- Home

- »

- Advanced Interior Materials

- »

-

Concrete Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Concrete Market Size, Share & Trends Report]()

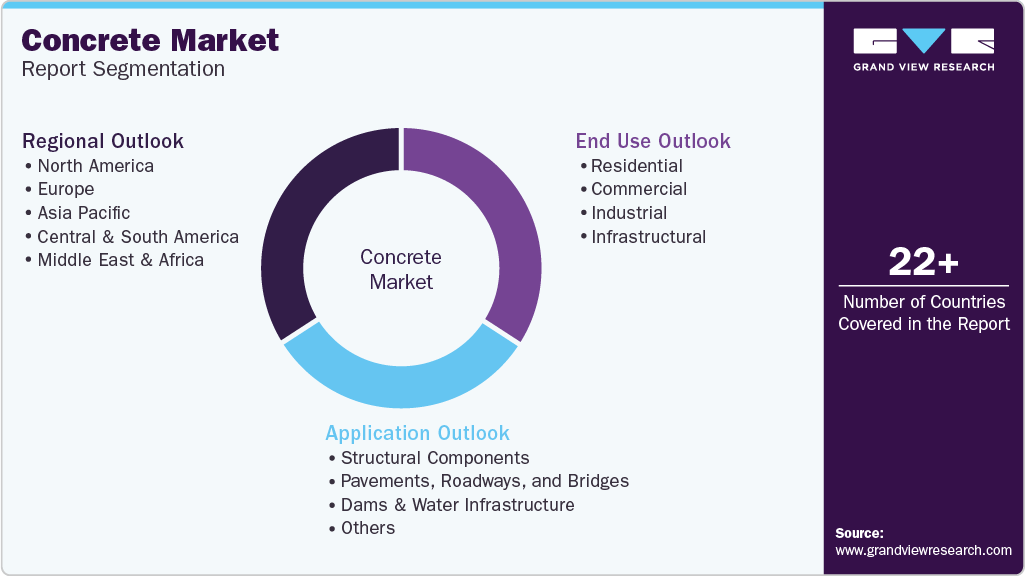

Concrete Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Structural Components, Pavements, Roadways, Bridges), By End Use (Residential, Commercial, Industrial, Infrastructural), By Region (North America), And Segment Forecasts

- Report ID: GVR-4-68040-585-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Concrete Market Summary

The global concrete market size was estimated at USD 1.82 billion in 2024 and is anticipated to reach USD 2.28 billion by 2030, growing at a CAGR of 3.8% from 2025 to 2030. The growth is driven by the rapid pace of urbanization and industrialization across developing economies.

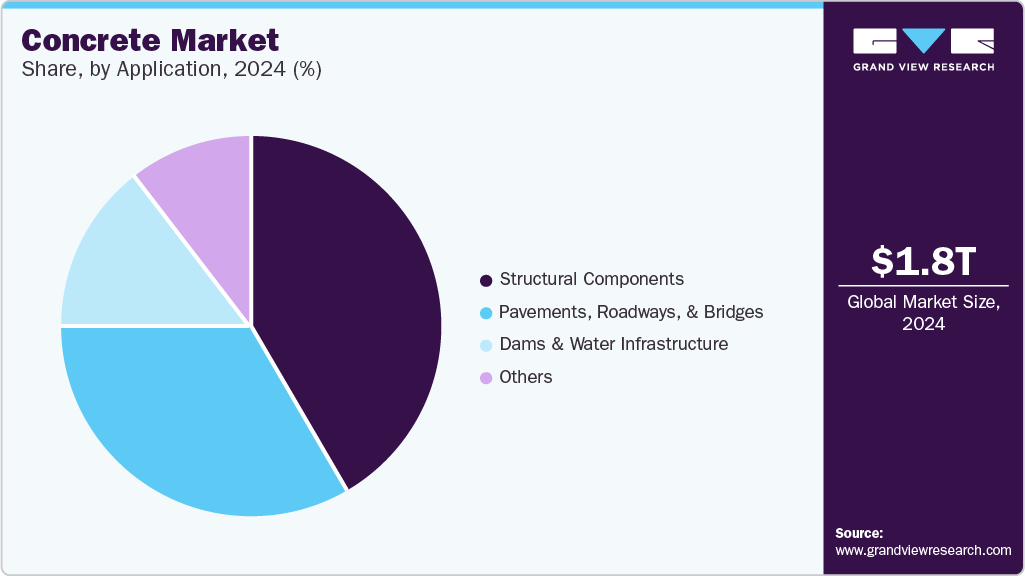

Key Market Trends & Insights

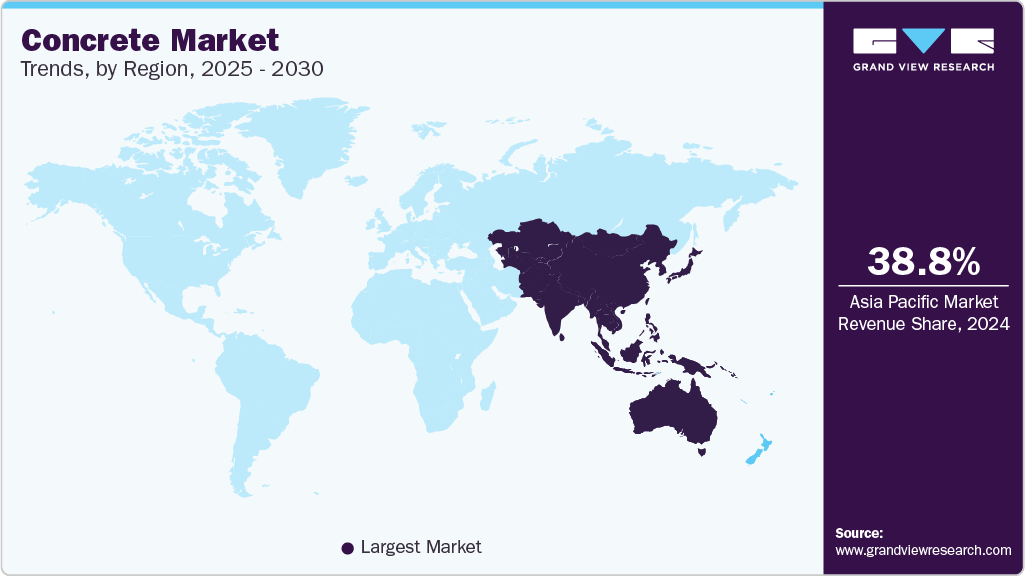

- Asia Pacific dominated the concrete market and accounted for the largest revenue share of about 38.8% in 2024.

- By application, the structural components segment accounted for the largest revenue share of 41.7% in 2024.

- By end-use, the residential segment accounted for the largest revenue share of 38.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.82 Billion

- 2030 Projected Market Size: USD 2.28 Billion

- CAGR (2025-2030): 3.8%

- Asia Pacific: Largest market in 2024

Governments are investing heavily in public infrastructure and affordable housing schemes, creating a sustained need for high-performance construction materials. As concrete remains a fundamental building component due to its strength, durability, and cost-efficiency, it continues to experience robust demand in these emerging markets.

Governments are investing heavily in public infrastructure and affordable housing schemes, creating a sustained need for high-performance construction materials. As concrete remains a fundamental building component due to its strength, durability, and cost-efficiency, it continues to experience robust demand in these emerging markets.

The expansion of the global construction industry, particularly in commercial and industrial sectors, also propels the demand for concrete. The rise of smart cities, the proliferation of high-rise buildings, and increased investment in energy-efficient infrastructure are driving the use of advanced concrete types such as ready-mix concrete, precast concrete, and high-strength concrete. These specialized products cater to the evolving requirements of modern construction, including speed of execution, aesthetic appeal, and structural integrity. Moreover, the growing emphasis on resilience in building materials to withstand natural disasters and climate variability reinforces the importance of concrete in contemporary construction practices.

Another key driver of the concrete market is the increasing adoption of sustainable and high-performance concrete solutions. With growing environmental concerns and regulatory pressure to reduce carbon emissions, construction companies are turning toward green concrete alternatives that utilize supplementary cementitious materials such as fly ash, slag, and silica fume. These materials not only enhance the performance and lifespan of concrete but also contribute to lower environmental impact. The development of carbon capture technologies and innovations in cement production further support the shift toward eco-friendly concrete, fostering market growth.

Market Concentration & Characteristics

The global concrete market exhibits moderate to high market concentration, with several major players operating alongside a fragmented base of regional and local manufacturers. The degree of innovation in the sector remains steady, primarily focused on enhancing the durability, sustainability, and environmental performance of concrete materials. Technological advancements such as self-healing concrete, ultra-high-performance concrete, and carbon-capturing formulations are gaining traction as environmental regulations grow more stringent. While innovation is gradually transforming product characteristics, the rate of breakthrough technologies remains measured due to the industry's heavy dependence on traditional methods and large-scale infrastructure compatibility.

Mergers and acquisitions play a significant role in shaping the competitive dynamics of the concrete industry. Companies are increasingly pursuing strategic alliances to expand geographical reach and optimize supply chains. Regulatory frameworks have a profound influence on the market, particularly environmental and building codes that push for sustainable practices and materials. The threat from service substitutes is minimal due to the irreplaceable structural properties of concrete in construction. However, alternative materials like cross-laminated timber (CLT) are being explored for specific applications. End-user concentration is moderately high, with the construction industry comprising residential, commercial, and infrastructure sectors dominating demand, especially in emerging economies experiencing urbanization and industrial growth.

Application Insights

The structural components segment led the market and accounted for the largest revenue share of 41.7% in 2024, driven by the rapid expansion of infrastructure development projects worldwide. Governments and private sector entities are heavily investing in the construction of bridges, highways, tunnels, airports, and public buildings, all of which require durable and load-bearing materials. Concrete, known for its high compressive strength, versatility, and longevity, remains a material of choice for these applications. This has led to consistent demand across both developed and emerging economies, particularly in regions experiencing accelerated urbanization and modernization of existing infrastructure.

The pavements, roadways, and bridges segment is expected to grow at the fastest CAGR of 4.2% over the forecast period. This growth is driven by the increasing demand for durable and sustainable infrastructure to support growing urbanization and economic development worldwide. Governments and private sectors are investing heavily in the construction and renovation of transportation networks to improve connectivity and reduce traffic congestion. Concrete’s inherent strength, longevity, and low maintenance requirements make it the preferred material for these applications, particularly in environments subject to heavy traffic loads and harsh weather conditions. Additionally, advancements in concrete technology, such as high-performance and fiber-reinforced concrete, enhance the structural integrity and lifespan of pavements and bridges, further driving market growth in this segment.

End Use Insights

The residential segment dominated the concrete industry and accounted for the largest revenue share of 38.4% in 2024, driven by increasing urbanization and rising population levels, which fuel the demand for new housing developments and infrastructure. Rapid growth in urban areas, particularly in emerging economies, has led to a surge in the construction of apartments, villas, and residential complexes, thereby boosting concrete consumption. Additionally, government initiatives focused on affordable housing and urban renewal projects are significant contributors, encouraging large-scale residential construction activities that require durable and cost-effective building materials like concrete.

The infrastructural segment is expected to grow at the fastest CAGR of 4.9% over the forecast period, driven by escalating investments in public infrastructure projects worldwide. Governments across both developed and developing regions are prioritizing the development and modernization of transportation networks, including roads, bridges, tunnels, railways, and airports. These large-scale projects demand vast quantities of concrete due to its strength, durability, and cost-effectiveness, making it the preferred material for infrastructure construction. Additionally, the rising focus on urbanization and smart city initiatives further propels the need for robust infrastructure, increasing concrete consumption to support sustainable and resilient urban development.

Regional Insights

Asia Pacific dominated the concrete market and accounted for the largest revenue share of about 38.8% in 2024, driven by rapid urbanization and industrialization across emerging economies such as India, China, and Southeast Asian nations. Massive infrastructure projects, including smart cities, highways, and public transit systems, are fueling demand for concrete. Additionally, government initiatives focused on affordable housing and sustainable construction practices are promoting the use of innovative concrete materials and technologies. The growing population and rising disposable incomes are also contributing to increased construction activities, further boosting concrete consumption in the region.

China’s concrete market growth is propelled by its continuous focus on large-scale infrastructure development and urban renewal programs. The government’s commitment to expanding transportation networks, such as high-speed railways and expressways, is driving high volumes of concrete demand. Furthermore, environmental regulations encouraging the use of eco-friendly and energy-efficient construction materials are leading to innovations in concrete formulations. The rapid expansion of commercial and residential real estate sectors also plays a significant role in supporting the market’s growth trajectory.

North America Concrete Market Trends

The North America concrete industry is supported by significant investments in repairing and upgrading aging infrastructure, including roads, bridges, and public utilities. Government funding through infrastructure stimulus packages is a key driver, stimulating demand for durable and resilient construction materials like concrete. Additionally, the rising adoption of advanced concrete technologies, such as high-performance and self-healing concrete, is enhancing the market’s growth. The commercial construction sector, buoyed by urban development and industrial projects, further propels the market in this region.

U.S. Concrete Market Trends

The U.S. concrete industry benefits from robust infrastructure spending driven by federal and state government initiatives aimed at revitalizing deteriorating transport systems and public facilities. The increased focus on sustainable building practices and green construction is encouraging the adoption of eco-friendly concrete variants. Moreover, growth in the residential sector, supported by low mortgage rates and population migration to urban and suburban areas, stimulates concrete demand. Industrial construction projects, particularly in energy and manufacturing, also contribute to market expansion.

Europe Concrete Market Trends

Europe’s concrete industry growth is largely influenced by stringent environmental regulations that promote the use of sustainable and low-carbon concrete solutions. The region is witnessing steady infrastructure investments, especially in transportation and renewable energy projects, which demand high-quality concrete materials. Urban regeneration and smart city projects in major European countries are further driving concrete consumption. Additionally, the restoration of heritage buildings and seismic retrofitting initiatives add to the infrastructural concrete demand.

Germany’s concrete market is driven by its strong emphasis on sustainable construction and energy-efficient building standards. Government policies encouraging the reduction of carbon footprints in the construction sector have accelerated the development and use of innovative concrete mixes. The country’s focus on expanding transport infrastructure, including rail and road networks, supports consistent concrete demand. Moreover, investments in industrial and commercial construction projects, along with residential housing developments, underpin the market’s growth.

Latin America Concrete Market Trends

Latin America’s concrete industry growth is fueled by increasing urbanization and government initiatives to improve public infrastructure and housing. Investments in road construction, airports, and energy projects, especially in countries like Brazil and Mexico, drive concrete consumption. Economic development and rising foreign direct investment in construction sectors also contribute to market expansion. Furthermore, efforts to enhance disaster-resilient infrastructure due to the region’s susceptibility to natural calamities boost demand for durable concrete solutions.

Middle East & Africa Concrete Market Trends

The Middle East & Africa concrete industry is propelled by large-scale infrastructure and real estate developments, including commercial complexes, airports, and transport networks, particularly in Gulf Cooperation Council (GCC) countries. Government-led mega projects and diversification efforts away from oil dependency stimulate construction activities, driving concrete demand. Additionally, the adoption of advanced concrete technologies to withstand harsh climatic conditions is gaining traction. Urban population growth and investments in affordable housing projects further support the market’s expansion across the region.

Key Concrete Company Insights

Some of the key players operating in the market include CEMEX S.A.B. de C.V. and China Petroleum & Chemical Corporation (Sinopec)

-

CEMEX is a global building materials company that offers a range of construction Applications, including Concrete. Their Concrete solutions are designed to meet various performance requirements, with Applications like VIALOW, a low-temperature Concrete that allows quicker reopening of roads post-construction. VIALOW also offers reduced carbon emissions, aligning with sustainable construction practices.

-

Sinopec is a major integrated energy and chemical company in China, engaged in the application and supply of various petroleum Applications, including Concrete. Their Concrete Applications are used extensively in road construction and maintenance across China. Sinopec's Concrete offerings cater to different climatic and traffic conditions, ensuring durability and performance.

Exxon Mobil Corporation, Marathon Petroleum Corporation are some of the emerging participants in the concrete market.

-

ExxonMobil is a leading global energy company with a significant presence in the Concrete market. They produce a variety of Concrete Applications, including Performance Graded (PG) concretes like PG 46-34, suitable for road construction. Their Concrete blendstocks are derived from selected crude oils through controlled refining processes, ensuring consistent quality for paving and industrial applications.

-

Marathon Petroleum is the largest Concrete producer in the United States, offering a comprehensive range of Concrete Applications. Their portfolio includes Concrete cements, polymer-modified Concretes, emulsified Concretes, and industrial Concretes. These Applications are utilized in various applications, from paving to roofing, and are distributed through an extensive network across the U.S.

Key Concrete Companies:

The following are the leading companies in the concrete market. These companies collectively hold the largest market share and dictate industry trends.

- CEMEX, S.A.B. de C.V.

- CRH

- Forterra

- Heidelbergcement AG

- Holcim

- Shay Murtagh Precast Ltd

- Sika AG

- Votorantim S.A.

- Weckenmann Anlagentechnik GmbH & Co. KG

- Wells Concrete

Recent Developments

- In August 2023, Cemex España took a strategic step to bolster its position in the Concrete market by acquiring two additional quarries near Madrid. This move significantly strengthens the company’s limestone reserves, a key raw material in concrete application. With enhanced access to high-quality aggregates, Cemex aims to support infrastructure development and meet growing demand for road construction materials.

Concrete Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.89 billion

Revenue forecast in 2030

USD 2.28 billion

Growth rate

CAGR of 3.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

CEMEX, S.A.B. de C.V.; CRH plc; Forterra plc; HeidelbergCement AG; Holcim Ltd; Shay Murtagh Precast Ltd; Sika AG; Votorantim S.A.; Weckenmann Anlagentechnik GmbH & Co. KG; Wells Concrete

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Concrete Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Concrete market report based on application, end use and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Structural Components

-

Pavements, Roadways, and Bridges

-

Dams & Water Infrastructure

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Infrastructural

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global concrete market size was estimated at USD 1.82 billion in 2024 and is expected to reach USD 1.89 billion in 2025.

b. The global concrete market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 2.28 billion by 2030.

b. The structural components segment led the market and accounted for the largest revenue share of 41.47% in 2024, driven by the rapid expansion of infrastructure development projects worldwide.

b. Some of the prominent companies in the concrete market include CEMEX, S.A.B. de C.V., CRH plc, Forterra plc, HeidelbergCement AG, Holcim Ltd, Shay Murtagh Precast Ltd, Sika AG, Votorantim S.A., Weckenmann Anlagentechnik GmbH & Co. KG, and Wells Concrete.

b. Key factors driving the concrete market include rapid urbanization and infrastructure development, particularly in emerging economies, which are increasing the demand for roads, highways, and airports.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.