- Home

- »

- Sensors & Controls

- »

-

Collision Avoidance Sensors Market Size, Industry Report, 2018-2025GVR Report cover

![Collision Avoidance Sensors Market Report]()

Collision Avoidance Sensors Market Analysis Report By Application (Parking Assistance, Forward Collision Warning System), By Technology (Radar, Camera, Ultrasound), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-843-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2018 - 2025

- Industry: Semiconductors & Electronics

Report Overview

The global collision avoidance sensors market size was valued at USD 4.39 billion in 2017 and is anticipated to exhibit a CAGR of 21.2% from 2018 to 2025. Due to increasing developments in the fields of camera, LiDAR, radar, and ultrasound technologies, the market has witnessed rapid growth over the past few years. Many luxury automobile manufacturers are expected to adopt these sensors on a large scale, implementing them as an indispensable component of a vehicle’s active safety systems package.

An increase in sales of sports utility vehicles (SUVs), utility vehicles, and high-end luxury vehicles is expected to be a major growth driver for the market. Some of the major automobile manufacturers have already started integrating basic collision avoidance sensors in their mass-market product offerings. For instance, Toyota Motor Corporation introduced advanced technologies such as auto-parking, pre-crash braking system, vehicle communication system, and auto-adjust headlamp in its 2015 models.

Adoption and integration of collision avoidance sensors in passenger and commercial vehicles are expected to result in a decrease in road accidents while providing increased protection to vehicle occupants. Stringent government policies and regulations relating to the installation of vehicle safety features are also anticipated to be an important growth driver for the market.

Increased consumer awareness, high focus on research and development by automobile manufacturers, and updated safety ratings by regulatory bodies have also propelled the growth of the market. For instance, in January 2015, to prevent and/or reduce the severity of crashes, the U.S. National Highway Traffic Safety Administration (NHTSA) announced the addition of automatic emergency braking systems into its New Car Assessment Program (NCAP).

Demand for active sensors and systems is anticipated to slow down over the forecast period as a result of high procurement and integration costs for manufacturers. The cost of sensors and systems has a direct impact on vehicle pricing, thus making it expensive for consumers.

Technology Insights

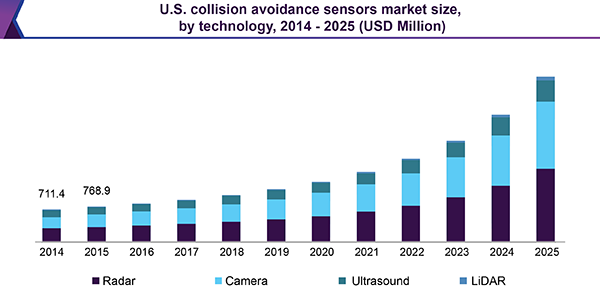

Multiple technology-based vehicle collision avoidance sensors, such as radar, camera, ultrasound, and LiDAR, offer active vehicle safety and pre-crash risk mitigation capabilities to vehicles. Radars are the most preferred choice in case of detection systems that require accurate measurement of location and distance of obstacles. Compared to radar, vision and infrared cameras have a narrower and shorter field of view but are more helpful for identification and classification of the obstacle.

Ultrasound systems are inexpensive and are capable of short-distance obstacle detection. They are especially used in vehicle parking assistance solutions. LiDAR-based anti-collision sensors offer a wide-angle field view and are capable of generating detailed imagery. However, LiDAR sensors are very expensive and consume more vehicle space for installation. The camera and radar-based segments are expected to hold a significant market share over the coming years.

Application Insights

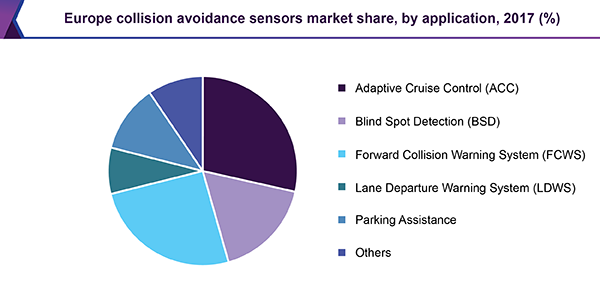

The collision avoidance sensors market is propelled by increasing sales of Advanced Driver Assistance Systems (ADAS), such as blind spot detection, forward collision warning, adaptive cruise control, lane departure warning, and parking assistance system.Vehicles with parking assistance systems use a combination of vision-based and ultrasound anti-collision sensors. For instance, Mercedes-Benz, BMW Audi, and Infiniti cars have parking assistance systems that consist of integrated surround-view cameras and ultrasonic sensors.

Owing to declining prices of radar and camera systems over the last few years, lane departure warning and blind-spot detection systems have gained prominence and are expected to capture a significant market share over the next few years. Over the forecast period, adaptive cruise control systems are expected to account for a major market share. These systems utilize short-, medium-, and long-range radars to automatically adjust the vehicle’s speed as per the intensity of traffic.

Regional Insights

North America and Europe are mature markets for anti-collision sensor-based advanced safety systems in vehicles. The installation of advanced safety systems has been made mandatory by government regulations in the abovementioned regions. For instance, in the U.S., the Electronic Stability Control (ESC) standard has been adopted for all new vehicles manufactured after 2012. As per the European NCAP, passenger vehicle manufacturers have to offer an emergency autonomous braking solution as part of the agency’s safety rating standards.

Owing to stringent standards and regulations pertaining to road safety, North America and Europe are expected to account for a sizable market share over the forecast period. The market in Asia Pacific is expected to witness remarkable growth owing to increased emphasis on the implementation of stringent road safety rules. The rise in the purchasing power of consumers, high standards of living, growth in GDP, and increasing sales of premium cars are expected to be major regional growth drivers for Asia Pacific and MEA.

Key Companies & Market Share Insights

Key market players include Robert Bosch GmbH, Delphi Automotive, Continental AG, NXP Semiconductors, and Murata Manufacturing Co., Ltd.Development of 360-degree surveillance systems is expected to offer a significant growth opportunity for the market. In 2015, Delphi Automotive manufactured 360-degree vehicle surveillance systems.

Key market players are heavily investing in research and development projects and establishing production infrastructure to develop and offer differentiated and cost-effective vehicle safety solutions. Continental AG has a strong market presence owing to its strong R&D department and production facilities. The company mainly focuses on product innovation and effective distribution through a strong network of partners in multiple countries, such as the U.S., Germany, India, and Brazil.

Collision Avoidance Sensors Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 6.49 billion

Revenue forecast in 2025

USD 18.97 billion

Growth Rate

CAGR of 21.2% from 2018 to 2025

Base year for estimation

2017

Historical data

2014 - 2017

Forecast period

2018 - 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2018 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, applications, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Germany; France; India; Japan; China; Brazil; and Mexico

Key companies profiled

Robert Bosch GmbH; Delphi Automotive; Continental AG; NXP Semiconductors; and Murata Manufacturing Co.; Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global collision avoidance sensors market report on the basis of technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2014 - 2025)

-

Radar

-

Camera

-

Ultrasound

-

LiDAR

-

-

Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Adaptive Cruise Control (ACC)

-

Blind Spot Detection (BSD)

-

Forward Collision Warning System (FCWS)

-

Lane Departure Warning System (LDWS)

-

Parking Assistance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."