- Home

- »

- Healthcare IT

- »

-

Medication Management System Market Size Report, 2030GVR Report cover

![Medication Management System Market Size, Share & Trends Report]()

Medication Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Hardware (Automated Dispensing Systems, Delivery Workstation), By Software, By Software Type, By Mode Of Delivery, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-268-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medication Management System Market Summary

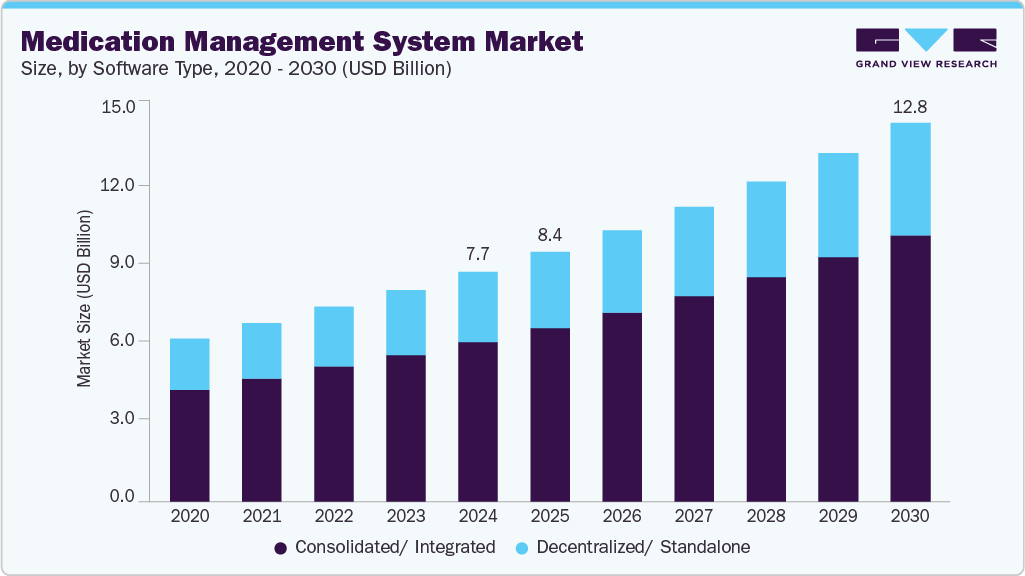

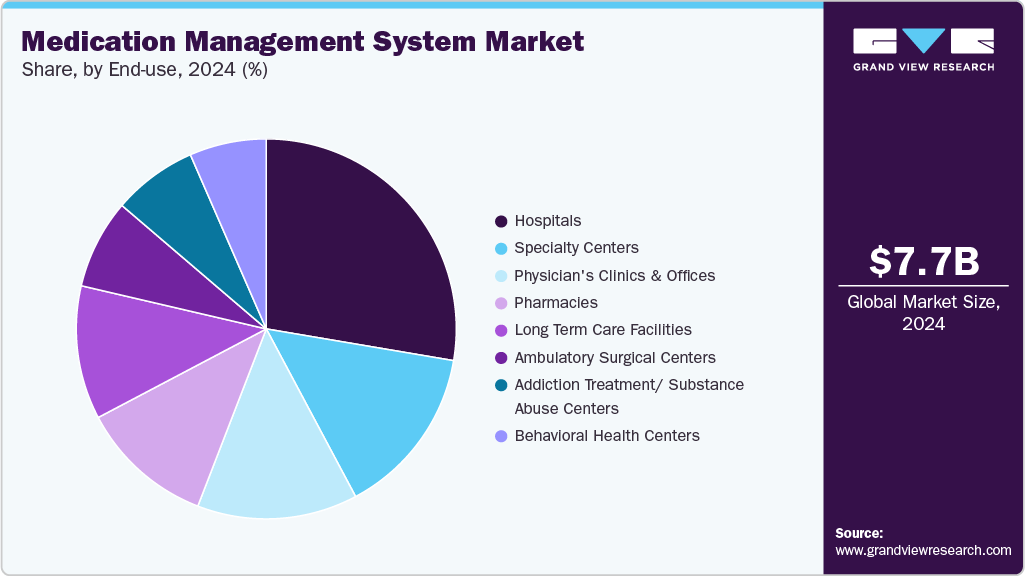

The global medication management system market size was estimated at USD 7.70 billion in 2024 and is projected to reach USD 12.79 billion by 2030, growing at a CAGR of 8.8% from 2025 to 2030. The increasing demand to reduce medication errors, the rising number of prescriptions, and the growing investment in the implementation of the medication management system are driving the market growth globally.

Key Market Trends & Insights

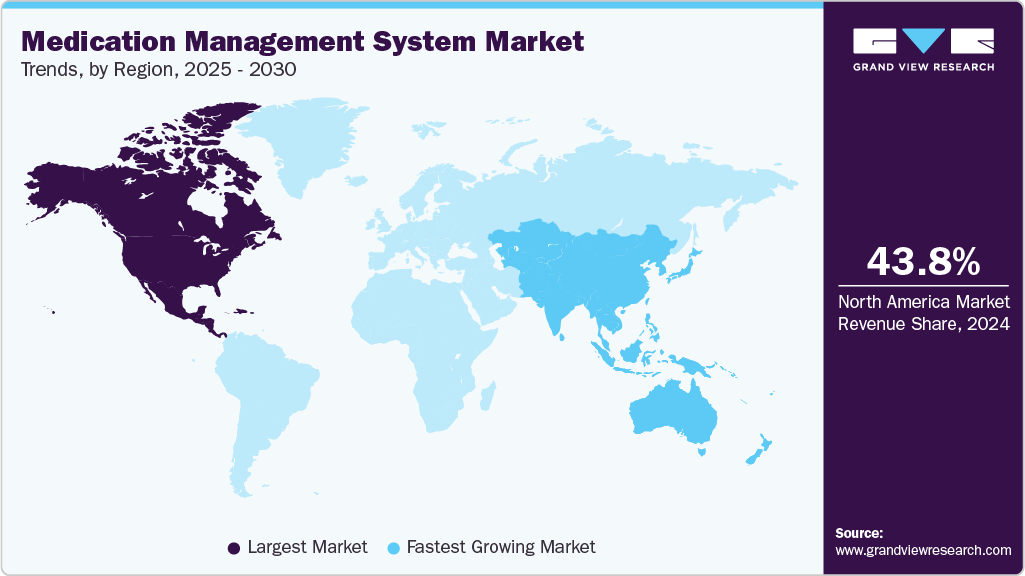

- North America medication management system market dominated the market and accounted for a revenue share of 43.83% in 2024.

- The medication management system market in the U.S. held a significant share of the market in 2024.

- By hardware, the automated dispensing systems segment accounted for the largest market share of 49.17% in 2024.

- By software, the clinical decision support system solutions (CDSS) segment accounted for the largest market share of 30.95% in 2024 and is expected to grow at the fastest CAGR over the forecast period.

- By software type, the consolidated/ integrated systems segment accounted for the largest market share of 69.33% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 7.70 Billion

- 2030 Projected Market Size: USD 12.79 Billion

- CAGR (2025-2030): 8.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to Centers for Disease Control and Prevention (CDC), in the U.S., 60% of adults aged 18 and above reported using at least one prescription drug, while 36% indicated they were taking three or more. Thus, such a rise in the number of prescriptions being dispensed boosts market growth. The rising investments by market players and hospitals to improve the quality of treatment services are also a major factor contributing to the growth of the medication management system market. For instance, in January 2024, SmithRx secured USD 60 million in Series C funding. This latest investment follows the company’s USD 20 million Series B round in 2022 and underscores its commitment to addressing the challenges of accessibility and affordability in the prescription drug market. SmithRx aims to disrupt the traditional model of pharmacy benefit managers (PBMs) and ensure that patients have access to medications at fair and reasonable prices.

Moreover, many hospitals and healthcare facilities are increasingly incorporating electronic systems for medication management to simplify medication administration processes and enhance patient care. For instance, according to an article published by NCBI in June 2022, the medication management systems have supported medication safety. This improvement can be attributed to the fact that these systems enable doctors to directly add prescriptions to a structured medication list, thereby enhancing documentation at the point of order. The benefits provided by this medication management system are anticipated to propel market growth over the forecast period.

The growing technological advancements in healthcare IT infrastructure, including IoT, big data, and AI, significantly propel market growth. For instance, in June 2024, AssureCare announced the acquisition of Cureatr and SinfoniaRx Technology. The acquisition is aimed at further expanding the AssureRx medication management solutions portfolio. Furthermore, medication management software enhances inventory management, dispensing of medicines, and controls Adverse Drug Events (ADE). In recent times, there has been a significant shortage of healthcare professionals and pharmacists. Thus, to ensure efficient workflow, there has been a rise in the adoption of medication management software.

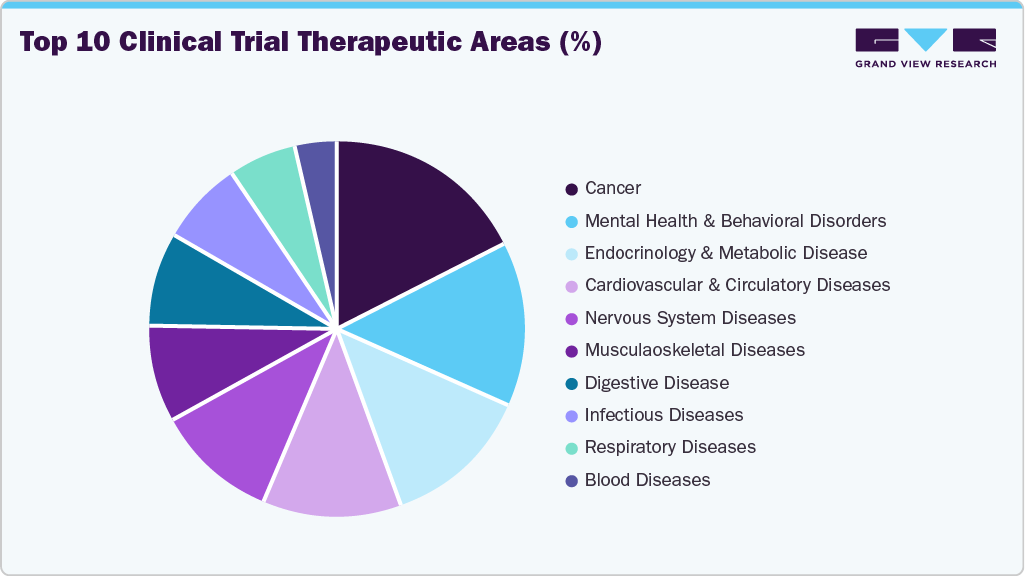

The number of clinical trials conducted in recent years has significantly increased, contributing to the growth of the medication management market. For instance, according to the U.S. National Library of Medicine, as of January 2024, there were 20,465 clinical trials recruiting patients in the U.S. and 65,474 trials recruiting subjects worldwide. These large numbers of clinical trials have significantly helped drug discovery and development and are likely to continue to drive the growth of the medication management market over the forecast period.

GLP1 drug for weight loss/management and diabetes management

Glucagon-like peptide-1 (GLP-1) receptor agonists, originally developed for type 2 diabetes, have emerged as powerful tools for both glycemic control and weight loss. These drugs mimic natural GLP-1 to stimulate insulin secretion, suppress appetite, and slow gastric emptying. Driven by their dual effectiveness, GLP-1 drugs are rapidly transforming metabolic disease care and creating new opportunities for digital health, particularly in medication management systems (MMS). As demand grows, vendors are integrating support tools for adherence, dosing, and lifestyle coaching, while pharma pipelines continue to innovate with oral and combination therapies, expanding access and therapeutic reach.

List of approved and key GLP-1 drugs for weight loss, including those under development:

Drug Name

Approval Status & Year

Weight Loss Efficacy

Notes

Liraglutide (Saxenda)

FDA approved 2014 for weight loss

Moderate weight loss

Requires daily injections; originally developed for diabetes

Semaglutide (Wegovy)

FDA approved 2021 for obesity; 2017 diabetes

Significant (~15-16% body weight loss)

Also approved in 2024 for cardiovascular risk reduction; weekly dosing improves adherence

Tirzepatide (Zepbound)

FDA approved Nov 2023 for obesity

Greater weight loss than semaglutide in some studies

Dual GLP-1/GIP agonist; also approved for diabetes as Mounjaro

Retatrutide

Not yet FDA approved (Phase III)

~24% body weight loss over 11 months

Triple agonist (GLP-1, GIP, glucagon); promising superior efficacy

Orforglipron

Not yet FDA approved (Phase III)

~10% weight loss over 26 weeks

Oral GLP-1 agonist; advantage of pill form over injections

CagriSema

Not yet FDA approved (Phase III)

~15% weight loss over 7 months

Combination of cagrilintide + semaglutide; possibly more effective than monotherapies

The Impact of GLP-1 Therapies on the Medication Management System Market

The rapid adoption of GLP-1 receptor agonists for weight loss and metabolic conditions is reshaping the medication management system (MMS) market, introducing new requirements for adherence support, patient engagement, and digital integration. Drugs such as semaglutide (Wegovy), tirzepatide (Zepbound), and liraglutide (Saxenda) are driving this shift, given their complex administration, chronic use, and high cost.

Opportunities for Medication Management System Vendors:

- Integration with Digital Therapeutics and Remote Monitoring Tools

MMS platforms can enhance their value by integrating digital therapeutics and remote patient monitoring (RPM) tools focused on obesity, type 2 diabetes, and related cardiometabolic conditions.

-

Use Case: Syncing data from continuous glucose monitors (CGMs), weight scales, and wearables with MMS platforms to provide a holistic view of a patient’s health.

-

Value: Enables more personalized dosing adjustments, detects non-adherence early, and improves clinical decision-making.

- Expanded Patient Support Programs with Behavioral Coaching

GLP-1 therapies are most effective when combined with lifestyle interventions. MMS vendors can add value by offering or integrating behavioral health and coaching services.

-

Use Case: Delivering reminders, motivation nudges, and education about diet, physical activity, and sleep via apps or SMS.

-

Value: Increases medication adherence and supports sustainable weight loss, a key challenge in obesity management.

Market Concentration & Characteristics

The medication management system industry exhibits a moderate level of concentration. Characteristics include rapid technological advancements, such as the integration of artificial intelligence (AI), and remote monitoring & consultancy. The industry shows continuous innovation and expansion fueled by rising healthcare expenditure, the rise in investment by hospitals to improve workflow, and the growing adoption of healthcare solutions.

The global medication management system market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced at regular intervals. The Closed-Loop Medication Management (CLMM) system offers an innovative solution by fully integrating automated and smart technologies to optimize hospital patients' medication management & delivery process. This shift to a digital framework enhances patient safety and improves the efficiency of the complete medication management cycle, including prescription ordering, dispensing, and administration stages.

Regulations significantly impact the medication management system industry by ensuring patient safety, service quality, and efficacy. Big data analytics can assist healthcare organizations in maintaining compliance with regulatory requirements such as HIPAA and FDA guidelines. By analyzing medication data and ensuring proper documentation, organizations can demonstrate adherence to regulations and mitigate compliance risks.

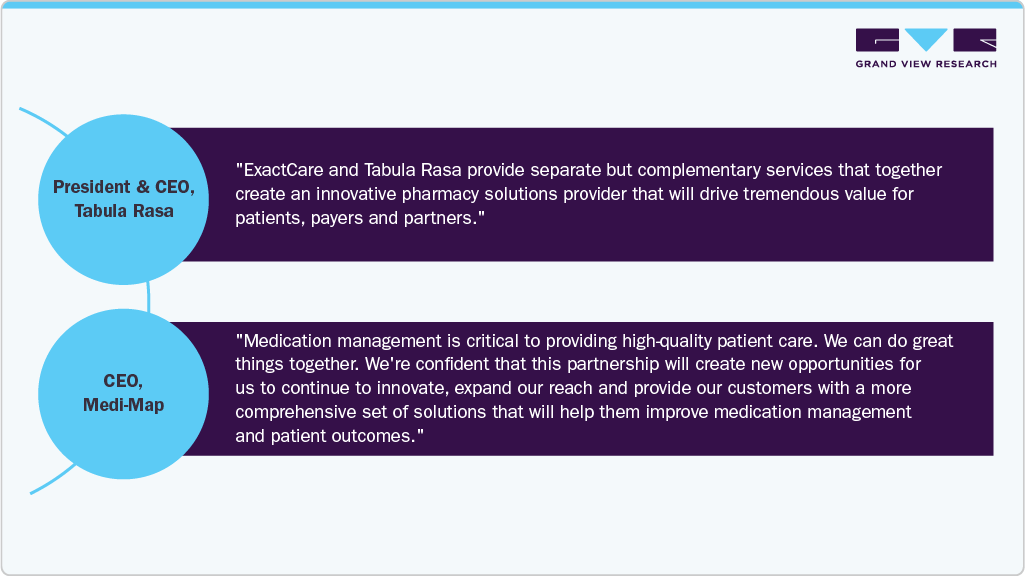

Mergers and acquisitions in the medication management system industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in November 2023, ExactCare announced the acquisition of Tabula Rasa HealthCare, a leading firm in the healthcare industry known for delivering personalized and comprehensive care to value-based organizations.

Manual tracking, mobile applications, and healthcare provider support are substitutes for medication management systems. Mobile apps are readily available on smartphones, which most individuals always carry with them. This accessibility ensures that patients can manage their medications wherever they are without the need for a dedicated medication management system.

The medication management system market has a significant global presence, with substantial growth and adoption observed across various regions worldwide. This market’s expansion can be attributed to several factors, including the increasing geriatric population, rising chronic diseases, advancements in healthcare infrastructure, and technological innovations in healthcare. For instance, North America, particularly the U.S., holds a considerable share in the medication management system market. The dominance is primarily due to the region’s sophisticated healthcare infrastructure, enabling early adoption of advanced medication management systems.

Hardware Insights

The automated dispensing systems segment accounted for the largest market share of 49.17% in 2024. The growth is attributed to the rising adoption of automated dispensing systems in healthcare facilities and an increasing number of research studies are expected to fuel market growth. In March 2024, Pinderfields Hospital Pharmacy implemented an automated medication dispensing system to speed up dispensing controlled drugs and improve patient safety. These systems help reduce errors in dispensing medication, thereby fueling market growth. Moreover, rising product launches and approvals are expected to support market growth. For instance, in October 2023, JVM launched MENITH, a next-generation automated drug dispensing machine with a robotic arm, in Europe.

The delivery workstation segment is anticipated to grow at the fastest CAGR during the forecast period. The rising adoption of automation and digitalization in healthcare operations are propelling segment growth. As healthcare providers seek to streamline medication management processes and enhance operational efficiency, delivery workstations offer a solution for optimizing medication distribution workflows. By automating tasks such as medication dispensing, inventory management, and documentation, these workstations enable healthcare staff to focus more on direct patient care. Furthermore, the availability of delivery workstations in the market is driving segment growth. For instance, the AccessRx MD medication delivery workstation is intended to aid in closing the gap between pharmacy and patient bedside in medication delivery. Its goal is to decrease errors and prevent common workarounds.

Software Insights

The clinical decision support system solutions (CDSS) segment accounted for the largest market share of 30.95% in 2024 and is expected to grow at the fastest CAGR over the forecast period. Clinical Decision Support System (CDSS) solutions are transforming healthcare by providing a range of benefits that positively impact on patient care, clinical workflows, and healthcare outcomes. One of the most significant advantages is the improvement in patient safety. CDSS offers real-time alerts and reminders that help healthcare professionals identify potential medication errors, drug interactions, allergies, and contraindications. This ultimately reduces adverse drug events and improves patient safety. Moreover, it helps enhance the monitoring of ICU patients when avoidance of such combinations is not feasible and reduces the length of patient stay in the ICU. When potential Drug-Drug Interaction (DDI) alerts are tailored to the ICU, the study found a 12% decline in the number of administered high-risk drug combinations per 1,000 drug administrations per patient.

The automated dispensing systems segment held a significant share of the market. The system is designed to minimize the risk of human errors in medication dispensation. It ensures patients receive the right medications in the correct dosages and at the appropriate times. The software integrates advanced algorithms and verification mechanisms to prevent medication errors, such as incorrect dosages or drug interactions. Thus, this technology helps improve patient outcomes and reduces adverse events. Moreover, the increasing complexity of medication regimens and the need for efficient management solutions are driving segment growth.

Software Type Insights

The consolidated/ integrated systems segment accounted for the largest market share of 69.33% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030. The growth is attributed to the systems comprehensive solutions for medication management by centralizing various functions such as prescription processing, inventory management, patient records, and billing within a single platform. One of the primary benefits of these systems is the seamless coordination and communication among different healthcare stakeholders, including pharmacists, physicians, nurses, & patients. These systems simplify workflows, reduce errors, and enhance efficiency by consolidating disparate processes into a unified interface. For instance, according to a study published by Oxford University Press in 2023, out of the 386 patients analyzed, integrated medicines management resulted in a mean reduction of 1.34 in potential prescribing omissions at discharge compared to 1.57 in the control group.

The decentralized/standalone segment held a significant share in the market in 2024. These systems are designed to meet the specific needs and preferences of healthcare providers, especially those working in smaller practices or specialized settings. These systems provide autonomy and flexibility by allowing organizations to customize solutions according to their unique workflows and requirements.

Mode Of Delivery Insights

The cloud-based systems segment accounted for the largest market share of 40.41% in 2024 and is expected to grow at the fastest CAGR over the forecast period. The growth is attributed to the increasing demand for secure and efficient patient data management. Cloud-based systems are popular because they provide higher protection against theft and robust data security, a major concern in the healthcare industry. The cloud-based medication management system market is driven by several factors, including the need for easy access to information in remote locations, greater attention to patient data protection, and implementing regulations addressing data security. These factors have led to a significant increase in demand for cloud-based solutions, which are more secure than traditional on-premises or web-based systems.

The on-premise segment held a significant share of the market in 2024. The healthcare organization is using an on-premise solution to store health data in its own data centers or servers, which is driving market growth. This gives the organization greater control over data security and enables compliance with regulations (such as HIPAA in the U.S.) & data governance. Several medium- & small-scale enterprises commonly adopt on-premises deployment through in-house data centers and security infrastructure.

End-use Insights

The hospital segment dominated the market with 27.67% of the market share in 2024. Hospitals are heavily investing in upgrading their IT systems to improve workflow efficiency, ensure safe medication distribution, and simplify complex clinical processes. This is expected to boost the segment growth. As the segment continues to grow, hospitals emphasize streamlining workflows and simplifying complicated clinical procedures. The shift in trend from volume-based care to value-based care is leading to increased demand for information systems in hospitals. Moreover, the advantages of cloud computing in healthcare include streamlined, collaborative patient care, reduced data storage costs, and better data security than on-premises software. For instance, in July 2023, The National Association of Boards of Pharmacy (NABP) collaborated with IBM Consulting to develop Pulse by NABP, a modern digital platform designed to enhance transparency within the drug supply chain. This initiative aims to safeguard patients by preventing the distribution of counterfeit or inferior-quality prescription drugs

Ambulatory surgical centers (ASCs) segment is anticipated to grow at the fastest CAGR during the forecast period. It is governed by several authorities, including the Centers for Medicare & Medicaid Services (CMS), various accreditation bodies, the Drug Enforcement Administration (DEA), and The U.S. Pharmacopeia. Due to the complex nature of pharmaceutical regulation in ASCs, a registered nurse should lead the medication management program, ensuring effective collaboration with ASC's consultant pharmacist. Furthermore, ASCs increasingly rely on software for various organizational needs, which is important for enhancing medication management system.

Regional Insights

North America medication management system marketdominated the market and accounted for a revenue share of 43.83% in 2024. The increasing prevalence of chronic diseases, such as diabetes, cardiovascular diseases, and cancer, is expected to drive the demand for advanced medication management system to ensure accurate dosing and adherence to treatment regimens. As per the American Diabetes Association, around 1.2 million Americans are diagnosed with diabetes annually. In 2021, diabetes affected about 11.6% of the American population, which is equivalent to 38.4 million people. Of these, around 2 million people have type 1 diabetes, with around 304,000 of them being children and adolescents.

U.S. Medication Management System Market Trends

The medication management system market in the U.S. held a significant share of the market in 2024. This can be attributed to the increasing adoption of healthcare IT and the growing number of medication errors in the U.S. According to the NIH report published in 2023, between 7,000 and 9,000 people in the U.S. die due to medication errors annually. In addition, numerous patients experience medication complications; however, they do not report them. Hence, the growing emphasis on reducing medication errors and improving patient outcomes are predicted to facilitate market growth over the forecast period.

Europe Medication Management System Market Trends

The European medication management system market is witnessing growth fueled by the growing adoption of IT in the healthcare sector. In addition, the rising awareness among healthcare providers regarding the benefits of digital health solutions and the need for streamlining medication processes are expected to fuel market growth in Europe. For instance, healthcare stakeholders, including patients, health managers, the medical technology industry, and healthcare professionals, have formed an alliance for the digitalization of medication management in hospitals across Europe.

UK Medication Management System Market Trends

UKmedication management system market is one of the major markets in the region. The increasing government and nongovernment initiatives for the development of advanced medication management system are one of the key factors propelling market growth. In addition, the increasing R&D activities are likely to accelerate market growth. For instance, in April 2024, Lancaster University participated in a project to develop a medication management system for individuals who receive home-based care.

The medication management system market in Germany is projected to expand in the forecast period owing to the robust healthcare infrastructure and emphasis on quality healthcare delivery. Moreover, there is an increasing adoption of digital health solutions, leading to a rise in e-prescriptions, which contributes to market growth. A survey conducted by Doctolib in 2022 revealed that around 66% of patients showed interest in using online appointment booking, 58% in e-prescriptions, and 55% in digital transmission of diagnostic results.

Asia Pacific Medication Management System Market Trends

The medication management system market in the Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2030.The Therapeutic Goods Administration (TGA) of Australia, being a member of the Pharmaceutical Inspection Co-operation Scheme (PIC/S), is in the process of transitioning to the newer version of the PIC/S Guide to Good Manufacturing Practice (GMP). The current version of the guide is PE 009-13, and the transition is to the newer PE 009-16 version. This transition reflects the TGA’s commitment to maintaining and enhancing the quality and safety of therapeutic goods in Australia and the Asia-Pacific region.

The medication management system market in China is expected to grow at the fastest. China government is significantly investing in smart medicine, which includes medication management system. This investment is driving the growth of the medication management system market in China. By allocating resources towards the development and implementation of these systems, China is signaling its commitment to improving healthcare outcomes through technology.

India medication management system market holds a significant share of the Asia Pacific regional market revenue. The introduction of Soliqua, a complex medication requiring precise dosage and monitoring, is likely to encourage the adoption of digital health solutions for diabetes management. These solutions, such as connected insulin pens, smart glucose monitors, and mobile apps, can help patients track their medication adherence, blood sugar levels, and overall health outcomes.

The increased production of generic drugs by Indian pharmaceutical companies has led to a higher demand for medication management system. These systems are required to manage the increased production, inventory, and distribution of drugs, both within India and for export to the US and other countries.

Latin America Medication Management System Market Trends

The medication management system market in Latin America is experiencing significant growth. The partnership between PAHO (Pan American Health Organization) and St. Jude Children’s Research Hospital in February 2024 aims to improve access to medicines for childhood cancer in Latin America and the Caribbean. This initiative will drive the growth of the medication management system market in Latin America for several reasons.

The increased access to essential medicines will result in a higher demand for medication management system. As more children are diagnosed and treated for cancer, healthcare providers will require more advanced systems to manage medications, track patient progress, and ensure appropriate dosages and administration. This increased demand will encourage the development and adoption of medication management system across the region.

The medication management system market in Brazil is experiencing significant growth. The new law in Brazil that strengthens participant protections in clinical trials is expected to drive market growth. This is because the law will likely lead to an increase in the number of clinical trials conducted in Brazil, which may increase the demand for the medication management system. They are essential for ensuring the safety and efficacy of clinical trials, and they help to track the use of medications, manage adverse events, and ensure compliance with regulatory requirements. As more clinical trials are conducted in Brazil, the demand for these systems will increase, driving market growth.

Middle East & Africa Medication Management System Market Trends

The medication management system market in MEA is experiencing significant growth. The increasing adoption of biosimilars in the Middle East and Africa is a significant market growth. Biosimilars are highly similar versions of already approved biological drugs, offering cost-effective alternatives while maintaining efficacy and safety. This surge in biosimilar adoption necessitates robust medication management system to ensure accurate identification, tracking, and administration of these complex drugs.

The medication management system market in Saudi Arabia is expected to grow over the forecast period. In October 2023, the Saudi Food and Drug Authority (SFDA) introduced the Break-Through Medicine Program to expedite the review and approval process for innovative and life-saving medications in Saudi Arabia. This program aims to provide patients with faster access to cutting-edge treatments, which in turn drives the growth of the medication management system market.

UAE medication management system market is anticipated to expand in the forecast period due to technological innovation. The introduction of innovative pharmaceutical products in the UAE leads to an increased demand for medication management systems. These systems help in managing, tracking, and monitoring the use of these products, thus ensuring their safe and effective use. With the growing number of pharmaceutical products, the need for an efficient medication management system is becoming more critical.

Key Medication Management System Company Insights

The global market is highly competitive. Key companies deploy strategic initiatives, such as product development, launches, and sales & marketing strategies to increase product awareness and regional expansions and partnerships to strengthen their market share. Market players are also involved in conducting clinical testing of their products, patent applications, and increasing product penetration.

Key Medication Management System Companies:

The following are the leading companies in the medication management system market. These companies collectively hold the largest market share and dictate industry trends.

- Bluesight

- BD

- Swisslog Healthcare

- eAgile Inc. (CCL Industries)

- GUARDIAN RFID

- RMS Omega

- Impinj, Inc.

- Epic Systems Corporation

- Omnicell, Inc.

- MEPS Real-Time, Inc. (INTELLIGUARD)

- Veradigm LLC (ALLSCRIPTS HEALTHCARE, LLC)

- GE HealthCare

- Komodo Health, Inc.

- Talyst Systems, LLC,

- MCKESSON CORPORATION

- Oracle (Cerner Corporation)

- Capsa Healthcare

- TouchPoint Medical

- Medminder Systems, Inc. (PersonalRX)

- Tecsys

- Cencora, Inc. (AmerisourceBergen Corporation)

- Amazon.com Inc. (Amazon)

Recent Developments

-

In February 2024, GUARDIAN RFID, a provider of inmate tracking systems joined forces with an Amazon Web Services (AWS) Partner Network (APN) and the AWS Public Sector Partner (PSP) Program. The APN encompasses a global network of AWS Partners who utilize various expertise, programs, and resources to develop, promote, & distribute their solutions to customers.

-

In November 2023, Baptist Health, a Kentucky-based company, collaborated with Omnicell’s Central Pharmacy Dispensing Service. This collaboration aimed to improve pharmacy services and strengthen control over medication supply chain.

-

In July 2023, Thoma Bravo, an investment firm specializing in software, completed a significant investment in Bluesight. This investment aimed to strengthen Bluesight's capabilities in preventing drug diversion by incorporating Medacist, a drug diversion analytics company, into its operations. Moreover, it aimed to expand Bluesight's solutions in managing inventory and optimizing expenditure.

Medication Management System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.38 billion

Revenue forecast in 2030

USD 12.79 billion

Growth rate

CAGR of 8.8% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Hardware, software, software type, mode of delivery, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Bluesight; BD; Swisslog Healthcare; eAgile Inc. (CCL Industries); GUARDIAN RFID; RMS Omega; Impinj, Inc.; Epic Systems Corporation; Omnicell, Inc.; MEPS Real-Time, Inc. (INTELLIGUARD); Veradigm LLC (ALLSCRIPTS HEALTHCARE, LLC; GE HealthCare; Komodo Health, Inc.; Talyst Systems, LLC; MCKESSON CORPORATION; Oracle (Cerner Corporation); Capsa Healthcare; TouchPoint Medical; Medminder Systems, Inc. (PersonalRX); Tecsys; Cencora, Inc. (AmerisourceBergen Corporation); Amazon.com Inc. (Amazon)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medication Management System Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medication management system market report based on hardware, software, software type, mode of delivery, end-use, and region:

-

Hardware Outlook (Revenue, USD Million, 2018 - 2030)

-

Automated Dispensing Systems

-

Delivery Workstation

-

Other Hardware

-

-

Software Outlook (Revenue, USD Million, 2018 - 2030)

-

Computerized Physician Order Entry (CPOE)

-

Clinical Decision Support System Solutions (CDSS)

-

Diversion Medication Management

-

Inventory Management and Supply Chain Management Software

-

Administration Software

-

Electronic Medication Administration Record

-

Barcode Medication Administration

-

-

Automated Dispensing Systems

-

Centralized Automated Dispensing System

-

Robots

-

Carousels

-

-

Decentralized Automated Dispensing System

-

Pharmacy-Based ADS

-

Ward-Based ADS

-

Automated Unit Dose Dispensing

-

-

-

Assurance System Software

-

Other Software

-

-

Software Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Consolidated/ Integrated

-

Decentralized/ Standalone

-

-

Mode of Delivery Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Web-Based

-

Cloud-Based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Pharmacies

-

Ambulatory Surgical Centers

-

Physician's Clinics and Offices

-

Behavioral Health Centers

-

Addiction Treatment/ Substance Abuse Centers

-

Long Term Care Facilities

-

Specialty Centers

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medication management system market size was estimated at USD 7.70 billion in 2024 and is expected to reach USD 8.38 billion in 2025.

b. The global medication management system market is expected to grow at a compound annual growth rate of 8.82% from 2025 to 2030 to reach USD 12.79 billion by 2030.

b. North America dominated the medication management system market, with a share of 43.83% in 2024. This is attributable to the high adoption of IT in healthcare, technological advancement, increase in the incidence of infectious and chronic diseases, and rise in the number of prescriptions.

b. Some key players operating in the medication management system market include Bluesight, BD, Swisslog Healthcare, eAgile Inc. (CCL Industries), GUARDIAN RFID, RMS Omega, Impinj, Inc., Epic Systems Corporation, Omnicell, Inc., MEPS Real-Time, Inc. (INTELLIGUARD), and Veradigm LLC among others.

b. Key factors that are driving the medication management system market growth include rise in number of prescriptions globally, an increase in investments by hospitals for workflow management, advanced technologies, and rise in government reforms and policies boosting integration of IT in healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.