- Home

- »

- Next Generation Technologies

- »

-

Contact Center As A Service Market, Industry Report, 2030GVR Report cover

![Contact Center As A Service (CCaaS) Market Size, Share & Trends Report]()

Contact Center As A Service (CCaaS) Market Size, Share & Trends Analysis Report By Solution, By Service (Support & Maintenance, Integration & Deployment), By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-284-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

CCaaS Market Size & Trends

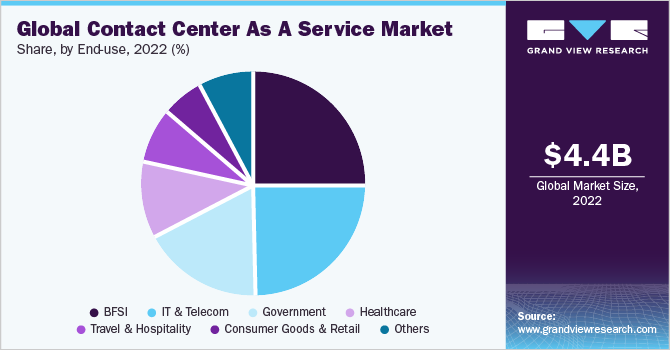

The global contact centre as a service (CCaaS) market size was valued at USD 4.43 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.1% from 2023 to 2030. The increasing remote and distributed workforce is a significant driver for the growing demand for Contact Center As A Service (CCaaS). With the rise of remote work and the need for virtual contact centers, organizations are realizing the benefits of CCaaS solutions in enabling their agents to work from anywhere. CCaaS solutions offer the necessary infrastructure and tools for agents to deliver quality customer service regardless of their location. Agents can access the contact center platform remotely, using their own devices, and connect with customers through various channels such as phone calls, emails, chats, and social media.

Advancements in Artificial Intelligence (AI) and automation technologies are pivotal in driving the CCaaS market's growth. Integrating AI-powered features and automation capabilities in CCaaS solutions allows organizations to streamline their contact center operations, enhance customer experiences, and improve overall efficiency. Virtual assistants and AI-powered chatbots are becoming increasingly popular in contact centers. These intelligent bots can handle routine customer inquiries, respond instantly, and assist with self-service options.

In response to evolving customer needs, many companies are prioritizing the development of cloud contact center solutions that leverage artificial intelligence technologies to enhance accuracy and performance. For instance, in April 2023, Meera, an AI-powered platform for SMS marketing, partnered with Five9, a leading provider of cloud contact center solutions. Through this collaboration, businesses can now leverage Meera's automated text messaging capabilities within the Five9 Intelligent Cloud Contact Center. Meera's conversational AI technology can be seamlessly integrated into the Five9 CX Marketplace, offering enhanced communication and engagement opportunities for businesses utilizing the Five9 platform.

Delivering timely and satisfactory customer responses is crucial for organizations to retain their customer base. Therefore, providing an enhanced customer experience across various communication channels has become a necessity. By improving customer experience, organizations can offer comprehensive support throughout the customer journey, from initial contact to building long-term loyalty. Customer experience is vital in Customer Relationship Management (CRM) as it significantly impacts customer retention. When customers have positive experiences with a business, they are more likely to become loyal patrons.

One major restraint in the Contact Center as a Service (CCaaS) market is the potential loss of control over data and customization. Organizations may have concerns about storing their customer data on third-party cloud platforms, as it raises data security and privacy issues. In addition, limited customization options can be a drawback for companies that have specific requirements or unique workflows. To overcome these challenges, businesses can carefully choose reputable and reliable service providers that prioritize data security and compliance with industry regulations. Conducting thorough due diligence, implementing strong encryption measures, and establishing robust data protection policies can help address security concerns.

COVID-19 Impact Analysis

The COVID-19 pandemic is expected to have a positive impact on the market. The CCaaS model provides remote location working capabilities. Businesses are increasingly adopting cloud-based solutions as they offer advantages such as scalability and flexibility, and are encouraging work from home policies to maintain the customer experience effectively. Moreover, increasing online transactions and the rise in online purchases during the COVID-19 crisis have increased the need for implementing cloud-based solutions.

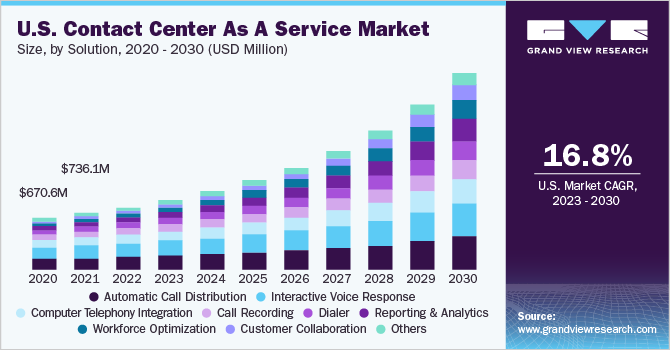

Solution Insights

The automatic call distribution segment dominated the market in 2022 and accounted for more than 22.0% share of the global revenue. The automatic call distribution solution is widely adopted in contact centers as it helps them to handle a large volume of inbound calls. This solution routes the incoming calls to specific agents or departments within an organization based on the pre-set distribution rules. It also assists the callers when the call volume is too high, or the call center agents are busy, thus providing a better customer experience.

The customer collaboration segment is expected to register the fastest CAGR over the forecast period. Organizations are recognizing the importance of building strong customer relationships and delivering exceptional experiences. Customer collaboration solutions enable businesses to engage with their customers across various channels, including voice, chat, email, and social media, fostering meaningful interactions and providing personalized support. Moreover, the rise of self-service options and customer empowerment has fueled the demand for customer collaboration solutions.

Service Insights

The integration and deployment segment dominated the market in 2022 and accounted for more than 40.0% of the global revenue. Growing adoption of the cloud-based CCaaS to provide better flexibility and customer experience is expected to drive the segment growth over the forecast period. The rapid pace of digitalization across industries is compelling businesses to focus on constant transformation and upgradation of their IT infrastructure. This trend is creating promising growth opportunities for the integration & deployment segment in the contact center industry. Moreover, contact center businesses have to manage a diverse user base across various channels. This is anticipated to drive the adoption of integration & deployment services to deploy various contact center solutions in their IT infrastructure.

The managed services segment is expected to register the fastest growth over the forecast period. The need to simplify the management of complex systems and deliver continuous operation improvement among contact centers is expected to drive the adoption of managed services over the forecast period. Managed services streamline technology operations across applications and network and infrastructure domains for contact centers. Managed services offer features such as incident and problem management, proactive performance management, configuration management, performance reporting and change management.

Enterprise Size Insights

The large enterprises segment dominated the market in 2022 and accounted for over 54.0% of the global revenue. Large enterprises have a customer base spread widely across the globe, and hence to maintain business continuity efficiently, large enterprises are aggressively investing in advanced Contact Center as a Service (CCaaS) technology. These services assist large enterprises in offering a better customer experience and reducing operational costs. As large enterprises deal with high call volumes, they adopt CCaaS solutions to provide an excellent customer experience.

The small and medium enterprises segment is expected to register the fastest growth over the forecast period. Small & medium enterprises prefer cloud-based contact center solutions as the IT support and components expenditure required are less, leading to a low investment cost and better cost savings. The lack of customer service representatives and on-board IT staff in small and medium enterprises is also fueling the market growth. CCaaS solutions help small and medium enterprises enhance the overall customer experience and maximize agent productivity.

End-use Insights

The BFSI segment dominated the market in 2022 and accounted for over 25.0% of the global revenue. The BFSI industry relies heavily on efficient and effective customer service to build trust and maintain customer satisfaction. Customers often require personalized assistance and timely support with the increasing complexity of financial products and services. CCaaS solutions offer the necessary tools and functionalities to handle a wide range of customer inquiries, manage complex transactions, and provide real-time support, ensuring a seamless customer experience.

The consumer goods and retail segment is anticipated to register a promising CAGR over the forecast period. Shift in consumer demands and buying behavior are reshaping the consumer goods & retail segment. The increasing use of online channels for buying consumer goods is fueling the demand for CCaaS solutions in the consumer goods & retail industry. CCaaS solutions allow representatives to offer customers with personalized and quick services. Moreover, these solutions also streamline cross-channel and omnichannel communications while improving customer and agent experiences.

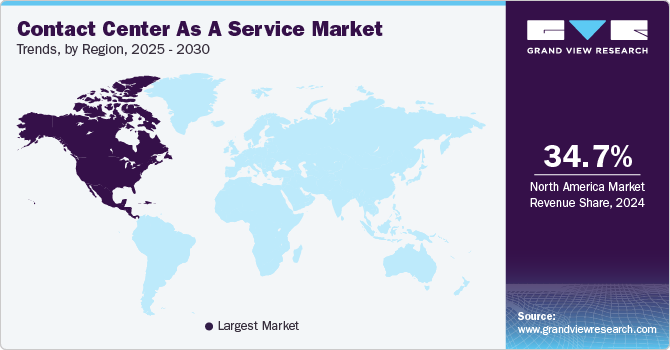

Regional Insights

North America dominated the Contact Center as a Service (CCaaS) market in 2022 and accounted for over 35.0% of the global revenue. Numerous players across this region are focusing on developing the CCaaS aimed to provide better customer service. For instance, in January 2023, Sprinklr, a U.S.-based unified customer experience management platform, and Sitel Group, a provider of customer experience solutions based in the U.S., joined forces in a partnership to empower companies to elevate their contact center operations with social customer service. This collaboration offers a comprehensive suite of digital services for businesses across various industries, encompassing social listening, engagement, social media strategy, and design. By leveraging the combined expertise of Sprinklr and Sitel Group, organizations can unlock a range of benefits, including operational excellence, end-to-end social and digital capabilities, access to global services, and a strategic advantage in the competitive market.

The Asia Pacific regional market is anticipated to record the highest CAGR over the forecast period. The e-commerce industry in the region is making a significant contribution to the increasing demand for CCaaS solutions in contact centers. The promising pace of industrial development and expansion in the region is also anticipated to create growth opportunities for the regional market growth. Furthermore, the small & medium enterprises in the region are adopting CCaaS solutions owing to the various benefits offered, including the reduction of operational costs, increase in ROI, and enhanced customer experience.

Key Companies & Market Share Insights

The competitive landscape of the market is highly fragmented and characterized by the presence of a large number of players. Vendors are focusing on offering fully flexible, scalable CCaaS offerings through a monthly subscription to enable quick deployment of new functions, channels, and features and effectively deliver lower Total Cost of Ownership (TCO). Moreover, market players are focusing on offering better agent assistance solutions and services.

The vendors are investing in the development of omnichannel solutions for various end-use industries, such as BFSI, government, healthcare, and IT & telecom. Market players are also engaging in partnerships and collaborations to strengthen their market positions. For instance, in March 2023, Qualtrics and Five9 partnered to integrate Five9's renowned cloud contact center solutions with Qualtrics Frontline Care. This collaboration involves seamlessly integrating Five9 Event Subscription Services and the Qualtrics XM Platform. By leveraging this integration, customer service teams can gain deeper insights into customer sentiment, identify agent coaching opportunities and quality assurance concerns, and enhance their responsiveness in critical customer relationship scenarios. Some of the prominent players in the global contact center as a service market include:

-

Alcatel Lucent Enterprise

-

Avaya, Inc.

-

Cisco Systems, Inc.

-

Enghouse Interactive Inc.

-

Five9, Inc.

-

Genesys

-

Microsoft Corporation

-

NICE inContact

-

SAP SE

-

Unify Inc.

Contact Center As A Service (CCaaS) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.04 billion

Revenue forecast in 2030

USD 17.12 billion

Growth rate

CAGR of 19.1% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report Updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Alcatel Lucent Enterprise; Avaya, Inc.; Cisco Systems, Inc.; Enghouse Interactive Inc.; Five9, Inc.; Genesys; Microsoft Corporation; NICE inContact; SAP SE; Unify Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contact Center As A Service (CCaaS) Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global contact center as a service (CCaaS) market report based on solution, service, enterprise size, end-use, and region:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Automatic Call Distribution

-

Call Recording

-

Computer Telephony Integration

-

Customer Collaboration

-

Dialer

-

Interactive Voice Response

-

Reporting & Analytics

-

Workforce Optimization

-

Others

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Consumer Goods & Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contact center as a service market size was estimated at USD 4.43 billion in 2022 and is expected to reach USD 5.04 billion in 2023.

b. The global contact center as a service market is expected to grow at a compound annual growth rate of 19.1% from 2023 to 2030 to reach USD 17.12 billion by 2030.

b. The automatic call distribution segment accounted for the highest revenue share of more than 22.0% in 2022 in the CCaaS market.

b. Some key players operating in the CCaaS market include Alcatel Lucent Enterprise; Avaya, Inc.; Cisco Systems, Inc.; Enghouse Interactive Inc.; Five9, Inc.; Genesys; Microsoft Corporation; NICE inContact; SAP SE; and Unify Inc.

b. Key factors driving the contact center as a service market growth include the increasing need to improve customer experience and reduce operational costs post-CCaaS adoption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."