- Home

- »

- Renewable Chemicals

- »

-

Hydrocolloids Market Size, Share & Growth Report, 2030GVR Report cover

![Hydrocolloids Market Size, Share & Trends Report]()

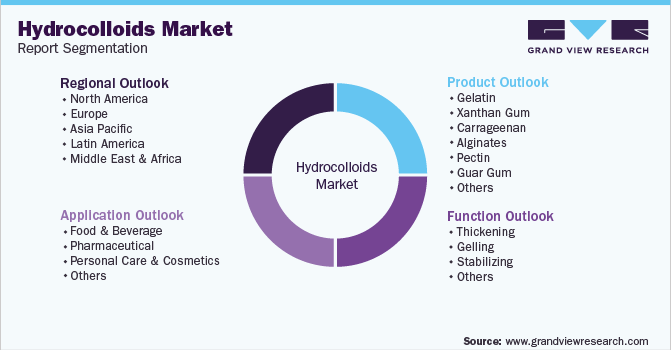

Hydrocolloids Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Gelatin, Xanthan Gum, Carrageenan, Alginates, Pectin, Guar Gum, Carboxy Methyl Cellulose), By Function, By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-145-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrocolloids Market Summary

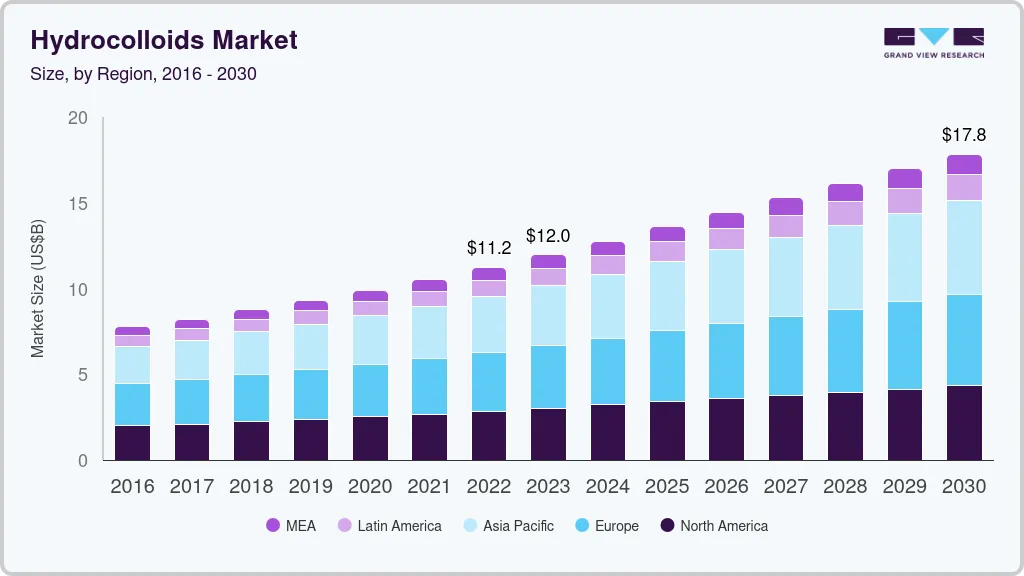

The global hydrocolloids market size was estimated at USD 11.23 billion in 2022 and is projected to reach USD 17.83 billion by 2030, growing at a CAGR of 6.0% from 2023 to 2030. Growing demand for thickeners and gelling agents from pharmaceutical, personal care, cosmetics, and food & beverage industries, in the emerging economies of Asia Pacific, is driving the growth.

Key Market Trends & Insights

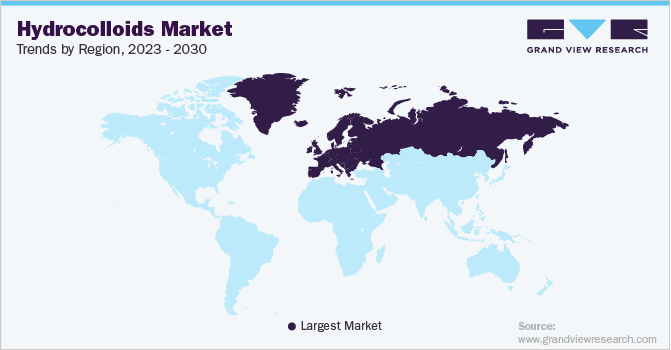

- In 2022, Europe emerged as the largest regional market for hydrocolloids, in terms of revenue.

- By product, the gelatin product segment dominated the market with the highest revenue share of 33.5% in 2022.

- By application, the food and beverage application segment dominated the market with the highest revenue share of 70% in 2022.

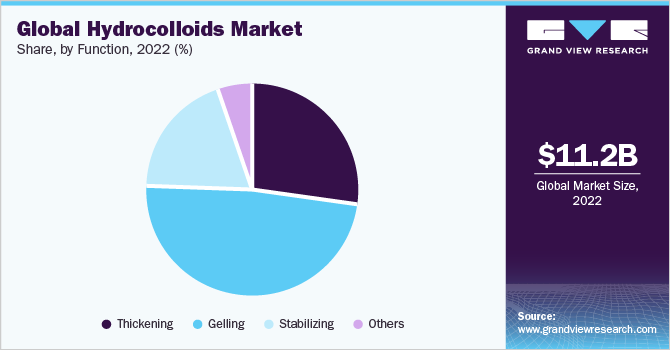

- By function, the thickening agents function segment accounted for the second-highest revenue share of 27.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 11.23 Billion

- 2030 Projected Market Size:USD 17.83 Billion

- CAGR (2023 - 2030): 6.0%

- Europe: Largest market in 2022

The upsurge in the consumption of hydrocolloid-based products in building materials coupled with rising demand from the cosmetics industry is expected to boost the market growth over the forecast period. Additionally, the high demand for thickening and gelling applications from the food and beverage sector is expected to be the major factor in boosting sales.

The extensive series of functions performed by hydrocolloids in the food industry is a key driving force for the market. The foremost function contributing to the abundant utilization of the products in the food industry is their capability to bind with water and enhance the properties of food ingredients. Increasing demand for healthy food products is likely to translate into an ascending demand for hydrocolloids, thereby fueling the growth of the global hydrocolloid market. Growing demand due to the convenience offered by processed food is expected to positively impact the market in the forthcoming years.

Hydrocolloids are commonly used in numerous food formulations to enhance shelf-life and quality. The primary reason for their extensive popularity in the food industry is their capability to alter the rheology of the food system such as viscosity and texture. Such modifications are known to enhance the sensory properties of food and hence hydrocolloids are used as the key food additives to carry out specific functions.

While most of the hydrocolloids impart thickness and stickiness to aqueous dispersions, some of the biopolymers are known to form gels. The textural properties of food items such as brittleness or elasticity, spreadability or longevity, and creaminess or chewiness vary depending on the type of hydrocolloid being used. The other sensory properties such as mouth feel, opacity and taste also depend on the hydrocolloid employed.

Hydrocolloids are used in a wide range of food and beverage products as a thickening, gelling, stabilizing, coating, and emulsifying agents. The hydrocolloids that mainly provide a thickening effect include methyl cellulose, hydroxypropylmethyl cellulose, carboxy methyl cellulose, guar gum, tara gum, konjac mannan, locust bean gum, gum tragacanth, and gum Arabic. On the other hand, the commonly used gelling agents include carrageenan, agar, pectin, alginate, methyl cellulose, hydroxypropylmethyl cellulose, and gellan gum.

The surface activity of hydrocolloids plays a vital role in pharmaceutical formulations. Hydrocolloid-based polymeric materials are expected to gain popularity in targeted or smart drug delivery systems owing to their advantages such as enhanced absorption, reduced dosage, reduced side effects, prolonged drug release, and biodegradability. Advancements in targeted drug delivery systems along with ascending demand for hydrocolloids in pharmaceutical formulations are projected to drive the market over the forecast period.

Hydrocolloids are gaining popularity in the personal care industry owing to the growing inclination of consumers toward natural products. In cosmetic applications, hydrocolloids often replace synthetic chemicals with analogous properties. The increasing consumption of hydrocolloids in conjunction with personal care & cosmetic ingredients is projected to drive the market growth over the forecast period.

The soaring prices are a consequence of various market dynamics, such as substantial growth in seaweed feedstocks, energy, ocean freight and product stewardship expenses, and other raw materials prices. For instance, cellulose ethers production company Aqualon Group, also increased their global prices for its pharmaceutical grade methylcellulose and carboxyl methylcellulose by 5% in the year 2008. As per the company, this hike was quite compulsory so as to invest in their research and development activities and enhance their production capacity.

Product Insights

The gelatin product segment dominated the market with the highest revenue share of 33.5% in 2022. Gelatin is used in the production of a broad range of pharmaceuticals including wound dressings, blood volume substitutes, and homeostatic sponges. The development of the pharmaceutical industry in the U.S. and Canada in light of increasing expenditure for the incorporation of the latest technologies is anticipated to have a substantial impact on market growth.

Xanthan gum is mainly used for its exclusive characteristic to regulate the rheological properties of numerous food products. It provides uniform brine distribution, dissolves easily in cold or hot water, is stable in alkaline as well as acidic solutions, and has synergistic connections with other hydrocolloid products such as guar gum and locust bean gum.

Application Insights

The food and beverage application segment dominated the market with the highest revenue share of 70% in 2022. Food and beverage manufacturers primarily employ hydrocolloids owing to their ability to alter the rheology of food systems including mechanical solid properties (texture) and flow behavior (viscosity). The alteration of viscosity and/or texture of food helps modify the sensory properties and thus, hydrocolloids are significantly used as food additives to perform specific purposes.

Hydrocolloids find application in various food formulations such as sauces, toppings, salad dressings, gravies, and soups. They are also used in various food products including cakes, candies, gelled desserts, ice creams, jellies, and jams to obtain the desired texture. Future acceptance, positive endorsement, and functional attributes of hydrocolloids are expected to positively contribute to the food & beverage sector.

Besides, hydrocolloids act as an excellent replacement for sugar in food and beverage products. Thus, increasing the demand for low-calorie food and beverages is expected to propel the product demand over the forecast period. Hydrocolloids are a group of chemical compounds that modify the rheology or flow properties of aqueous solutions in which they are dispersed. They are extensively used in personal care and cosmetic water-based applications as viscosity control agents owing to their water-binding, thickening, and gelling properties. Also, they exhibit functional benefits such as emulsion stabilization and organoleptic properties.

Function Insights

The thickening agents function segment accounted for the second-highest revenue share of 27.5% in 2022. Hydrocolloids are widely utilized as thickening agents in the food industry. They disperse in the water quite easily and thus have a viscosity-producing effect, this attribute is harnessed in a wide range of applications as a thickening agent. This thickening property is common to all hydrocolloids and is one of the primary reasons for their use across various industries.

The degree of thickening differs with the nature and type of hydrocolloid. A majority of the hydrocolloids give a high thickness at a concentration below 1% while a few of them give low viscosity at a fairly high concentration as well.

Hydrocolloids are employed in various food types such as soups, salad dressings, sauces, and gravies. The most common hydrocolloids used as thickening agents include starch, guar gum, xanthan, locust bean gum, gum tragacanth, gum karaya, gum Arabic, and other cellulose derivatives. Starch is the most popular thickener as it is widely available and is cheaper than other products.

Along with this, the selection of the hydrocolloid to be used as a gelling agent depends on the desired characteristics required for a food product. Alginates find applications in restructured vegetables and fruits, restructured meat and fish, puddings and desserts, fruit preparations, and bakery jams.

Regional Insights

Asia Pacific accounted for the second-highest revenue share of 29.0% in 2022. Growing consumption of carboxymethyl cellulose in processed food products along with expanding textiles and the construction sector is expected to fuel the regional product demand. China is expected to remain a major consumer owing to rising demand for food and beverage products, Huge population along with abundant availability of raw materials is projected to drive the regional market growth.

In 2022, Europe emerged as the largest regional market for hydrocolloids, in terms of revenue. The growth in this region can be attributed to favorable government policies, substantial production capacities, and early adoption of hydrocolloids in the food & beverage sector. In addition, the rising demand for hydrocolloids in the pharmaceutical sector has contributed to market growth in the region.

The Comprehensive Economic and Trade Agreement (CETA) is likely to impact the customs duty on industrial products as well as a majority of food and agricultural products. This, in turn, is anticipated to propel the trade of hydrocolloids between North America and Europe, thereby providing a significant growth opportunity for hydrocolloid manufacturers in North America.

In 2017, the exchange rate between the U.S. dollar and the Euro became favorable for European exporters, thereby impacting the imports of hydrocolloids on a positive note. Countries such as the UK, Germany, Spain, and France are characterized by the presence of a large-scale food industry, which is the most significant end-user of the product across the region. Expanding research base, scaling up of hydrocolloid production, and rising product demand from the pharmaceutical sector are factors expected to drive the market in Europe over the forecast period.

Market players in these countries must comply with the Fair Packaging and Labeling Act (FPLA) and the Federal Food, Drug, And Cosmetic Act (FD&C Act). The Food and Drug Administration (FDA) holds all rights to inspect the manufacturers, distributors, and hydrocolloid-based products to keep a check and to ensure compliance with the required standards.

The demand for hydrocolloids is ascending in the region on account of the presence of a large consumer base and end-use sectors. The market growth in this region can be primarily attributed to the abundant availability of raw materials, substantial production capacities, and enhanced economic efficiency of the products. Low-cost skilled labor and advancements in biotechnology in emerging economies such as India and China are likely to propel the demand for hydrocolloids. In China, hydrocolloids are mostly consumed in food & beverage products.

North America emerged as one of the most prominent regional markets for hydrocolloids after Europe and the Asia Pacific. The demand for hydrocolloids in North America is primarily driven by growing consumer preference toward natural food products along with increasing demand from the personal care & cosmetics sector. The U.S., followed by Canada, emerged as the leading regional market for hydrocolloids in 2022. The market growth in these countries can be attributed to the presence of a well-developed agricultural sector owing to the abundant availability of natural resources including diverse plants, freshwater, and marine and animal life.

Key Companies & Market Share Insights

Leading market players are channelizing their efforts into the development of new products and technologies, utilizing advanced methods to manufacture cost-effective products. The companies are also striving to reduce supply chain risk while strictly adhering to the delivery requirements. On account of this, hydrocolloids are gaining consumer confidence across the globe. Globally, the companies are entering into partnerships, agreements, joint ventures, and mergers and acquisitions to strengthen their market share and increasing geographical reach.

The market is fragmented in nature with the presence of numerous participants across the value chain. However, a limited number of big multinational companies possess the caliber of bringing innovations. These big multinational companies are also entering into a collaboration with small companies that have a stronghold in the domestic market. These collaborations are aimed to achieve unique selling points that these big market players can leverage on a global scale. Some of the prominent players in the global hydrocolloids market include:

-

DuPont

-

Palsgaard

-

Nexira

-

Ingredion, Incorporated

-

Kerry

-

BASF

-

Ashland

-

CP Kelco U.S. Inc.

-

Glanbia Nutritionals

-

Darling Ingredients, Inc.

-

Tate & Lyle Plc

-

Cargill, Incorporated

-

Fuerst Day Lawson

-

Koninklijke DSM N.V.

-

The Archer Daniels Midland Company (ADM)

Hydrocolloids Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.96 billion

Revenue forecast in 2030

USD 17.83 billion

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report Coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, function, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

DuPont; Palsgaard; Nexira; Ingredion, Incorporated; Kerry; BASF; Ashland; CP Kelco U.S. Inc.; Glanbia Nutritionals; Darling Ingredients, Inc.; Tate & Lyle Plc; Cargill, Incorporated; Fuerst Day Lawson; Koninklijke DSM N.V.; The Archer Daniels Midland Company (ADM)

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Hydrocolloids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hydrocolloids market report based on product, function, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Xanthan Gum

-

Carrageenan

-

Alginates

-

Pectin

-

Guar Gum

-

Gum Arabic

-

Carboxy Methyl Cellulose

-

Agar

-

Locust Bean Gum

-

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thickening

-

Gelling

-

Stabilizing

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some key players operating in the hydrocolloids market include Kelco, Hispanagar, S.A., Koninklijke DSM N.V., Ingredion Incorporated, Ashland Inc., Kerry Group, Jungbunzlauer Suisse AG and FMC Corporation

b. Key factors that are driving the hydrocolloids market growth include rising demand for natural food additives which are source soluble dietary fiber coupled with changing lifestyle and consumer consumption patterns is expected to fuel the demand for hydrocolloids in the food and beverage industry

b. The global hydrocolloids market size was estimated at USD 11.23 billion in 2022 and is expected to reach USD 11.96 billion in 2023.

b. The global hydrocolloids market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 17.83 billion by 2030.

b. Europe dominated the hydrocolloids market with a share of 30.6% in 2022. This is attributable to the growing consumption of convenience foods which uses hydrocolloids to reduce the fat content by dispersing water and act as a fat replacer in food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.