- Home

- »

- IT Services & Applications

- »

-

Computerized Maintenance Management System Market, 2030GVR Report cover

![Computerized Maintenance Management System Market Size, Share & Trends Report]()

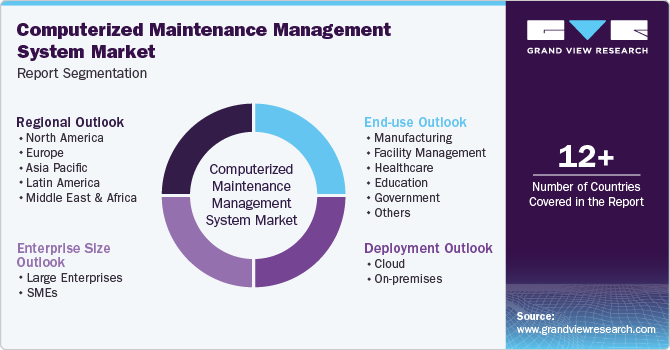

Computerized Maintenance Management System Market (2025 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud, On-premises), By Enterprise Size (Large Enterprises, SMEs), By End-use (Manufacturing, Facility Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-014-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Computerized Maintenance Management System Market Summary

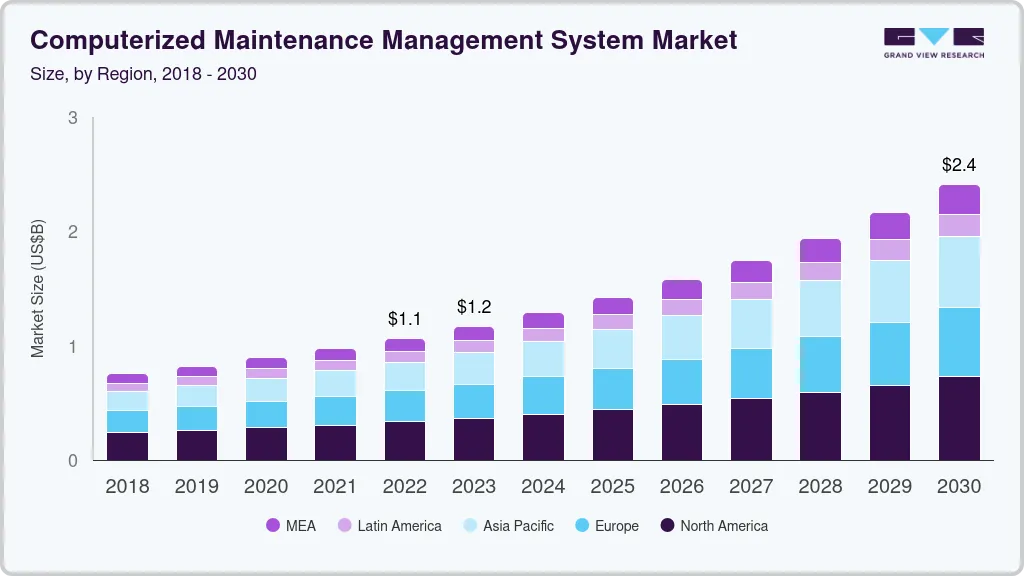

The global computerized maintenance management system market size was estimated at USD 1.29 billion in 2024 and is projected to reach USD 2.41 billion by 2030, growing at a CAGR of 11.1% from 2025 to 2030. The market rise is attributed to government spending on deployment projects, the rise of SMEs, the rapid adoption of digital services, and growing IT spending.

Key Market Trends & Insights

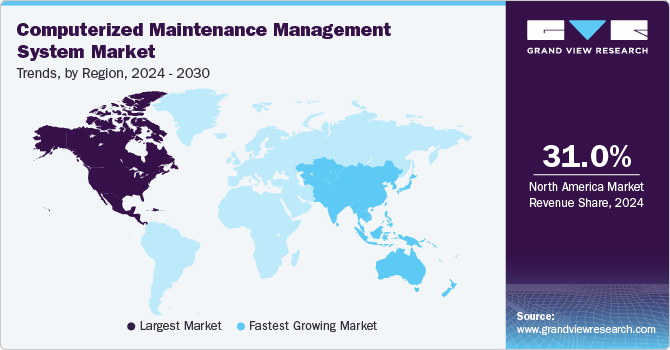

- North America computerized maintenance management system market held a largest share of around 31.0% in 2024.

- The U.S. computerized maintenance management system industry held a substantial market share in 2024.

- By deployment, the on-premises segment dominated the computerized maintenance management system industry with a revenue share of 57.0% in 2024.

- By enterprise size, the large enterprises segment dominated the computerized maintenance management system market with a revenue share of 61.0% in 2024.

- By end use, the manufacturing segment dominated the market and accounted for a revenue share of 22.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.29 Billion

- 2030 Projected Market Size: USD 2.41 Billion

- CAGR (2025-2030): 11.1%

- North America: Largest market in 2024

In addition, the emergence of new technologies such as the internet of things (IoT), artificial intelligence (AI), and analytics to offer valuable insights, cloud services, and the need for asset-intensive industries to extend asset life and delay capital investments also contribute to the market growth. Moreover, the COVID-19 pandemic led to the inability to travel and cross borders, which pushes businesses to rethink their current way of doing things, including their asset management options. Increasing compliance regulations and health and safety are also driving market growth.

Market share for cloud-based computerized maintenance management system (CMMS) has increased rapidly in recent years. Several factors facilitate the growth of cloud-based remote solutions. These driving factors include empowering companies to access the software via remote access, regular feature updates, quick implementation, low in-house IT staff requirements, and low upfront investment, among many others. Moreover, most data and assets require real-time maintenance monitoring, inventory management, and auditing.

Cloud-based software provides real-time data monitoring with the help of AI and the IoT to develop predictive analysis, minimizing human interference while providing seamlessly. The implementation of cloud-based systems continues to result in large growth for companies. For instance, in January 2022, Industrial and Financial Systems (IFS), a CMMS provider, announced its financial results for December 2021. The company witnessed a 22% growth in software revenue in 2021, with cloud revenue witnessing strong growth at a 105% increase yearly despite COVID-19. The most significant contributor to the development was the launch of the IFS cloud service in March 2021.

Furthermore, the cloud-based computerized maintenance management system (CMMS) comes equipped with a mobile CMMS system to eliminate paperwork and allows technicians to access all their tasks in real time by receiving instant notifications. It also embeds additional features such as offline operations, instant push notifications, speed-to-text diction, and QR and barcode scanners to pull up information quickly. For instance, in April 2022, MobilityWork, a CMMS software provider, introduced 3D imaging to remotely visualize a complete view of equipment in the mobile application. 3D visualization works by implementing Internet of Things (IoT) sensors.

Deployment Insights

The on-premises segment dominated the computerized maintenance management system industry with a revenue share of 57.0% in 2024. On-premises CMMS solutions are installed and managed on the organization's internal IT infrastructure, ensuring high security. The on-premise system usually requires only a one-time purchase fee while reducing costs over time. Local servers usually power on-premises solutions, which means speed can be changed and controlled, offering much-needed flexibility to all organizations.

The cloud segment is expected to grow significantly with a CAGR of 11.8% over the forecast period. Due to faster Internet speeds, cheaper database storage, and the advent of smartphones and tablets, cloud-based software is now viable. Cloud-based software offers automatic updates in the subscription, so enterprises always have the most up-to-date version of the CMMS at no additional charge. Furthermore, a cloud-based CMMS offers increased flexibility and scalability based on your current needs and bandwidth. Compared to on-premise software, cloud-based ones are much faster, and users can set up and enter the software in a significantly shorter time.

Enterprise Size Insights

The large enterprises segment dominated the computerized maintenance management system market with a revenue share of 61.0% in 2024. Large enterprises require CMMS solutions to manage preventive maintenance from the factory to warehouse machinery. Large businesses reap major benefits by implementing a CMMS, as downtime can be extremely expensive for businesses. The CMMS software can be installed at different locations in a large corporation because it can be implemented in many languages. Maintaining inventory in large enterprises can be crucial for meeting client and customer requirements on time. Therefore, with the help of CMMS software, large organizations can manage and track their inventory automatically.

The SMEs segment is expected to grow significantly with the fastest CAGR over the forecast period. Growing awareness of predictive maintenance and data-driven decision-making is a key factor driving SMEs' adoption of CMMS. With advancements in Internet of Things (IoT) and AI-powered analytics, SMEs can collect and analyze real-time data from their equipment. CMMS platforms integrated with IoT sensors can predict potential failures, suggest maintenance actions, and optimize resource allocation. This predictive approach helps SMEs reduce unplanned downtime, lower maintenance costs, and improve overall equipment effectiveness (OEE). As more SMEs recognize the benefits of data-driven maintenance strategies, the demand for CMMS solutions with advanced analytics and AI capabilities is expected to increase.

End-use Insights

The manufacturing segment dominated the market and accounted for a revenue share of 22.4% in 2024. The CMMS software helps manufacturing industries by supporting preventive maintenance strategies and reducing machinery downtime during working hours. The software tracks equipment keeps asset information and quickly finds data. It assists manufacturing plants and prevents machines and equipment from failing and breaking down. A CMMS can be essential for ensuring that the correct safety procedures are followed, and proper compliance is executed and documented.

The healthcare segment is expected to grow significantly with a CAGR of over 12.1% over the forecast period. The healthcare industry is increasingly adopting CMMS to enhance asset management, ensure regulatory compliance, improve patient safety, and optimize operational efficiency. One of the primary drivers behind CMMS adoption in healthcare is the critical need for equipment uptime and reliability. Hospitals, clinics, and other healthcare facilities rely on various medical devices, HVAC systems, and critical infrastructure to provide uninterrupted patient care. Equipment failures can result in delayed treatments, compromised patient safety, and increased operational costs. CMMS solutions help healthcare providers schedule preventive maintenance, track asset performance, and reduce the likelihood of unexpected breakdowns, ensuring that medical devices and facility equipment remain in optimal working condition.

Regional Insights

North America computerized maintenance management system market held a largest share of around 31.0% in 2024. Due to increasing technological advancements and established vendors in CMMS software, the rise of small and startup manufacturing hubs across the region is expected to drive market growth. In addition, emerging new-age technologies such as AI, edge, IoT, analytics, and cloud also play a pivotal role in the development of CMMS. The increasing use of cloud technologies and data volumes has increased the complexity of managing workloads and applications manually, contributing to the adoption of CMMS among enterprises in this region and the increased demand, specifically from oil and gas companies and other end user industries.

U.S. Computerized Maintenance Management System Market Trends

The U.S. computerized maintenance management system industry held a substantial market share in 2024. Regulatory compliance is a major factor driving CMMS adoption in the U.S., especially in healthcare, pharmaceuticals, food processing, and energy industries. Government agencies such as the Occupational Safety and Health Administration (OSHA), the Food and Drug Administration (FDA), and the Environmental Protection Agency (EPA) impose strict regulations regarding equipment maintenance, safety, and environmental standards. CMMS platforms enable organizations to maintain detailed maintenance records, track inspections, and generate compliance reports automatically. This helps businesses avoid fines, maintain operational transparency, and ensure equipment meets safety and quality standards. The growing complexity of regulatory requirements is prompting organizations to invest in CMMS solutions to streamline compliance management.

Europe Computerized Maintenance Management System Market Trends

The computerized maintenance management system industry in Europe is anticipated to register considerable growth from 2025 to 2030. Expanding infrastructure projects across Europe are also fueling the adoption of CMMS solutions. Governments and private enterprises invest heavily in modernizing transportation networks, utilities, and public facilities, requiring extensive maintenance. Smart city initiatives across Europe further emphasize the role of CMMS in managing infrastructure sustainability. As urbanization continues and infrastructure projects grow in scale, the need for efficient maintenance management solutions is expected to rise, driving demand for CMMS software.

The UK computerized maintenance management system market is expected to grow rapidly during the forecast period. The rise of remote and mobile workforce management contributes to the growth of the CMMS market in the UK With an increasing number of field service teams and distributed maintenance operations, businesses require flexible solutions that allow employees to manage maintenance tasks on the go. Cloud-based CMMS platforms with mobile applications enable technicians to receive work orders, update maintenance logs, and access asset history in real-time from any location. This capability improves response times, enhances team communication, and ensures operations continuity, particularly in industries like utilities, transportation, and facility management.

The computerized maintenance management system market in Germany held a substantial market share in 2024. The growing adoption of mobile CMMS solutions is shaping the German market. Many industries, particularly facility management, logistics, and utilities, require maintenance teams to operate in multiple locations or perform field-based maintenance. Cloud-based CMMS with mobile access enables technicians to receive real-time work orders, update maintenance records, and access equipment data from any location. This mobile accessibility improves communication among maintenance teams, reduces response times for urgent repairs, and enhances overall workforce productivity.

Asia Pacific Computerized Maintenance Management System Market Trends

Asia Pacific region is expected to register the fastest CAGR of 12.3% during the forecast period, due to the growing demand for computerized maintenance management systems (CMMS) in Japan, China, and India. Additionally, the governments in many Asian Pacific countries are continuously focusing on investing in cloud and related ICT technologies to enhance digital transformation across industries, which would drive the market's growth. Furthermore, growing awareness among end-users about CMMS is expected to create new opportunities for the market in the Asia Pacific.

The India computerized maintenance management systemmarket is expected to grow rapidly during the forecast period. Indian industries are increasingly integrating automation, IoT, and AI-driven analytics into their operations to enhance efficiency. When integrated with IoT sensors, CMMS software enables real-time predictive maintenance by monitoring equipment health. This shift from reactive to predictive maintenance helps businesses reduce unexpected equipment failures, extend asset lifespans, and minimize production losses. The government's "Make in India" initiative also drives industrial modernization, prompting enterprises to adopt advanced maintenance solutions like CMMS to remain competitive in global markets.

The computerized maintenance management system market in China held a substantial market share in 2024. The growth of China’s energy and utility sector is fueling the demand for CMMS solutions. The country heavily invests in renewable energy projects, including solar, wind, and hydroelectric power. These projects require robust asset management systems to ensure the reliability and efficiency of power generation equipment. CMMS helps utility companies schedule regular inspections, track asset performance, and optimize maintenance strategies to prevent unexpected failures. As China aims to achieve carbon neutrality by 2060, CMMS solutions play a crucial role in improving the efficiency and sustainability of energy production.

Key Computerized Maintenance Management System Company Insights

Some of the key players operating in the market include IBM, Accruent, and TMA Systems.

- TMA Systems is a global provider of facility management software solutions. Specializing in Computerized Maintenance Management Systems (CMMS) and Enterprise Asset Management (EAM) solutions, TMA Systems serves various industries, including healthcare, education, manufacturing, government, and more. The company's software solutions are designed to optimize maintenance, facility operations, and asset management, helping organizations improve operational efficiency, reduce costs, and extend the lifespan of their assets. TMA Systems also provides specialized solutions for different industries, such as healthcare facilities, universities, government buildings, and manufacturing plants.

Fiix Inc., Limble CMMS, and Accruent are some of the emerging participants in the target market.

- Limble CMMS is a cloud-based software platform that simplifies maintenance management for organizations across various industries. This software helps businesses improve the efficiency of their maintenance operations, reduce downtime, optimize asset management, and increase overall operational performance. Limble CMMS is designed to support the manufacturing, healthcare, hospitality, education, and facilities management industries.

Key Computerized Maintenance Management System Companies:

The following are the leading companies in the computerized maintenance management system market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Facilio.Inc.

- Fiix Inc.

- Eptura

- Limble CMMS

- Accruent

- TMA Systems

- MicroMain Corp

- Parafernalia, Lda.

- Fluke Corporation

Recent Developments

-

In January 2025, TMA Systems, a global enterprise asset and computerized maintenance management systems (CMMS) provider, secured a new cooperative purchasing contract with Sourcewell, a renowned cooperative purchasing organization. This collaboration will allow North American government, educational, and nonprofit entities to easily access TMA’s top-tier maintenance management solutions through a streamlined procurement process.

-

In March 2024, Parafernalia, Lda. partnered with Hexastate, an AI-driven company specializing in industrial equipment maintenance. This collaboration is designed to offer customers a complete, integrated predictive maintenance solution. By implementing this new platform in highly automated plants, equipment availability will be further improved through human-free monitoring resources. With this partnership, industrial maintenance teams can leverage AI to track the health and performance of their assets, receiving early alerts about potential failures or anomalies directly through their comma CMMS system.

Computerized Maintenance Management System Market Report Scope

Report Attribute

Details

Market size value In 2025

USD 1.42 billion

Revenue forecast In 2030

USD 2.41 billion

Growth rate

CAGR of 11.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

IBM; Facilio.Inc.; Fiix Inc.; Eptura; Limble CMMS; Accruent; TMA Systems; MicroMain Corp; Parafernalia, Lda.; Fluke Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computerized Maintenance Management System Market Report Segmentation

This report forecasts revenue growths at the global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global computerized maintenance management system market report based on deployment, enterprise size, end use, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Facility Management

-

Healthcare

-

Education

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global computerized maintenance management system market size was estimated at USD 1.29 billion in 2024 and is expected to reach USD 1.42 billion in 2025.

b. The global computerized maintenance management system market is expected to witness a compound annual growth rate of 11.1% from 2025 to 2030 to reach USD 2.41 billion by 2030.

b. North America held the largest share of over 31.0% in 2024. Due to increasing technological advancements and established vendors in CMMS software, the rise of small and startup manufacturing hubs across the region is expected to drive market growth.

b. Key industry players operating in the CMMS market include IBM, Facilio.Inc, Fiix Inc., Eptura, Limble CMMS, Accruent, TMA Systems, MicroMain Corp, Parafernalia, Lda., Fluke Corporation

b. The market rise is attributed to government spending on infrastructure projects, the rise of SMEs, the rapid adoption of digital services, and growing IT spending. In addition, the emergence of new technologies such as the internet of things (IOT), artificial intelligence (AI), and analytics to offer valuable insights, cloud services, and the need for asset-intensive industries to extend asset life and delay capital investments also contribute to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.