- Home

- »

- Advanced Interior Materials

- »

-

Compressed Air Treatment Equipment Market Report, 2030GVR Report cover

![Compressed Air Treatment Equipment Market Size, Share & Trends Report]()

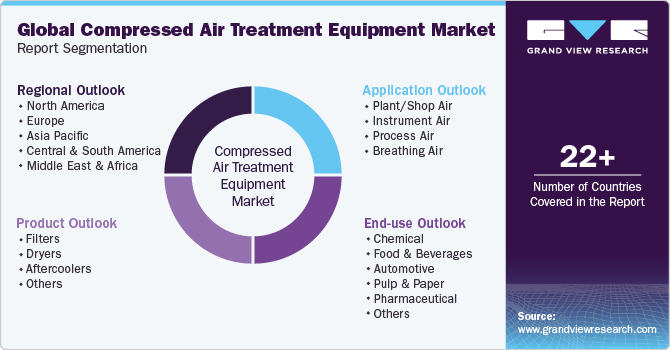

Compressed Air Treatment Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Filters, Dryers, Aftercoolers), By End Use (Chemical, Food & Beverages), By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-297-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Compressed Air Treatment Equipment Market Summary

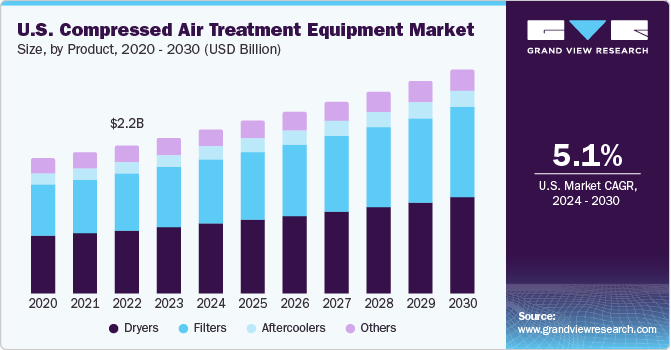

The global compressed air treatment equipment market size was valued at USD 8.88 billion in 2023 and is projected to reach USD 13.57 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. Compressed air, also known as the fourth utility, is used across diverse industrial sectors.

Key Market Trends & Insights

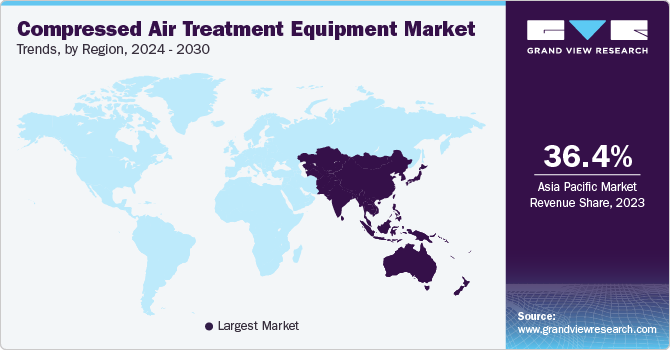

- Asia Pacific region dominated the market and accounted for 36.4% share in 2023.

- Based on product, the dryers segment led the market and accounted for 43.3% of the global revenue in 2023.

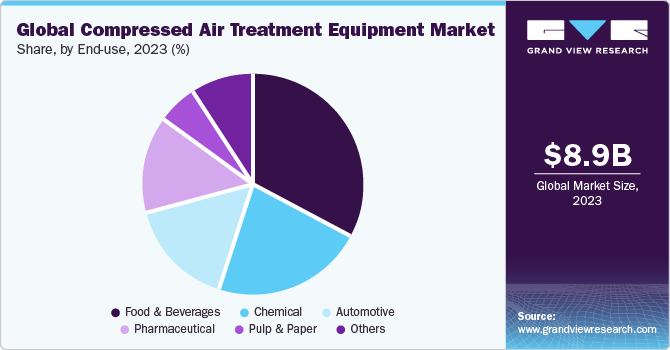

- Based on end use, the food & beverage segment led the market's global revenue in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.88 Billion

- 2030 Projected Market Size: USD 13.57 Billion

- CAGR (2024-2030): 6.3%

- Asia Pacific: Largest market in 2023

The application areas vary from untreated blow-down air to completely oil-free, sterile compressed air for the food and pharmaceutical industry. Uncertainty regarding economic conditions is expected to affect the market drastically, especially due to the spread of the new COVID-19 strain, which may force industries to impose a lockdown in the near future. Other factors affecting the market may include currency exchange rates, inflation, deflation, and credit availability.Compressed air treatment solutions improve end-use machinery performance and reliability while lowering CO2 emissions, energy consumption, and operational costs to deliver maximum manufacturing uptime. This has increased product adoption in several end-use industries, such as chemical, food & beverages, automotive, and aerospace & defense.

Compressed air treatment equipment is heavily used in manufacturing end-use industries, such as food & beverage, paper, chemical, and pharmaceutical. For instance, chemical industries usually face inefficient or disorganized storage. This issue can be resolved with storage and handling systems that are highly specific or customized toward the load.

The procedure of treating the air before it is used for the relevant application has a greater impact on the quality of compressed air than the compression itself. The equipment not only shields end-use gear from all types of impurities but also increases its performance and lengthens its lifespan by minimizing corrosion and rust, making compressed air treatment a wise decision when purchasing a compressor.

Innovation, global competition, and new technologies are the key driving factors behind the compressed air treatment industry's expansion and growth. Companies are increasingly investing in research & development to develop products that are technologically advanced, energy-efficient, and cost-effective. However, the advent of smart technologies that resonates with the Industry 4.0 revolution across the globe is anticipated to be the prominent driving factor for market growth in the next seven years. For instance, Kaeser Kompressoren has introduced the SIGMA AIR MANAGER 4.0, an advanced compressed air management system. The system helps in enhancing the reliability & efficiency of air treatment with the help of an adaptive 3-D Advanced Control system that calculates the perfect compressor combination to provide maximum energy efficiency.

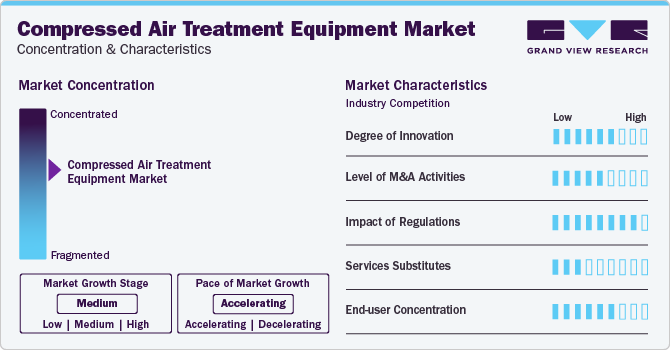

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The compressed air treatment equipment market plays a crucial role in ensuring the quality and efficiency of compressed air systems used across various industries. These systems are designed to remove impurities, moisture, and contaminants from compressed air, ultimately enhancing the performance and longevity of pneumatic equipment.

The compressed air treatment equipment market exhibits robust growth driven by the escalating demand for high-quality compressed air across diverse industries. Industries such as manufacturing, pharmaceuticals, food, and beverage, automotive, and electronics are pivotal contributors to the market's expansion. Stringent quality standards, including adherence to ISO 8573, propel the adoption of advanced filtration, drying, and condensate management systems to ensure optimal performance and longevity of pneumatic equipment.

Furthermore, energy efficiency remains a focal point, with a growing emphasis on sustainable practices, prompting the integration of energy-saving technologies and smart, connected solutions. The market is characterized by a competitive landscape, featuring global and regional players vying for market share by offering innovative, reliable, and efficient compressed air treatment solutions.

Positive trends in the market include continuous technological advancements, with manufacturers introducing energy-saving innovations such as variable speed drives and heat recovery systems. These solutions not only contribute to reducing operational costs but also align with the global focus on environmental sustainability. Additionally, the increasing awareness of the importance of clean and dry compressed air for industrial processes is driving greater adoption. The market benefits from a growing recognition of the long-term cost-effectiveness of investing in high-quality compressed air treatment equipment, as it leads to improved equipment reliability, reduced downtime, and enhanced overall system efficiency. As industries prioritize these benefits, the compressed air treatment equipment market is poised for sustained growth, offering promising opportunities for manufacturers and stakeholders alike.

Product Insights

Dryers product led the market and accounted for 43.3% of the global revenue in 2023. Refrigeration dryers operate on the principle of condensation by compressed air cooling through a refrigeration circuit. These dryers are used to eliminate water vapor in several industrial applications including food processing & packaging, chemical, paper, semiconductor manufacturing, and pharmaceutical drugs.

An aftercooler serves as a heat exchanger in turbocharged engines, positioned post-compressor to swiftly cool the discharged compressed air back to nearly ambient temperature. This essential component employs ambient air to facilitate the condensation of moisture within the compressed air, simultaneously aiding in the cooling process. The advantageous features of the aftercooler product segment are anticipated to be a significant driver for market growth throughout the forecast period.

Meanwhile, the other product segment encompasses condensate drains, along with oil/vapor separators. Condensate drains play a crucial role in minimizing wear on the distribution network and connected compressed air equipment. Specifically engineered drain technology ensures controlled condensate drainage without any unintended compressed air leakage. These distinct product offerings contribute to the overall efficiency and reliability of compressed air systems, further enhancing their appeal in the market.

Application Insights

In the realm of breathing air applications, compressed air treatment equipment is paramount for ensuring the safety and well-being of individuals in environments where clean and contaminant-free air is critical. This specialized application involves the use of advanced filtration systems, air dryers, and monitoring devices to meet stringent standards for breathing air quality. Compressed air treatment equipment plays a pivotal role in removing impurities, moisture, and potential contaminants from the compressed air, making it suitable for respiratory protection in industries such as healthcare, firefighting, and confined space operations. The emphasis on adherence to regulatory guidelines, including those set by organizations like OSHA and NFPA, underscores the importance of reliable and efficient compressed air treatment solutions to safeguard the health of personnel relying on breathing air systems.

In the context of plant/shop air applications, the compressed air treatment equipment market plays a pivotal role in ensuring the optimal performance and reliability of pneumatic systems used within industrial facilities. This specific application involves the deployment of compressed air treatment equipment in manufacturing plants, workshops, and similar settings. The primary goal is to enhance the quality of compressed air used in various pneumatic tools and machinery, contributing to improved operational efficiency and longevity of equipment.

End-use Insights

Food & beverage end-use led the market's global revenue in 2023. Food processing and pharmaceutical plants require clean rooms with zero impurities for product manufacturing. This has led to the emergence of industrial standards for compressed air treatment equipment. The most widely used standard in the market is ISO8573 which seeks to establish a method for classifying the purity of compressed air.

Compressed air treatment equipment is widely used in a variety of end-use industries such as chemical, paper, food & beverages, pharmaceutical, healthcare, and others. Chemical industries usually face inefficient or disorganized storage. This issue can be resolved with storage and handling systems that are highly specific or customized toward the load. Growing product demand owing to its high adoption in various chemical processes is expected to drive the demand.

The integration of humidity detection sensors in the air treatment system ensures the quality of end products. Growing product demand owing to the aforementioned factors is boosting their adoption across the pharmaceutical and food processing industries, thereby driving the overall sales for compressed air filtration products. Furthermore, the growing disposable income and rising Internet penetration have created shopping convenience online. This has urged the need to set up more warehouses, which would indirectly spur compressed air treatment equipment sales across the e-commerce industry. This in turn is expected to fuel the market growth over the forecast period.

Regional Insights

Asia Pacific region dominated the market and accounted for 36.4% share in 2023. The compressed air treatment equipment market in the Asia Pacific is likely to increase significantly in the future years as industrial facilities and infrastructure investment in India, China, and Japan expands. Furthermore, the increasing use of modern automation technology in various production units is likely to boost product sales. The regional food & beverage industry has been heavily impacted by compressed air treatment equipment due to the availability of leading manufacturers.

The rapidly expanding industrial, pharmaceutical, and other end-use sectors are likely to drive significant growth in the compressed air treatment equipment market in Europe over the forecast period. Compressed air treatment equipment improves the efficiency of hospital equipment and decreases rust and corrosion of surgical instruments caused by polluted air. The expanding pharmaceutical and healthcare sectors are likely to drive the market demand for compressed air treatment equipment throughout the forecast period.

The expansion of a number of food processing industries in Central and South America, coupled with increasing automation in the food and beverage sector, is likely to drive demand for compressed air treatment equipment in these industries. Additionally, the growing need for packaged foods and snacks around the globe as well as a rise in the use of clean, food-grade compressed air for tasks like bottle cleaning and spray painting are predicted to fuel market growth in this area.

Key Compressed Air Treatment Equipment Companies:

- Atlas Copco AB

- Airfilter Engineering

- Beko Technologies

- BOGE

- Chicago Pneumatic

- Sanmina Corporation

- Ingersoll-Rand

- Mann+Hummel

Recent Developments

-

In January 2023, Ingersoll Rand Inc., acquired SPX FLOW's Air Treatment business through an all-cash transaction valued at around USD 525 million. The addition of SPX FLOW's Air Treatment business brings in a synergistic product portfolio featuring energy-efficient compressed filters, air dryers, and other consumables, complementing Ingersoll Rand's core compressor product offering with a high attachment rate.

-

In November 2022, Atlas Copco completed the acquisition of Aircel, LLC, a U.S.-based company specializing in air treatment and purification solutions. The financial details of the transaction were not disclosed. Following the acquisition, Aircel, LLC will integrate into the Industrial Air division within the Compressor Technique Business Area of Atlas Copco.

Compressed Air Treatment Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.42 billion

Revenue forecast in 2030

USD 13.57 billion

Growth Rate

CAGR of 6.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Atlas Copco AB, Airfilter Engineering, BEKO TECHNOLOGIES, BOGE, Chicago Pneumatic, Compressed Air Parts Company, Donaldson Company, Inc., Gem Equipments Private Limited, Sanmina Corporation, SPX FLOW, Inc., Ingersoll Rand, KAESER KOMPRESSOREN, MANN+HUMMEL, Pentair plc, Sullair, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Compressed Air Treatment Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global compressed air treatment equipment market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Filters

-

Particulate filter/pre-filter

-

Coalescing filter/oil removal

-

Activated Carbon Filter

-

Filtered Centrifugal Separator

-

Others

-

-

Dryers

-

Refrigerated dryers

-

Desiccant air dryers

-

Membrane dryers

-

Others

-

-

Aftercoolers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Plant/Shop Air

-

Instrument Air

-

Process Air

-

Breathing Air

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Food & Beverages

-

Automotive

-

Pulp and Paper

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global compressed air treatment equipment market size was estimated at USD 8,382.0 million in 2022 and is expected to be USD 8,883.12 million in 2023.

b. The global compressed air treatment equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 13.57 billion by 2030.

b. Asia Pacific dominated the compressed air treatment equipment market with a revenue share of 36.0% in 2022. The compressed air treatment equipment market in the Asia Pacific is likely to increase significantly in the future years as industrial facilities and infrastructure investment in India, China, and Japan expands. Furthermore, the increasing use of modern automation technology in various production units is likely to boost product sales.

b. Some key players operating in the compressed air treatment equipment market include Ingersoll-Rand PLC; Parker Hannifin Corp.; and Gardner Denver, Inc.

b. Key factors that are propelling the market growth include the compressed air treatment equipment is widely used in a variety of end-use industries such as chemical, paper, food & beverages, pharmaceutical, healthcare, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.