- Home

- »

- Advanced Interior Materials

- »

-

Composite Materials And Aluminum Alloys in Aerospace Market Report, 2030GVR Report cover

![Composite Materials And Aluminum Alloys in Aerospace Market Size, Share & Trends Report]()

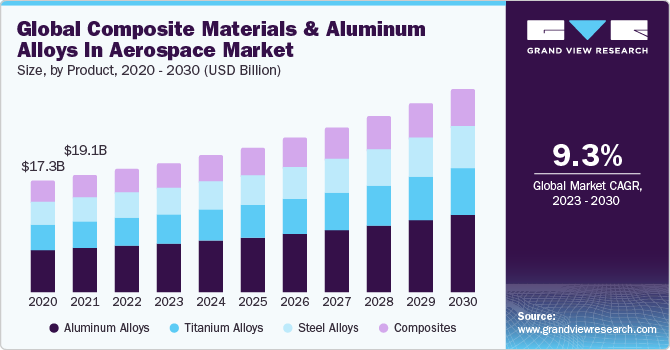

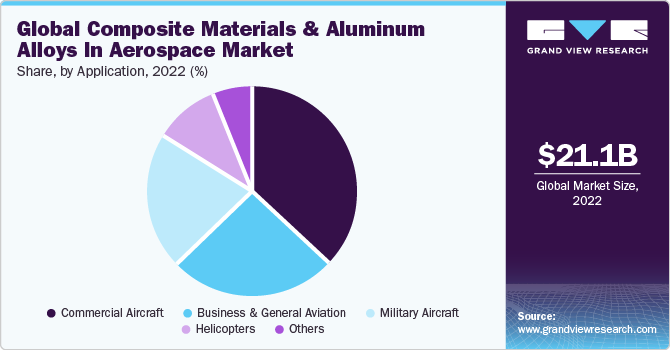

Composite Materials And Aluminum Alloys in Aerospace Market Size, Share & Trends Analysis Report By Type (Aluminum Alloys, Titanium Alloys, Steel Alloys, Composites), By Application, By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455957

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Data: ---

- Forecast Period: 1 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global composite materials and aluminum alloys in aerospace market was valued at USD 21.1 billion in 2022 and is expected to grow at a CAGR of 9.3% over the forecast period. Composite materials and aluminum alloys have long played pivotal roles in the aerospace industry, each offering a unique set of advantages. Aluminum alloys, renowned for their strength-to-weight ratio, have been a staple in aircraft manufacturing for decades. They provide structural integrity and durability, making them a reliable choice for components like airframes and wings. However, in the pursuit of greater fuel efficiency and reduced emissions, the aerospace market has been increasingly turning to composite materials.

The aerospace market faced unique challenges with the outbreak of the COVID-19 pandemic. The unprecedented downturn in air travel and the resulting financial strain on airlines led to a temporary slump in the industry. While this had a substantial impact on manufacturers, including those producing aluminum alloys and composite materials, it also accelerated certain trends. Airlines became increasingly focused on reducing operational costs and emissions as they sought to recover and adapt to the new normal.

This shift emphasized the demand for lightweight, fuel-efficient aircraft, favoring the use of composite materials. In response, aerospace manufacturers began further exploring advanced composite technologies and their applications. Aluminum alloys continued to serve their vital role, particularly in existing fleets, but the aerospace market has increasingly moved towards composite materials to align with industry goals of enhanced fuel efficiency and reduced environmental impact. Thus, the COVID-19 pandemic acted as a catalyst, steering the industry toward more sustainable materials and technologies, while still recognizing the enduring significance of aluminum alloys in aerospace applications.

Composite materials, often combining carbon or glass fibers with polymer matrices, offer exceptional strength-to-weight ratios and corrosion resistance. They enable the development of lightweight yet robust structures that contribute to enhanced fuel efficiency and overall performance. Many modern aircraft, such as the Boeing 787 and Airbus A350, incorporate composite materials in their airframes, leading to reduced fuel consumption and operational costs. While aluminum alloys still find their place in aerospace, composite materials are playing an increasingly prominent role, representing a crucial innovation in the industry's ongoing efforts to create more efficient and environmentally sustainable aircraft.

Type Insights

Based on the type, the market is segmented into aluminum alloys, titanium alloys, steel alloys, and composites. The aluminum alloys segment held the largest market share in 2022. One of the key advantages of aluminum alloys is their remarkable strength-to-weight ratio. This property is of paramount importance in the aerospace industry where reducing the weight of aircraft components is critical. The low density of aluminum, combined with its robust structural properties, allows for the creation of lightweight yet sturdy aircraft parts. These parts include airframes, wings, and fuselages, which play a fundamental role in ensuring the safety and performance of aircraft.

U.S. Airline Industry Annual Revenue, 2010-2022

Year

Revenue

2022

$206.3 billion

2021

$194.7 billion

2020

$131.5 billion

2019

$248 billion

2018

$240 billion

2017

$222.24 billion

2016

$209.3 billion

2015

$205.36 billion

2014

$207.71 billion

2013

$200.24 billion

2012

$196.11 billion

2011

$193.04 billion

2010

$174.68 billion

Application Insights

Based on application, the commercial aircraft, military aircraft, helicopters, business and general aviation, and others. Commercial aircraft segment dominated the end-use segmentation in 2022. the commercial aircraft market benefits from a judicious blend of composite materials and aluminum alloys. While composite materials drive advances in fuel efficiency and weight reduction, aluminum alloys continue to deliver the strength and durability required for the industry's most essential components. Together, these materials represent a harmonious combination that propels modern commercial aviation towards greater sustainability and performance.

Regional Insights

North America dominated the largest market share in 2022. In the aerospace market of North America, the integration of composite materials and aluminum alloys is pivotal for the development of cutting-edge aircraft. The region's aerospace industry, with its prominence in commercial and military aviation, relies on the unique advantages offered by these materials. Aluminum alloys, renowned for their strength and durability, have a long history in North American aerospace, with applications ranging from airframes to critical components. Simultaneously, composite materials, with their exceptional strength-to-weight ratio and corrosion resistance, have gained prominence in the pursuit of fuel efficiency and sustainability.

Key Companies & Market Share Insights

The aerospace market's competitive landscape is shaped by the dynamic interplay between composite materials and aluminum alloys, each contributing unique advantages to stay at the forefront of innovation. Aluminum alloys, valued for their historical reliability and strength, maintain a substantial presence in the aerospace industry, particularly in North America. However, the market's relentless pursuit of fuel efficiency and sustainability has prompted a surge in the use of composite materials, which offer an exceptional strength-to-weight ratio and corrosion resistance.

In September 2021, Hexel Corporation, a US-based company, announced its plans to extend its presence into Morocco, driven by the growing demand following its prosperous ventures in the North African Kingdom. This expansion initiative is expected to reach completion by 2023 and will result in Hexel doubling the size of its manufacturing facility.

In February 2022, Sovay revealed its commitment to invest in expanding its PVDF capacity in Europe, aiming to address the increasing demand for electric vehicle (EV) batteries. This strategic move further bolsters Solvay's dominant presence in the worldwide lithium-ion battery market, as the company increases its manufacturing capacity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."