- Home

- »

- Communications Infrastructure

- »

-

Command And Control Systems Market Size Report, 2030GVR Report cover

![Command And Control Systems Market Size, Share & Trends Report]()

Command And Control Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Platform (Airborne, Maritime, Land, Space), By Solution (Hardware, Software, Services), By Application (Defense, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-098-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Command And Control Systems Market Summary

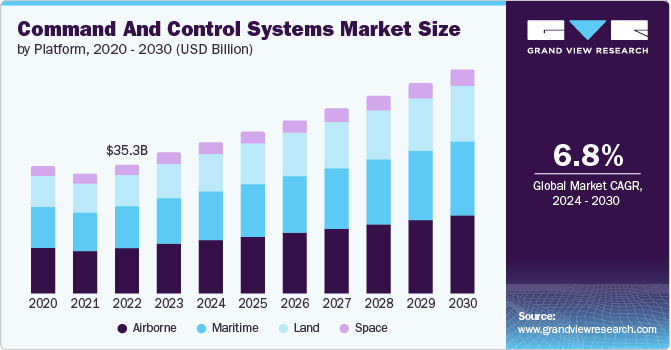

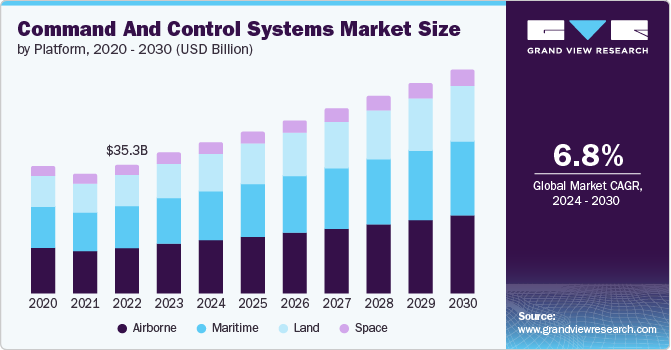

The global command and control systems market size was estimated at USD 38.57 billion in 2023 and is projected to reach USD 61.09 billion by 2030, growing at a CAGR of 6.8% from 2024 to 2030. The market growth is attributed to the rising preference for integrated command and control (C2) solutions, which combine hardware, software, and advanced analytics to manage diverse data sources, from Internet of Things (IoT) sensors to satellite imagery, enable real-time monitoring, analysis, and decision-making; and enhance situational awareness and operational efficiency, which is crucial for rapid response and effective resource allocation.

Key Market Trends & Insights

- The command and control systems market in North America is expected to record a significant growth rate of nearly 6.0% from 2024 to 2030.

- The U.S. command and control systems market is estimated to witness a significant growth rate of over 5.0% from 2024 to 2030.

- Based on platform, the airborne segment accounted for the largest share of nearly 35.0% in 2023.

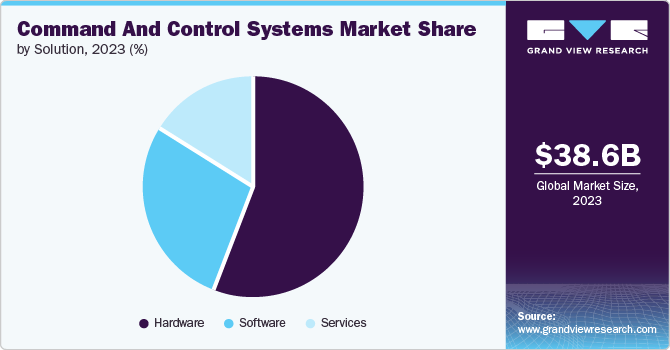

- Based on solution, the hardware segment accounted for largest revenue share in 2023.

- Based on application, the defense segment accounted for largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 38.57 Billion

- 2030 Projected Market Size: USD 61.09 Billion

- CAGR (2024-2030): 6.8%

- North America: Largest Market in 2023

Moreover, rising geopolitical tensions and governments' growing need to strengthen their defenses contribute to market growth. Increasing military budgets and technological advancements in the defense industry fuel the demand for C2 systems. Advancements, such as integrating artificial intelligence (AI) technology in C2 systems for smarter decision-making, cloud adoption for scalability, 5G deployment for enhanced connectivity, and heightened cybersecurity measures to protect interconnected systems, further drive market growth. C2 systems are evolving with the continued digital transformation and the subsequent shift to cloud-based architecture and virtualized environments.

Cloud computing offers scalability, flexibility, and cost-efficiency, allowing organizations to access critical data and applications remotely while ensuring data security and adequate regulatory compliance. Advances in cybersecurity measures to protect sensitive information and maintain operational integrity against evolving cyber threats are complementing this shift. In addition, the increasing adoption of C2 technologies in the commercial sector to effectively manage mission-critical operations is opening new growth avenues for the industry. Moreover, they are used in airports and manufacturing plants, power plants, oil & gas installation plants, and research labs, which, in turn, positively influence the overall market outlook.

Market Concentration & Characteristics

The command and control systems market growth stage is high, and the pace of market growth is accelerating. It is characterized by a high degree of innovation due to rapid technological advancements, including the integration of AI, machine learning (ML), and the IoT, the advent of cloud-based solutions, and the adoption of immersive technologies.

The market is also characterized by a high level of merger and acquisition (M&A) activities by leading players. Through these initiatives, companies seek to leverage complementary strengths, expand their global footprint, and enhance technological capabilities to gain a competitive edge in the industry.

Regulations significantly impact the market due to the growing importance of security and compliance of these advanced systems among governments and defense agencies. The regulations aim to address concerns related to data privacy, cybersecurity, and ethical use of emerging technologies involved in command and control.

The threat of substitutes in the market is low, as command and control systems are critical for real-time decision-making and operational coordination in military, government, and corporate settings, and very few direct substitutes can offer the same level of integration, reliability, and capabilities.

The market has moderate end-user concentration, as the major industries requiring command and control systems are limited to government, defense, and commercial companies operating in the aerospace, land, space, and maritime sectors.

Platform Insights

The airborne segment accounted for the largest share of nearly 35.0% in 2023. The segment growth is attributed to airborne C2 systems' critical role in modern military operations, surveillance, and reconnaissance missions. Advanced airborne C2 systems facilitate real-time data collection, analysis, and communication, essential for maintaining air superiority, coordinating ground operations, and ensuring effective responses to security threats. The increasing integration of Unmanned Aerial Vehicles (UAVs) & drones in military and civilian applications necessitates versatile airborne command systems, further contributing to the segment's growth.

The maritime segment is expected to record its highest CAGR of over 7.0% from 2024 to 2030. Modernization efforts are being pursued worldwide to enhance naval operations, maritime security, and coastal surveillance amidst the increasing geopolitical tensions and evolving maritime threats. At this juncture, advanced maritime C2 systems are being deployed aggressively to enable more efficient management of naval fleets by enhancing real-time tracking, communication, and coordination, which is critical for maritime defense and surveillance. The expansion of maritime trade and implementation of regulations to enhance safety and security at sea are creating lucrative growth avenues for the market.

Solution Insights

The hardware segment accounted for largest revenue share in 2023. The increasing demand for robust hardware that enhances the functionality and effectiveness of C2 systems is favoring segmental growth. Hardware, such as sensors, communication devices, displays, and control units, forms the backbone of a typical C2 system, enabling the collection, processing, and dissemination of critical data in real time. The introduction of modern hardware, including more powerful processors, enhanced sensors, and robust communication networks, further accelerates segmental growth.

The software segment is expected to record the highest CAGR from 2024 to 2030. The segment growth can be attributed to software's critical role in integrating, analyzing, and visualizing data to enhance decision-making and operational efficiency. Advanced software solutions facilitate real-time data processing, situational awareness, and coordination across various command and control operations. Advances in AI, ML, and big data analytics are facilitating the development of sophisticated software platforms capable of delivering predictive analysis, automation, and enhanced cybersecurity, enhancing the market outlook.

Application Insights

The defense segment accounted for largest revenue share in 2023. Several governments worldwide are aggressively pursuing defense modernization initiatives amid rising security concerns and growing armed conflicts in different parts of the world. Defense organizations are investing in advanced C2 systems to facilitate real-time monitoring, establish communication and coordination between troops, vehicles, and other assets, enhance situational awareness, and improve operational effectiveness across the overall military operations. The high prominence of C2 systems across the defense sector due to their advantages drives the segment growth.

The commercial segment is expected to register the highest CAGR from 2024 to 2030 owing to continued industrial automation, smart city initiatives, and rising emphasis on deploying efficient emergency response systems. As cities and industrial establishments transform digitally, the need for advanced C2 systems to enable real-time monitoring and predictive maintenance, streamline resource allocation, support urban development and industrial operations, and enhance safety protocols is growing. Moreover, the rising demand for C2 systems integrating diverse IoT sensors and communication networks further contributes to segment growth.

Regional Insights

The command and control systems market in North America is expected to record a significant growth rate of nearly 6.0% from 2024 to 2030. This can be attributed to the advancements in AI, ML, and cybersecurity, among other technologies, driving innovations in command and control systems in the region. The region’s commitment to modernizing its defense and homeland security devices, including the integration of cyber defense strategies with command and control systems, is creating substantial market opportunities.

U.S. Command and Control Systems Market Trends

The U.S. command and control systems market is estimated to witness a significant growth rate of over 5.0% from 2024 to 2030 owing to the country's substantial investment in defense and security to upgrade its military capabilities, including the integration of advanced technologies.

Asia Pacific Command and Control Systems Market Trends

The command and control systems market in Asia Pacific is expected to record the highest CAGR from 2024 to 2030. The increasing geopolitical tensions and border disputes among regional countries have led to a considerable focus on national security, creating a significant demand for advanced command and control systems. In addition, rapid urbanization and smart city initiatives across the Asia Pacific are increasing the demand for robust command and control systems, thereby contributing to market growth.

The India command and control systems market is estimated to record a notable growth rate from 2024 to 2030 owing to increasing investments in advanced command and control systems to boost surveillance and operational capabilities amid the rising border tensions.

The command and control systems market in China accounted for the largest market share in 2023 due to a significant focus on developing indigenous technology and strengthening self-reliance in defense technologies.

The Japan command and control systems market is expected to witness a CAGR of over 9.0% from 2024 to 2030, owing to increasing emphasis on enhancing defense capabilities driven by growing concern over national security and geopolitical tensions.

Europe Command and Control Systems Market Trends

The command and control systems market in Europe accounted for a significant revenue share in 2023 owing to the implementation of the North Atlantic Treaty Organization (NATO) standards in member states, which are raising interoperability and modernizing military assets, including command and control systems. Moreover, the European Union's investment in research and development for defense technology innovation, particularly in AI and cyber defense, is propelling the adoption of command and control systems, thereby contributing to market growth.

The UK command and control systems market is expected to witness significant growth over the coming years. Government initiatives toward defense spending, adhering to NATO guidelines, and ensuring sustained investment in modernizing military capabilities are driving the segmental growth.

The command and control systems market in Germany is estimated to record a CAGR of around 8% from 2024 to 2030 owing to significant investments aimed at transforming the country’s military infrastructure through comprehensive digitization initiatives.

Middle East and Africa (MEA) Command and Control Systems Market Trends

The MEA command and control systems market is anticipated to grow at a significant rate from 2024 to 2030. The market growth is being driven by the ongoing infrastructure projects in the region, particularly in the Gulf Cooperation Council (GCC) countries, which involve the development of smart cities. These projects require integrated command and control systems for efficient urban management, traffic control, and public safety, fueling market demand. These systems are integral to protecting critical infrastructure and ensuring secure communication channels, further contributing to the market's growth.

The command and control systems market in Saudi Arabia accounted for a considerable revenue share in 2023 owing to the rising demand for efficient urban management driven by ongoing infrastructure development and smart city projects in the country.

Key Command And Control Systems Company Insights

Some of the key players operating in the market include Lockheed Martin Corporation, BAE Systems plc, RTX Group, and Boeing, among others.

-

Lockheed Martin Corporation is an aerospace and security company engaged in developing,developing, manufacturing, and integrating advanced systems, products, and services. Its major business segments include aeronautics, missiles & fire control, rotary & mission systems, and space

-

BAE Systems Plc manufactures military aircraft, submarines, surface ships, radar, communications, avionics, electronics, and guided weapon systems. Its major business segments include electronic systems, platforms & services, air, maritime, and cyber & intelligence

-

RTX Corporation is an aerospace and defense company offering advanced systems and services for commercial, military, and government organizations. It caters to government and commercial customers in the original equipment and aftermarket parts and services segments of the aerospace industry

-

Boeing manufactures and services defense products, commercial airplanes, and space systems across the globe. Its three main business segments include commercial airplanes, global services, and defense, space & security. Command and control systems come under the defense, space & security segment

Barco NV, Planar, and Christie Digital Systems USA, Inc., are some of the emerging market participants in the command and control systems market.

-

Barco NV operates as a digital visualization solution provider, majorly in three business segments, including healthcare, entertainment, and enterprise. The company offers monitors, projectors, video walls, light-emitting diode displays, image processing, and visual display systems. The command and control systems are covered under the enterprise segment

-

Christie Digital Systems USA, Inc. is a global audio and visual technologies company offering a wide range of projection solutions, including advanced RGB pure laser projection, video walls, LCD panels, and video wall processors, to SDVoE technology, content management, and image processing, among others

-

Planar offers display solutions that are utilized in various control rooms and command centers, including those for military operations, space flight control, emergency management, network infrastructure management, real-time crime prevention, and traffic management. The company’s versatile, ultra-high resolution video walls and large format displays provide sharp visibility of data and the flexibility to display it effectively

Key Command And Control Systems Companies:

The following are the leading companies in the command and control systems market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- BAE Systems

- Collins Aerospace

- Thales Group

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Boeing

- Northrop Grumman

- Saab

- CACI International Inc

- Barco NV

- Christie Digital Systems USA, Inc.

- InFocus Corporation

- Activu

- Panasonic Corporation

- Planar

- Datapath Ltd.

- Extron Electronics

- Matrox

- Hiperwall, Inc.

- Green Hippo Ltd. (tvOne)

- RTX Corporation

- tvONE

- RGB Spectrum

- Userful Corporation

- VuWall Technology Inc.

Recent Developments

-

In April 2024, Lockheed Martin Corporation launched a new Power over Ethernet (POE) touchscreen panel called the Controlvu Touch Panel for command and control applications. This product allows operators to manage and monitor multiple video sources in real-time, directly from the touch screen panel

-

In March 2024, Northrop Grumman signed a Memorandum of Understanding (MOU) with Diehl Defense GmbH & Co. KG to support Germany’s innovative layered air and missile defense capabilities. The former’s expertise in IAMD and control capabilities, such as the Integrated Battle Command System, complements Diehl’s ground-based air and missile defense systems

-

In May 2024, VuWall Technology Inc. received an indefinite-delivery/indefinite-quantity contract with a maximum ceiling of USD 4.09 billion from the Missile Defense Agency. This initiative is aimed at accelerating the development of command and control, battle management, and communications systems

-

In February 2024, BAE Systems Plc. announced plans to deliver advanced electromagnetic warfare mission systems for the U.S. Air Force’s fleet of EA-37B aircraft, which will become a part of the Compass Call mission that counters the command and control, computing, communications, combat systems, and intelligence, surveillance, reconnaissance, and targeting (C5ISRT) capabilities of the enemy

Command And Control Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.25 billion

Revenue forecast in 2030

USD 61.09 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, solution, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Lockheed Martin Corp.; BAE Systems; Collins Aerospace; Thales Group; Leonardo S.p.A.; Elbit Systems Ltd.; Boeing; Northrop Grumman; Saab. CACI International Inc; Barco NV; Christie Digital Systems USA, Inc.; InFocus Corp.; Activu; Panasonic Corp.; Planar; Datapath Ltd.; Extron Electronics; Matrox; Hiperwall, Inc.; Green Hippo Ltd. (tvOne); RTX Corp.; tvONE; RGB Spectrum; Userful Corp.; VuWall Technology Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Command And Control Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the command and control systems market report based on platform, solutions, application, and region:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Land

-

Maritime

-

Space

-

Airborne

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Defense

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

- Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global command and control systems market size was estimated at USD 38.57 billion in 2023 and is expected to reach USD 41.25 billion in 2024.

b. The global command and control systems market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 61.09 billion by 2030.

b. North America dominated the command and control systems market with a share of 39.9% in 2023. This is attributed to the rapid technological developments and concentration of the major command and control system providers. Additionally, collaborative multinational military operations practiced by U.S. with the local governments in Middle East are contributing to the regional growth.

b. Some key players operating in the command and control systems market include Lockheed Martin Corporation, BAE Systems plc, RTX Corporation, Boeing, and Northrop Grumman.

b. Key factors that are driving the market growth include the rising need for situational awareness in military, security & surveillance, law enforcement, utilities, and manufacturing industries coupled with rising geopolitical tensions around various parts of the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.