- Home

- »

- Next Generation Technologies

- »

-

Contact Center Software Market Size, Industry Report, 2033GVR Report cover

![Contact Center Software Market Size, Share & Trends Report]()

Contact Center Software Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment, By Enterprise Size (Large Enterprise, Small & Medium Enterprise), By End Use (BFSI, Government, IT & Telecom), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-400-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Contact Center Software Market Summary

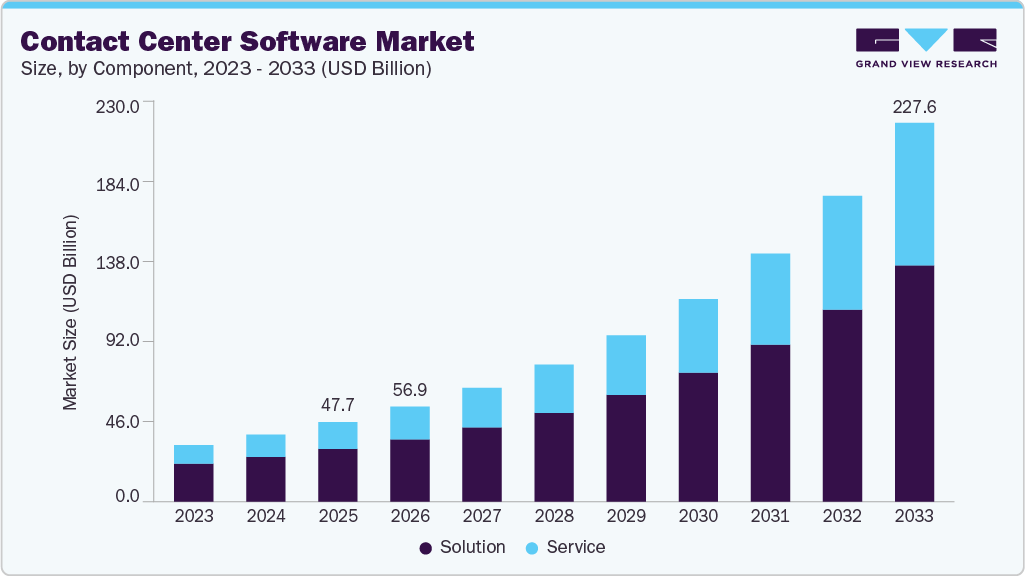

The global contact center software market size was estimated at USD 47.71 billion in 2025, and is projected to reach USD 227.57 billion by 2033, growing at a CAGR of 21.9% from 2026 to 2033. The increasing demand for enhanced customer experience is expected to significantly drive market growth.

Key Market Trends & Insights

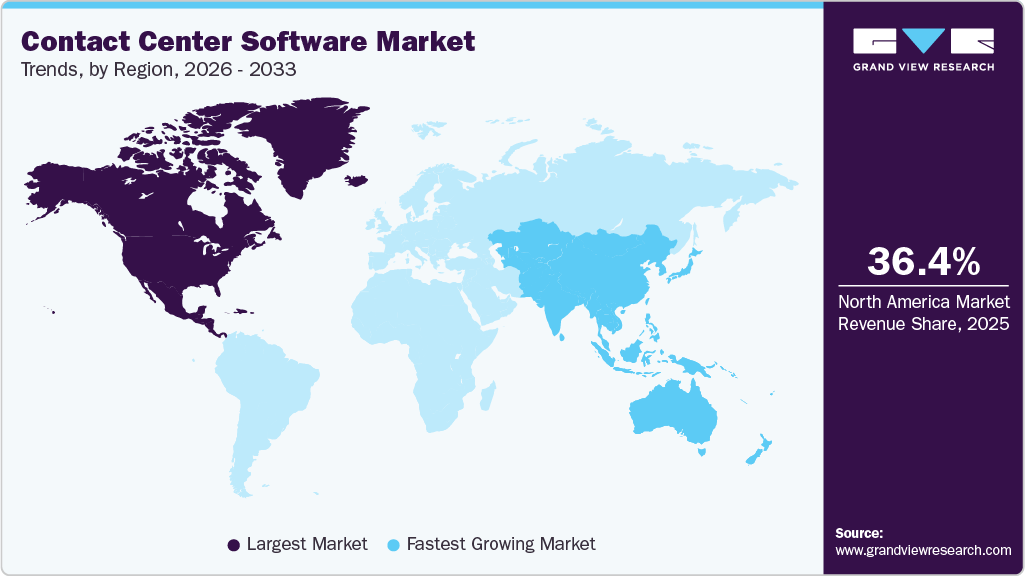

- North America contact center software market accounted for a 36.4% share of the overall market in 2025.

- The contact center software industry in the U.S. held a dominant position in 2025.

- By component, the solution segment accounted for the largest share of 66.2% in 2025.

- By deployment, the on-premise segment held the largest market share in 2025.

- By enterprise size, the large enterprises segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 47.71 Billion

- 2033 Projected Market Size: USD 227.57 Billion

- CAGR (2026-2033): 21.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Businesses understand the importance of providing exceptional customer service and investing in contact center software to streamline customer interactions, improve response times, and personalize customer experience. Moreover, the rise of omnichannel communication is driving the adoption of contact center software. Customers now expect to interact with businesses through various channels such as voice, email, chat, social media, and more. Contact center software enables enterprises to manage and integrate these channels, providing a seamless and consistent experience across all touchpoints. Furthermore, the increasing focus on data analytics and AI-powered technologies drives the demand for advanced contact center software. Businesses are leveraging AI-powered features such as chatbots, speech analytics, and predictive analytics to automate processes, gain valuable insights from customer interactions, and improve operational efficiency.

The need for cost optimization and operational efficiency is a major driving factor. Contact center software enables businesses streamline their operations, reduce manual tasks, and improve agent productivity. With features such as call routing, workforce management, and real-time reporting, businesses can optimize their resources and improve overall efficiency. In addition, the globalization of businesses is also driving the adoption of contact center software.

As companies expand their operations internationally, they need contact center solutions that can support multiple languages, time zones, and geographical locations. Advanced contact center software provides multi-site capabilities and language support, enabling businesses to deliver consistent customer service across borders. Moreover, regulatory compliance requirements push businesses to invest in contact center software. With increasing data privacy regulations, businesses need to ensure that customer data is handled securely and in compliance with industry standards. Contact center software with built-in security features and compliance tools helps businesses meet these requirements and avoid potential legal issues.

One of the major restraints of the contact center software market is the complexity and integration challenges associated with implementing new software solutions. Integrating contact center software with existing systems and infrastructure can be a complex process that requires careful planning and coordination. Legacy systems and outdated infrastructure may not be compatible with modern contact center software, resulting in integration difficulties and potential disruptions in operations. To overcome this restraint, businesses can take several steps. First, thoroughly assessing the existing systems and infrastructure is crucial to identify gaps or compatibility issues. This assessment can help businesses plan for upgrades or modifications to ensure seamless integration.

Component Insights

The solution segment accounted for the largest share of 66.2% in 2025. Growth in the solution segment is driven by enterprises migrating from legacy, on-premise contact center systems to cloud-native and omnichannel platforms. Organizations seek unified solutions that seamlessly integrate voice, email, chat, social media, and messaging apps into a single interface, delivering consistent customer experiences. Cloud-based solutions offer faster deployment, elastic scalability, and lower upfront costs, making them attractive to both large enterprises and mid-sized businesses. This transition is accelerating replacement cycles and driving sustained demand for modern contact center software solutions.

The service segment is expected to grow at the fastest CAGR during the forecast period. The service segment is growing as enterprises require expert support to implement, migrate, and optimize contact center platforms. Transitioning to cloud-based, AI-enabled contact centers involves complex integration with existing IT infrastructure, data migration, and process redesign. Professional services, such as consulting, system integration, and deployment, are therefore essential to ensure business continuity and maximize return on investment. This complexity continues to drive demand for vendor-led and partner-led services alongside core software offerings.

Deployment Insights

The on-premise segment dominated the market in 2025. On-premise deployment envisages deploying all the hardware and software required to operate and maintain a contact center at the customer’s property. On-premise solutions provide integrability, reliability, customizability, and also scalability to some extent. However, they can be very difficult and expensive to deploy at times. The customizability benefits of on-premise solutions can be realized only when businesses invest heavily in professional services.

The hosted segment is projected to grow at the fastest CAGR over the forecast period. Businesses across the globe prefer cloud-based contact center solutions over on-premise solutions owing to the ability of cloud-based contact center solutions to scale services. Cloud solutions are designed to connect contact center agents to effectively centralized contact center applications while offering a secure intranet for employees to collaborate and communicate with each other. Cloud-based solutions are also capable of offering in-depth information about the agents and customers, which executives would not be able to track using on-premise solutions. According to a study by RingCentral, Inc., shifting to cloud-based solutions can help in improving customer call answer rates by around 5% while reducing the average speed of answer (ASA) by as much as 50%.

Enterprise Size Insights

The large enterprise segment dominated the market in 2025. Large enterprises have their customers spread across the globe. Hence, large enterprises are more likely to invest in the latest, advanced technologies to run their business effectively and ensure business continuity. Moreover, large enterprises typically prefer solutions and services that can potentially help in augmenting profitability. The integration of AI with contact center operations is also driving the adoption of contact center software by large enterprises.

The small & medium enterprise segment is expected to grow at the fastest CAGR over the forecast period. The growing implementation of customer care solutions by small & medium enterprises across the globe is expected to drive the growth of the segment over the forecast period. Small & medium enterprises are adopting these solutions as part of the efforts to ease the workloads of carrying out the normal, mundane tasks while allowing contact center agents to focus on organizational development. The growing number of small- and medium-sized businesses across the globe is anticipated to create new growth opportunities for the segment over the forecast period.

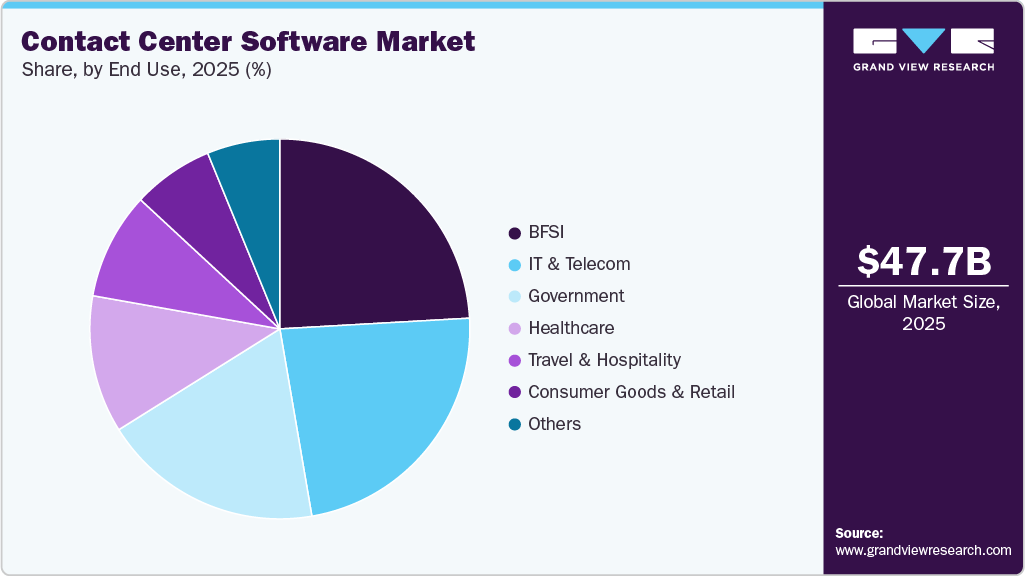

End Use Insights

The IT & telecom segment held a significant share in the market in 2025. The IT & telecom industry relies heavily on customer support and interaction to address technical issues, provide assistance, and deliver exceptional service. Contact center software plays a crucial role in managing and optimizing these customer interactions, ensuring seamless communication between customers and IT & telecom companies. These software solutions offer features such as call routing, automatic call distribution, and customer relationship management integration, which help IT & telecom companies efficiently manage large volumes of customer inquiries and provide timely resolutions.

The consumer goods and retail segment is projected to grow at the fastest CAGR over the forecast period. Customers are moving continuously toward digital channels for their shopping needs. Moreover, customers are also utilizing the latest technologies and channels, thereby prompting consumer goods & retail businesses to opt for contact center solutions for providing exceptional customer experience. These solutions allows retailers and businesses in striking personalized interactions with customers and building strong customer relationships. Contact center software is also helping brands and retailers in delivering automated, high-quality service while freeing agents to focus on revenue generation and brand enhancement activities with the help of AI.

Regional Insights

The North America contact center software market held a significant share in 2025. The contact center software market in North America is characterized by mature adoption of cloud-native platforms, omnichannel routing, and advanced workforce engagement suites. Enterprises increasingly prioritize integration of AI-driven automation, speech and sentiment analytics, and low-code orchestration to drive efficiency and improve customer experience.

U.S. Contact Center Software Market Trends

The U.S. contact center software market held a dominant position in 2025. The U.S. market remains a leading adopter of innovative contact center capabilities, with large enterprises and digital-native companies investing heavily in AI assistants, real-time analytics, and CRM integration. Buyers favor flexible consumption models (SaaS and hybrid) and modular platforms that scale across distributed agent workforces and remote-first operations.

Europe Contact Center Software Industry Trends

The Europe contact center software market was identified as a lucrative region in 2025. European organizations approach contact center transformation with a strong emphasis on data sovereignty, omnichannel compliance, and multilingual support for diverse customer bases. Adoption rates for cloud contact center platforms and conversational AI are growing steadily, driven by cost optimization goals and the need for consistent CX across digital and voice channels.

Contact center software market in the UK is expected to grow rapidly during the forecast period. In the UK, demand for contact center software is shaped by a competitive retail and financial services landscape where speed, personalization, and secure handling of sensitive customer data are priorities. Organizations are investing in customer journey analytics, authentication technologies, and omnichannel orchestration to reduce friction and fraud risk while improving first-contact resolution.

Asia Pacific Contact Center Software Industry Trends

The Asia Pacific contact center software market is expected to grow at the fastest CAGR of 27.5% over the forecast period. The APAC market is highly heterogeneous, with rapid cloud uptake in some markets and continued reliance on on-premises or hybrid deployments in others. Growth is driven by expanding e-commerce, digital payments, and rising customer expectations for localized, instant support across messaging apps and social platforms.

The Japan contact center software industry is expected to grow rapidly in the coming years. Japan’s contact center landscape emphasizes high-quality, culturally nuanced customer interactions, with enterprises favoring stable, reliable platforms that support omnichannel messaging and detailed quality assurance processes.

Contact center software market in China is distinctive for its mobile-first customer behaviors and deep integration with domestic messaging and social ecosystems, prompting strong demand for contact center solutions that natively support platforms such as WeChat and other local channels.Domestic cloud and SaaS providers compete intensely with global vendors, differentiating on local compliance, speed of innovation, and integrations with popular domestic CRMs and commerce platforms.

Key Contact Center Software Company Insights

Some of the key companies in the contact center software market include 8X8, Inc., Amazon Web Services, Inc., Avaya Inc., Cisco Systems, Inc., Enghouse Interactive Inc., and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Avaya, Inc. is a provider of communication software and services. The company’s product offerings include contact center solutions and unified communications solutions, offered either for on-premise deployment, hybrid deployment, or cloud deployment. The company has developed omnichannel contact center applications that can potentially fulfill an organization’s customer-centric communication requirements. The solutions are compatible with several web applications and enable seamless communication through e-mails, voice-based channels, social media, and video calls.

-

Alcatel-Lucent Enterprise is engaged in providing contact center software and solutions categorized for different applications. The company’s main aim while designing these solutions is to offer its clients omnichannel services that are available for cloud deployment as well as on-premise deployment.

Key Contact Center Software Companies:

The following are the leading companies in the contact center software market. These companies collectively hold the largest market share and dictate industry trends.

- 8X8, Inc.

- Amazon Web Services, Inc.

- Avaya Inc.

- Cisco Systems, Inc.

- Enghouse Interactive Inc.

- Exotel Techcom Pvt. Ltd.

- Five9, Inc.

- Genesys

- Talkdesk, Inc.

- Twilio Inc.

Recent Developments

-

In October 2025, Zoom Communications partnered with Oracle in a strategic go-to-market agreement to host its Zoom Contact Center platform, part of the Zoom CX customer experience suite, on Oracle Cloud Infrastructure (OCI). This partnership expands Zoom's enterprise reach into sectors such as finance and retail, while bolstering Oracle's cloud credentials against rivals Amazon and Microsoft. The deal focuses on infrastructure hosting and cross-marketing, rather than joint product development or new technology, allowing enterprises embedded in Oracle's ecosystem to deploy Zoom's tools seamlessly.

-

In October 2025, Vi Business, the enterprise division of Vodafone Idea (Vi), partnered with Genesys, a provider of AI-powered experience orchestration, to deliver next-generation cloud-based Contact Centre as a Service (CCaaS) solutions in India, marking Vi's entry into the sector with unified omnichannel customer experiences. This collaboration combines Vi's robust telecom network with Genesys' advanced cloud platform, featuring in-country deployment for data residency, AI-driven personalization, and scalable consumption models, to enable enterprises to transform their contact centers without incurring heavy capital investments.

Contact Center Software Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 56.93 billion

Revenue forecast in 2033

USD 227.57 billion

Growth rate

CAGR of 21.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

8X8, Inc.; Amazon Web Services, Inc.; Avaya Inc.; Cisco Systems, Inc.; Enghouse Interactive Inc.; Exotel Techcom Pvt. Ltd.; Five9, Inc.; Genesys; Talkdesk, Inc.; Twilio Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contact Center Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global contact center software market report based on component, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Automatic Call Distribution (ACD)

-

Call Recording

-

Computer Telephony Integration (CTI)

-

Customer Collaboration

-

Dialer

-

Interactive Voice Responses (IVR)

-

Reporting & Analytics

-

Workforce Optimization

-

Others

-

-

Service

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Consumer Goods & Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Traveling & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contact center software market size was estimated at USD 47.71 billion in 2025 and is expected to reach USD 56.93 billion in 2026.

b. The global contact center software market is expected to witness a compound annual growth rate of 21.9% from 2026 to 2033 to reach USD 227.57 billion by 2033.

b. North America dominated the contact center software market with a share of 36.4% in 2025. This is attributable to the presence of a large number of contact center software vendors in the region.

b. Some key players operating in the contact center software market include 8X8, Inc.; Amazon Web Services, Inc.; Avaya Inc.; Cisco Systems, Inc.; Enghouse Interactive Inc.; Exotel Techcom Pvt. Ltd.; Five9, Inc.; Genesys; Talkdesk, Inc.; Twilio Inc.

b. Key factors that are driving the contact center software market growth include increasing demand for the automation of contact center solutions, the growing emphasis on enhancing customer experience through omnichannel solutions, and the surging adoption of cloud-based contact centers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.