- Home

- »

- Next Generation Technologies

- »

-

Connected Enterprise Market Size And Share Report, 2025GVR Report cover

![Connected Enterprise Market Report]()

Connected Enterprise Market Analysis By Component, By Solution (Manufacturing Execution System, Customer Experience Management, Business Analytics), By Services, By Platform, By Application, & Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-430-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Technology

Report Overview

The global connected enterprise market size was estimated at USD 90.10 billion in 2015. The surge in technological advancements such as big data, analytics, and cloud computing is triggering investments in this market.

Connected enterprise solutions are providing extending opportunities for high product utilization, new functionalities, enhanced capabilities, and greater reliabilities that exceed the conventional product boundaries. The changing nature of solutions and services are transforming value chain activities and are enabling investments in research & development to offer distinguished products.

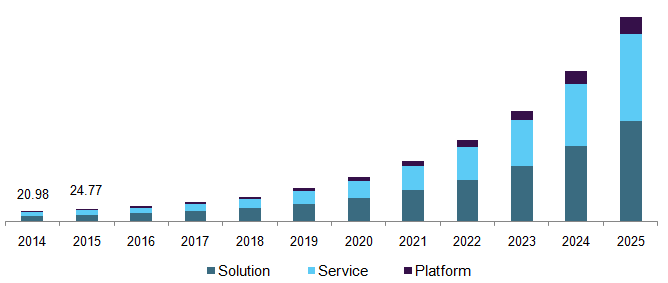

U.S. connected enterprise market, by component, 2014 - 2025 (USD Billion)

Additionally, these solutions share information across devices, people, and processes for ensuring end-to-end process optimization. This enables companies to quickly react to customer and supplier activities, changing their market conditions and business opportunities. The connected enterprise solutions aid in connecting technology and people in several transformative ways. Companies are developing new business models and are enhancing their operations to access and analyze voluminous data.

Connected technology is emerging at a faster pace as millions of devices and machines are getting interconnected leading to new realms of opportunities. Organizations are aggressively adopting IoT solutions in retail, healthcare, and industries for transforming their business processes. Further, they are embracing data exchange, automation and smart manufacturing technologies as digital solutions are disrupting the industrial sector.

Component Insights

Connected enterprise solutions captured a market share of over 55% in 2015. The need for enhanced customer experience and the capability to manage a large amount of data are driving the demand for the solutions segment.

These solutions aid enterprises to maximize their operational efficiency by helping them achieve real-time asset monitoring. For instance, monitoring shipping containers for temperature changes affects their quality using 4G LTE connectivity and battery-powered sensors.

The platforms segment significantly contributed to the industry growth in 2015 due to the elevating demand for connectivity management and application development and enablement platforms. This segment is expected to open new growth opportunities for developers and industry players due to the absence of a single platform that offers an all-around approach. These platforms provide an optimized solution to reduce the time to market with an end-to-end and fully enabled solution for end-users. It provides a user interface and tools to facilitate the creation and modeling of interactive applications.

Solution Insights

The remote monitoring segment dominated the market in 2015. The advancements in connected technology offer opportunities to connect sensors and equipment across manufacturing plants. This has increased the need for real-time monitoring systems to identify and resolve issues before their escalation.

The Manufacturing Execution System (MES) segment held a revenue share of close to 30% in 2015. MES is a vibrant component in the manufacturing sector as it integrates business systems with the information systems on the plant floor. The growth in industrial automation and the need to increase lead-time are expected to positively impact positively the growth of the MES segment.

The application value management segment captured a significant revenue share in 2015. It helps in resolving the challenging delivering outcomes and the mandate of improving efficiencies. It provides organizations with a clear and complete understanding of the value proposition of each application.

Services Insights

The professional services segment accounted for a significant revenue share in 2015. The increasing demand for managing and operating complex IoT environments is expected to propel its growth over the next nine years. The need for reducing operational and capital expenditure and the demand for customized IoT services are the key factors contributing to the growth of professional services.

Along with products, manufacturers are offering professional services related to installation and deployment, training, helpdesk support, and repair and maintenance. The high adoption of IoT in the industrial sector has increased the demand for infrastructure and application management services. Moreover, organizations require customized solutions to boost their efficiency and productivity. The need for such customization is propelling the demand for consulting services

The managed services captured a revenue share of over 40% in 2015 due to the growing prominence of managed cloud services among organizations. The burgeoning growth can be attributed to the increasing adoption of these services to reduce IT costs. Organizations are outsourcing services to reduce the risks so that they can focus on core competencies.

Platform Insights

The connectivity management platform segment was valued at over USD 2.80 billion in 2015. The deployment of connected technologies is complex and involves the convergence of a variety of solutions to tackle the concerns of security and privacy. This has led to the development of IoT-related platforms to manage solutions for accelerating the deployment of enterprise solutions.

These platforms offer real-time analysis of inbound data by triggering event aggregation, correlation, and filtering. Additionally, they have the potential to detect and remotely control the existing network infrastructure in an integrated environment. These platforms are critical in providing the value-added attributes in the IoT landscape bridging the gap between interconnected devices and high layers of architecture.

The increasing adoption of big data analytics and cloud-based technologies has stimulated the demand for these platforms. The key factors contributing to the growth of these platforms include the evolution of high-speed networking technologies and the increasing need for operational efficiency.

Application Insights

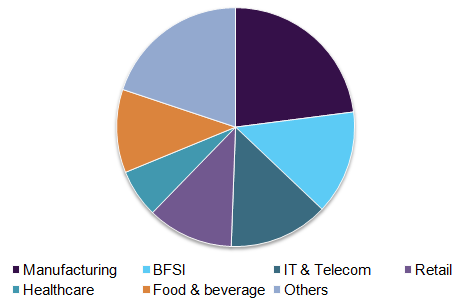

Global connected enterprise market, by application, 2015 (%)

The manufacturing sector is expected to dominate the industry in 2015 owing to the increased need for adopting smart and digital technologies. These technologies offer key benefits such as asset optimization, automated plant routines, and operating efficiencies. Organizations in the manufacturing sector have made substantial investments in analytics and sensor capabilities and are poised to receive optimum Return on Investment (ROI).

The food & beverage sector accounted for over 10.5% of the industry revenue in 2015. The sector is facing the challenge in this dynamic market to synchronize the production levels with consumer demands and rapidly changing consumer needs. This leads to the generation of voluminous data enabling the adoption of enterprise solutions enabling manufacturers to transform real-time data into valuable information to maximize the throughput.

These solutions help end-use industries to reconfigure equipment quickly, maximize production, monitor machine health, and track energy consumption. The integrated information and control systems let users securely access plant-floor data and share it through the manufacturing supply chain by generating usable information about the manufacturing process.

Regional Insights

North America accounted for over 30% of the revenue share in 2015 and is projected to witness substantial growth over the forecast period. Increased technological spending and the growing demand for connected infrastructure are providing traction to industry growth.

Moreover, the growing prominence of automation and the need for increased flexibility and functionality are expected to have a positive impact on industry growth. Additionally, the healthcare and telecom sectors in the region have adopted internet-enabled solutions and devices for enhancing their customer experience.

The MEA region contributed significantly to the industry growth in 2015 due to the presence of a large number of retail establishments, manufacturing, and industrial automation units. The demand for these solutions is expected to gain prominence as organizations in the region are sourcing a range of innovative digital solutions for business transformation and enhancing employee engagement. The region is diversifying its operations from the traditional oil and gas industry, which is providing an impetus for increased investments in upcoming technologies.

Key Companies & Market Share Insights

The key players in the industry include Rockwell Automation, Inc., IBM Corporation, PTC, Inc., Microsoft Corporation, and Honeywell International Inc. Vendors engaging in collaborations with service providers and system integrators for increasing their market penetration. For instance, in September 2016, Rockwell Automation acquired Automation Control Products to support its strategy of increasing the proliferation of connected enterprises.

Recent Developments

-

In April 2023, Rockwell Automation announced the extension of its partnership with the AB market to serve Azerbaijan and Turkmenistan to increase the availability of Rockwell Automation's connected enterprise solutions in Azerbaijan and Turkmenistan. This partnership will help to support the digital transformation of industrial businesses in these countries.

-

In May 2022, Rockwell Automation collaborated with Microsoft, Cisco, PTC, and Ansys to improve the efficiency and productivity of industrial businesses. The technologies that Rockwell Automation and its partners are showcasing at Hannover Messe are all key enablers of the connected enterprise.

-

In May 2022, IBM announced that they had signed a strategic collaboration agreement with Amazon Web Services to offer a more comprehensive solution for businesses. The collaboration will make it easier for businesses to adopt the connected enterprise.

-

In April 2023, IBM announced that their partnership with Siemens Digital Industries Software is expanding for the long – term to help businesses become more sustainable. Siemens and IBM will work together to develop solutions that can help businesses to reduce their environmental impact.

-

In April 2022, PTC and ITC Infotech announced an agreement to speed up customer digital transformation initiatives focusing on the adoption of PTC's market-leading Windchill® product lifecycle management (PLM) software as a service (SaaS).

-

In June 2023, Moody’s Corporation and Microsoft today announced a new strategic partnership to help businesses simplify their operations and improve their efficiency. Businesses will be able to use Moody's software solutions on Microsoft's cloud platform, which will give them a scalable and secure platform for storing and processing data.

Connected Enterprise Market Report Scope

Report Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2014 - 2016

Forecast period

2016 - 2025

Market representation

Revenue in USD Billion and CAGR from 2016 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, U.K., Germany, China, India, Japan, Brazil, and Mexico

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope(equivalent to five analyst working days)

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization

Segments Covered in the ReportThis report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global connected enterprise market based on component, solution, services, platform, and region.

-

Component Outlook (Revenue, USD Billion; 2014 - 2025)

-

Solution

-

Services

-

Platform

-

-

Solution Outlook (Revenue, USD Billion; 2014 - 2025)

-

Manufacturing Execution Systems (MES)

-

Customer experience management

-

Business analytics

-

Application value management

-

Remote monitoring

-

-

Services Outlook (Revenue, USD Billion; 2014 - 2025)

-

Professional

-

Managed

-

-

Platform Outlook (Revenue, USD Billion, 2014 - 2025)

-

Connectivity management

-

Application enablement and development

-

Device management

-

-

Application Outlook (Revenue, USD Billion, 2014 - 2025)

-

Manufacturing

-

BFSI

-

IT & Telecom

-

Retail

-

Healthcare

-

Food & beverage

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East and Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."