- Home

- »

- Advanced Interior Materials

- »

-

Composite Doors & Windows Market, Industry Report, 2030GVR Report cover

![Composite Doors And Windows Market Size, Share & Trends Report]()

Composite Doors And Windows Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin Type (PVC, Polyester, Other Resin Types), By Application (Residential, Commercial, Industrial), By Region And Segment Forecasts

- Report ID: GVR-4-68040-432-8

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

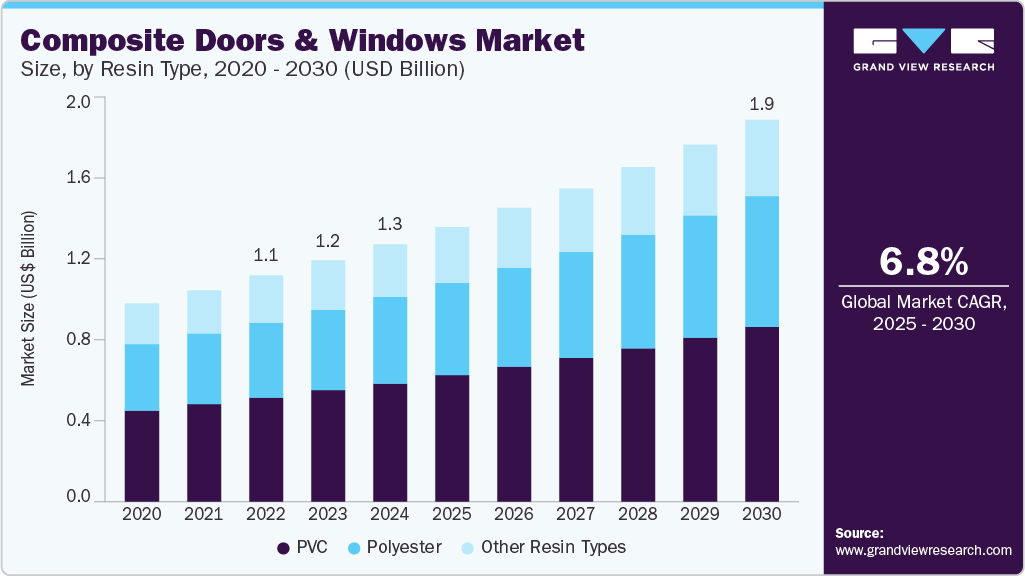

The global composite doors and windows market size was valued at USD 1.30 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. This growth is attributed to the strength and weather resistance of composite doors and windows, which reduces the need for frequent maintenance compared to traditional materials.

Key Highlights:

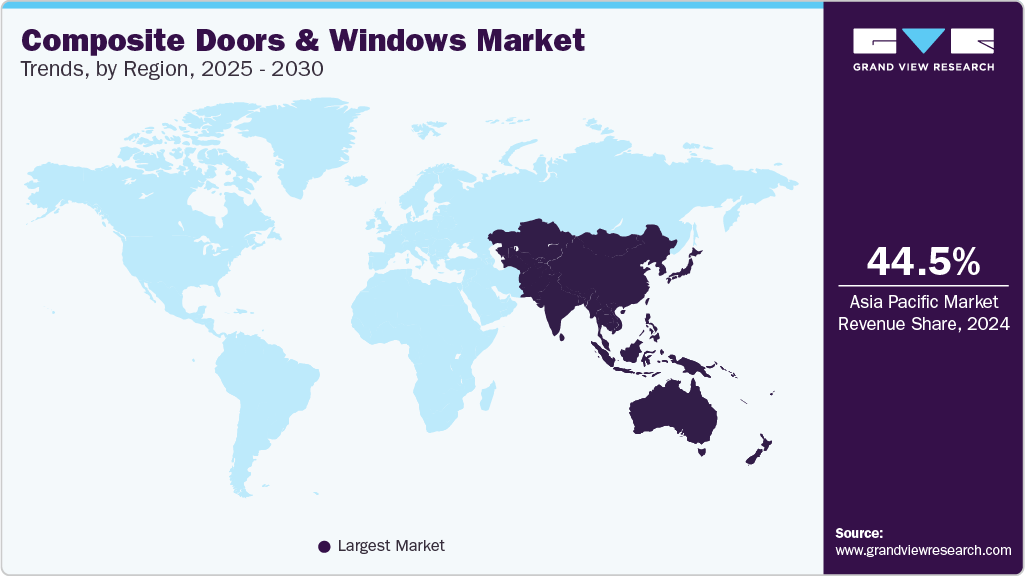

- Asia Pacific composite doors and windows market dominated the market with the largest revenue share of 44.5% in 2024

- China composite doors and windows market accounted for the largest share in the regional market in 2024

- In terms of resin type segment, the PVC segment held the largest revenue share of 45.9% in 2024

- In terms of resin type segment, the polyester segment is anticipated to grow at the fastest CAGR of 8.6% over the forecast period

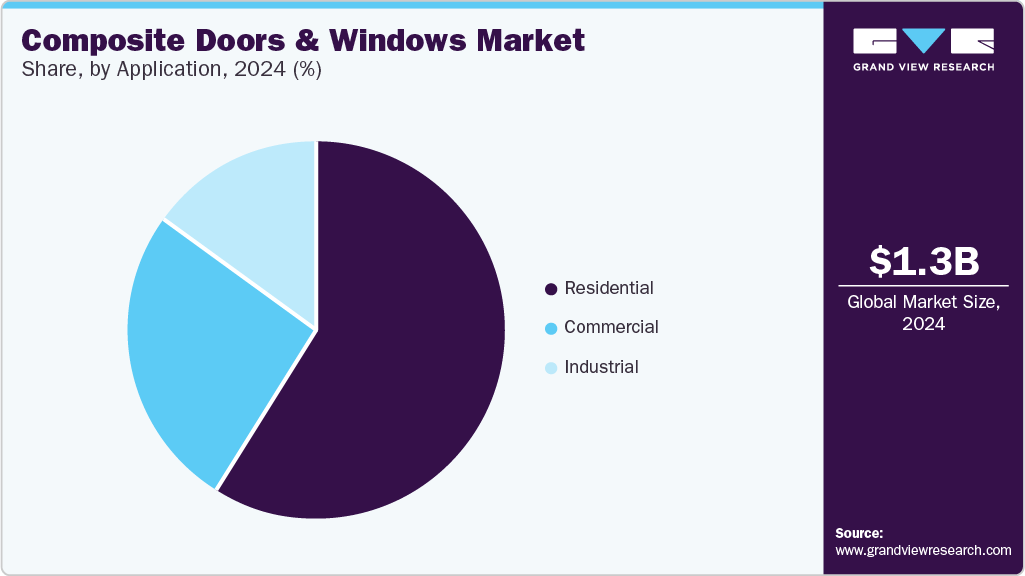

- In terms of application segment, the residential segment held the largest revenue share in 2024, primarily due to the increasing demand

Furthermore, these products often offer superior thermal insulation, helping reduce energy consumption for heating and cooling, which appeals to energy-conscious consumers.

Composite materials can be engineered to imitate various traditional finishes, such as wood, while providing a modern, sleek look, offering greater aesthetic flexibility. In addition, increasing awareness of environmental sustainability is driving the adoption of composite materials, which are often designed to be eco-friendly than conventional options.

The production process for composite materials can be complex and resource-intensive, potentially leading to higher production costs and longer lead times. Furthermore, factors such as limited market penetration and lower brand awareness in certain regions can restrict the growth of composite window and door products. These products may also have a higher upfront cost compared to traditional materials like vinyl or aluminum, which can affect adoption among budget-conscious consumers.

Technological advancements in composite materials and manufacturing processes are expected to lead to improved product performance and reduced costs, further supporting market growth. Moreover, policies and incentives promoting energy efficiency and sustainable building practices are expected to boost the adoption of composite windows and doors in the coming years.

The expansion of construction activities, especially in emerging markets, provides significant growth opportunities for composite windows and doors. In addition, the growing trend of home renovations and retrofits presents a substantial opportunity for these products as replacements for outdated or less efficient alternatives.

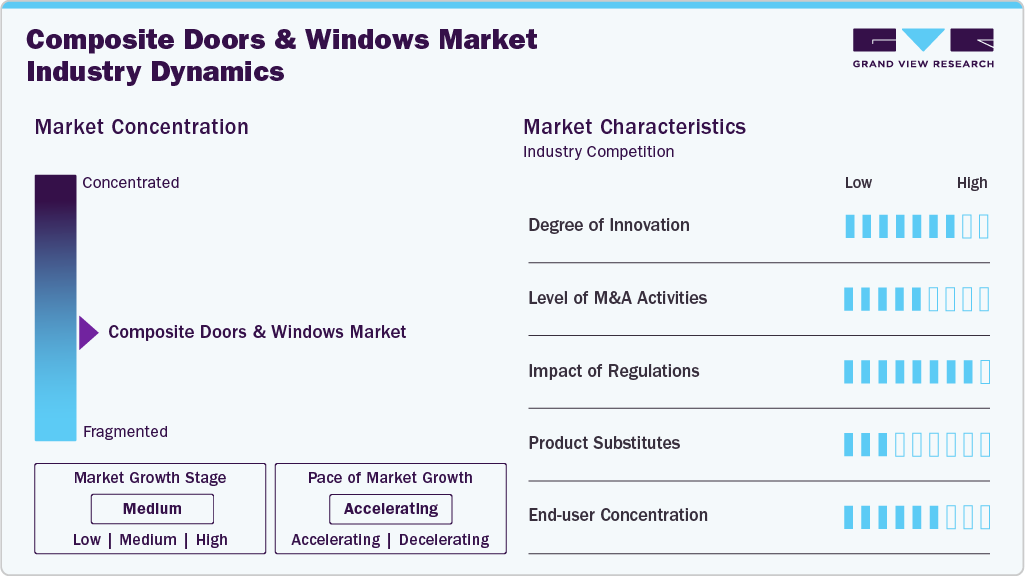

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Ongoing efforts by key industry participants have resulted in fragmented market scenarios by driving innovation, improving product quality, and meeting evolving consumer demands. Manufacturers are constantly investing in research and development to enhance composite solutions' thermal efficiency, durability, and aesthetic appeal. Moreover, the focus on integrating smart technologies, sustainability, and energy efficiency standards strengthens the market. Industry players are also working on expanding their product offerings and entering new markets, which fosters competition, accelerates growth, and increases the adoption of composite materials in both residential and commercial applications.

The global composite doors and windows industry is characterized by the growing integration of smart technologies, driving high innovation. Features such as remote access, automated locking, energy monitoring, and compatibility with home automation systems transform traditional doors and windows into intelligent, multifunctional solutions. This technological shift enhances security, convenience, and energy efficiency-key concerns for modern consumers. As demand rises for smart homes and connected living spaces, manufacturers increasingly invest in innovative composite designs, accelerating market growth, and reshaping consumer expectations across residential and commercial applications. For instance, in May 2024, Emplas expanded its door range with the next-generation GRiPCORE composite door, designed for enhanced strength and thermal efficiency.

New product launches are crucial in shaping the composite doors and windows market by introducing cutting-edge materials, improved energy efficiency, and advanced design features. These innovations meet the growing demand for durable, low-maintenance, and aesthetically versatile solutions in both residential and commercial construction. With rising interest in smart technologies and sustainable building practices, manufacturers are leveraging product development to stay competitive and address consumer expectations. Such launches also expand application possibilities, enhance performance standards, and support the market’s shift toward high-performance, customizable, and environmentally conscious building materials. For instance, in July 2023, the Trade Village launched the new Smart Signature aluminium composite door, offering a blend of durability, modern design, and high thermal efficiency. Manufactured in the UK, this door is available in over 250 RAL colours, with a quick 15-working-day lead time and enhanced security features.

Resin Type Insights

The PVC segment held the largest revenue share of 45.9% in 2024, driven by its affordability, low maintenance, and excellent insulating properties. PVC windows and doors are particularly appealing for budget-conscious projects, offering a cost-effective solution without compromising on quality. Their ease of maintenance-requiring no painting and being easy to clean-makes them a popular choice for residential applications. The growing demand for energy-efficient and sustainable building materials, coupled with the rise in green building practices, has further driven the adoption of PVC in composite doors and windows.

The polyester segment is anticipated to grow at the fastest CAGR of 8.6% over the forecast period due to its exceptional durability and resistance to environmental factors like UV radiation and moisture. These properties make polyester composites ideal for windows and doors exposed to diverse weather conditions. Moreover, polyester resin’s strength and aesthetic flexibility allow for a wide range of designs, catering to residential and commercial needs. As demand grows for long-lasting, weather-resistant, and visually appealing building materials, the polyester segment is set to witness significant growth in the composite doors and windows industry.

Application Insights

The residential segment held the largest revenue share in 2024, primarily due to the increasing demand for both aesthetic appeal and energy efficiency. Homeowners are attracted to the design flexibility of composite materials, which can be customized to suit various styles. Furthermore, with rising awareness of energy conservation, composite windows and doors are gaining popularity for their excellent insulation properties, helping to reduce energy consumption for heating and cooling. This growing preference for energy-efficient, visually appealing, and low-maintenance solutions has significantly contributed to the segment's dominance in the market.

The commercial segment is projected to witness significant growth in the composite doors and windows industry from 2025 to 2030, propelled by the need for durable, high-performance solutions that withstand heavy use and traffic. Composite materials offer excellent strength, sound insulation, fire resistance, and enhanced security features essential for commercial environments. In addition, the rising focus on green building certifications encourages the adoption of sustainable and energy-efficient materials. As businesses and developers prioritize long-lasting, compliant, and environmentally responsible construction solutions, the demand for composite doors and windows in the commercial sector continues to rise steadily.

Regional Insights

North America composite doors and windows market is set to experience significant expansion over the forecast period, fueled by increasing demand for energy-efficient, durable building materials. The region’s strict energy regulations and rising consumer preference for sustainable solutions are key drivers. Moreover, areas with harsh weather conditions, such as extreme cold or heat, amplify the need for materials offering superior insulation and weather resistance-qualities inherent in composite products.

U.S. Composite Doors and Windows Market Trends

The U.S. composite doors and windows market held the largest share in 2024, driven by stringent energy efficiency standards and building codes that favor high-performance materials. Composite doors and windows, valued for their excellent insulation and durability, align perfectly with these regulations. The thriving home renovation market further fuels demand, as homeowners increasingly prioritize energy-efficient, low-maintenance upgrades.

Europe Composite Doors and Windows Market Trends

The European composite doors and windows market is expected to grow significantly from 2025 to 2030, fueled by advancements in smart technology integration and the increasing demand for energy-efficient solutions. Smart features such as automated locking systems, remote control, and energy optimization enhance composite products' convenience, security, and appeal. Furthermore, growing concerns over energy conservation and rising utility costs are prompting consumers and builders to prioritize energy-efficient solutions. Composite doors and windows, known for their superior insulation and durability, are well-positioned to meet these evolving consumer needs, fueling the expansion of the composite doors and windows industry.

Asia Pacific Composite Doors and Windows Market Trends

Asia Pacific composite doors and windows market dominated the market with the largest revenue share of 44.5% in 2024, owing to rapid urbanization and escalating construction activities. Countries like China, India, and Japan are experiencing substantial urban population increases, with China targeting 70% urbanization by 2030. This urban shift drives a surge in residential and commercial construction projects, increasing the demand for modern, energy-efficient building materials.

China composite doors and windows market accounted for the largest share in the regional market in 2024, attributed to its rapid urbanization and expansive infrastructure development. Government initiatives, including affordable housing and urban renewal programs, have increased demand for high-quality, energy-efficient building materials. The country’s robust manufacturing sector supports the large-scale production of composite materials such as PVC and fiberglass, offering cost-effective solutions.

Key Composite Doors And Windows Company Insights

Some of the key companies in the composite doors and windows industry include Andersen Corporation; Pella Corporation; Starline uPVC Window Systems; Fenesta Building Systems; and PolyTech Products LTD.

-

Andersen Corporation offers awnings, bay and bow, casement, double- & single-hung, gliding, picture, specialty, and pass-through windows. This company has categorized its products under series including E-series, A-series, big doors, 400 series, 200 series, 100 series, Andersen aluminum, and renewable by Andersen. Furthermore, its products are manufactured from several materials such as wood, vinyl, composite, fiberglass, and aluminum.

-

Pella Corporation offers windows and doors for residential and commercial applications such as educational facilities, multifamily buildings, healthcare buildings, office buildings, and commercial hospitality windows. It offers casement, awning, specialty, double-hung, single-hung, and sliding windows. In addition to this, it offers patio, front, and storm doors of various types.

Key Composite Doors And Windows Companies:

The following are the leading companies in the composite doors and windows market. These companies collectively hold the largest market share and dictate industry trends.

- Andersen Corporation

- Pella Corporation

- Profine International Group

- Starline uPVC Window Systems

- Marvin

- Prestige Windows & Doors LTD

- Signature Windows & Doors

- Fenesta Building Systems

- Windoorz Inc.

- PolyTech Products LTD

Recent Developments

-

In October 2024, Emplas introduced the BRiTDOR Composite Door collection-its second new composite door launch this year and third in the range.

-

In January 2023, GAP introduced a new range of GRP composite doors under its established HomeFrame brand, previously known for PVC-U windows and entrance doors.

-

In May 2022, Marvin, a window and door manufacturer, expanded its operations by opening a new distribution center in West Fargo. The company also plans to open another facility soon to further strengthen its presence in the region.

Composite Doors And Windows Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.39 billion

Revenue forecast in 2030

USD 1.93 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Andersen Corporation; Pella Corporation; Profine International Group; Starline uPVC Window Systems; Marvin; Prestige Windows & Doors LTD; Signature Windows & Doors; Fenesta Building Systems; Windoorz Inc.; and PolyTech Products LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Composite Doors & Windows Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global composite doors and windows market report based on resin type, application, and region:

-

Resin Type Outlook (Revenue, USD Million, 2018 - 2030)

-

PVC

-

Polyester

-

Other Resin Types

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global composite doors and windows market size was estimated at USD 1.22 billion in 2023 and is expected to reach USD 1.30 billion in 2024.

b. The global composite doors and windows market is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030 to reach USD 1.93 billion by 2030.

b. Residential end use accounted for largest revenue share of 58.7% in 2023 as composite windows and doors are used in residential buildings as they often emphasize on aesthetic appeal and design flexibility.

b. Some key players operating in the composite doors and windows market include Andersen Corporation, The Pella Corporation, Profine International Group, Starline uPVC Window Systems, Marvin, Prestige Windows and Doors, Signature Windows & Doors, Fenesta, Windoorz Inc, and PolyTech Products LTD.

b. The key factors that are driving the composite doors and windows market growth is the strength and resistance to weathering of composite doors and windows, which reduces the need for frequent maintenance compared to traditional materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.