- Home

- »

- HVAC & Construction

- »

-

Construction Equipment Rental Market Size Report, 2033GVR Report cover

![Construction Equipment Rental Market Size, Share & Trends Report]()

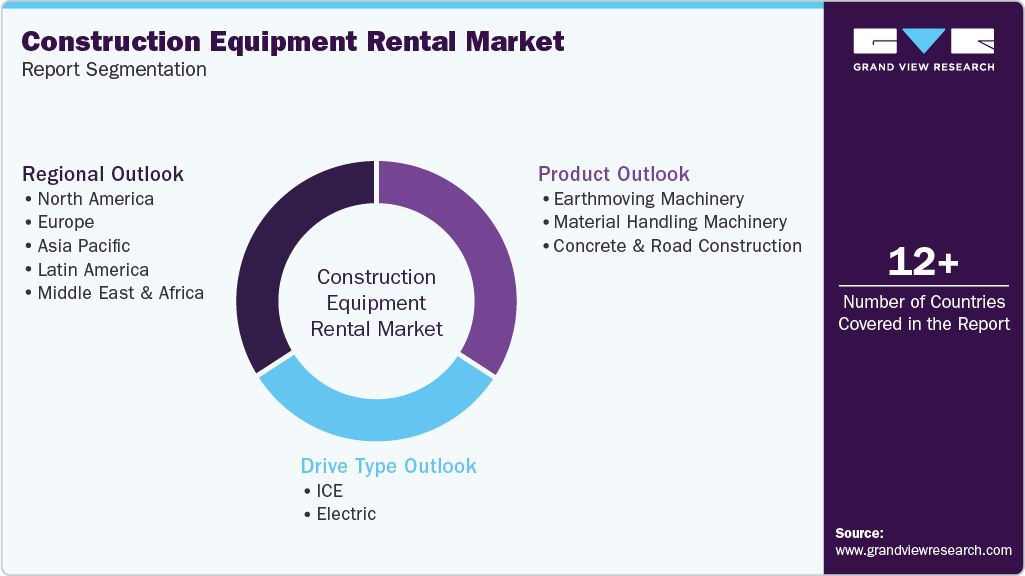

Construction Equipment Rental Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Earthmoving Machinery, Material Handling Machinery, Concrete & Road Construction), By Drive Type (ICE, Electric), By Region, And Segment Forecasts

- Report ID: 978-1-68038-678-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Equipment Rental Market Summary

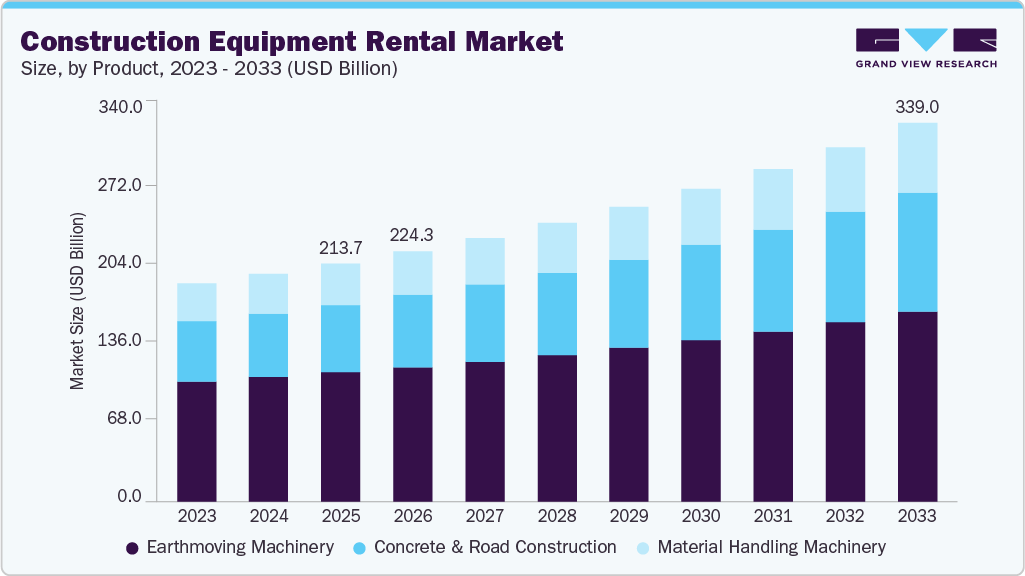

The global construction equipment rental market size was valued at USD 213.68 billion in 2025 and is projected to reach USD 339.04 billion by 2033, growing at a CAGR of 6.1% from 2026 to 2033. The increase in government investment in public infrastructure projects has boosted mining and construction activities in developing nations, increasing the market need for construction equipment.

Key Market Trends & Insights

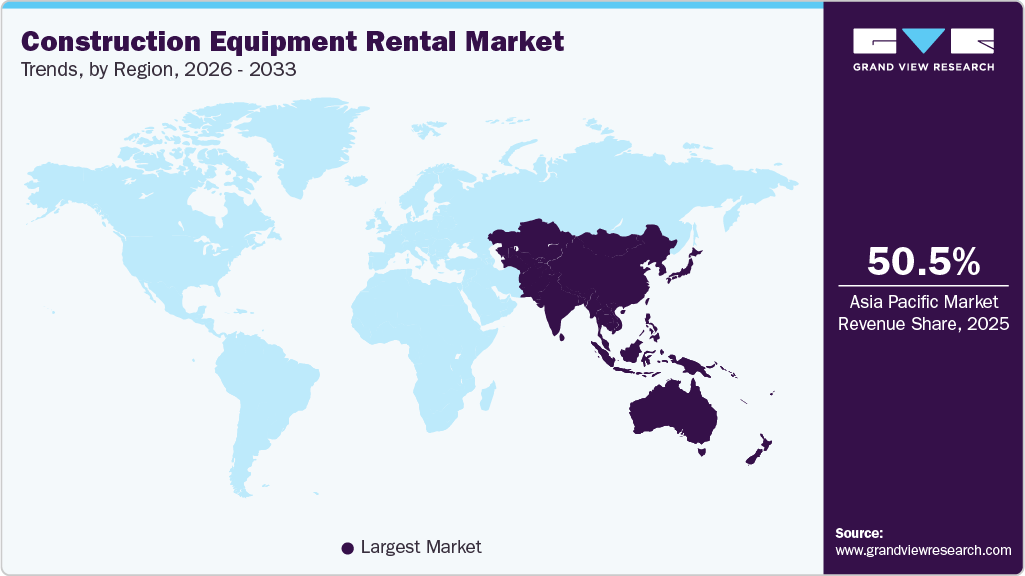

- Asia Pacific construction equipment rental market accounted for a 50.5% share of the overall market in 2025.

- The construction equipment rental industry in China held a dominant position in 2025.

- By product, the earthmoving machinery segment accounted for the largest share of 54.2% in 2025.

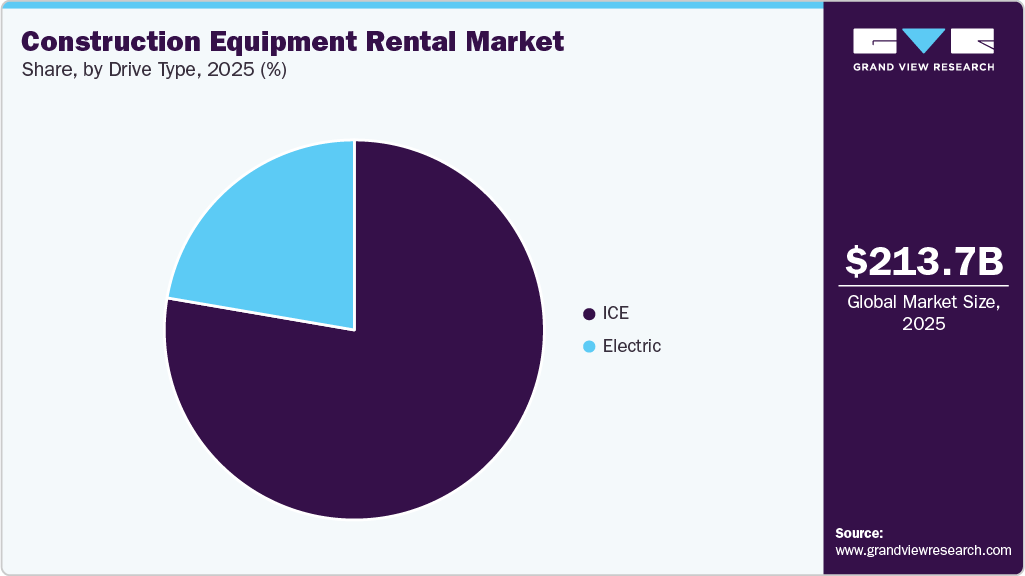

- By drive type, the ICE segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 213.68 Billion

- 2033 Projected Market Size: USD 339.04 Billion

- CAGR (2026-2033): 6.1%

- Asia Pacific: Largest market in 2025

Renting construction equipment is becoming more appealing to construction companies and contractors as new construction machinery prices are rising. In addition, the advent of cutting-edge technologies and a rise in automation will fuel market expansion. The use of telematics systems in the construction equipment rental industry is experiencing a remarkable surge as more companies recognize their immense benefits. These advanced systems empower rental companies to remotely monitor crucial aspects such as equipment usage, location, and performance. This transformative capability enables a significant improvement in fleet management and the implementation of proactive maintenance practices. One of the key drivers behind this adoption is the integration of IoT devices and sensors into construction equipment rental units. These cutting-edge technologies deliver real-time data on vital parameters, including fuel consumption, equipment health, and operator safety.Through this, rental companies can make data-driven decisions to enhance operational efficiency while minimizing downtime. The rental companies have a significant opportunity to stand out by providing customized equipment configurations and attachments to fulfill specific project requirements. According to the first quarter forecast released by the American Rental Association (ARA) in March 2023, the U.S. rental equipment market is expected to grow at a rate of 5.3% in 2023 and 1.9% in 2024. At this juncture, customized equipment strategies can allow large-sized companies to distinguish themselves and cater to the diverse needs of their clients.

By providing tailored equipment solutions, these rental companies can effectively tackle the unique challenges presented by various construction projects. Whether it is any intricate infrastructure development, a high-rise building construction, or a specialized industrial project, possessing the ability to supply equipment with customized configurations and attachments would be essential if these companies were to help their clients in enhancing operational efficiency and productivity by providing equipment specifically designed to meet their project demands.

Advances in online platforms and mobile applications have played a potent role in streamlining the rental experience while offering a myriad of benefits for both equipment owners and renters. Online platforms provide equipment owners with an efficient avenue to showcase their inventory to a wider audience. Owners can significantly increase their chances of securing rental agreements and generating additional revenue streams by listing their equipment portfolio on online marketplaces to make it visible to all participants, thereby typically enabling small-sized companies to highlight their unique offerings and build a reputation based on excellent service and equipment quality. This democratization of the rental market fosters healthy competition, benefiting customers with improved options and service levels.

Product Insights

The earthmoving machinery segment accounted for the largest share of 54.2% in 2025. Global demand for renting earth-moving machinery such as excavators has soared due to increased large-scale projects in the mining, road, port construction, and oil and gas industries. Another significant driving force for the earth-moving rental machinery market is the freedom manufacturers and operators have for using the machinery to its fullest potential without making substantial capital commitments. Equipment producers are creating environmentally friendly equipment due to strict emission control rules included in the rental machinery provider's fleet.

The concrete & road construction segment is expected to grow at the fastest CAGR during the forecast period. The market growth can be driven by investments in highway and road infrastructure projects, increased cars on the road, and rising highway infrastructure demand. For instance, India's Bharatmala project, which is being constructed across Indian states such as Maharashtra, Punjab, Gujarat, Haryana, Sikkim, and West Bengal, among other states, is expected to generate substantial demand for renting construction equipment machines on a large scale The demand for renting concrete &road construction equipment is anticipated to increase internationally due to a surge in the requirement to sustain existing civil infrastructures, particularly high-rise buildings.

Drive Type Insights

The ICE segment held the largest market share in 2025. The global availability of diesel and gasoline stations further reinforces the convenience of ICE-powered machinery in the construction industry. Construction companies often operate across multiple regions and countries, where varying levels of infrastructure development and electric vehicle adoption exist. This disparity in infrastructure readiness can present obstacles for the widespread adoption of electric construction equipment. In contrast, with the prevalent presence of fuelling stations, contractors and rental companies can rely on a consistent supply of fuel for their ICE equipment, eliminating concerns about range limitations or the need for costly infrastructure upgrades.

The electric segment is expected to grow at the fastest CAGR during the forecast period. In recent years, the construction industry has witnessed a remarkable shift towards more environmentally friendly practices, owing to the implementation of stringent environmental regulations and the rise of sustainability initiatives. Governments around the world have recognized the urgent need to address climate change and have consequently set emission reduction targets and imposed stricter regulations on construction machinery emissions. For instance, in March 2023, the U.S. administration approved California's request for legal authority to enforce a mandate stating that by 2035, at least half of all garbage trucks, cement mixers, tractor-trailers, and other equipment sold within the state must be powered by electricity. This ambitious initiative aims to tackle the most significant contributors to road pollution and promote cleaner transportation.

Regional Insights

North America construction equipment rental market held a significant share in 2025. With the U.S. leading the region, rental demand is being fueled by large-scale infrastructure revitalization projects under government programs such as the Bipartisan Infrastructure Law. The trend of outsourcing equipment needs to rental service providers is gaining traction, particularly in commercial and industrial construction. Moreover, digital transformation and telematics integration enhance modern rental fleets' appeal.

U.S. Construction Equipment Rental Market Trends

The construction equipment rental market in the U.S. held a dominant position in 2025. Demand for rental services surged due to rising construction activity in both residential and non-residential sectors, labor shortages, and the growing adoption of project-based procurement strategies. Emphasizing sustainability and efficient asset utilization encourages contractors to rent equipment with emissions-reducing technologies. In addition, leading rental companies are expanding their fleet offerings and investing in customer-centric digital platforms to improve service delivery and retention.

Europe Construction Equipment Rental Market Trends

The construction equipment rental market in Europe was identified as a lucrative region in 2025. Rental adoption is high in countries like Germany, France, and the UK, where construction companies prioritize cost efficiency, flexibility, and sustainability. Europe’s rental market also benefits from the increased use of advanced telematics, machine diagnostics, and green technologies. Rising urban redevelopment and energy-efficient construction projects continue to fuel the demand for short- and long-term rental solutions.

The UK construction equipment rental industry is expected to grow rapidly in the coming years due to sustained demand from commercial construction, road rehabilitation, and large transport infrastructure initiatives. Contractors increasingly rely on rental providers due to fluctuating project timelines and the need to comply with sustainability regulations that favor low-carbon machinery.

The construction equipment rental industry in France held a substantial market share in 2025 due to ongoing investments in residential modernization, transportation upgrades, and industrial expansion projects. The market has strong participation from organized rental players that offer standardized service packages, equipment maintenance, and digitalized fleet booking systems.

Asia Pacific Construction Equipment Rental Market Trends

The construction equipment rental industry in Asia Pacific is anticipated to grow at a CAGR of 7.5% during the forecast period. The urbanization, expanding infrastructure development, and the rising cost of owning equipment drive rental demand across the region's developed and emerging economies. In China, rental firms are scaling operations to support mega construction projects and smart city initiatives. India is also witnessing strong growth in equipment rentals, bolstered by government-led infrastructure missions such as Bharatmala and Smart Cities. While the fragmented nature of the rental market presents operational challenges, increasing demand from the real estate, roads, and energy sectors continues to fuel market growth.

The India construction equipment rental market is expected to grow rapidly in the coming years. The country is experiencing a shift toward rental services due to high capital investment and maintenance costs associated with equipment ownership. National programs like the National Infrastructure Pipeline (NIP) and Gati Shakti have created a surge in demand for earthmoving and road construction equipment. Moreover, the growth of rental aggregators and equipment-sharing platforms supports the rise of organized rental markets in urban centers.

The construction equipment rental market in China held a substantial market share in 2025. China’s booming construction and infrastructure sectors, backed by government investments in urban development, rail, and road connectivity, have significantly boosted the need for rental equipment. Environmental regulations also encourage companies to shift from outdated machinery to cleaner, rental alternatives. The rise of digital platforms for equipment booking and fleet management has also improved accessibility, making rentals more efficient and attractive for contractors of all sizes.

Key Construction Equipment Rental Company Insights

Key players operating in the construction equipment rental market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

-

Ahern Rentals Inc. is an independently owned, family-run equipment rental company in the U.S., with over 70 locations across more than 20 states, including Arizona, California, Texas, Colorado, and others. Specializing in construction equipment rentals, the company provides a vast fleet exceeding 40,000 units of high-reach gear, including boom lifts and scissor lifts, alongside general tools, heavy machinery, lawn equipment, and homeowner items. It serves commercial/residential builders, industrial firms, utilities, municipalities, and DIY customers.

-

Liebherr-International AG, along with its subsidiaries, manufactures and supplies construction machinery. The company offers a range of products, including commercial freezing and refrigeration equipment, domestic appliances, crawler cranes, mobile cranes, deep foundation machines, maritime cranes, and port equipment. It also offers mobile construction cranes, aerospace systems, mining equipment, tower cranes, concrete technology, material handling equipment, transportation systems, machine tools, and automation components & systems.

Key Construction Equipment Rental Companies:

The following are the leading companies in the construction equipment rental market. These companies collectively hold the largest Market share and dictate industry trends.

- Ahern Rentals Inc.

- AKTIO Corporation

- Caterpillar Inc.

- Byrne Equipment Rental

- Cramo Plc

- Finning International Inc.

- Liebherr-International AG

- Kanamoto Co., Ltd.

- Maxim Crane Works, L.P.

- United Rentals, Inc.

Recent Developments

-

In December 2025, SILA, India's real estate platform with over 15 years of expertise, 30,000+ employees, including 1,000+ trained operators, and operations in 125+ cities, has launched a Material Handling Equipment (MHE) Rental Solutions division in partnership with Nilkamal, an equipment manufacturer, targeting the manufacturing and warehousing sectors. This initiative offers an all-electric fleet of forklifts and specialized rental equipment through flexible models, including full-service Wet Lease, hands-on Dry Lease, and Annual Maintenance Contracts, emphasizing operational efficiency, sustainability, and nationwide support.

-

In February 2024, United Rentals, an equipment rental company, partnered with Raiven, a procurement and supply chain management platform for contractors and facility managers, to integrate its extensive fleet of construction, industrial, and general equipment into Raiven's marketplace. The collaboration enables Raiven users, comprising over 3,000 contractors in the mechanical, electrical, and plumbing sectors, to access United Rentals' inventory through an intuitive, cloud-based platform powered by AI algorithms, facilitating streamlined purchasing, competitive pricing, and efficiency gains amid rising costs and supply chain challenges.

Construction Equipment Rental Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 224.27 billion

Revenue forecast in 2033

USD 339.04 billion

Growth rate

CAGR of 6.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, drive type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; KSA; South Africa; UAE

Key companies profiled

Ahern Rentals Inc.; AKTIO Corporation; Caterpillar Inc.; Byrne Equipment Rental; Cramo Plc; Finning International Inc.; Liebherr-International AG; Kanamoto Co., Ltd.; Maxim Crane Works, L.P.; United Rentals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Construction Equipment Rental Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global construction equipment rental market report based on product, drive type, and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Earthmoving Machinery

-

Material Handling Machinery

-

Concrete & Road Construction

-

-

Drive Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

ICE

-

Electric

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global construction equipment rental market size was estimated at USD 213.68 billion in 2025 and is expected to reach USD 224.27 billion in 2026.

b. The global construction equipment rental market is expected to grow at a compound annual growth rate of 6.1% from 2026 to 2033 to reach USD 339.04 billion by 2033.

b. Asia Pacific dominated the construction equipment rental market with a share of 50.5% in 2025. This is attributable to growth in the number of highway constructions, metro construction, airports, Special Economic Zones (SEZs) in the region.

b. Some key players operating in the construction equipment rental market include Ahern Rentals Inc., AKTIO Corporation, Caterpillar Inc., Byrne Equipment Rental, Cramo Plc, Finning International Inc., Liebherr-International AG, Kanamoto Co., Ltd., Maxim Crane Works, L.P., United Rentals, Inc.

b. Key factors that are driving the construction equipment rental market growth include growing access to advanced and updated technology, and improved customer service.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.