- Home

- »

- Medical Devices

- »

-

Colonoscopes Market Size & Share, Industry Report, 2030GVR Report cover

![Colonoscopes Market Size, Share & Trends Report]()

Colonoscopes Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Video Colonoscopes, Fiber Optic Colonoscopes), By Procedure Type (Diagnostic, Therapeutic), By Age Group, By End Use, By Application, By Region And Segment Forecasts

- Report ID: GVR-4-68040-517-7

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Colonoscopes Market Size & Trends

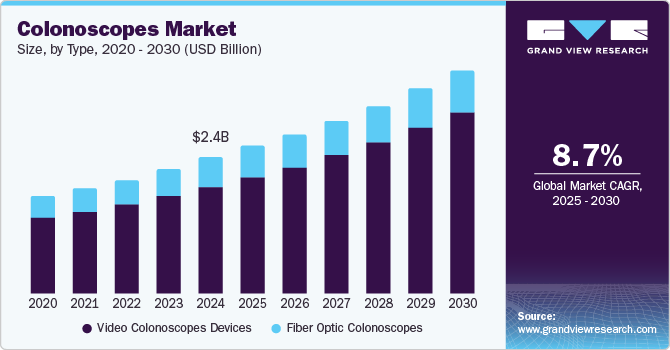

The global colonoscopes market size was estimated at USD 2.4 billion in 2024 and is projected to grow at a CAGR of 8.72% from 2025 to 2030. One of the primary factors contributing to the rise of the colonoscopes market is the increasing incidence of colorectal diseases, including colorectal cancer and inflammatory bowel disease (IBD). Colorectal cancer is one of the most common cancers globally, and its prevalence is on the rise.

According to the World Health Organization (WHO), it accounts for a substantial percentage of cancer-related deaths each year. This escalation necessitates early detection and intervention, which colonoscopes facilitate through routine screenings and diagnostic procedures. For instance, in 2022, around 1,926,425 new cases of colorectal cancer were recorded, according to World Cancer Research Fund statistics, among which 1,069,446 and 856,979 new cases were reported in men and women, respectively.

The growing recognition of these diseases has led healthcare providers to advocate for regular screenings, thereby boosting demand for advanced colonoscopy procedures and instruments. Growing public awareness about the importance of colorectal cancer screenings and education campaigns by health organizations have contributed significantly to the increased utilization of colonoscopes. For instance, According to the American Association for Cancer Research, March is colorectal cancer awareness month. The National Cancer Institute estimated that around 152,810 people in the U.S. received a diagnosis of colon or rectal cancer in 2024, and around 53,010 died because of it.

Top Ten Countries with Highest Colorectal Cancer Incidence In 2022

World

1,926,425

China

517,106

U.S.

160,186

Japan

145,756

Russia

83,693

India

70,038

Germany

62,544

Brazil

60,118

Italy

54,784

France (Metropolitan)

51,636

UK

49,249

The shift towards preventive healthcare has led several countries to implement screening guidelines, advocating for routine colonoscopies, especially for individuals over the age of 50 or those with risk factors. Initiatives that emphasize the importance of early detection and provide information about available screening options have heightened awareness, resulting in increased demand for colonoscopy procedures.

As populations aged, particularly in developed countries, the demand for colonoscopy procedures is expected to rise. Older adults are at a higher risk for colorectal diseases and therefore require more frequent screenings. The World Population Ageing report indicates that the number of people aged 65 and older will continue to grow, placing further importance on healthcare services that cater to this demographic. This trend offers a substantial opportunity for growth in the colonoscope market as healthcare systems adapt to meet the needs of an aging population.

Investment in healthcare infrastructure, particularly in emerging economies, is another driving factor for the colonoscopes market. As hospitals and clinics upgrade their facilities and technologies to provide better healthcare services, the integration of advanced diagnostic tools, including colonoscopes, becomes essential. This expansion reflects a broader trend toward enhanced health services, improving overall healthcare delivery and increasing access to critical screening procedures.

Regulatory bodies in various countries have introduced support and incentives to improve cancer screening rates. These policies often include funding for colorectal cancer screening programs or initiatives that lower the financial burden on patients. Such regulatory encouragement helps drive demand for colonoscopy services and improves access to advanced diagnostic tools, thereby propelling the colonoscopes market.

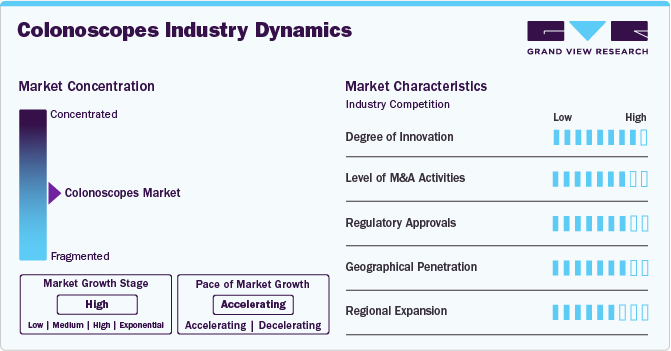

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The colonoscopes market is characterized by a high degree of growth. The colonoscopes market is characterized by dynamic market trends and technological advancements.

Key strategies implemented by players in the colonoscopes market are new product launches, regulatory approval, acquisitions, partnerships, and other strategies. For instance, in September 2024, Odin Medical Ltd., (Olympus) obtained 510(k) clearance from the U.S. Food and Drug Administration (FDA) for the CADDIE device. This device is the first cloud-based Artificial Intelligence (AI) technology aimed at assisting gastroenterologists in identifying potential colorectal polyps during colonoscopy procedures.

The colonoscopes market has witnessed significant innovation over the past decade, driven by advancements in technology and a growing emphasis on patient comfort, diagnostic accuracy, and procedural efficiency. Traditional colonoscopes, primarily rigid and limited in flexibility, have evolved into sophisticated instruments featuring improved visualization capabilities, such as high-definition imaging and near-infrared fluorescence. These enhancements allow for the detection of polyps and lesions with greater precision, ultimately contributing to earlier cancer detection and improved patient outcomes.

Industry players are strategically aligning through acquisitions and partnerships to enhance their technological capabilities, expand product portfolios, and gain a competitive edge. This surge in M&A activities reflects the dynamic landscape of the colonoscopes market, with companies seeking strategic collaborations to advance innovation, address evolving healthcare demands, and solidify their positions in this rapidly growing sector.

Regulatory approvals in the industry are critical for ensuring the safety and efficacy of these essential medical devices. In many countries, including the U.S. and those within the European Union, colonoscopes must undergo rigorous evaluation by regulatory bodies such as the FDA and the European Medicines Agency (EMA).

The traditional colonoscope, used for diagnostic and therapeutic procedures, is increasingly facing competition from emerging technologies and alternative products. For instance, capsule endoscopy offers a less invasive method for visualizing the gastrointestinal tract. Patients swallow a small, pill-sized camera, which captures images as they pass through the digestive system, providing valuable insights without the discomfort associated with traditional colonoscopy.

The colonoscopes market is witnessing a significant transformation, driven by increasing demand for early cancer detection and prevention. Key regions, such as the U.S., Europe, and Japan, are expected to experience substantial growth fueled by government initiatives, technological advancements, and a rising awareness of the importance of colon cancer screening.

Type Insights

The video colonoscopes segment dominated the market and accounted for the largest revenue share of 78.96% in 2024. One of the primary factors driving the dominance of video colonoscopes is their ability to provide high-definition imaging. These state-of-the-art instruments capture detailed, real-time video footage of the colon, allowing gastroenterologists to identify abnormalities, such as polyps or signs of colorectal cancer, with unprecedented clarity. Enhanced image quality not only facilitates accurate diagnosis but also improves the chances of early intervention, which is critical in combating colorectal cancer-a leading cause of cancer-related deaths worldwide.

Additionally, the evolution of video colonoscopes has led to the development of features such as narrow-band imaging (NBI) and chromoendoscopy. These technologies aid in the differentiation between benign and malignant lesions, allowing for better assessment during procedures. The integration of AI-powered tools further enhances diagnostic capabilities by assisting physicians in detecting subtle abnormalities that may be overlooked during manual review. This technological advancement positions video colonoscopes as an invaluable asset in the fight against colorectal disease.

The fiber-optic colonoscopes segment is anticipated to witness significant growth throughout the forecast period. This growth is fueled by the superior image quality, flexibility, and ergonomics offered by fiber-optic colonoscopes, making them an indispensable tool for gastroenterologists and medical practitioners worldwide.

Procedure Type Insights

The diagnostic segment dominated the colonoscopes market and accounted for the largest revenue share in 2024. The primary driver behind the dominance of the diagnostic segment is the rising incidence of colorectal cancer globally. As one of the leading causes of cancer-related deaths, early detection is crucial for improving survival rates. Colonoscopy is recognized as the gold standard for screening and diagnosing conditions such as colorectal cancer, polyps, and inflammatory bowel diseases. This critical role has heightened the demand for comprehensive diagnostic procedures, making the diagnostic segment a focal point in the colonoscopes market.

The therapeutic segment is anticipated to witness the fastest CAGR owing to the rising incidence of colon cancer, the growing demand for minimally invasive procedures, and an expanding array of therapeutic applications for colonoscopes.

Application Insights

The colorectal cancer segment dominated the market and accounted for the largest revenue share in 2024 due to the increasing incidence of colorectal cancer, increasing demand for minimally invasive procedures, growing awareness and screening rates, and expanding access to colonoscopy services.

The polyps segment is anticipated to witness the fastest CAGR over the forecast period, driven by increasing product launches that will help detect colorectal polyps, increasing awareness of colorectal health, and the rising incidence of colorectal cancer. Polyps, which are abnormal growths in the colon that can become cancerous, are often detected during routine colonoscopy procedures. As healthcare professionals emphasize preventive screenings, the demand for colonoscopes equipped to identify and remove polyps is sharply rising.

Age Group Insights

The adult segment dominated the market for colonoscopes and accounted for the largest revenue share in 2024, driven by the growing elderly population. Colorectal cancer is one of the leading causes of cancer-related morbidity and mortality worldwide, particularly among adults over the age of 50, according to WHO. As adults become more aware of these health risks, routine colonoscopy has become a critical part of preventive healthcare.

The pediatric segment is expected to witness the fastest CAGR over the forecast period. This anticipation is driven by the increasing prevalence of gastrointestinal disorders in children and the growing need for effective diagnostic and therapeutic tools.

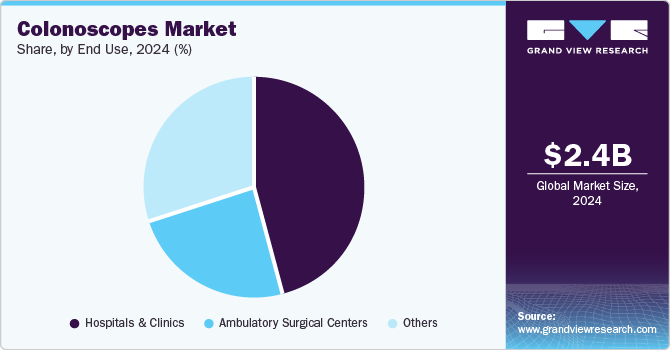

End Use Insights

The hospitals & clinics segment dominated the market for colonoscopes and accounted for the largest revenue share in 2024. Hospitals offer a comprehensive array of services, including outpatient and inpatient procedures, along with access to multidisciplinary teams of specialists who can manage complex cases effectively. The trend towards preventive healthcare has also led to an increase in routine screenings, further propelling the need for colonoscopes within these settings. Innovations in colonoscopes, including high-definition imaging and minimally invasive techniques, allow for improved accuracy and reduced recovery times, making them a preferred option in hospitals.

The ambulatory surgical centers segment is anticipated to experience the fastest growth in the colonoscopes market over the forecast period. This surge can be attributed to the increasing trend towards outpatient care, where patients prefer minimally invasive procedures that allow for quicker recovery and discharge. Ambulatory surgical centers offer a cost-effective alternative to traditional hospital settings, providing high-quality surgical services with shorter wait times and enhanced patient convenience.

Regional Insights

North America colonoscopes market held the largest revenue share of more than 32.62% in 2024. The key drivers of growth in the region include an increasing patient pool, particularly in the U.S. In addition, the rising geriatric population, which is more prone to colorectal diseases, will further boost demand for colonoscopes. According to Statistics Canada, the proportion of individuals aged 65 and older in the total population is projected to grow from 18.9% in 2023 to between 21.9% (slow-aging scenario) and 32.3% (fast-aging scenario) by 2073.

U.S. Colonoscopes Market Trends

The colonoscopes market in the U.S. is expected to dominate the North American market over the forecast period due to the growing number of colonoscopy procedures performed, presence of key players and the increasing launches of products. Some of the key players operating in the U.S. market include Olympus and Ambu among others. Further, in the U.S., more than 15 million colonoscopies are performed annually according to a research article published in 2023 in Translational Gastroenterology and Hepatology, thus fueling the market growth.

Europe Colonoscopes Market Trends

The Europe colonoscopes industry is influenced by several driving factors, such as the rising incidence of colorectal cancer in Europe, the growing aging population, and increasing endoscopic polypectomy procedures performed. Furthermore, supportive government initiatives and funding for healthcare infrastructure improvements are likely to bolster the expansion of the colonoscopes market across the region.

The colonoscope market in the UK is anticipated to experience substantial growth in the coming years. This growth can be attributed to several factors, including an aging population and advancements in colonoscopy technologies. In addition, increased healthcare investments, government initiatives, and a growing awareness of advanced diagnostic treatments are further driving demand in the colonoscopes market.

Germany colonoscopes market is likely to show significant growth driven by the increasing prevalence of gastrointestinal disorders and the growing adoption of technologically advanced products in clinical settings. Moreover, the rising investment in developing healthcare infrastructure is anticipated to drive the country's market growth in the coming years.

Asia Pacific Colonoscopes Market Trends

The colonoscopes market in the Asia Pacific region is anticipated to achieve the highest CAGR during the forecast period, fueled by substantial growth in the colonoscopes industry. Key drivers include the rising demand for minimally invasive procedures in emerging markets such as India and China. In addition, increasing healthcare expenditures in various Asian countries are expected to enhance market growth in the region further. The large patient populations in countries such as India, China, and Japan are expected to contribute to the market's expansion over the forecast period.

China colonoscopes market is witnessing significant growth and accounted for the largest revenue share in 2024. One of the primary drivers is the increasing incidence of colorectal cancer, which has prompted greater awareness and the need for early detection through screening procedures. As one of the leading forms of cancer in China, regular colonoscopy is crucial for timely intervention and improved patient outcomes. Additionally, China's aging population is fueling demand for colonoscopy services. With a substantial proportion of the demographic being over 65, there is a heightened necessity for screening and diagnostic tools to address age-related gastrointestinal disorders.

Latin America Colonoscopes Market Trends

The colonoscopes market in Latin America is experiencing significant growth driven by the increasing prevalence of colorectal cancer, advancements in technology, growing adoption of single use colonoscopes, and government initiatives to improve healthcare infrastructure.

Middle East And Africa Colonoscopes Market Trends

The Middle East and Africa colonoscopes market is expected to grow significantly in the coming years due to the rising prevalence of gastrointestinal disorders such as colorectal diseases. Improved healthcare systems and increased healthcare expenditure drive the adoption of advanced medical technologies, including colonoscopy. For instance, the UAE Government earmarks a significant percentage of the federal budget for the healthcare sector every year. As per Federal budget data issued in June 2024, almost USD 1.33 billion was allotted for 2023, which grew to 1.36 billion in 2024.

The colonoscope market in Saudi Arabia is expected to expand during the forecast period. The rising incidence of colorectal cancer, an aging population, and increased healthcare investments propel this growth. In addition, government initiatives aimed at enhancing healthcare infrastructure and growing awareness of advanced medical technologies are further contributing to the market's expansion

Key Colonoscopes Company Insights

The intensifying competition is leading to rapid technological advancements, and companies are constantly working to improve their product with a strong focus on research and development. Factors such as investments in R&D, compliance with regulatory policies, and technological advancements are constantly driving the introduction of novel products. In addition, market players are adopting strategies such as mergers & acquisitions, partnerships, product launches, and innovations to strengthen their foothold in the market.

Key Colonoscopes Companies:

The following are the leading companies in the colonoscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus

- FUJIFILM Corporation

- HOYA Corporation

- Medtronic

- Endowed Systems

- Ambu

- Smart Medical Systems Ltd.

- Cliniva Healthcare

Recent Developments

-

In September 2024, Odin Medical Ltd., a subsidiary of Olympus obtained 510(k) clearance from the U.S. FDA for the CADDIE device, the first cloud-based AI technology aimed at assisting gastroenterologists in identifying potential colorectal polyps during colonoscopy procedures.

-

In March 2024, Bausch Health Companies Inc. and its gastroenterology division, Salix Pharmaceuticals released results from their inaugural colonoscopy awareness and perspective survey, conducted in collaboration with The Harris Poll. The findings, timed to coincide with Colorectal Cancer Awareness Month, provide insights into patient attitudes toward colonoscopies and the preparation process. A significant majority of adults aged 45 and older surveyed (78%) indicated that they depend on their healthcare providers for information regarding colonoscopies and the preparation process.

-

In September 2023, Ambu received 510(k) regulatory clearance from the U.S. Food and Drug Administration (FDA) for its single-use colonoscope solution, the Ambu aScope Colon, along with the endoscopy system, the Ambu aBox 2.

-

In April 2022, SMART Medical Systems obtained FDA clearance for its G-EYE Colonoscope to be used on Olympus' PCF Colonoscope Series, expanding its availability in the U.S. As a result, the G-EYE Colonoscope is now compatible with commonly used models across all major endoscopy brands (Olympus, FUJIFILM, and PENTAX Medical), offering broader accessibility to healthcare professionals for enhanced visualization and diagnostic capabilities.

-

In April 2021, FUJIFILM Medical Systems U.S.A., Inc., a pioneering developer of endoscopic and endosurgical technologies introduced the G-EYE 700 Series Colonoscope, featuring innovative G-EYE technology developed by Smart Medical. This advanced technology is designed to enhance visualization, stability, and control during routine colon examinations, providing improved diagnostic capabilities.

Colonoscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.6 billion

Revenue forecast in 2030

USD 3.9 billion

Growth rate

CAGR of 8.72% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Type, procedure type, application, end use, age group, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus; FUJIFILM Corporation; HOYA Corporation; Medtronic; Endomed Systems; Ambu; Smart Medical Systems Ltd.; Cliniva Healthcare.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Colonoscopes Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global colonoscopes market report based on type, procedure type, application, end use, age group, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Video Colonoscopes Devices

-

Fiber Optic Colonoscopes

-

-

Procedure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic

-

Therapeutic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Colorectal Cancer

-

Ulcerative Colitis

-

Crohn’s Disease

-

Polyps

-

Lynch Syndrome

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thaliland

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global colonoscopes market size was valued at USD 2.4 billion in 2024 and is expected to reach USD 2.6 billion in 2025.

b. The global colonoscopes market is projected to grow at a CAGR of 8.72% from 2025 to 2030 to reach USD 3.9 billion by 2030.

b. The video colonoscopes segment dominated the market and accounted for the largest revenue share of 78.96% in 2024 primarily driven by growing incidence of colorectal cancer and increasing demand of minimally invasive procedures.

b. Key market players include Olympus, FUJIFILM Corporation, HOYA Corporation, Medtronic, Endomed Systems, Ambu, Smart Medical Systems Ltd., and Cliniva Healthcare among others.

b. The colonoscopes market is driven by several factors such as increasing incidence of colorectal cancer, growing awareness of preventive healthcare, advancements in colonoscopy technology, rising demand of minimally invasive procedures, and rising number of ambulatory surgical centers, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.