- Home

- »

- Automotive & Transportation

- »

-

Connected Logistics Market Size, Industry Report, 2030GVR Report cover

![Connected Logistics Market Size, Share & Trends Report]()

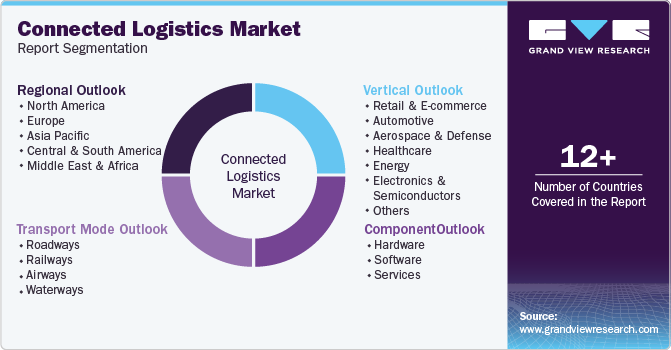

Connected Logistics Market (And Segment Forecasts 2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Transportation Mode (Roadways, Railways, Airways, Waterways), By Vertical (Retail & E-commerce, Automotive), By Region

- Report ID: GVR-4-68040-012-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected Logistics Market Size & Trends

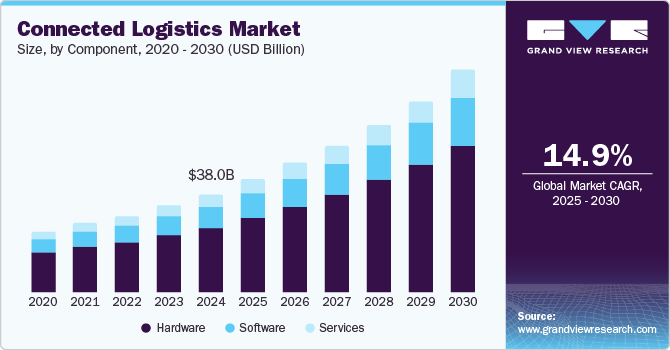

The global connected logistics market size was valued at USD 38.04 billion in 2024 and is expected to grow at a CAGR of 14.9% from 2025 to 2030. By sharing data, information, and facts with the supply chain partners, connected logistics has transformed the logistical operations to become more customer-centric. Connected logistics utilizes a network of interconnected communication systems, cloud platforms, and Internet of Things (IoT) technologies to improve the productivity of logistics operations. Furthermore, it can be characterized as a set of interconnected devices used by logistics service providers to gain more visibility into order processing, financial transactions, shipping, and other logistical processes such as warehousing, transportation, and other value-added logistics services.

Rising technological advancements and growing consumer inclination toward online shopping are some of the factors fueling the market's growth. The growing availability of linked logistics systems with high interoperability, security, and accessibility characteristics drives the demand for these solutions. Additionally, the necessity to reduce the cost of shipping and storage services is propelling the demand for connected logistics products and solutions. The need for intelligent transportation solutions is anticipated to rise significantly. During the forecast period, it is anticipated that the improved adoption of Logistics 4.0 and ongoing work on improving autonomous logistics trucks will present lucrative opportunities for the target market. The declining cost of loT sensors and connected logistics hardware is one of the driving factors of the target market growth. However, the logistics sector's mounting security and safety concerns limit the market's expansion to a certain extent.

The connected logistics sector faces several difficulties, including a competitive market, rising customer demands, and a lack of standardization in the logistics sector. Still, the logistics industry is increasingly adopting cutting-edge technologies due to the requirement for better integration, increased process efficiency, real-time reporting, more visibility, and improved communications. The potential for connected logistics is undeniable as new vehicles are equipped with fleet telematics, a technology made possible by cellular IoT connectivity that gives fleet management and operators access to data from the multiple onboard sensors. Although cellular IoT connections are expanding fast, their full potential still needs to be explored.

The Internet of Things connects people and devices across networks, enhancing security, disaster preparedness, and route planning. To manage transportation visibility, logistics organizations need IoT solutions for location & route management, which support real-time position tracking. As per a report published by LM Ericsson in 2021, IoT connections are projected to increase from 100 million in 2020 to 292 million in 2030 in the transportation sector alone as linked devices collect more data, thereby fostering growth with analytics solutions.

COVID-19 Impact on the Connected Logistics Industry

The COVID-19 epidemic impacted the global economy. Nationwide lockdowns were announced by governments all over the world to stop the infection's spread. In order to maintain social distancing and ensure employee safety, the production facilities were either shut down entirely or operated at reduced capacity. Lack of labor and raw materials caused disruptions in the supply chain across industry verticals, and trade in most sectors came to a standstill. Numerous businesses, including logistics, were impacted by the pandemic.

However, the pandemic has accelerated the adoption of technologies such as the Internet of Things (IoT), automation, and robotics in the logistics sector. These technologies are vital for tracking shipments and vehicles. Furthermore, there has been a shift from electronic data to app-based interfaces with cloud integration, allowing logistics companies to connect with e-commerce platforms. For instance, according to a survey conducted by Inmarsat, a leader in mobile satellite communications, 90% of the respondents have accelerated the adoption of the Internet of Things (IoT) due to the COVID-19 pandemic. The market witnessed a slight slowdown in terms of growth rate in 2020. However, the market picked up as the adoption of technology gained even more relevance post-pandemic.

Component Insights

Based on components, the hardware segment dominated the market in 2024. Based on the hardware, the market is further segmented into RFID tags, sensors, communication devices, tracking devices, and others. Due to the increasing demand to track assets, the sensors category is anticipated to witness a significant market share. Additionally, Internet of Things (IoT) based connected sensing technology aids in preserving temperature stability and reducing food waste while improving supply chain visibility.

The software segment is anticipated to grow at a considerable CAGR during the forecast period. The software segment is further categorized as warehouse management, fleet management, freight/transportation management, asset tracking and management, data management & analytics, and others. The warehouse management software automates and optimizes several warehouse processes, such as tracking, receiving, storing inventory, and workload planning, among others. The fleet management software offers a comprehensive range of vehicle management features to owners of cargo ships, aircraft, trucks, and other transport vehicles across the globe. Asset tracking and management provide tracking of fixed assets, inventory tools, and other important physical assets. The data management and analytics offer solutions to improve and measure end-to-end logistics performance.

The services segment is anticipated to grow at the fastest CAGR through the forecast period. The market's continued expansion is primarily due to the increased demand for managed services in connected logistics. The key participants are engaged in providing services such as consulting, integration & deployment, support & maintenance, and managed services. Consulting services offer advisory services that assist the shipping vendors through specialized and expertise solutions.

Transportation Mode Insights

Based on transportation mode, the roadways segment dominated the market in 2024. This can be attributed to the rising need for road-based transportation for transporting retail goods across long distances, particularly for last-mile delivery. Additionally, this mode of transport offers a large carrying capacity, which makes it a preferred choice for logistics. The increasing efforts taken by governments across the globe to promote road transport are also contributing to segment growth. For instance, the government of India has introduced a national logistics policy to facilitate the ease of doing business and reduce transportation costs. As part of this initiative, the government is constructing a highway network from the port area to the remote site of the country to reduce fuel consumption, which is considered the most cost-impacting factor in freight transport.

The railway segment is expected to grow at a considerable CAGR throughout the forecast period. This mode of transport has the intrinsic advantage of reduced frictional resistance, which enables it to attach a more significant load to wagons or carriages. Moreover, the increasing government initiatives to promote railway freight transport are expected to contribute to the segment growth. For instance, the U.S. Department of Transport has launched the Rail Program. Under this program, the government aims to increase the freight rail routes twofold.

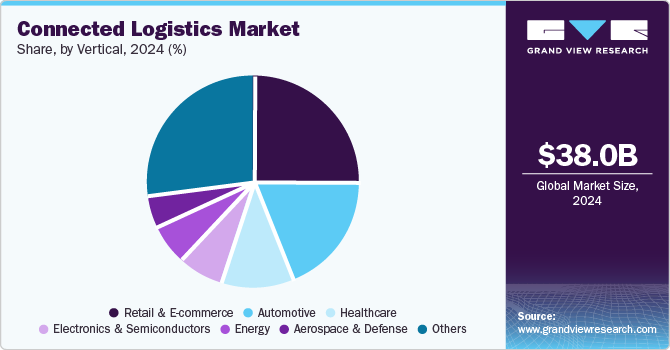

Vertical Insights

Based on the vertical, the retail and e-commerce segment dominated the market in 2024. The retail sector uses connected logistics solutions in order to meet the increasing enterprise demands. Connected logistics improve reliability through IoT solutions which aligns with the retail and e-commerce industry's interest.

The automotive segment is anticipated to register a significant market share over the forecast period. The connected logistics solutions for the automotive industry provide real-time infographics based on the location of the vehicle, the condition of the cargo, and the behavior of the driver. Key players in the market offer niche solutions for the automotive industry. For instance, Alibaba Cloud provides robust automotive management and monitoring solutions for vehicle manufacturers and goods owners to smoothen vehicle monitoring efficiently and accurately.

Regional Insights

North America connected logistics industry led the overall market in 2024 due to the presence of highly developed infrastructure in terms of rail and road connectivity. In addition, the presence of key players in the industry allows the region to be the leading revenue contributor in the global market during the projected period. Speedier implementation of modern technologies is enabled by modern infrastructure. The U.S. is expected to retain its dominance over the forecast period owing to the development of new technologies, increasing working capital, and rapid boom in the e-commerce sector.

U.S. Connected Logistics Market Trends

The connected logistics industry in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The U.S. has a well-established logistics infrastructure and a strong focus on technological advancements. The increasing adoption of IoT devices, AI, and machine learning in the logistics sector is driving growth. Moreover, the growing e-commerce industry and the need for efficient last-mile delivery are further fueling the demand for connected logistics solutions.

Asia Pacific Connected Logistics Market Trends

The connected logistics industry in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. Asia Pacific is expected to experience more rapid economic growth than other regions and is expected to be the hub of all logistical activity in terms of investment and growth. Furthermore, the rising technological advancements in transportation and increasing investment in megacity projects are also expected to fuel regional growth over the forecast period. The rapid growth of the e-commerce sector and manufacturing industry in the region is fueling the growth of the target market. China and India are the key markets in the region.

Japan connected logistics industry is expected to grow at a significant CAGR from 2025 to 2030. Japan is known for its advanced technological capabilities and a strong emphasis on automation and efficiency. The country's aging population and labor shortages are accelerating the adoption of autonomous vehicles and robotics in the logistics sector. Additionally, the government's initiatives to promote smart cities and digital transformation are expected to boost the growth of connected logistics.

The connected logistics industry in India is expected to grow at a significant CAGR from 2025 to 2030. India's burgeoning e-commerce market and rapid urbanization are driving the demand for efficient and reliable logistics solutions. The government's focus on infrastructure development, such as roads, railways, and ports, is further supporting the growth of the industry. However, challenges such as poor road infrastructure in certain regions and a lack of skilled labor may hinder growth.

Middle East And Africa (MEA) Connected Logistics Market Trends

The connected logistics industry in the Middle East and Africa (MEA) is expected to grow at a significant CAGR from 2025 to 2030. The region's growing population, rising middle class, and increasing urbanization are driving the demand for efficient logistics solutions. The development of mega-projects and special economic zones in various countries is expected to boost the growth of the industry. However, political instability, security concerns, and infrastructure challenges may hinder growth in certain countries.

UAE connected logistics industry is expected to grow at a significant CAGR from 2025 to 2030. The UAE is a major logistics hub in the Middle East and has a strong focus on technological advancements. The government's initiatives to promote smart cities and digital transformation are expected to drive the adoption of connected logistics solutions. Additionally, the country's strategic location and world-class infrastructure are further supporting the growth of the industry.

Industry Insights

The market is highly competitive and fragmented in nature owing to the presence of several global and regional companies. Key players in the market include Intel Corporation, Infosys Limited, and SAP SE, among others. All the major players in the market are focusing on new product development to stay relevant in the market and to enhance their market foothold further. For instance, Cisco Systems Inc. offers solutions for various modes of transportation, including aviation, rail, and roadways. For connected maritime, the company provides solutions such as Cisco IE 2000 and 3000 series switches.

Key players in the market are spending heavily on research and development in order to integrate advanced technologies in connected logistics for safer and more reasonable transport. The companies also collaborate and engage in partnerships with their competitors and end-users to gain a competitive edge. For instance, in February 2022, Oracle and RHI Magnesita signed a deal under which RHI Magnesita has selected Oracle's fusion cloud transportation management; this deal will help RHI Magnesita to unify its complete transport management system, which will eventually reduce cost and optimize service level. In another instance, in September 2020, SAP SE expanded its partner ecosystem with extended partnerships with Project44, ClearMetal, and Shippeo. Through these partnerships, the licensed members of SAP Logistics Business Network can access the estimated time of arrival, the exact location of shipment, and status changes for road and ocean carrier transports.

Some of the key companies operating in the connected logistics market include Intel Corporation, Cisco System Inc., and IBM Corporation, among others.

-

Intel's competitive advantage lies in its expertise in semiconductor technology and IoT solutions. The company offers a range of hardware and software solutions, including sensors, gateways, and analytics platforms that enable real-time tracking and monitoring of goods throughout the supply chain. Intel's strong focus on data-driven insights and AI-powered analytics empowers businesses to optimize their logistics operations, reduce costs, and enhance customer satisfaction.

-

Cisco Systems leverages its networking expertise to provide comprehensive solutions for connected logistics. The company's networking infrastructure, security solutions, and IoT platforms enable seamless connectivity and data exchange between various stakeholders in the supply chain. Cisco's strong focus on network security ensures the protection of sensitive data and prevents cyber threats. Additionally, the company's extensive partner ecosystem allows for flexible and customized solutions to meet specific customer needs.

-

IBM's competitive advantage in the Connected Logistics market stems from its strong foundation in AI, data analytics, and cloud computing. The company offers a range of solutions, including supply chain visibility platforms, AI-powered optimization tools, and blockchain-based solutions for secure and transparent transactions. IBM's deep industry expertise and global reach enable it to provide end-to-end solutions that address the complex challenges faced by logistics companies.

ORBOCMM and Freightgate Inc. are some of the emerging companies in the target market.

-

ORBOCOMM's competitive advantage lies in its specialized focus on IoT solutions for asset tracking and management. The company's robust network infrastructure and reliable device offerings enable real-time visibility into the movement of goods, vehicles, and equipment. ORBOCOMM's strong industry partnerships and domain expertise allow it to tailor solutions to specific customer needs, particularly in sectors like transportation and logistics.

-

Freightgate Inc. differentiates itself by offering a comprehensive digital freight platform that connects shippers and carriers. The platform's advanced features, including real-time visibility, automated freight matching, and predictive analytics, streamline the entire freight process. Freightgate's user-friendly interface and strong focus on customer experience have enabled it to attract a growing customer base and establish a strong foothold in the market.

Key Connected Logistics Companies:

The following are the leading companies in the connected logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Intel Corporation

- Infosys Limited

- Cisco System Inc.

- HCL Technology Limited

- IBM Corporation

- SAP SE

- ORBOCMM

- Freightgate Inc.

- Honeywell International Inc.

- NEC Corporation

Recent Developments

-

In February 2022, Oracle partnered with RHI Magnesita, a global leader in refractory products, to implement Oracle Fusion Cloud Transportation Management. This strategic move aims to streamline RHI Magnesita's logistics operations, reducing costs, improving service levels, and automating processes. By adopting this solution, RHI Magnesita will enhance the flexibility and efficiency of its operations, enabling it to scale its services and serve new market segments more effectively.

-

In February 2022, C.H. Robinson and Waymo Via partnered to explore the integration of autonomous driving technology in logistics. They will initially focus on pilot projects in the Dallas-Houston lane, using Waymo's autonomous trucks to haul C.H. Robinson's customer freight. The collaboration aims to improve capacity, enhance the carrier and driver experience, and address the challenges posed by driver shortages.

-

In May 2021, e2open acquired BluJay Solutions, a leading cloud-based logistics execution platform, in a deal valued at approximately $1.7 billion. This strategic acquisition aims to combine e2open's end-to-end supply chain management platform with BluJay's logistics execution software, offering enhanced capabilities and value to customers. By integrating BluJay's expansive network of suppliers, carriers, and partners, e2open aims to accelerate its growth and strengthen its position as a leading provider of cloud-based supply chain solutions.

Connected Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.28 billion

Revenue forecast in 2030

USD 86.57 billion

Growth Rate

CAGR of 14.9% from 2025 to 2030

Historic year

2017 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, transportation mode, vertical, and region

Regional scope

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, France, U.K., China, India, Japan, South Korea, Australia, Brazil, UAE, KSA, and South Africa

Key companies profiled

Intel Corporation; Infosys Limited; Cisco System Inc.; HCL Technology Limited; IBM Corporation; SAP SE; ORBOCMM; Freightgate Inc.; Honeywell International Inc.; NEC Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connected Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global connected logistics market report based on component, transportation mode, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

RFID Tags

-

Sensors

-

Communication Devices

-

Tracking Devices

-

Others

-

-

Software

-

Warehouse Management

-

Fleet Management

-

Freight TransportationManagement

-

Asset Tracking and management

-

Data Management and Analytics

-

Others

-

-

Services

-

Consulting

-

Integration and Deployment

-

Support & Maintenance

-

Managed Services

-

-

-

Transport Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Roadways

-

Railways

-

Airways

-

Waterways

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail & E-commerce

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Energy

-

Electronics & Semiconductors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global connected logistics market size was estimated at USD 38.04 billion in 2024 and is expected to reach USD 43.28 billion in 2025.

b. The global connected logistics market is expected to grow at a compound annual growth rate of 14.9% from 2025 to 2030 to reach USD 86.57 billion by 2030.

b. North America accounted for the largest revenue share in 2024, with the U.S. contributing significantly to the regional market. The growth of the North American market is attributed to the presence of various connected logistics solution providers, logistics players, and e-commerce giants in North America.

b. Some key players operating in the connected logistics market include Intel Corporation, Honeywell International Inc., Cisco System Inc., Infosys Limited, and SAP SE, among others.

b. Key factor driving the growth of the connected logistics market include increasing need to reduce the shipping prices, improvisation in the visibility of the supply chain, and growing emphasis of businesses on primary business activities, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.