- Home

- »

- Sensors & Controls

- »

-

Collision Avoidance Sensors Market Size, Share Report 2030GVR Report cover

![Collision Avoidance Sensors Market Size, Share & Trends Report]()

Collision Avoidance Sensors Market (2024 - 2030) Size, Share & Trends Analysis Report By Application, By Technology (Radar, Camera, Ultrasound, LiDAR, Others), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-843-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Collision Avoidance Sensors Market Trends

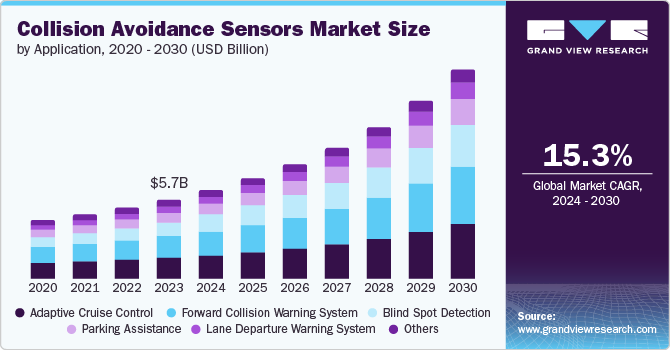

The global collision avoidance sensors market size was valued at USD 5.70 billion in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030. As the automotive industry moves toward the development of fully autonomous or semi-autonomous vehicles, the need for advanced collision avoidance systems becomes even more pronounced. Autonomous vehicles rely on complex sensors to interpret the driving environment, detect potential hazards, and make real-time decisions to avoid collisions.

The government's focus on improving safety standards and regulations is increasing, leading to the demand for collision avoidance sensors in vehicles to enhance road safety and reduce accidents. The European Union has implemented the General Safety Regulation, which requires that all new vehicles be equipped with advanced driver assistance systems (ADAS). These systems incorporate collision avoidance technologies designed to enhance road safety and reduce the risk of accidents. Therefore, manufacturers focus on designing cutting-edge products to align with these rules and regulations, paving a rising growth curve for the collision avoidance industry. Vehicles integrated with collision avoidance systems are considered lower risk as these systems reduce the possibility of collisions and accidents.

Furthermore, integrating artificial intelligence (AI) and machine learning (ML) enhances these sensors' features, driving the market's growth rate. Therefore, companies focus on innovating and integrating these technologies into their vehicles. For instance, in May 2024, Epiroc announced the launch of Titan CAS Generation 4, integrated with additional technologies, such as global navigation satellite system (GNSS) and AI vision, to enhance safety and productivity in mining. Moreover, rising sales of vehicles of different varieties and preference for premium cars globally are attributable to the growing market during the forecast period.

Application Insights

The adaptive cruise control (ACC) segment dominated the market and accounted for a market revenue share of 26.9% in 2023. As concerns regarding road safety continue to rise, consumers and regulatory agencies increasingly demand enhanced safety features in vehicles. ACC systems play a crucial role by automatically adjusting a vehicle’s speed to maintain a safe distance from the car in front, making them an essential element of ADAS. The growing consumer expectation for vehicles equipped with cutting-edge safety technologies to prevent accidents and improve the overall driving experience is driving the expansion of ACC systems within the market.

The Blind Spot Detection (BSD) segment is expected to register the fastest CAGR of 16.7% during the forecast period. BSD systems are designed to alert drivers to vehicles or objects in their blind spots, thus reducing the risk of side collisions during lane changes. As public awareness of road safety grows and consumers actively seek vehicles with advanced safety technologies, the demand for BSD systems is rising.

Technology Insights

Radar technology accounted for the largest market revenue share in 2023. Developing high-resolution radar sensors with improved angular resolution and better object discrimination capabilities allows for more precise detection of potential hazards. These advancements have made radar technology more practical for collision avoidance applications, such as adaptive cruise control and automatic emergency braking, thus driving its adoption across various vehicle segments. For instance, in January 2024, Texas Instruments Incorporated launched AWR2544 77GHz millimeter-wave radar sensor chip, a new semiconductor to enhance automotive safety, intelligence, and decision-making capabilities.

The LiDAR segment is anticipated to register the fastest CAGR over the forecast period. The ability of LiDAR to provide three-dimensional mapping and high precision of a vehicle's surroundings enhances the accuracy of object recognition and detection. Moreover, these sensors are cost-effective, widely available, and integrated with improved software and sensor technology. The rising preference for enhanced road safety, increasing consumer demand for enhanced safety features in vehicles, and regulatory requirements are major driving forces for LiDAR adoption in the collision avoidance industry.

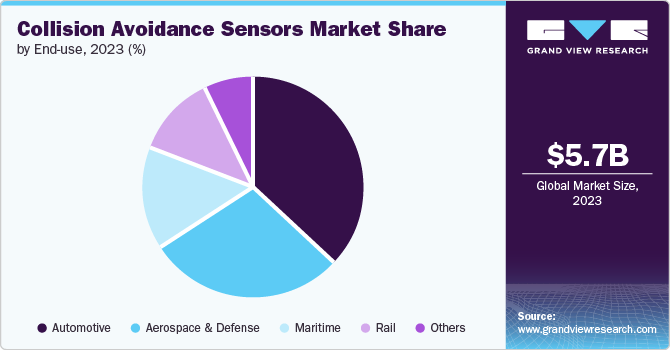

End-use Insights

The automotive sector accounted for the largest market revenue share in 2023. As EV adoption accelerates globally due to environmental concerns and government incentives, manufacturers increasingly incorporate advanced safety features into these vehicles. The integration of collision avoidance sensors enhances the overall safety profile of EVs and aligns with consumer preferences for high-tech features that complement their eco-friendly choices.

The rail sector is anticipated to register the fastest CAGR over the forecast period. Rail operators and regulatory bodies are increasingly focusing on improving safety measures to prevent collisions and reduce accidents on rail networks. Automatic Train Protection (ATP), Collision Avoidance Systems (CAS), and train-to-train communication systems are integral to achieving these safety objectives. Many countries are undertaking large-scale rail infrastructure projects to modernize their rail networks, improve efficiency, and enhance safety. The U.S. Department of Transportation anticipates a 30% increase in total freight demand by 2040.

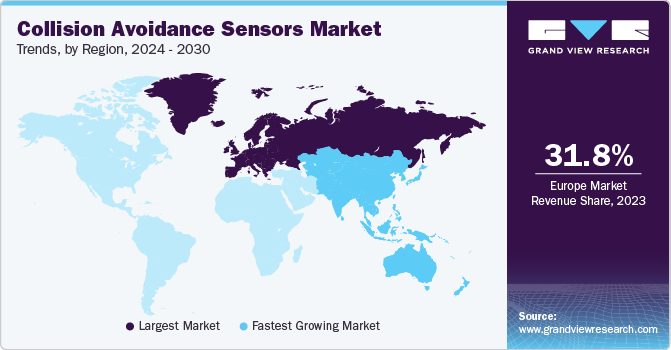

Regional Insights

North America collision avoidance sensors market was identified as a lucrative region in 2023. Regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) and Transport Canada have established comprehensive safety standards that mandate the inclusion of advanced driver assistance systems (ADAS) in vehicles. For instance, the NHTSA has proposed regulations for including technologies such as automatic emergency braking (AEB) and forward collision warning (FCW) in new vehicles. These regulations are designed to enhance road safety and reduce traffic accidents, creating a robust demand for collision avoidance sensors among automotive manufacturers in North America.

U.S. Collision Avoidance Sensors Market Trends

The U.S. collision avoidance sensors market accounted for the largest market revenue share in North America in 2023. American consumers increasingly seek vehicles equipped with the latest safety features, driven by greater awareness of the benefits of collision avoidance technologies. Features such as lane-keeping assist, adaptive cruise control, and blind spot detection are becoming standard expectations for new vehicles.

Europe Collision Avoidance Sensors Market Trends

Europe collision avoidance sensors market accounted for the largest market revenue share of 31.8% in 2023. As accidents caused by human error remain a leading cause of fatalities on European roads, there is a growing demand for technologies that can mitigate these risks. Consumers are becoming more educated about vehicle safety features and are actively seeking cars equipped with advanced collision avoidance systems. This shift in consumer behavior encourages automakers to prioritize developing and integrating such technologies into their vehicle offerings.

Germany collision avoidance sensors market is anticipated to grow significantly over the forecast period. Germany is home to car manufacturing, housing many major car companies such as Volkswagen, Audi, and others. Every year, Germany produces a large quantity of cars, including both passenger vehicles and commercial trucks. The increasing installation of ACC and BSD in automobiles is likely to fuel the growth. Moreover, the rising investments of companies in developing advanced sensors and premium cars to fulfill the evolving and increasing consumer base are attributable to market penetration.

Asia Pacific Collision Avoidance Sensors Market Trends

Asia Pacific collision avoidance sensors market is anticipated to witness the fastest growth during the forecast period. As urban areas across the Asia Pacific expand and develop, there is a substantial rise in vehicle numbers, leading to more traffic congestion and a higher risk of road accidents. Countries like China, India, and Japan are experiencing significant growth in vehicle ownership due to rising incomes, improving infrastructure, and expanding urban populations. There is a growing demand for advanced collision avoidance technologies to address the increased traffic density and enhance road safety. These technologies, including AEB, BSD, and ACC, are becoming essential for new vehicles in the region, thereby driving the market for collision avoidance sensors.

Japan collision avoidance sensors market held a substantial market share in 2023. The development of innovative sensor technologies, such as radar, LiDAR, and advanced camera systems, has significantly enhanced the capabilities of collision avoidance systems. Japanese companies and research institutions are at the forefront of these technological advancements, developing sensors with improved accuracy, range, and reliability. These innovations enhance vehicle safety and contribute to the evolution of autonomous driving technologies, which Japanese automotive manufacturers are increasingly adopting.

Key Collision Avoidance Sensors Company Insights

Some of the key companies in the collision avoidance sensors market include Continental AG, Delphi Automotive LLP, NXP Semiconductors, Infineon Technologies AG, Murata Manufacturing Co., Ltd. and others. Major players in the market are making significant investments in research and development initiatives and setting up production facilities to create and provide unique and affordable vehicle safety options. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Continental AG offers collision avoidance sensors that play a crucial role in preventing accidents by combining radar, lidar, and camera technologies. These sensors are designed to detect obstacles and potential hazards in real time, providing critical information to the vehicle’s control systems. By integrating these sensors with sophisticated algorithms, Continental AG enables vehicles to execute automatic braking, lane-keeping assistance, and adaptive cruise control functions.

-

NXP Semiconductors offers a range of collision avoidance sensors designed to improve road safety and facilitate the development of autonomous driving systems. These sensors leverage cutting-edge technologies such as radar, lidar, and vision-based systems to detect obstacles, pedestrians, and other vehicles in real time. By integrating these sensors into vehicles, NXP aims to reduce the likelihood of accidents and enhance overall driving experiences.

Key Collision Avoidance Sensors Companies:

The following are the leading companies in the collision avoidance sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- Delphi Automotive LLP

- NXP Semiconductors

- Infineon Technologies AG

- Murata Manufacturing Co., Ltd

- Panasonic Corporation

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- Joyson Safety Systems

- Texas Instruments Incorporated

Recent Developments

-

In December 2023, Continental AG collaborated with Telechips, a Korean semiconductor firm, to produce Smart Cockpit High-Performance Computers. The Smart Cockpit HPC is created for standard cockpit configurations featuring driver and central screens, providing optimal system performance for cluster, infotainment, and visualization of Advanced Driver Assistance Systems (ADAS).

-

In October 2023, Sensata Technologies announced the launch of the PreView Sentry 79 radar for monitoring blind spots during take-off and reverse operations. By utilizing cutting-edge technology, the PreView Sentry 79 establishes a higher benchmark for blind spot detection and collision prevention within the on- and off-road heavy vehicle sectors.

Collision Avoidance Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.41 billion

Revenue forecast in 2030

USD 15.09 billion

Growth rate

CAGR of 15.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; South Arabia; UAE; South Africa

Key companies profiled

Continental AG; Delphi Automotive LLP; NXP Semiconductors.; Infineon Technologies AG; Murata Manufacturing Co., Ltd; Panasonic Corporation; Robert Bosch GmbH; Sensata Technologies, Inc.; Joyson Safety Systems, Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Collision Avoidance Sensors Market Report Segmentation

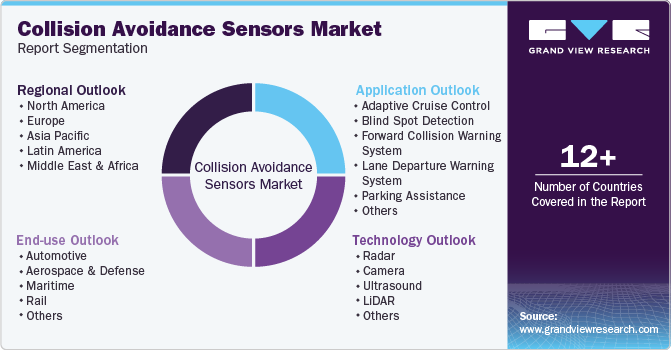

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the collision avoidance sensors market report based on technology, application, end-use, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Radar

-

Camera

-

Ultrasound

-

LiDAR

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adaptive Cruise Control (ACC)

-

Blind Spot Detection (BSD)

-

Forward Collision Warning System (FCWS)

-

Lane Departure Warning System (LDWS)

-

Parking Assistance

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Maritime

-

Rail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.