- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Conformal Coatings Market Size, Industry Report, 2033GVR Report cover

![Conformal Coatings Market Size, Share & Trends Report]()

Conformal Coatings Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Acrylic, Epoxy, Urethane, Silicone, and Parylene), By Application (Consumer electronics, Automotive, Medical), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-110-8

- Number of Report Pages: 76

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Conformal Coatings Market Summary

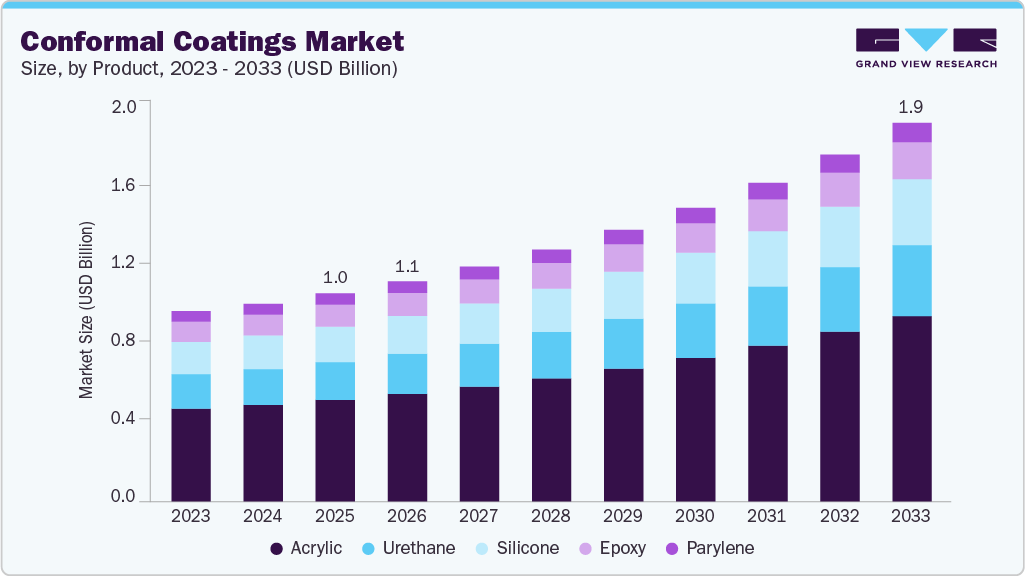

The global conformal coatings market size was estimated at USD 1,057.5 million in 2025 and is projected to reach USD 1,926.1 million by 2033, growing at a CAGR of 8.1% from 2026 to 2033. The growth of conformal coatings depends on their use in various automotive, medical, consumer electronics, and aerospace & defense applications.

Key Market Trends & Insights

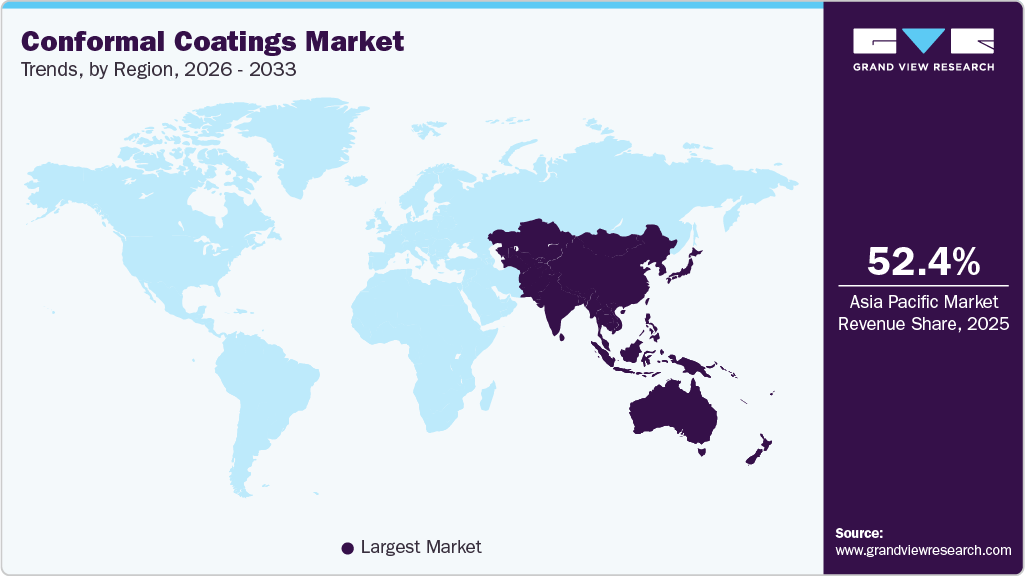

- The Asia Pacific dominated the regional segment and accounted for an overall revenue share of more than 52.4% in 2025.

- The acrylic segment dominated the market and accounted for the largest revenue share of 48.8% in 2025.

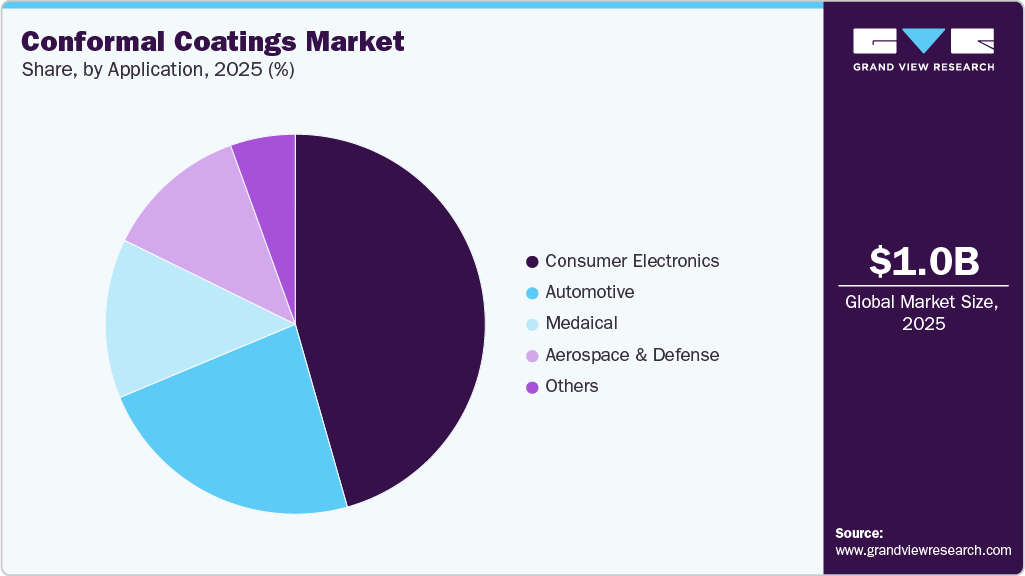

- The consumer electronics segment dominated the market and accounted for the largest revenue share of 45.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1,057.5 Million

- 2033 Projected Market Size: USD 1,926.1 Million

- CAGR (2026-2033): 8.1%

- Asia Pacific: Largest market in 2025

With the increasing popularity of miniaturized circuitry and electronic devices, conformal coatings have witnessed a surge in modern printed circuit board (PCB)-related applications. It spreads as a thin polymeric film over the substrate, ranging from 25 to 250µm, and conforms to the shape of the covered components, protecting them from extreme temperatures, chemicals, salt spray, and moisture. Major industry players are focusing on integrating their operations by venturing into raw material manufacturing and distribution sectors to gain a competitive edge in the market. Companies such as Dow Corning Corporation and Shin Etsu Chemical Company have entered into the distribution sector to cut down costs spent on third-party intermediaries.

Consumer electronics have been a significant driver in contributing to the conformal coatings market growth in the U.S. The growing adoption of wireless connectivity, technological advancements in consumer electronic equipment, and the increasing popularity of wearable electronic devices are driving the consumer electronics market in the U.S., contributing to the conformal coatings industry in the U.S. Moreover, during the COVID-19 pandemic in 2020, physical gaming events were halted, which extensively drove the demand for games such as Fortnite, a video game developed by U.S.-based Epic Games, Inc., which can further drive the demand for electronic devices and propel the market growth.

The U.S. aerospace industry is one of the largest aerospace industries in the world. The Federal Aviation Administration (FAA) has established Bilateral Aviation Safety Agreements (BASAs) in 47 countries to facilitate the trade of U.S.-made aerospace products. Such trade agreements governing the U.S. aerospace sector, overseen by its governing bodies, aim to drive the demand for aerospace products, which in turn drives the demand for conformal coatings in the U.S.

Product Insights

Acrylic dominated the global conformal coatings industry in the product segment and accounted for more than 48.8% overall revenue share in 2025. Adjusting the viscosity of acrylic coatings is easy, making it an ideal compound for the preparation of various application grade-based coatings. In addition, its drying process is significantly quicker as compared to its counterparts. This property enables its use in a wide range of applications in the automotive and electronics industries. In addition, the heat emitted by acrylics during the curing process eliminates the potential risk of damaging heat-sensitive components, thus promoting the market growth.

Epoxy conformal coatings are highly resistant to solvents and possess dielectric properties, suitable for electronic device applications on printed circuit boards. These coatings are rigid and resistant to abrasion, owing to which they are utilized in the manufacturing of home appliances and circuit boards.

Urethane conformal coating is recognized for its excellent abrasion resistance, chemical resistance, and superior moisture resistance. It is difficult to remove, which makes it suitable for use in aerospace applications, helping to eliminate the problems associated with exposing aerospace components to fuel vapors.

Application Insights

The consumer electronics segment dominated the application segment and accounted for the largest revenue share of more than 45.6% in 2025. Consumer electronics have witnessed a growing popularity post-COVID-19 pandemic, and the rising trend of miniaturized electronic circuit boards. These circuit boards are prone to dust, high temperatures, humidity, and other air-borne contaminants, driving the demand for conformal coatings.

The rising demand for consumer electronics has encouraged conformal coating manufacturers to launch new products to cater to the growing market. For instance, in October 2021, Dow introduced DOWSIL CC-2588 Conformal Coating, a silicone-based coating developed to protect the printed circuit boards (PCB) and electronic components. DOWSIL CC-2588 conformal coating cures at room temperature, reducing energy consumption, and facilitates inspection using ultraviolet light, which can drive demand in the consumer electronics segment.

The global focus on reducing decarbonization is increasing due to rising environmental issues arising from gasoline-powered vehicles. This has driven international governments and automobile manufacturers to develop fuel-efficient hybrid and electric cars. The emergence of intelligent vehicles is expected to drive the demand for electronic components such as sensors, electronic devices for entertainment, and GPS in automobiles, which can further contribute to the growth of conformal coatings to protect automobile electronic products.

Regional Insights

The Asia Pacific conformal coatings industry dominated the regional segment and accounted for the overall revenue share of more than 52.4% in 2025. The demand for conformal coatings is driven by the high demand from key industries, including aerospace, automotive, consumer electronics, and manufacturing industries. According to a press release by Airbus in February 2022, the Asia-Pacific region is anticipated to require 17,620 new passenger and freighter aircraft in the next 20 years. This is expected to be driven by the growing population in the area. According to Airbus, cargo traffic in Asia Pacific is expected to increase at 3.6% per annum, leading to a doubling in air freight in the region by 2040, positively impacting the market for conformal coatings in the area.

North America Conformal Coatings Market Trends

North America conformal coatings industry has witnessed a growing demand for advanced electronics, including GPS systems and other related products in the automotive industry. The e-commerce industry has experienced an upward trend in the region, leading to increased sales of commercial vehicles in the area to support the growing e-commerce sector. Besides, the rebound in passenger traffic has encouraged aircraft manufacturers to order new aircraft, resulting in increased sales in the region. Conformal coatings are used to protect the operating devices from vibrations, extreme temperatures, and shocks. The growing market for the aerospace sector in the U.S. is expected to drive the market for conformal coatings upward.

Key Conformal Coatings Company Insights

The global players operating in the market are Henkel AG & Co. KGaA, Chemtronics, Shin-Etsu Chemical Co., Ltd., Dow, and H.B. Fuller Company, along with a few medium and small regional players. Established players such as Henkel AG & Co. KGaA are investing in startups related to conformal coatings, which can further strengthen their position in the market.

For instance, in July 2025, KONIG announced the launch of a new conformal coating system with the aim of reaching a new level of precision, speed, and material efficiency in electronic manufacturing. The KP400 3D Digital Packaging Solution is manufactured by KONIG, a company specializing in low-pressure injection molding solutions and 3D digital packaging protection solutions. It works alongside customers to build high-quality, high-reliability electronic products.

Key Conformal Coatings Companies:

The following are the leading companies in the conformal coatings market. These companies collectively hold the largest Market share and dictate industry trends.

- Henkel AG & Company KGaA

- Chemtronics

- Shin-Etsu Chemical Co., Ltd.

- Dow

- H.B. Fuller Company

- Chase Corp

- Electrolube

- Europlasma NV

- MG Chemicals

- KISCO LTD

- Dymax Corporation

- ALTANA

Conformal Coatings Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,119.9 million

Revenue forecast in 2033

USD 1,926.1 million

Growth rate

CAGR of 8.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR (%) from 2026 to 2033

Report coverage

Revenue forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Henkel AG & Co. KGaA; Chemtronics; Shin-Etsu Chemical Co., Ltd; Dow; H.B. Fuller Company; Chase Corp; Electrolube; Europlasma NV; MG Chemicals; KISCO LTD; Dymax Corporation; ALTANA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Conformal Coatings Market Report Segmentation

This report forecasts revenue at the global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global conformal coatings market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2033)

-

Acrylic

-

Epoxy

-

Urethane

-

Silicone

-

Parylene

-

-

Application Outlook (Revenue, USD Million, 2018 - 2033)

-

Consumer Electronics

-

Automotive

-

Medical

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global conformal coatings market size was estimated at USD 1,057.5 million in 2025 and is expected to reach USD 1,119.9 million by 2026.

b. The global conformal coatings market is expected to grow at a compound annual growth rate of 8.1% from 2026 to 2033 to reach USD 1,928.1 million by 2033.

b. Asia Pacific dominated the conformal coatings market with a share of 52.4% in 2026. This is attributable to rising investment in electronic sector coupled with advance technologies acceptance and constant research and development initiatives.

b. Some key players operating in the conformal coatings market include Henkel AG & Company, KGaA, Chemtronics, Chase Corporation, MG Chemicals, Dymax Corporation, and Shin-Etsu Chemical Co., Ltd.

b. Key factors that are driving the conformal coatings market growth include growing product demand from the consumer electronics industry, in order to protect printed circuit boards from dust, moisture, heating, and other environmental impacts and increasing automation platforms across end-use industries.

b. The consumer electronics application segment dominated the global conformal coatings market and accounted for the highest revenue share of over 45.6% in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.