled-content mandates drive adoption. Advances in sorting and washing technologies also enhance rHDPE quality and broaden its applications.

The rPET segment is expected to grow at the fastest CAGR of 6.9% during the forecast period. rPET combines high stiffness, transparency, and good barrier properties, making it suitable for clear foldable crates and reusable trays in food and beverage logistics. It also supports strong sustainability branding due to circular economy benefits. Consumer preference for recycled-content packaging, stringent regulations for rPET inclusion, and investment in bottle collection and advanced recycling systems are key growth drivers.

Product Insights

The collapsible crates & foldable totes segment recorded the largest market revenue share of over 43.0% in 2024. Collapsible crates and foldable totes are among the most widely used products in the collapsible recycled plastic packaging industry. They are primarily used in food & beverage logistics, retail distribution, and automotive component handling. The growth of this segment is driven by increasing demand for space-efficient and returnable logistics packaging across retail, e-commerce, and grocery supply chains.

The collapsible bottles & tubes segment is expected to grow at the fastest CAGR of 6.7% during the forecast period. Collapsible bottles and tubes are lightweight packaging formats made from recycled polyethylene (rPE), polypropylene (rPP), or post-consumer recycled PET (rPET). They are primarily used in personal care, household cleaning, and food & beverage applications. Their design allows consumers to squeeze out nearly all the product while the packaging gradually compresses.

End Use Insights

The food & beverage logistics segment recorded the largest market share of over 37.0% in 2024. The segment represents one of the largest consumers of collapsible recycled plastic packaging. These solutions, such as foldable crates, stackable totes, and returnable bins, are used extensively for the transport and storage of perishable goods, including fruits, vegetables, meat, dairy, and beverages. Collapsible packaging ensures hygienic handling, minimizes contamination risks, and offers superior temperature resistance during cold chain transportation. The key growth drivers include the rising emphasis on sustainable cold chain logistics, stringent food safety regulations, and expanding global trade in fresh and processed foods.

The e-commerce & retail distribution segment is projected to grow at the fastest CAGR of 6.8% during the forecast period. In the e-commerce & retail distribution sector, collapsible recycled plastic packaging is utilized for order fulfillment, warehousing, and last-mile delivery. Online retail giants such as Amazon, Flipkart, and JD.com employ foldable totes and crates to manage high product turnover efficiently within automated logistics centers. These solutions facilitate easy stacking, reduce empty-return freight costs, and maintain product protection during transit. The collapsible nature of these containers helps streamline inventory management and improve operational flexibility across omnichannel retail networks. This segment’s expansion is driven by the rapid growth of e-commerce platforms, increased warehousing automation, and demand for efficient reverse logistics.

Regional Insights

The Asia Pacific collapsible recycled plastic packaging industry dominated the market and accounted for the largest revenue share of over 35.0% in 2024 and is expected to grow at the fastest CAGR of 7.3% over the forecast period. The outlook is influenced by rapid industrialization, expanding e-commerce, and growing policy emphasis on sustainability and waste reduction. Countries such as China, Japan, India, and South Korea are witnessing substantial demand growth from logistics, food and beverage, and retail sectors, where efficient and reusable packaging solutions are critical for large-scale operations. The region’s booming e-commerce and manufacturing hubs are propelling the adoption of collapsible recycled plastic pallets, crates, and containers to optimize storage and transport efficiency while meeting sustainability goals

The collapsible recycled plastic packaging industry in China dominated the revenue share in the regional landscape. This leadership is driven by robust government policies advancing circular economy principles and extensive investments in advanced recycling infrastructure. The country’s 14th Five-Year Plan for Circular Economy Development focuses on reducing plastic waste, improving recycling efficiency, and boosting the utilization of recycled materials across industries. These initiatives have accelerated the adoption of collapsible recycled plastic packaging solutions, such as crates, bins, and pallets, across logistics, e-commerce, and manufacturing sectors seeking to minimize storage requirements and carbon emissions.

North America Collapsible Recycled Plastic Packaging Market Trends

The collapsible recycled plastic packaging industry in North America has received impetus from the rapid growth of e-commerce, retail, and food delivery sectors, creating robust demand for durable, space-saving, and sustainable packaging options. Moreover, growing corporate commitments to ESG (Environmental, Social, and Governance) targets are reinforcing the regional dominance of North America in this market. Leading consumer goods companies, such as Procter & Gamble, PepsiCo, and Walmart, have pledged to use higher percentages of recycled content in their packaging, driving innovation and investment in collapsible recycled plastic packaging. Combined with strong consumer awareness around sustainability, supportive government initiatives, and a mature recycling ecosystem, these factors position North America as a frontrunner in the global collapsible recycled plastic packaging market.

U.S. Collapsible Recycled Plastic Packaging Market Trends

The U.S. collapsible recycled plastic packaging industry dominated the North America market, accounting for over 79.0% of the regional revenue share in 2024. This dominance is primarily attributed to the country’s robust regulatory framework, which promotes sustainable packaging, and its leadership in recycling innovation. Federal and state-level policies, such as the EPA’s National Recycling Strategy and statewide bans on single-use plastics in California, Washington, and New York, are driving the transition toward reusable and recyclable packaging solutions. These initiatives are compelling manufacturers and retailers to adopt collapsible recycled plastic packaging that aligns with waste reduction and carbon mitigation goals.

Europe Collapsible Recycled Plastic Packaging Market Trends

The collapsible recycled plastic packaging industry in the Europe will exhibit growth on the back of the European Green Deal, the EU Circular Economy Action Plan, and the Packaging and Packaging Waste Regulation (PPWR) driving a shift towards reusable and recyclable packaging by setting strict targets for recycling and waste reduction. These policies have accelerated investments in recycled plastic infrastructure and encouraged adoption of collapsible, returnable packaging formats across logistics, retail, and industrial sectors. Countries such as Germany, the Netherlands, and France lead in recycling efficiency, while initiatives such as the USD 41 million investment by ARA, Bernegger, and GreenDot in Austria’s TriPlast facility, capable of processing 41,000 tonnes of waste annually using UPCYCLE technology, underscore the region’s strong commitment to circular economy goals and high-quality recyclate production.

Key Collapsible Recycled Plastic Packaging Company Insights

The competitive environment of the market is characterized by a mix of global and regional players focusing on product innovation, sustainability, and supply chain efficiency. Companies are increasingly investing in advanced recycling technologies and lightweight, durable designs to meet the rising demand for eco-friendly and reusable logistics solutions. Strategic partnerships, mergers, and collaborations are common as firms aim to expand their recycling capabilities and geographic reach. For instance, major packaging and material companies are forming alliances with recycling firms to secure a steady supply of post-consumer recycled (PCR) materials and enhance circular economy practices.

-

In July 2025, IPL, inc., a North American rigid plastic packaging company, merged with Europe’s Schoeller Allibert, a reusable transport packaging specialist, forming a global sustainable packaging powerhouse with over USD 1.4 billion in annual revenue. This merger is expected to combine strengths across food, automotive, and industrial sectors to drive innovation and sustainability.

-

In February 2025, ORBIS Corporation opened a 660,000-square-foot manufacturing plant in Greenville, Texas, to produce reusable totes and pallets. This expansion boosts ORBIS’s production capacity and supports its commitment to sustainability and the circular economy.

Key Collapsible Recycled Plastic Packaging Companies:

The following are the leading companies in the collapsible recycled plastic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Schoeller Allibert

- IFCO SYSTEMS

- ORBIS Corporation

- IPL, Inc.

- DS Smith

- Tosca Services, LLC

- CHEP

- SSI SCHÄFER Plastics GmbH

- 360Eco Packaging

- RPP Containers

Collapsible Recycled Plastic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.92 billion

Revenue forecast in 2033

USD 16.11 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; the Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Schoeller Allibert; IFCO SYSTEMS; ORBIS Corporation; IPL, Inc.; DS Smith; Tosca Services, LLC; CHEP; SSI SCHÄFER Plastics GmbH; 360Eco Packaging; RPP Containers

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Collapsible Recycled Plastic Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global collapsible recycled plastic packaging market report based on material, product, end use, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Recycled High-Density Polyethylene (rHDPE)

-

Recycled Polypropylene (rPP)

-

Recycled Polyethylene Terephthalate (rPET)

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Collapsible Crates & Foldable Totes

-

Knock-Down Bulk Bins / Foldable Pallet Boxes

-

Foldable Intermediate Bulk Containers (IBCs)

-

Collapsible Bottles & Tubes

-

Collapsible Pallets

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage Logistics

-

E-commerce & Retail Distribution

-

Automotive & Industrial Components

-

Consumer Goods & Household Supplies

-

Agriculture & Horticulture

-

Pharmaceuticals & Chemical Handling

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.