- Home

- »

- Plastics, Polymers & Resins

- »

-

Concrete Superplasticizer Market Size, Industry Report, 2033GVR Report cover

![Concrete Superplasticizer Market Size, Share & Trends Report]()

Concrete Superplasticizer Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Polycarboxylate Ether (PCE) Based, Modified Lignosulphonates (MLS)), By Application (Ready Mix-Concrete, High Performance Concrete), By Form, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-626-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Concrete Superplasticizer Market Summary

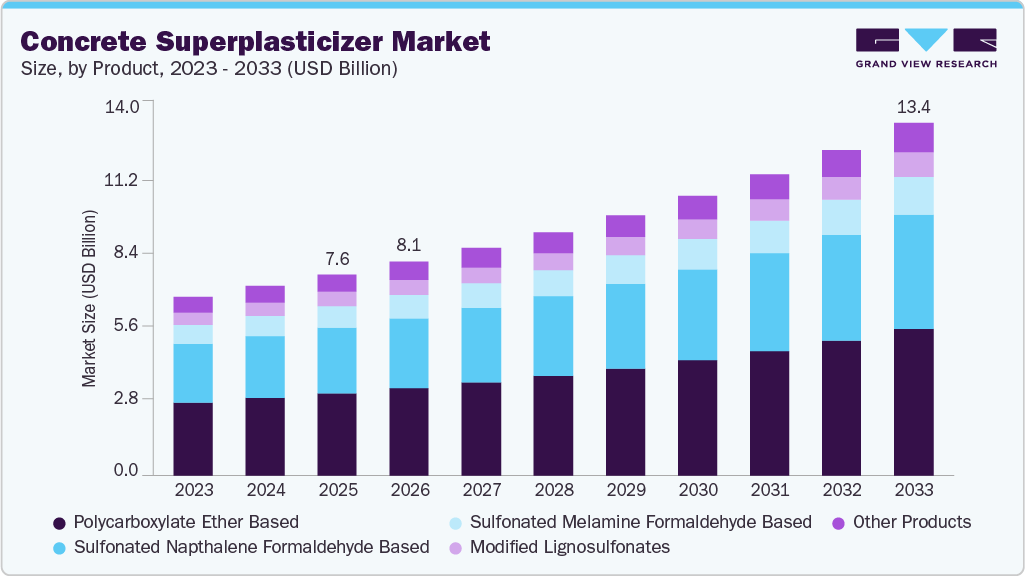

The global concrete superplasticizer market size was estimated at USD 7,634.58 million in 2025 and is projected to reach USD 13,389.6 million by 2033, growing at a CAGR of 7.4% from 2026 to 2033. The market growth is primarily driven by factors such as the increasing demand for high-performance concrete in infrastructure and real estate development.

Key Market Trends & Insights

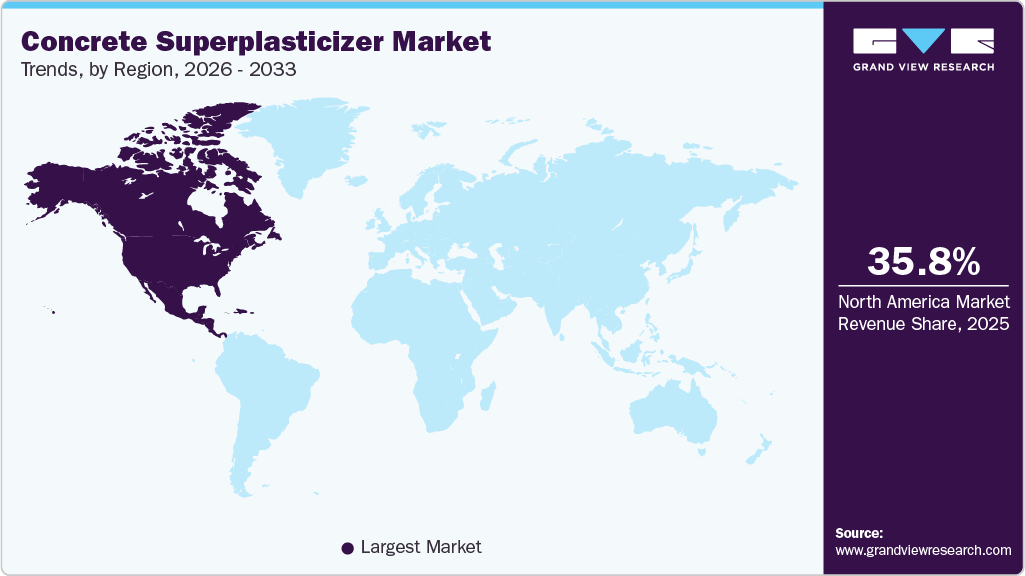

- North America dominated the global concrete superplasticizer industry with the largest revenue share of 35.8% in 2025.

- The concrete superplasticizer industry in the U.S. is expected to grow at a substantial CAGR of 7.0% from 2026 to 2033.

- By product, the Modified Lignosulfonates (MLS) segment is expected to grow at a considerable CAGR of 7.8% from 2026 to 2033 in terms of revenue.

- By application, the high-performance concrete segment is expected to grow at a considerable CAGR of 7.6% from 2026 to 2033 in terms of revenue.

- By form, the liquid segment led the market and accounted for the largest revenue share of 70% in 2025 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 7,634.58 Million

- 2033 Projected Market Size: USD 13,389.6 Million

- CAGR (2026-2033): 7.4%

- North America: Largest market in 2025

This demand is fueled by urbanization, rising infrastructure projects, and the need for durable, resilient structures. In addition, environmental regulations encouraging reduced water-cement ratios in concrete production further boost superplasticizer adoption.The global concrete superplasticizer industry is driven by a combination of rapid urbanization, growing infrastructure investments, and evolving construction technologies. As cities expand and megaprojects emerge across transportation, housing, and industrial sectors, there is rising demand for high-performance concrete that offers superior strength, workability, and durability. Superplasticizers particularly Polycarboxylate Ether (PCE)-based types are essential in producing such concrete, enabling low water-to-cement ratios without compromising performance.

Environmental regulations and climate commitments are also influencing material choices. Countries are increasingly promoting low-carbon construction through mandates and certifications. Leadership in Energy and Environmental Design (LEED) and Building Research Establishment Environmental Assessment Method (BREEAM) standards have accelerated the use of admixtures that reduce concrete’s carbon footprint. Furthermore, the integration of Automated Batching Systems, Precast Construction, and 3D Concrete Printing is fueling demand for admixtures that deliver consistency and adaptability. In this evolving landscape, superplasticizers are not just performance enhancers they are enablers of sustainable, efficient, and future-ready construction practices.

Despite strong growth potential, the concrete superplasticizer industry faces challenges such as fluctuating raw material prices and limited availability of high-quality inputs, which can affect production costs. Compatibility issues between admixtures and certain types of cement or aggregates can lead to performance inconsistencies. Moreover, small-scale contractors in developing regions may lack technical know-how or willingness to adopt high-performance admixtures. Regulatory barriers and concerns about long-term durability or chemical interactions in complex mix designs may also restrain broader market penetration.

The market presents significant opportunities through the growing emphasis on green construction and the rising number of LEED-certified and sustainable building projects. Advancements in eco-friendly superplasticizer technologies, particularly those derived from renewable sources or bio-based polymers, offer potential for differentiation. Expansion into underserved markets in Asia, Africa, and Latin America, where urbanization and infrastructure needs are rising, creates new avenues for growth.

Market Concentration & Characteristics

The global concrete superplasticizer industry is moderately concentrated, with key players such as Sika AG, Fosroc, Inc., MAPEI S.p.A., and Arkema dominating due to their strong product portfolios, technical expertise, and global reach. These companies offer advanced admixtures tailored to specific concrete applications, with polycarboxylate ether (PCE) superplasticizers leading due to superior water-reduction and workability. Market consolidation is notable, with mergers and acquisitions enabling large firms to expand regional footprints, increase manufacturing capacity, and enhance innovation through R&D synergies.

The market is innovation-driven, characterized by the development of high-performance, eco-friendly admixtures to meet evolving construction standards and sustainability goals. Liquid formulations are widely adopted in ready-mix and precast concrete, while powder types serve dry-mix or remote applications. Asia-Pacific leads market demand due to rapid urbanization and infrastructure growth, while Europe and North America emphasize environmental compliance and advanced concrete technologies. Overall, the market’s evolution is shaped by product specialization, global expansion, and green construction trends.

Product Insights

The polycarboxylate ether (PCE) based segment led the market and accounted for the largest revenue share of 40.8% in 2025. This growth is driven primarily due to its superior dispersing ability, high water reduction potential, and enhanced workability retention in concrete. PCE-based superplasticizers are particularly suitable for high-performance and self-compacting concrete, meeting the evolving demands of sustainable construction practices. Their compatibility with low water-to-cement ratio mixes and reduced setting times makes them the preferred choice in infrastructure and commercial construction projects.

The modified lignosulfonates (MLS) segment is expected to grow fastest with a CAGR of 7.7% from 2026 to 2033. Its increasing adoption is attributed to its cost-effectiveness, renewable origin, and improvements in performance through chemical modification. MLS-based superplasticizers offer reasonable water reduction and dispersion in concrete while being biodegradable and environmentally friendly. These characteristics make them suitable for mass and general-purpose concrete applications in price-sensitive regions and for projects emphasizing sustainability and reduced carbon impact.

Form Insights

The liquid segment dominated the market with a revenue share of 70% in 2025. This dominance is attributed to the ease of mixing, precise dosing capabilities, and compatibility with automated batching systems in large-scale concrete operations. Liquid superplasticizers are favored in commercial ready-mix, precast, and infrastructure projects due to their reliability, fast dispersion, and adaptability across climatic conditions. Their flowability and fast action ensure uniform performance in concrete mixes, contributing to widespread use in both developing and developed construction markets.

The growth of the powder segment is attributed to the increasing use in dry-mix concrete, remote construction sites, and markets where liquid admixture logistics are limited. Powder superplasticizers offer longer shelf life, reduced transportation costs, and ease of storage without the need for special handling. They are often used in precast elements, packaged mortar mixes, and export-ready concrete products. With advances in formulation, powder-based PCEs and lignosulfonates are becoming more competitive in performance, driving their gradual penetration into infrastructure and residential projects.

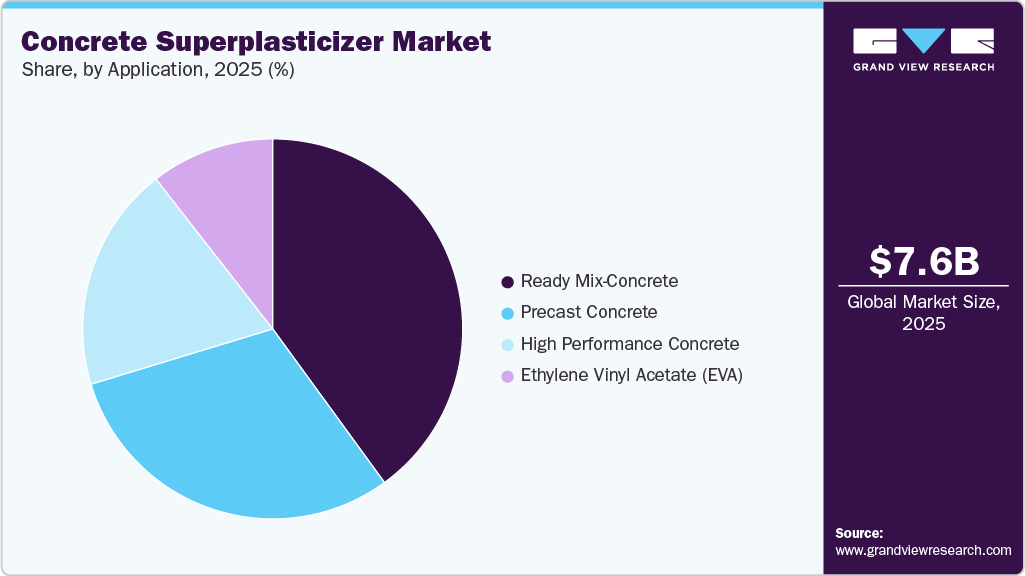

Application Insights

The ready mix-concrete segment led the market and accounted for the largest revenue share of 40.0% in 2025. This growth is driven primarily due to the rising demand for consistent quality, reduced on-site labor, and faster construction cycles. Superplasticizers in ready-mix applications allow for extended workability and superior flow, especially important in urban settings with long transportation distances. The segment benefits from infrastructure development projects, growing urbanization, and industrial construction, where precise batching and placement efficiency are paramount.

The high performance concrete segment is expected to grow fastest, with a CAGR of 7.5% from 2026 to 2033 during the forecast period. This growth is driven by increasing demand for durable, high-strength, and chemically resistant concrete in critical infrastructure, high-rise buildings, and transportation projects. Superplasticizers used in this segment enable reduced cement usage, enhanced workability at low water content, and long-term performance. This segment is particularly influenced by green building codes, durability standards, and the adoption of advanced construction technologies.

Regional Insights

North America concrete superplasticizer industry dominated the global landscape with a revenue share of 35.9% in 2025. This is primarily attributed to the region's robust demand due to robust infrastructure investments and rising demand for high-performance concrete in highways, bridges, and urban developments. The region’s growth is supported by the widespread adoption of automated batching systems and an increasing focus on sustainability, particularly in LEED-certified projects. The U.S. leads the region, leveraging superplasticizers to optimize water usage and enhance concrete durability.

Canada’s concrete superplasticizer industry is expanding through residential and industrial development, while Mexico benefits from infrastructure modernization and cross-border construction activity. Across the region, there is consistent demand for liquid superplasticizers in ready-mix, precast, and large-scale infrastructure projects. Major chemical producers are ramping up local manufacturing and R&D capabilities to meet evolving performance standards and regulatory expectations.

U.S. Concrete Superplasticizer Market Trends

The U.S. concrete superplasticizer industry is mature yet dynamic, anchored by significant infrastructure investments, automation in concrete production, and increasing need for high-performance admixtures. Public initiatives targeting highway, bridge, and water system upgrades are driving demand. The adoption of automated batching systems and sustainability standards further boosts usage of liquid superplasticizers for ready-mix and precast applications. Domestic producers and global majors are scaling local production and tailoring formulations to meet stringent environmental and performance criteria.

Asia Pacific Concrete Superplasticizer Market Trends

The Asia Pacific concrete superplasticizer industry is expected to grow fastest with a CAGR of 7.7 % during the forecast period. It is experiencing rapid growth, fueled by rapid urbanization, extensive infrastructure initiatives, and booming residential and commercial construction. Countries like China and India are significant consumers, deploying advanced admixtures for sustainable, high-strength concrete.

Japan and South Korea focus on high-performance and sustainable concrete technologies. Southeast Asian nations also contribute to growth through industrial and logistics construction, often leveraging cost-effective local manufacturing. Local manufacturers pair global innovation with cost-effective production, targeting affordable housing and transport projects. The result is strong expansion in admixture technologies and widening adoption of eco-friendly formulations.

China concrete superplasticizer industry is propelled by fast-paced urbanization, infrastructure expansion, and government-supported sustainability efforts. Rapid deployment of metro, housing, and highway projects generates strong demand for advanced admixtures. PCE-type solutions, enhanced through molecular innovation, are reshaping local admixture standards. Leading chemical firms maintain a strong presence through integrated domestic production and export operations. China’s focus on eco-conscious construction reinforces continued market growth and supports manufacturing that aligns with global green cement trends.

Europe Concrete Superplasticizer Market Trends

Europe concrete superplasticizer industry accounted for the second largest revenue share of 32.1% in 2025. Europe's market is driven by green construction regulations, environmental targets, and structural modernization projects. The EU’s Green Deal encourages reduced cement usage and the adoption of advanced admixtures for carbon-efficient concrete. Germany and France, in particular, invest heavily in domestic admixture production and battery-related infrastructure. European admixture players emphasize eco-conscious formulations and technical services to meet strict performance and environmental standards across both new and retrofit construction.

Germany concrete superplasticizer industry growth is driven by stringent building codes and sustainable construction mandates. The country emphasizes high-quality admixtures to deliver water-saving, durable, and carbon-efficient concrete, particularly in battery plants, infrastructure extensions, and residential retrofits. Collaboration between government, research institutes, and industry boosts innovation in eco-friendly admixtures. With a strong network of local producers and technical service providers, Germany remains a hub for high-performance admixture adoption, setting standards for environmental compliance and construction quality.

Latin America Concrete Superplasticizer Market Trends

Latin Americaconcrete superplasticizer industry is steadily emerging as a key market for concrete superplasticizers, driven by growing infrastructure development and abundant local cement production. Countries such as Brazil, Mexico, and Argentina are witnessing increased use of admixtures in highways, bridges, and urban projects. Brazil leads the region, with a surge in large-scale construction across transport and water infrastructure.

Argentinaconcrete superplasticizer industry is following suit with modernization initiatives and export-oriented industrial growth. The region is also seeing rising interest in higher-grade and sustainable concrete mixes. Collaborations between global admixture producers and local suppliers are expanding access to advanced formulations and technical expertise, helping improve concrete quality and support the region’s evolving construction needs.

Middle East & Africa Concrete Superplasticizer Market Trends

The Middle East and Africa concrete superplasticizer industry growth is gradual yet meaningful, supported by rising investments in urban development, logistics hubs, and energy infrastructure. GCC nations such as Saudi Arabia and the UAE are increasingly relying on superplasticizers to enhance concrete performance in high-temperature environments, especially for large-scale projects like airports, ports, and smart cities. South Africa is also adopting advanced admixtures in commercial and infrastructure developments. Across the region, international partnerships with local suppliers are expanding product availability and technical expertise, enabling formulations tailored to regional climates and sustainability requirements.

Key Concrete Superplasticizer Company Insights

Some key players operating in the market include Sika AG, Rhein-Chemotechnik GmbH, Fosroc, Inc., Rain Carbon Inc., and MAPEI S.p.A.

-

Sika AG is a Swiss specialty chemical company, headquartered in Baar, supplying systems and products for bonding, sealing, damping, reinforcing, and protecting across building and automotive sectors. It maintains a global footprint with operations in over 100 countries and production in over 400 facilities. Sika is recognized as innovation‑driven, with R&D and sustainability at its coretargeting low‑carbon and resource‑efficient solutions in construction and transportation. Its concrete superplasticizer segment includes advanced third-generation polycarboxylate-based admixtures, such as ViscoCrete and SikaPlast, which improve strength, lower water use, enhance workability, and enable high-performance modern concrete systems.

-

MAPEI S.p.A. originated in Milan in 1937 and is a manufacturer of adhesives, sealants, waterproofing compounds, mortars, and concrete admixtures for the building sector. The company operates nearly 100 production sites across more than 50 countries. It is driven by a continuous R&D program based in Italy and coordinated globally. MAPEI focuses on sustainable construction methods. Its concrete superplasticizer range features both high-efficiency acrylic-based and advanced polycarboxylate-ether (PCE) products such as the Dynamon series and Mapefluid line that improve cement dispersion, enhance early and ultimate strengths, prolong slump retention, reduce water usage, and support ready-mix, precast, and self-compacting applications.

Enaspol a.s., Shandong Wanshan Chemical Co., Ltd., and Zhejiang LanYa Concrete Admixture Inc. are some emerging market participants in the concrete superplasticizer market.

-

Enaspol a.s. is a Czech chemical company based near Rtyně nad Bílinou that specializes in surfactants and construction‑chemical additives, serving European and Asian markets. With over four decades of operational history, it offers tailored, high‑value products such as detergents, textile auxiliaries, and emulsion polymerization aidsbacked by local production and research expertise. Its Concrete Superplasticizer segment features high‑molecular polynaphthalene‑sulfonate‑based admixturesoffered in dust‑free powder and viscous liquid forms that improve fresh concrete flow, reduce water use, boost early and long‑term strength, and support heavy, precast, and hydraulic structures.

Key Concrete Superplasticizer Companies:

The following are the leading companies in the concrete superplasticizer market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema

- BASF

- Fosroc, Inc.

- Kao Corporation

- MAPEI S.p.A.

- Shandong Wanshan Chemical Co., Ltd.

- Sika AG

- The Euclid Chemical Company

- Zhe Jiang LanYa Concrete Admixture Inc.

- Evonik Industries AG

- GCP Applied Technologies Inc.

- Enaspol a.s.

- Rain Carbon Inc.

- Rhein-Chemotechnik GmbH

Recent Development

-

In January 2025, MAPEI launched a service that enables concrete manufacturers to generate Environmental Product Declarations (EPDs) using its Cube System and Life Cycle Assessment (LCA) methodology. This initiative promotes sustainability, supports green building certifications, and provides transparent data on the environmental impacts of concrete mix. It strengthens MAPEI’s superplasticizer segment by aligning its admixture solutions with low-carbon construction goals and certified environmental standards.

-

In November 2023, Sika AG officially announced the expansion of polymer production at its Sealy, Texas facility. The move is designed to meet the growing demand for its ViscoCrete concrete admixtures in the U.S. and Canada. This capacity enhancement directly supports the surge in infrastructure activity across North America, particularly following major federal initiatives such as the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA). This investment will strengthen local supply capabilities and support regional customer needs more efficiently. This expansion reinforces Sika’s position in the concrete superplasticizer industry by ensuring stable supply, shorter delivery times, and improved responsiveness to infrastructure sector growth.

Concrete Superplasticizer Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 8,114.31 million

Revenue forecast in 2033

USD 13,389.6 million

Growth rate

CAGR of 7.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, form, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Arkema; BASF; Fosroc, Inc.; Kao Corporation; MAPEI S.p.A.; Shandong Wanshan Chemical Co., Ltd.; Sika AG; The Euclid Chemical Company; GCP Applied Technologies Inc.; Zhe Jiang LanYa Concrete Admixture Inc.; Evonik Industries AG; Enaspol a.s.; Rain Carbon Inc.; Rhein-Chemotechnik GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Concrete Superplasticizer Market Report Segmentation

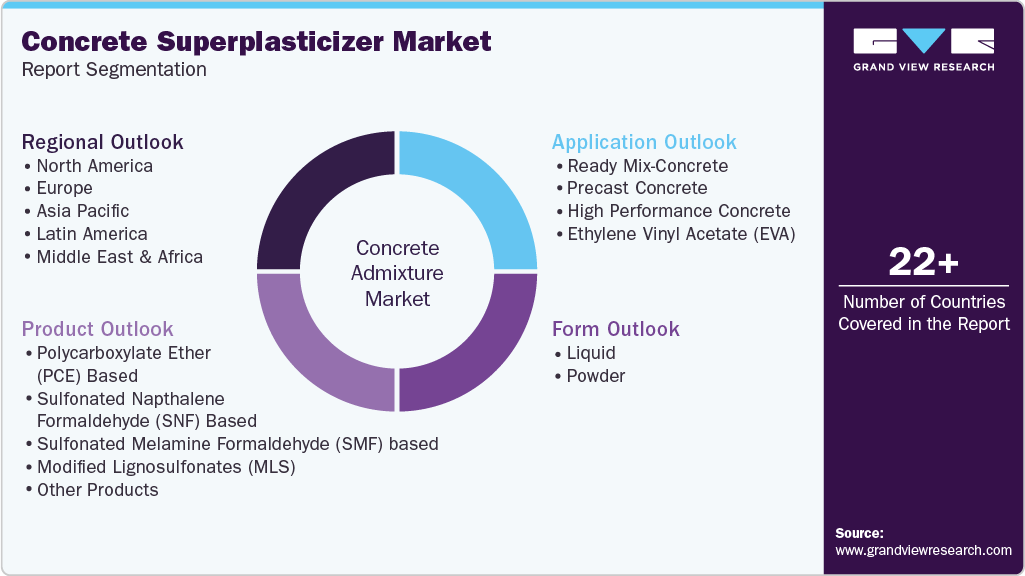

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global concrete superplasticizer market report based on product, application, form, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Polycarboxylate ether (PCE) based

-

Sulfonated Napthalene Formaldehyde (SNF) based

-

Sulfonated Melamine Formaldehyde (SMF) based

-

Modified Lignosulfonates (MLS)

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Ready Mix-Concrete

-

Precast Concrete

-

High Performance Concrete

-

Ethylene Vinyl Acetate (EVA)

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Liquid

-

Powder

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the concrete superplasticizer market include Arkema, BASF, Fosroc, Inc., Kao Corporation, MAPEI S.p.A., Shandong Wanshan Chemical Co., Ltd., Sika AG, The Euclid Chemical Company, GCP Applied Technologies Inc., Zhe Jiang LanYa Concrete Admixture Inc., Evonik Industries AG, Enaspol a.s., Rain Carbon Inc., Rhein-Chemotechnik GmbH.

b. The market is experiencing strong growth due to the rising need for high-performance concrete across infrastructure and real estate sectors. Rapid urbanization, expanding construction activities, and the demand for durable, long-lasting structures are key contributors. In addition, growing emphasis on sustainability and regulatory push for lower water-cement ratios in concrete production are driving the increased use of superplasticizers.

b. The global concrete superplasticizer market size was estimated at USD 7,634.58 million in 2025 and is expected to reach USD 8,114.31 million in 2025.

b. The global concrete superplasticizer market is expected to grow at a compound annual growth rate of 7.4% from 2026 to 2033 to reach USD 13,389.6 million in 2033.

b. North American region led the global landscape with a revenue share of 35.8% in 2025. This is primarily attributed to the region's robust demand driven by substantial infrastructure investments and growing use of advanced concrete in highways, bridges, and urban development projects. The region’s momentum is further supported by the adoption of automated batching technologies and a growing shift toward sustainable construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.