- Home

- »

- Plastics, Polymers & Resins

- »

-

Confectionery Packaging Market Size & Share Report, 2030GVR Report cover

![Confectionery Packaging Market Size, Share & Trends Report]()

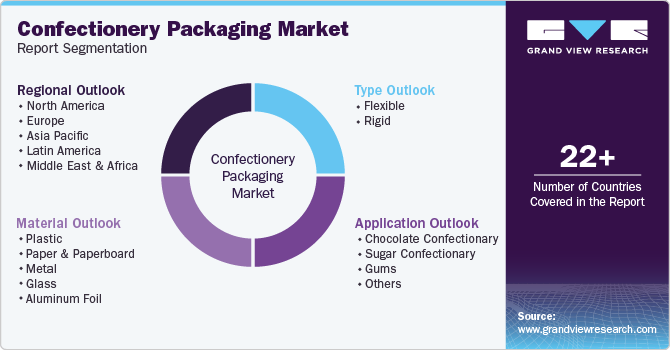

Confectionery Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Flexible, Rigid), By Material (Plastic, Paper & Paperboard, Metal, Glass, Aluminum Foil), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-162-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Confectionery Packaging Market Trends

The global confectionery packaging market size was valued at USD 9,446.8 million in 2024 and is projected to grow at a CAGR of 10.2% from 2025 to 2030. The drivers for the confectionery packaging market are the rising confectionery consumption, a growing preference for premium products, and a heightened focus on sustainability. Application of packaging has expanded beyond just protection over the past few years. It has become an important factor to enhance the aesthetics of the product, which attracts consumers’ attention. Therefore, currently, manufacturers of this industry are applying a consumer-centric approach while developing a product. E-commerce growth and technological advancements in packaging materials are further driving market expansion, as consumers demand innovative and eco-friendly solutions.

Increasing disposable incomes and changing lifestyles are driving demand for confectionery products, consequently boosting the need for packaging solutions. The expansion of e-commerce platforms has significantly impacted the confectionery market by providing consumers with greater access to a variety of products from different brands. This trend necessitates innovative packaging solutions that ensure product integrity during shipping while also being visually appealing to attract online shoppers.

There is a noticeable trend towards premium products within the confectionery sector, where consumers are willing to pay more for high-quality products that offer unique flavors or artisanal qualities. This trend drives manufacturers to invest in attractive and sophisticated packaging designs that reflect the premium nature of their offerings.Technological innovations are playing a pivotal role in transforming the confectionery packaging landscape. Innovations in packaging materials, printing techniques, and barrier properties are expanding the possibilities for confectionery packaging.

Type Insights

The rigid segment dominated the confectionery packaging market with a revenue share of 49.7% in 2023due to its ability to provide superior protection and preservation for confectionery products. The trend towards buying premium products and gifting has increased the demand for high-end packaging, such as tins, boxes, and jars. Moreover, rigid packaging offers opportunities for creative designs and branding, making it a popular choice for confectionery products targeting specific consumer segments.

The flexible material segment is expected to register the fastest CAGR of 4.8% during the forecast perioddue to its cost-effectiveness, lightweight nature, and versatility. It offers excellent barrier properties to protect product freshness and flavor while providing convenient and easy-to-open options for consumers. The growing popularity of on-the-go consumption and the need for sustainable packaging solutions are further driving the demand for flexible packaging in the confectionery industry.

Material Insights

The plastic segment accounted for the largest market revenue share of 51.8% in 2023 due to its versatility, cost-effectiveness, and barrier properties. It offers excellent product protection, maintains freshness, and allows for a wide range of packaging formats, from flexible pouches to rigid containers. As consumers lead busier lifestyles, they prefer packaging that is lightweight, and easy to carry. Plastic packaging meets these needs effectively, offering flexibility in design and functionality. Polyester or polyethylene terephthalate (PET), polyolefins, Nylon (polyamide), and aluminum metalized plastic films are some of the important innovations that have gained significant popularity in this industry.

The aluminum foil is expected to register a CAGR of 4.3% during the forecast period. Aluminum foil offers excellent barrier properties, which protect products from moisture, oxygen, and light. It offers a premium look and feel, making it ideal for high-end confectionery products. Additionally, aluminum is infinitely recyclable, aligning with the increasing demand for sustainable packaging solutions.

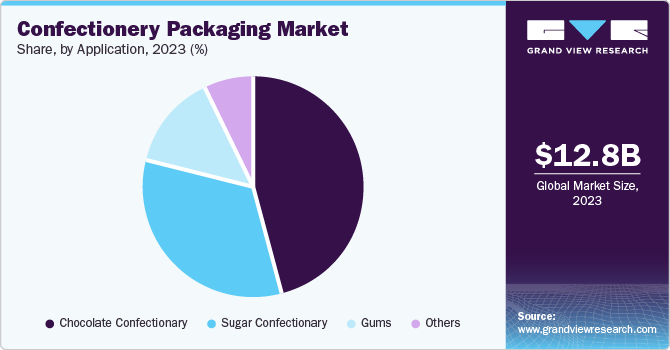

Application Insights

Chocolate confectionary dominated the confectionery packaging market with a revenue share of 46.3% in 2023. The increasing demand for premium and artisanal chocolate products is a primary driver of growth in the chocolate confectionery segment. The demand for premium and luxury chocolate has surged, driving the need for sophisticated and visually appealing packaging. Moreover, the growing trend of gifting chocolates has fueled the demand for decorative and elegant packaging solutions.

Sugar confectionary is expected to register a CAGR of 4.3% during the forecast period. Products such as gummies, hard candies, and marshmallows are being reintroduced with modern twists that appeal to both children and adults alike. The demand for convenient and portable packaging formats is on the rise, particularly for on-the-go consumption. Moreover, the focus on child-friendly packaging and the growing trend of sugar-reduced confectionery are influencing packaging material choices and designs.

Regional Insights

North America confectionery packaging market dominated the global confectionery packaging market with a share of 29.9% in 2023. This market growth is fueled by high confectionery consumption, a strong economy, and a preference for premium and indulgent products. The region's focus on innovation and consumer-centric packaging solutions, coupled with the growing emphasis on sustainability, is driving demand for advanced and eco-friendly packaging materials.

U.S. Confectionery Packaging Market Trends

The confectionery packaging market in U.S. dominated the North America confectionery packaging market with a market share of 76.1% in 2023. The country's large population, high disposable income, and a culture of snacking contribute to the robust demand for confectionery packaging.

Europe Confectionery Packaging Market Trends

Europe confectionery packaging market held a substantial market share in 2023 driven by mature confectionery industry, a strong emphasis on sustainability, and a diverse consumer base. The European Union’s stringent regulations on plastic use further encourage companies to explore biodegradable and recyclable options, thereby driving growth in the market.

The confectionery packaging market in Germany is expected to grow in the coming years. The country's focus on quality and innovation drives the demand for premium packaging solutions. German consumers have a strong inclination towards high-quality confectionery items, which drives manufacturers to focus on sophisticated packaging designs that reflect quality and craftsmanship.

Asia Pacific Confectionery Packaging Market Trends

Asia Pacific confectionery packaging market is expected to register the fastest CAGR of 6.4% during the forecast period. The growth is driven by rapid urbanization, rising disposable incomes, and a burgeoning middle-class section. The increasing demand for Western-style confectionery products, coupled with a growing preference for premium and indulgent treats, is driving the need for attractive and innovative packaging solutions.

The confectionery packaging market in China held significant market share in 2023, fueled by a rapidly expanding economy and a growing population with a sweet tooth. The country's focus on modernization and Westernization has led to a surge in demand for confectionery products, driving the need for sophisticated and appealing packaging.

Key Confectionery Packaging Company Insights

Some key companies in the confectionery packaging market include Amcor plc, Smurfit Kappa, Rengo Co., and others.

-

Amcor plc is a is a prominent player in packaging solutions, providing a diverse range of products that include flexible and rigid packaging, specialty cartons, closures, and related services.

Key Confectionery Packaging Companies:

The following are the leading companies in the confectionery packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Smurfit Kappa

- Rengo Co., Ltd

- Coveris

- Huhtamaki Oyj

- Constantia Flexibles

- Printpack

- Stanpac Inc

- Toppan Inc.

- novel packaging

Recent Developments

-

In July 2024, Smurfit Kappa announced the acquisition of WestRock. Smurfit Westrock is now one of the largest packaging organizations.

-

In June 2024, Saica Group and Mondelēz joined forces to introduce paper-based products, for multipacks-products, for chocolates, biscuits and confectionery markets. The product meets sustainability standards of the Confederation of European Paper (CEPI).

-

In June 2024, Constantia Flexibles introduced EcoTwistPaper. It is a wax free twist wrap product made from paper and supports shift towards sustainable products and is a packaging solution for confectionery industry.

Confectionery Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10,863.8 million

Revenue forecast in 2030

USD 17,651.0 million

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Thailand, Indonesia, Malaysia, Brazil, Argentina, South Africa, Saudi Arabia, UAE.

Key companies profiled

Amcor plc, Smurfit Kappa, Rengo Co., Ltd, Coveris, Huhtamaki Oyj, Constantia Flexibles, Printpack, Stanpac Inc, Toppan Inc. , novel packaging

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Confectionery Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global confectionery packaging market report based on type, material, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible

-

Wrappers

-

Stick Packs & Sachets

-

Liners

-

Pouches

-

-

Rigid

-

Folding Cartons

-

Corrugated Boxes

-

Trays

-

Containers

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Paper & Paperboard

-

Metal

-

Glass

-

Aluminum Foil

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chocolate Confectionary

-

Contlines

-

Slabs/Bars/Blocks

-

Boxed Assortments

-

Tablets

-

Others

-

-

Sugar Confectionary

-

Gums, Jellies & Pastilles

-

Medicated Confectionary

-

Mints

-

Boiled Sweets

-

Toffees, Caramel, & Nougats

-

Lollipops

-

Others

-

-

Gums

-

Chewing Gums

-

Bubble Gums

-

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.