- Home

- »

- Advanced Interior Materials

- »

-

Commercial Flooring Market Size and Trends Report, 2030GVR Report cover

![Commercial Flooring Market Size, Share & Trends Report]()

Commercial Flooring Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Wood & Laminate, LVT, Ceramics, Natural Stone, Linoleum & Rubber), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: 978-1-68038-403-1

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Flooring Market Summary

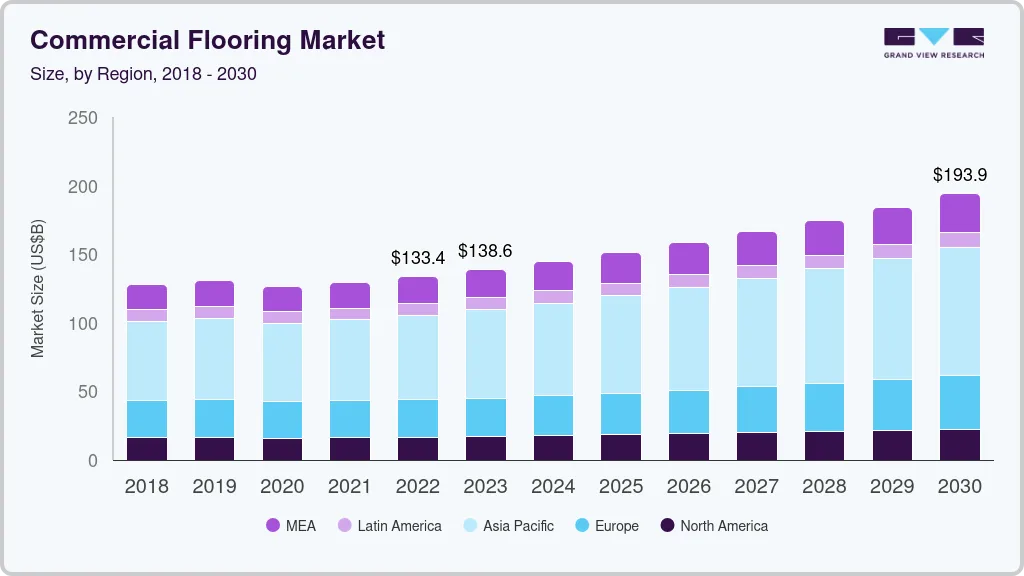

The global commercial flooring market size was estimated at USD 137.61 billion in 2022 and is projected to reach USD 200.56 billion by 2030, growing at a CAGR of 4.8% from 2023 to 2030. The growing commercial construction activities in developing countries are driving the demand for commercial flooring in the market.

Key Market Trends & Insights

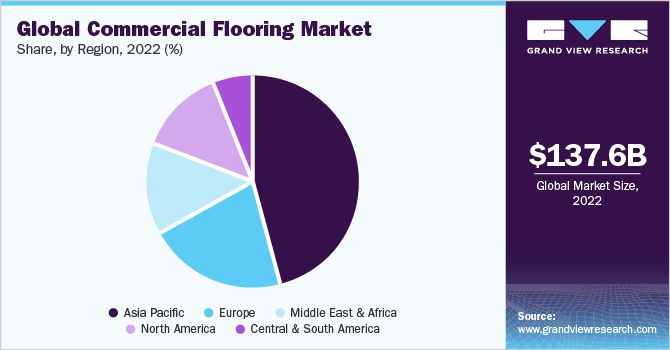

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

- Country-wise, China is expected to register the significant CAGR from 2023 to 2030.

- On the basis of product, the vitrified (ceramic) segment dominated the market with a revenue share of 28.2% in 2022.

- Linoleum & Rubber is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 137.61 Billion

- 2030 Projected Market Size: USD 200.56 Billion

- CAGR (2023-2030): 4.8%

- Asia Pacific: Largest market in 2022

Increasing government spending on infrastructure development on non-residential structures is expected to play a vital role in augmenting demand for flooring. Moreover, the emergence of India, Taiwan, and Mexico as the upcoming manufacturing hubs will not only result in the establishment of factories but also, in a significant population migrating close to these centers, resulting in the development of new cities or expansion of the existing towns.This factor is expected to play a fundamental role in developing the commercial floorings market over the next few years. Green buildings offer better cost-effective advantages as compared to conventional buildings. These sustainable structures consume nearly one-third less amount of energy, reduce the overall loads induced on metal structures, and are capable of improving indoor air quality standards. Furthermore, they incorporate the use of building materials that tend to have a minimalistic harmful impact on the environmental surroundings. Rise in the construction activities of commercial sub-sectors, such as institutional buildings, office complexes, public buildings, and municipal corporations, are expected to witness a significant boost over the next couple of years.

The recovery of the construction industry in developed economies, such as the U.S., coupled with rapidly rising infrastructure activities in developing economies, such as China and India, is a key factor influencing the global development of the non-residential construction market. Commercial applications are subject to high-traffic areas and therefore require durable flooring, such as resilient and wooden. Flooring products are used in numerous commercial building applications including offices, convenience stores, shopping malls, and the construction of other retail stores. Commercial buildings are often maintained as high-security zone and local authorities usually maintain strict regulations in such areas.

Increasing construction of commercial buildings, such as drugstores, grocery, and big-box stores, over the past few years, will benefit the segment growth. Moreover, the high demand for office spaces, especially in urban areas of emerging economies, is propelling the demand for high-quality flooring products. The market in North America is expected to witness significant growth over the coming years due to the increasing construction of residential and commercial buildings in the region. The market is witnessing a rapid shift toward the domestic production of commercial flooring products, such as ceramic tiles, carpets, wood, and laminate. Many Italian companies are increasingly investing in the North American market owing to the abundant raw material availability and a huge customer base.

Product Insights

On the basis of product, the vitrified (ceramic) segment dominated the market with a revenue share of 28.2% in 2022. Vitrified (ceramic) products are highly used as these possess low porosity and are used as an alternative to granite and marble flooring. Ceramic tiles are used in commercial flooring due to their low maintenance, which helps in keeping the maintenance costs of commercial buildings to a minimum over a long period. These are also durable, can withstand moisture, and protect the sub-flooring of the buildings. Scratch-resistant tiles are used for special applications, such as staircase solutions, high-traffic tiles, external wall cladding, and swimming pool tiles.

Furthermore, manufacturers are developing new products with high durability and functionality for use in spaces exposed to high wear and tear, such as restaurants and passages. Increasing investments in commercial offices, hotels, and others are anticipated to augment the demand for ceramic flooring products over the forecast period. The linoleum & rubber product segment is forecasted to grow at the highest CAGR of 6.3% over the coming years. Linoleum is a natural ingredient-based floor covering; comprising ingredients including linseed oil, which is 100% biodegradable and obtained from flax plants, wood flour, limestone, and jute resin.

These ingredients aid linoleum products to have better longevity and durability than vinyl solutions. Rubber as a raw material is highly expensive, which makes rubber flooring an expensive solution. However, increasing use of recycled rubber floorings, primarily in gym and yoga studios, due to low cost, is expected to drive the segment growth over the projected period. Wooden flooring includes products made using timber. It is vulnerable to moisture; even a small amount of moisture can deteriorate wooden flooring, thus, is not preferred for wet places. However, these floorings are aesthetically pleasing owing to their natural wood grain patterns and offer warmth & richness to the interiors. Hence these are widely used in hospitality buildings including hotels and spas.

Regional Insights

The Asia Pacific segment dominated the market with the highest revenue share of 46.2% in 2022. It is also forecasted to be the fastest-growing region with a compounded annual growth rate of 5.4% from 2023 to 2030. This is attributed to the rapid urbanization and growing construction industry in the developing countries in the region. The growing population in major economies in the Asia Pacific region is driving the industrialization and construction of commercial buildings. This has triggered the market for commercial flooring products, such as ceramics, porcelain, carpet, LVT, and natural stone, in the market. Moreover, the growing consumer disposable income has resulted in increased spending on the renovation and refurbishment of commercial spaces based on the color & texture of products.

This is positively influencing the demand for commercial flooring in the market. Rise in the office completion orders, especially in Asia Pacific, North America, and Europe, is the key driving factor of the commercial floorings market demand. Furthermore, growing construction activities of green buildings in the U.S. and the major countries in Western Europe are considered another major factor driving the market demand. The Europe commercial flooring market is forecasted to grow at a CAGR of 4.8% from 2023 to 2030. This is attributed to the growing commercial buildings, mainly the healthcare buildings & centers and hospitality buildings. The region is experiencing significant growth in the number of tourists, which is triggering the demand for malls & shopping centers, auditoriums & theaters, and hotels & restaurants. This will drive the market for commercial flooring in the region over the coming years.

Key Companies & Market Share Insights

Major commercial flooring industry participants include Hanwha, LG Hausys, Flowcrete, James Halstead, Nora, Milliken Floor Covering, Novalis, Tajima, Tkflor, NOX Corporation, and Toli Flooring. Vendors are constantly developing innovative goods, such as including display and distribution systems like virtual assistants and online catalogs to help consumers choose the perfect product for the intended applications. Commercial flooring manufacturers aim to intensify their competitive positions by widening their customer base. Furthermore, these manufacturers are focusing on distribution, new product launches, and product expansion to gauge existing as well as future demand patterns from emerging application sectors. The existing and emerging application scenario is anticipated to offer favorable opportunities for key players. Some prominent players in the global commercial flooring market include:

-

Amtico

-

The Armstrong Flooring, Inc.

-

Congoleum

-

Flowcrete (RPM)

-

Forbo International SA

-

Gerflor

-

Interface, Inc.

-

IVC Group

-

James Halstead Plc.

-

Mannington Mills, Inc.

-

NOX Corp.

-

Tkflor

-

Nora

-

Toli Flooring

Commercial Flooring Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 142.99 billion

Revenue forecast in 2030

USD 200.56 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Volume in million square meters, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Romania; Czech Republic; Portugal; Ukraine; Slovakia; Hungary; China; India; Japan; South Korea; Indonesia; Australia; Philippines; Vietnam; Saudi Arabia; Qatar; UAE; Egypt; Israel; South Africa; Morocco; Chile; Brazil; Argentina; Colombia; Peru

Key companies profiled

Amtico; The Armstrong Flooring, Inc.; Congoleum, Flowcrete (RPM); Forbo International SA; Gerflor; Interface Inc.; IVC Group; James Halstead Plc.; Mannington Mills Inc.; NOX Corp.; Tkflor; Nora; Toli Flooring

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Flooring Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the commercial flooring market based on product and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Ceramics

-

Vitrified (Porcelain)

-

Carpet

-

Vinyl

-

LVT

-

Linoleum & Rubber

-

Wood & Laminate

-

Natural Stone

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Romania

-

Czech Republic

-

Portugal

-

Ukraine

-

Slovakia

-

Hungary

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Philippines

-

Vietnam

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

Qatar

-

South Africa

-

Morocco

-

-

Central & South America

-

Chile

-

Brazil

-

Colombia

-

Argentina

-

Peru

-

-

Frequently Asked Questions About This Report

b. The global commercial flooring market size was estimated at USD 137.61 billion in 2022 and is expected to reach USD 142.99 billion in 2023.

b. The global commercial flooring market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 200.56 billion by 2030.

b. The vitrifies (porcelain) product segment dominated the commercial flooring market with a share of 28.2% in 2022, owing to the growing construction activities for commercial spaces in developing countries.

b. Some of the key players operating in the Commercial Flooring market includes Amtico, The Armstrong Flooring, Inc, Congoleum, Flowcrete (RPM), Forbo International SA, Gerflor, Interface Inc., IVC Group, James Halstead Plc., Mannington Mills Inc, NOX Corporation, Tkflor, Nora, and Toli flooring.

b. The key factors driving the commercial flooring market include the rapidly growing urbanization and industrialization in developing economies by triggering construction activities, which positively influence the demand for commercial flooring in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.