- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Commercial Seaweed Market Size, Share, Trends Report, 2030GVR Report cover

![Commercial Seaweed Market Size, Share & Trends Report]()

Commercial Seaweed Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Brown, Red, Green), By Application (Human Consumption, Animal Feed, Agriculture), By Form (Leaf, Powdered, Flakes), By Region, And Segment Forecasts

- Report ID: 978-1-68038-995-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Commercial Seaweed Market Summary

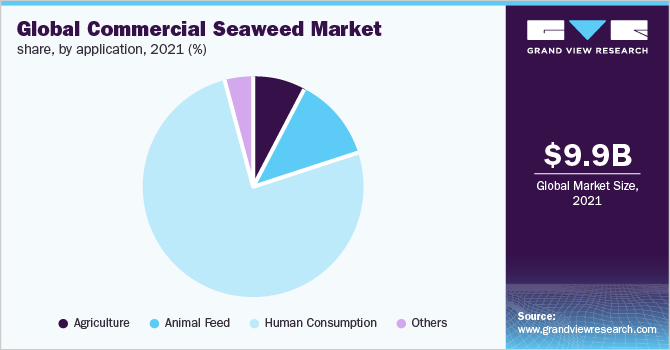

The global commercial seaweed market size was estimated at USD 9.9 billion in 2021 and is projected to reach USD 12.1 billion by 2030, growing at a CAGR of 2.3% from 2022 to 2030. The growth is attributed to factors such as high nutritional value and health benefits, increased adoption of seaweed for hydrocolloids, and rising demand for seaweed in end-use industries such as personal care, pharmaceuticals, agriculture, food and beverages, and animal feed.

Key Market Trends & Insights

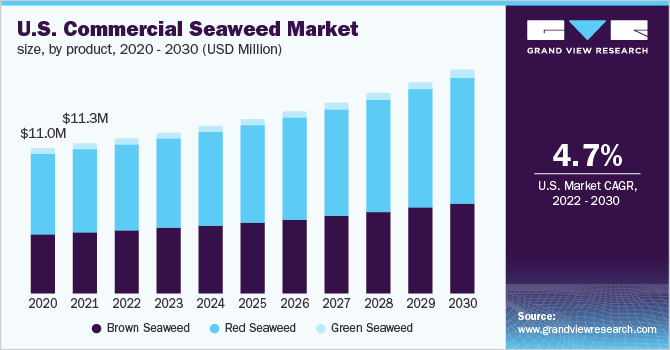

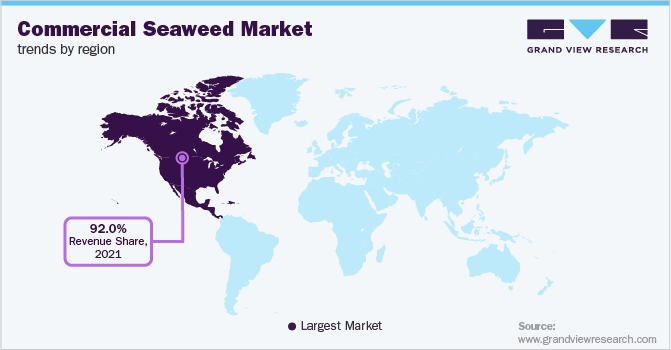

- Asia Pacific dominated the market and accounted for nearly 92.0% in 2021.

- China is the largest producer of seaweed in the region followed by Indonesia, with Japan, China, and South Korea among the top consumers.

- By product, the green seaweeds segment dominated the market and accounted for revenue share of 49.0% in 2021.

- By form, the leaf form led the market and accounted for revenue share of around 41.0% in 2021.

- By application, the human consumption segment led the application segment with a revenue share of 76.2% in 2021..

Market Size & Forecast

- 2021 Market Size: USD 9.9 Billion

- 2030 Projected Market Size: USD 12.1 billion

- CAGR (2022-2030): 2.3%

- Asia Pacific: Largest market in 2021

The COVID-19 pandemic had a significant impact on the commercial seaweed market. Production decreased following the closure of most manufacturing facilities in the sector. As per the United Nations Industrial Development Organization (UNIDO), the COVID-19 pandemic has directly impacted seaweed farmers due to decreased demand for raw materials and lower prices. However, the recently growing number of studies indicating that certain macroalgae compounds may be useful in immunity enhancement and cancer treatment have heightened global interest in seaweed. Furthermore, the rising demand for healthy foods to maintain overall wellness and health is expected to drive product demand in the coming years.

Farmers use seaweed extract in agriculture because it is an excellent fertilizer for crop production. Leaf seaweed extract has been shown to have novel mechanisms for higher crop productivity. Farmers have witnessed additional benefits, such as improved root structures of plants, as their awareness of the utilization of seaweeds in crop production has risen. Moreover, seaweeds also help to improve soil microbiology, soil structure, and water retention capacity. These factors are expected to drive product demand during the forecast period.

Seaweed is a good source of iodine, which is rare in other foods or ingredients. Furthermore, it is critical to control the levels of estradiol and estrogen in the human body. The utilization of seaweed and its isolates tends to increase satiety, lowering postprandial glucose and lipid absorption rates in humans, which aids in the creation of anti-obesity foods. Seaweeds are used as ingredients or consumed as foods owing to their anti-microbial properties, which provide a preservative benefit to foods.

Growing environmental consciousness has resulted in significant changes in consumer preferences, spurring the demand for sustainable products. Macroalgae cultivation is considered to be sustainable since the algae are fast-growing and nutrient-rich hat emits oxygen and absorbs carbon dioxide. The increasing popularity of plant-based products and veganism is also contributing to the increased demand for seaweed production. According to the State of the Industry Report 2021 by Good Food Institute, the sale of plant-based meat grew almost 50% from 2019 to 2021. Therefore, rising demand for plant-based products is expected to drive market growth.

Seaweed can be employed as biomass in the production of energy. Seaweed is crushed in the process, and then water is added to create a slurry. Fermentation is used to produce methane with the help of microorganisms. The resulting methane gas is used to power gas engines, which generate electricity. Furthermore, the commercial seaweed co-extrusion process offers a broad range of calibers. Continuous R&D investment by market leaders has significantly contributed to improved gums, preservatives, and thickeners. Increasing advancements in the possible applications of seaweed are expected to drive market growth over the forecast period.

Product Insights

The green seaweeds segment dominated the market and accounted for revenue share of 49.0% in 2021. Green algae have a high level of beta-carotene, which is shown to be effective in cancer prevention. The growing demand for green algae in dietary supplements in the form of capsules and tablets is expected to increase the segment growth during the forecasted timeframe.

Brown seaweed dominated the product segment with the highest revenue share of over 49.0% in 2021. The brown seaweed segment is expected to grow rapidly during the forecast period due to its widespread use in industries such as agriculture, animal feed, and food & beverage. Brown seaweeds are primarily used as a raw material for the extraction of the hydrocolloid alginate and as food. Additionally, the product is used as an emulsifier and thickener in syrups, as well as a filler in candy bars and salad dressings. Research is ongoing in the use of alginic acid in lithium ion batteries which when realized, is expected to increase demand for brown seaweeds in during estimated timeframe.

Meanwhile, red seaweeds are primarily used as food and as a source of two hydrocolloids namely carrageenan and agar. Furthermore, it is high in vitamins and proteins, making it an excellent source of alternative proteins. The key health benefits of red seaweed are the ability to lower bad cholesterol and control blood sugar levels. Moreover, it is also regarded as a good source of antioxidants and aids in enhancing immunity and nourishing the skin. These benefits are expected to drive market growth.

Form Insights

The leaf form led the market and accounted for revenue share of around 41.0% in 2021. Seaweed leaves are used in local cuisines from Japan to Indonesia, such as Sushi, Nori, Onigiri, Pandan, etc to name a few. Seaweed is also consumed in Icelandic, Norwegian, and Irish local cuisines for the past 1000 years. Recently, the use of seaweed has observed increased favor in a wide range of global cuisines in the form of vegetable additives, salad, to even pickles.

The powdered form is expected to be the second fastest growing market segment increasing at a CAGR of 2.3% during the forecast period. Powdered seaweeds are widely utilized in both cosmetics and food industries. The process of conversion of macroalgae extracts to powder eliminates water and extends the shelf life of the product. Powders are also easier to store and transport, thereby lowering operational costs and spoilage. Furthermore, rising demand for vegan products and plant-based proteins is expected to drive up demand for powdered seaweed in the coming years.

Application Insights

The human consumption segment led the application segment with a revenue share of 76.2% in 2021. The growth is attributed to factors such as increased awareness of the seaweed's nutrient enrichment and health benefits, as well as an increase in demand for more organic and natural food & beverage products. Moreover, in the Asia Pacific region, particularly in China, Indonesia, South Korea, Malaysia, Japan, and the Philippines, the demand for seaweeds for direct human consumption is higher due to cultural factors.

The market for other applications is expected to grow rapidly over the forecast years 2022 - 2030, with a CAGR of 3.2%. Besides human and animal consumption, seaweed is used to prepare coloring additives, Biofuel, flavor/perfume enhancers, chemical research/production, botanical research, pharmaceuticals, cosmetics, and clinical research. Such trending applications are expected to drive demand for commercial seaweed in coming years with numerous successful research coming into fruition.

Regional Insights

Asia Pacific dominated the market and accounted for nearly 92.0% in 2021. China is the largest producer of seaweed in the region followed by Indonesia, with Japan, China, and South Korea among the top consumers. Commercial seaweed is one of the most prevalent marine plant foods in all these countries, with traditional uses in both food and medicine. Rising product demand in the regional food industry is expected to boost the market in Asia Pacific.

The market in Europe and North America is also expected to expand significantly during the forecast period, owing to increased demand for vegan and plant-based products in these regions. European countries including Ireland, Iceland, and Norway are major producers of seaweed in the region. Ireland dominates the European seaweed export market, exporting seaweed to the majority of European countries such as France, Germany, and U.K.

Key Companies & Market Share Insights

The global commercial seaweed sector is characterized by a moderate presence of players. Seaweed production is concentrated along the coasts of seaweed-producing countries such as Indonesia, China, Japan, and the Philippines. Some strategies adopted by key players include new product development, mergers & acquisitions, geographic expansions, and joint ventures among others. Furthermore, companies have set up their own distribution network to cut down operational costs and provide high-quality products.

For instance, in February 2021, Cargill Inc. launched a new seaweed powder made from Gracilaria red seaweed which is a traditional ingredient in Europe. The new powder is launched under the WavePure ADG line and is named WavePure ADG 8250. The product is used to develop a creamy and smooth texture in dairy applications as it offers thickening and gelling properties. The key companies operating in the commercial seaweed market include.

-

Cargill Inc.

-

E.I. Du Pont de Nemours and Company

-

Roullier Group

-

Biostadt India Limited

-

Compo GmbH & Co. KG

-

Acadian Seaplants Limited

-

Gelymar SA

-

BrandT Consolidated, Inc.

-

Seasol International Pty. Ltd.

-

CP Kelco.

-

West Coast Marine Bio-Processing Corp.

-

Leili Group

-

Chase Organics GB Limited

-

Indigrow Ltd.

-

Travena Organic Solutions Ltd.

Commercial Seaweed Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 10.1 billion

Revenue forecast in 2030

USD 12.1 billion

Growth rate (Revenue)

CAGR of 2.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in thousand tons, revenue in USD million, and CAGR from 2022 to 2030

Report coverage

Volume estimationrevenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, form, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Ireland; Iceland; Norway; China; Indonesia; Japan; South Korea; Philippines; Chile; Peru, South Africa

Key companies profiled

Cargill Inc.; E.I. Du Pont de Nemours and Company; Roullier Group; Biostadt India Limited; Compo GmbH & Co. KG; Acadian Seaplants Limited; Gelymar SA; BrandT Consolidated, Inc.; Seasol International Pty. Ltd.; CP Kelco.; West Coast Marine Bio-Processing Corp.; Leili Group; Chase Organics GB Limited; Indigrow Ltd.; Travena Organic Solutions Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Seaweed Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global commercial seaweed market report on the basis of product, application, form, and region:

-

Product Outlook (Volume, ‘000 Tons; Revenue, USD Million, 2017 - 2030)

-

Brown seaweed

-

Red seaweed

-

Green seaweed

-

-

Application Outlook (Volume, ‘000 Tons; Revenue, USD Million, 2017 - 2030)

-

Agriculture

-

Animal Feed

-

Human Consumption

-

Others

-

-

Form Outlook (Volume, ‘000 Tons; Revenue, USD Million, 2017 - 2030)

-

Leaf

-

Powdered

-

Flakes

-

-

Regional Outlook (Volume, ‘000 Tons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

U.K.

-

Germany

-

Ireland

-

Iceland

-

Norway

-

-

Asia Pacific

-

China

-

Indonesia

-

Japan

-

South Korea

-

Philippines

-

-

Central & South America

-

Chile

-

Peru

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global commercial seaweed market size was estimated at USD 9.9 billion in 2021 and is expected to reach USD 10.1 billion in 2022.

b. The commercial seaweed market is expected to grow at a compound annual growth rate of 2.3% from 2022 to 2030 to reach USD 12.1 billion by 2030.

b. Brown seaweed dominated the commercial seaweed market as of 2021 with a share of 49.06%, due to its widespread use in industries such as agriculture, animal feed, and food & beverages.

b. Some key players operating in the commercial seaweed market include Cargill Inc.; E.I. Du Pont de Nemours and Company; Roullier Group; Biostadt India Limited; Compo GmbH & Co. KG; Acadian Seaplants Limited; Gelymar SA; BrandT Consolidated, Inc.; Seasol International Pty. Ltd.; CP Kelco.; West Coast Marine Bio-Processing Corp.; Leili Group; Chase Organics GB Limited; Indigrow Ltd.; and Travena Organic Solutions Ltd.

b. Key factors that are driving the commercial seaweed market growth include technological developments in cultivating cultured seaweed coupled with rising investments in application segments, including animal feed and agriculture.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.