Market Size & Trends

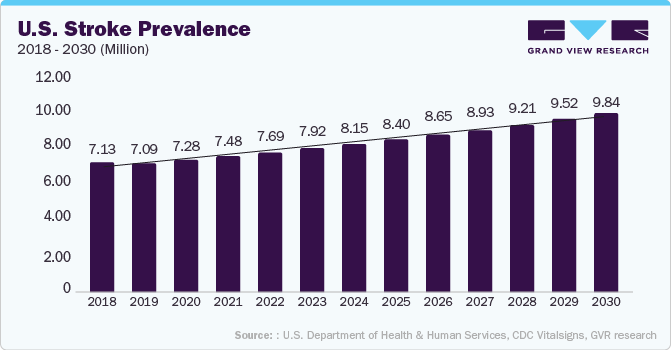

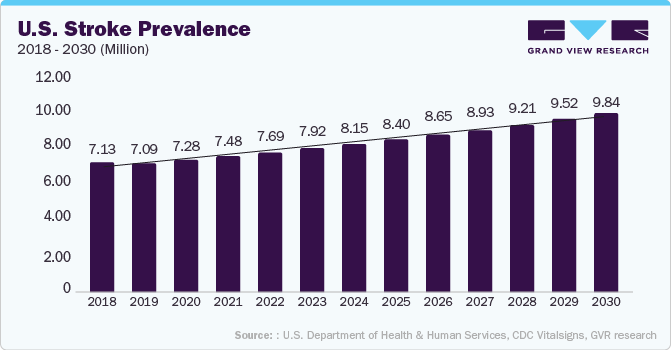

The global complex regional pain syndrome market size was valued at USD 103.5 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 2.8% from 2023 to 2030. Complex regional pain syndrome (CRPS) is a type of persistent pain condition that commonly impacts one arm or leg. This syndrome typically arises following an injury, surgical procedure, stroke, or heart attack. The market is growing due to several key factors, including greater awareness and diagnosis of the condition, a growing elderly population, increased emphasis on pain management, and ongoing research and development efforts to find more effective treatments.

The COVID-19 pandemic negatively impacted the complex regional pain syndrome (CRPS) market. Disrupted healthcare services, including postponed treatments and interventions, resulted in delayed care and increased suffering for some individuals. Moreover, the stress and isolation brought about by the pandemic made mental health issues worse for some CRPS patients. While telemedicine has become more common and improved access to care, it's not always a complete replacement for in-person evaluations, which are crucial for diagnosing and managing CRPS. Lockdowns and restrictions on rehabilitation and physical therapy left some patients less physically fit and in more pain. Economic uncertainties made it harder for some to get healthcare services and research and clinical trials for new treatments were delayed, potentially limiting options.

The main factors propelling the complex regional pain syndrome market growth in the future include the escalating occurrence of complex regional pain syndrome and the growing number of individuals experiencing chronic pain. CRPS is more commonly diagnosed in women, occurring approximately 3 to 4 times more frequently in females than males. While it can develop at any age, it is a rare condition among children and adolescents. In the pediatric population, CRPS typically emerges in early adolescence, with most cases appearing between 7 and 9 years of age. In adults, the age of onset varies widely, ranging from 37 to 70 years. This condition is most prevalent among individuals of European descent, accounting for approximately 66% to 80% of cases. A study conducted in the U.S. found that CRPS type I was diagnosed in approximately 5.46 individuals per 100,000 annually. It is estimated that CRPS affects nearly 200,000 patients each year in the U.S. The increasing incidence of complex regional pain syndrome and the growing prevalence of chronic pain are key drivers for the future growth of the CRPS market.

Therapy Type Insights

Based on the therapy type, the market is segmented into drugs, spinal cord stimulation, surgical sympathectomy, and others. The drug segment is further segmented into analgesics, antidepressants, and corticosteroids. The drugs-based therapy type segment dominated the market and held the largest market share in 2022, as drugs are often the first-line treatment for CRPS, providing symptomatic relief from pain and inflammation. Additionally, the ease of administration, familiarity among healthcare providers, and relatively lower cost compared to other treatment modalities contribute to their prevalence.

Disease Type Insights

Based on disease type, the market is segmented into CRPS I, CRPS II, and CRPS-NOS. The CRPS I segment dominated the market in 2022. It is referred to as reflex sympathetic dystrophy (RSD). This variant arises following an illness or injury that did not directly harm the nerves in the impacted limb. Approximately 90% of individuals diagnosed with CRPS have type 1 CRPS. Furthermore, its higher prevalence and wider scope have attracted more research and development efforts, driving innovation and investment in this segment. Increased clinical studies and trials focusing on CRPS 1 is expected to contribute to the segment growth.

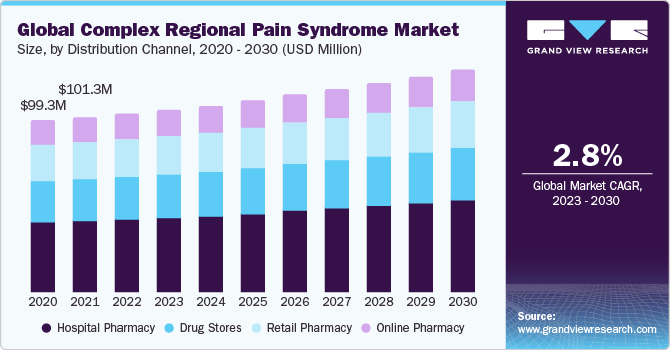

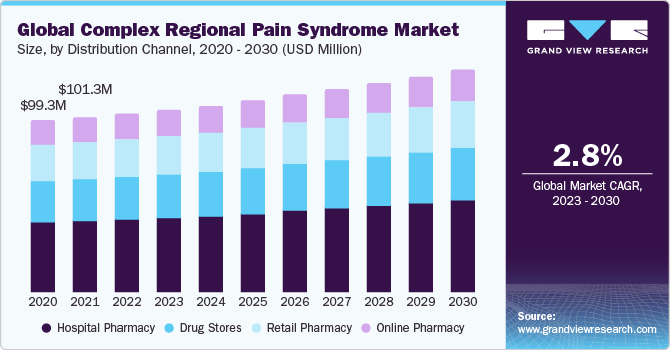

Distribution Channel Insights

Based on distribution channels, the market is segmented into hospital pharmacies, drug stores, retail pharmacies, and online pharmacies. The hospital pharmacy segment dominated the market in 2022 with a strong market share of over 40.0%. The adoption of pain management strategies, especially for post-surgical pain, has increased in hospitals. With the global increase in surgical procedures, hospital pharmacies are expected to maintain significant demand for products related to complex regional pain syndrome (CRPS). Hospitals predominantly utilize common CRPS techniques, particularly for managing post-surgical pain, where the necessity for monitoring and addressing side effects fuels a strong demand for CRPS medications and technologies.

Regional Insights

North America is anticipated to maintain a significant market share in the coming years. This substantial market presence is primarily attributed to the increasing prevalence of complex regional pain syndrome and growing healthcare expenditure from the public and private sectors, fueling the region's growth. Furthermore, North America benefits from favorable reimbursement policies, convenient access to high-quality healthcare, a strong clinical pipeline, and the approval of innovative drugs. These factors are all anticipated to play a significant role in contributing to revenue growth in the region.

Key Companies & Market Share Insights

The market's competitive landscape comprises diverse key players, including pharmaceutical companies, medical device manufacturers, and healthcare providers. Pharmaceutical companies focus on developing and marketing medications to manage pain, emphasizing analgesics, anti-inflammatory drugs, and neuropathic pain agents. Medical device manufacturers contribute by creating spinal cord stimulators to alleviate CRPS-related symptoms. Hospitals and healthcare providers offer comprehensive care, including diagnosis, medication management, physical therapy, and interventional procedures.

The major companies in the market are adopting various strategies to maintain their market position and increase their reach in the market. Some of the key players in the market are Boston Scientific Corporation, GSK plc, Abbott, ICU Medical, Medtronic, Viatris Inc., Johnson & Johnson, Nevro Corp., Purdue Pharma, and Sanofi, among others. The key players focus on collaborations, partnerships, and acquisitions to expand their business footprint and widen their product portfolios. The following are the strategies undertaken by the players:

-

In January 2022, Medtronic received approval from the U.S. Food and Drug Administration (FDA) for its Intellis rechargeable neurostimulator, designed to address chronic pain linked to diabetic peripheral neuropathy. Additionally, the neurostimulator is authorized to manage intractable pain in the trunk and limbs, including pain associated with Complex Regional Pain Syndrome (CRPS), whether unilateral or bilateral.

-

In June 2022, Mallinckrodt plc, a biopharmaceutical company, made public the reapplication of their New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) for the experimental drug terlipressin. This drug aims to address hepatorenal syndrome (HRS), an acute and life-threatening condition with no approved treatment by the FDA, in adult patients.