- Home

- »

- Next Generation Technologies

- »

-

Contact Center Software Market Size & Share Report, 2030GVR Report cover

![Contact Center Software Market Size, Share, & Trends Report]()

Contact Center Software Market Size, Share, & Trends Analysis Report By Solution, By Service, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-400-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

Contact Center Software Market Size & Trends

The global contact center software market size was valued at USD 33.38 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 23.9% from 2023 to 2030. The increasing demand for enhanced customer experience is expected to significantly drive the market growth. Businesses understand the importance of providing exceptional customer service and invest in contact center software to streamline customer interactions, improve response times, and personalize the customer experience. Moreover, the rise of omnichannel communication is driving the adoption of contact center software.

Customers now expect to interact with businesses through various channels such as voice, email, chat, social media, and more. Contact center software enables businesses to manage and integrate these channels, providing a seamless and consistent experience across all touchpoints. Furthermore, the increasing focus on data analytics and AI-powered technologies drives the demand for advanced contact center software. Businesses are leveraging AI-powered features such as chatbots, speech analytics, and predictive analytics to automate processes, gain valuable insights from customer interactions, and improve operational efficiency.

The need for cost optimization and operational efficiency is a major driving factor. Contact center software helps businesses streamline their operations, reduce manual tasks, and improve agent productivity. With features like call routing, workforce management, and real-time reporting, businesses can optimize their resources and improve overall efficiency. In addition, the globalization of businesses is also driving the adoption of contact center software.

As companies expand their operations internationally, they need contact center solutions that can support multiple languages, time zones, and geographical locations. Advanced contact center software provides multi-site capabilities and language support, enabling businesses to deliver consistent customer service across borders. Moreover, regulatory compliance requirements push businesses to invest in contact center software. With increasing data privacy regulations, businesses need to ensure that customer data is handled securely and in compliance with industry standards. Contact center software with built-in security features and compliance tools helps businesses meet these requirements and avoid potential legal issues.

One of the major restraints of the contact center software market is the complexity and integration challenges associated with implementing new software solutions. Integrating contact center software with existing systems and infrastructure can be a complex process that requires careful planning and coordination. Legacy systems and outdated infrastructure may not be compatible with modern contact center software, resulting in integration difficulties and potential disruptions in operations. To overcome this restraint, businesses can take several steps. First, thoroughly assessing the existing systems and infrastructure is crucial to identify gaps or compatibility issues. This assessment can help businesses plan for upgrades or modifications to ensure seamless integration.

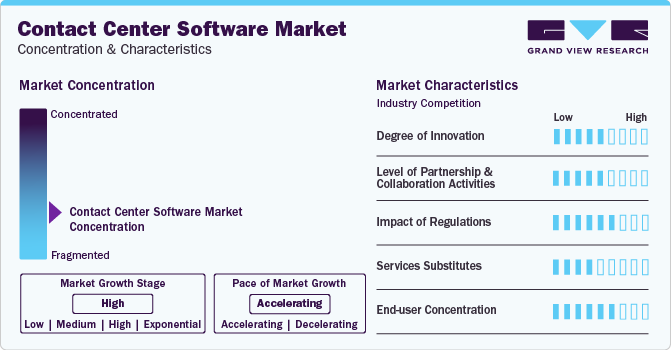

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The growing use of the internet and the proliferation of digital channels have increased the level of convenience while doing business. New mobile applications and social collaboration software provide flexibility to employees.

The contact center software market is also characterized by a high level of partnership and collaboration activity by the market players. The market players have adopted these strategies to gain a significant share of the market. Furthermore, the market players have developed novel concepts & ideas, improved manufacturing techniques, upgraded the current set of products, and enhanced their profitability to sustain the intense competition in the market.

Contact center solution providers need to abide by some of the basic regulations related to the security of their customers’ data. For instance, the ISO/IEC 27000 has laid down regulations for the security of customer information. Similarly, the Telephone Consumer Protection Act (TCPA) regulates auto-dialed calls, messages, and prerecorded calls by prohibiting advertisements before 8 am and after 9 pm.

The contact center software market is lucrative and constantly encounters technological developments in products and services. Product competition is expected to increase owing to the introduction of artificial intelligence, process automation, and mobile technology. These new features or innovative products, such as omnichannel services for enhanced customer experience and the use of mobile applications for enhanced flexibility, are increasingly being integrated with the existing contact center systems. Cloud contact center software and solutions can act as substitutes for legacy on-premise systems, and the demand for these solutions is expected to surge.

The end users of contact center solutions include government agencies as well as incumbents of various sectors and industries such as BFSI, consumer goods & retail, healthcare, IT & telecom, media & entertainment, and travel & hospitality. Factors such as growing emphasis on customer satisfaction, customer loyalty, and implementation of predictive analytics at contact centers are expected to drive the growth of the contact center software market over the forecast period.

Solution Insights

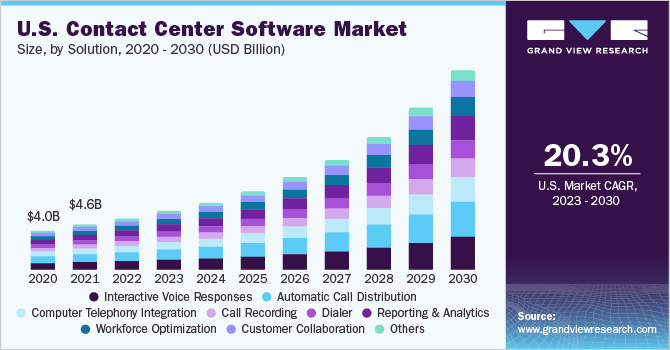

The interactive voice responses (IVR) segment dominated the market in 2022 and accounted for a revenue share of more than 21.0%. IVR systems provide an efficient and automated way to handle customer interactions by allowing callers to navigate through menu options using voice or keypad inputs. This enables self-service capabilities, reducing the need for live agent assistance for routine inquiries and simple tasks. The convenience and time-saving benefits of IVR systems have made them widely adopted by businesses across various industries.

The customer collaboration segment is expected to register the fastest growth over the forecast period. Customer collaboration solutions allow businesses to interact with both existing and potential customers in a better way. These solutions help businesses quickly tracking, receiving, and resolving customer support issues while simultaneously gathering and utilizing customer feedback to improve the products and service offerings. The strong emphasis on enhancing collaboration by using images and videos to communicate effectively with the clients is expected to drive the growth of the segment over the forecast period.

Service Insights

The integration and deployment segment dominated the market in 2022 and accounted for a revenue share of more than 41.0%. The increasing adoption of cloud-based contact center software solutions is expected to drive the adoption of integration & deployment services over the forecast period. Businesses across the globe are investing aggressively in integrating multiple applications and tools, such as customer relationship management (CRM), into their business processes, thereby driving the growth of the integration & deployment segment. The rising need for rapid deployment of cloud-based solutions and business agility also bodes well for the growth of the integration & deployment segment over the forecast period.

The managed services segment is expected to register the fastest growth over the forecast period. Managed services allow businesses to focus on their core products and services while handing over the company’s IT-related tasks to managed service providers. Managed services help businesses in keeping their applications running for end users leveraging configuration management, provisioning, standard change management, and patch management tools. Managed services also include an array of value-added services to help businesses achieve the most from contact center solutions in terms of performance and reliability while keeping operational costs under control. The growing adoption of cloud solutions bodes well for the growth of the managed services segment.

Deployment Insights

The on-premise segment dominated the contact center software market in 2022 and accounted for a global revenue share of over 57.0%. On-premise deployment envisages deploying all the hardware and software required to operate and maintain a contact center at the customer’s property. On-premise solutions provide integrability, reliability, customizability, and also scalability to some extent. However, they can be very difficult and expensive to deploy at times. The customizability benefits of on-premise solutions can be realized only when businesses invest heavily in professional services.

The hosted segment is anticipated to register the fastest growth over the forecast period. Businesses across the globe are preferring cloud-based contact center solutions over on-premise solutions owing to the ability of cloud-based contact center solutions to scale services. Cloud solutions are designed to connect contact center agents to effectively centralized contact center applications while offering a secure intranet for employees to collaborate and communicate with each other. Cloud-based solutions are also capable of offering in-depth information about the agents and customers, which executives would not be able to track using on-premise solutions. According to a study by RingCentral, Inc., shifting to cloud-based solutions can help in improving customer call answer rates by around 5% while reducing the average speed of answer (ASA) by as much as 50%.

Enterprise Size Insights

The large enterprise segment dominated the contact center software market in 2022 and reported for a global revenue share of over 57.0%. Large enterprises have their customers spread across the globe. Hence, large enterprises are more likely to invest in the latest, advanced technologies to run their business effectively and ensure business continuity. Moreover, large enterprises typically prefer solutions and services that can potentially help in augmenting profitability. The integration of AI with contact center operations is also driving the adoption of contact center software by large enterprises.

The small & medium enterprise segment is anticipated to register the fastest growth over the forecast period. The growing implementation of customer care solutions by small & medium enterprises across the globe is expected to drive the growth of the segment over the forecast period. Small & medium enterprises are adopting these solutions as part of the efforts to ease the workloads of carrying out the normal, mundane tasks while allowing contact center agents to focus on organizational development. The growing number of small- and medium-sized businesses across the globe is anticipated to create new growth opportunities for the segment over the forecast period.

End Use Insights

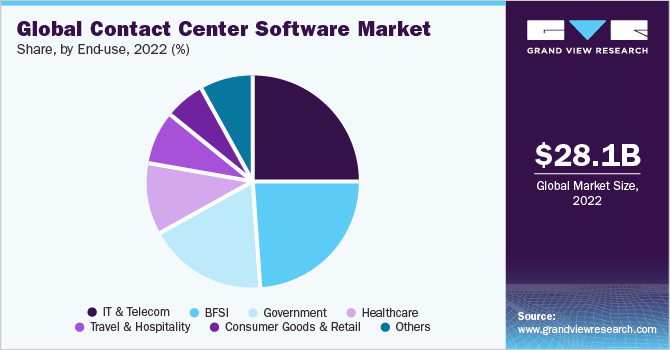

The IT & telecom segment dominated the market in 2022 and reported a revenue share of more than 24.0%. The IT & telecom industry relies heavily on customer support and interaction to address technical issues, provide assistance, and deliver exceptional service. Contact center software plays a crucial role in managing and optimizing these customer interactions, ensuring seamless communication between customers and IT & telecom companies. These software solutions offer features such as call routing, automatic call distribution, and customer relationship management integration, which help IT & telecom companies efficiently manage large volumes of customer inquiries and provide timely resolutions.

The consumer goods and retail segment is anticipated to register the fastest growth over the forecast period. Customers are moving continuously toward digital channels for their shopping needs. Moreover, customers are also utilizing the latest technologies and channels, thereby prompting consumer goods & retail businesses to opt for contact center solutions for providing exceptional customer experiences. These solutions are helping retailers and businesses in striking personalized interactions with customers and building strong customer relationships. Contact center software is also helping brands and retailers in delivering automated, high-quality service while freeing agents to focus on revenue generation and brand enhancement activities with the help of AI.

Regional Insights

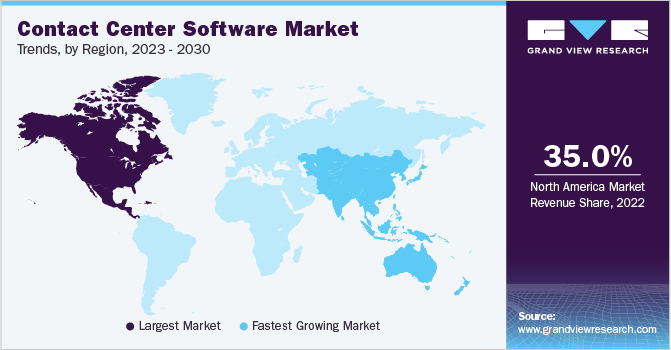

North America dominated the contact center software market in 2022 and accounted for a revenue share of over 35.0%. The region has a highly developed and technologically advanced business landscape, with a large number of enterprises across various industries. These organizations have recognized the importance of delivering exceptional customer experiences and have therefore invested significantly in contact center solutions. In addition, North America is home to several major players in the contact center software industry who have a strong presence and extensive market reach.

Asia Pacific is projected to emerge as the fastest-growing regional market over the forecast period. The growth of the regional contact center software market can be attributed to the existence of a large number of Information Technology-enabled Services (ITES) and IT companies in the region. The growing adoption of contact center solutions by both large and small & medium enterprises is anticipated to drive the growth of the regional market. The favorable initiatives governments in the region have been pursuing to encourage the adoption of cloud-based systems and automation of business processes are also expected to play a decisive role in driving the growth of the regional market. The fact that several organizations across the globe remain keen on investing in Asia Pacific bodes equally well for the growth of the regional market.

Key Companies & Market Share Insights

Some of the key players operating in the market include Alcatel-Lucent Enterprise, Cisco Systems, Inc., Avaya Inc., SAP SE, Enghouse Interactive Inc., and Five9, Inc.

- Avaya, Inc. is a provider of communication software and services. The company’s product offerings include contact center solutions and unified communications solutions, offered either for on-premise deployment, hybrid deployment, or cloud deployment. The company has developed omnichannel contact center applications that can potentially fulfill an organization’s customer-centric communication requirements. The solutions are compatible with several web applications and enable seamless communication through e-mails, voice-based channels, social media, and video calls.

- Alcatel-Lucent Enterprise is engaged in providing contact center software and solutions categorized for different applications. The company’s main aim while designing these solutions is to offer its clients omnichannel services that are available for cloud deployment as well as on-premise deployment.

NEC Corporation, 8X8, Inc., Twilio Inc, and ConvergeOne Holding, Inc are some of the emerging market participants in the contact center software market.

-

8X8, Inc. is engaged in providing configurable and scalable cloud communication platforms for video and voice interactions, chat and team collaboration, contact center, and analytics for enterprises of all sizes. The company markets their services directly to end users through various channels, including third-party lead generation sources, search engine marketing and optimization, industry conferences, digital advertising, webinars, and trade shows.

-

Twilio Inc. is engaged in providing cloud communications solutions and services to businesses across the globe. The company’s Application Programming Interfaces (APIs) allow developers to build, operate, and scale real-time communications within their software applications. The reliability and flexibility offered by the company’s software building blocks empower businesses of all sizes to build engagement into their customer experience.

Key Contact Center Software Companies:

- 8X8, Inc.

- ALE International

- Altivon

- Amazon Web Services, Inc.

- Ameyo

- Amtelco

- Aspect Software

- Avaya Inc.

- Avoxi

- Cisco Systems, Inc.

- Enghouse Interactive Inc.

- Exotel Techcom Pvt. Ltd.

- Five9, Inc.

- Genesys

- Microsoft Corporation

- NEC Corporation

- SAP SE

- Spok, Inc.

- Talkdesk, Inc.

- Twilio Inc.

- UiPath

- Unify Inc

- VCC Live

Recent Developments

-

In May 2023, BT Group plc and Five9, Inc. announced the expansion of partnership to provide cloud-based contact centers across the globe. Through the partnership end use companies can access Five9 Intelligent CX Platform which is embedded with data and voice services of BT Group plc.

-

In March 2023, Five9, Inc. introduced an Agent Assist 2.0 solution. It is integrated with AI summary and powered by OpenAI. The solution help end use companies to improve agent performance, processes, and customer experience.

-

In January 2023, NICE, a New York-based contact center software provider, unveiled a global strategic partnership with Cognizant to expedite customer experience (CX) transformation. This collaboration brings together the extensive consulting and business transformation expertise of Cognizant and the powerful, all-encompassing cloud platform of NICE CXone. By leveraging advanced CX solutions such as digital, analytics, and conversational AI, this partnership aims to drive the widespread adoption of innovative CX offerings. Both NICE and Cognizant anticipate significant growth opportunities within their respective customer bases through this strategic alliance.

-

In May 2022, Amazon Web Services and IBM signed a strategic collaboration agreement. This agreement enabled IBM to provide a wide range of its software portfolio as Software-as-a-Service (SaaS) on Amazon Web Services.

Contact Center Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 33.38 billion

Revenue forecast in 2030

USD 149.58 billion

Growth rate

CAGR of 23.9% from 2023 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Germany, U.K., France, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

8X8, Inc.; ALE International; Altivon; Amazon Web Services, Inc.; Ameyo; Amtelco; Aspect Software; Avaya Inc.; Avoxi; Cisco Systems, Inc.; Enghouse Interactive Inc.; Exotel Techcom Pvt. Ltd.; Five9, Inc.; Genesys; Microsoft Corporation; NEC Corporation; SAP SE; Spok, Inc.; Talkdesk, Inc.; Twilio Inc.; UiPath; Unify Inc.; VCC Live

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contact Center Software Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global contact center software market report based on solution, service, deployment, enterprise size, end use, and region.

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Automatic Call Distribution (ACD)

-

Call Recording

-

Computer Telephony Integration (CTI)

-

Customer Collaboration

-

Dialer

-

Interactive Voice Responses (IVR)

-

Reporting & Analytics

-

Workforce Optimization

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hosted

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Consumer Goods & Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contact center software market size was estimated at USD 28.09 billion in 2022 and is expected to reach USD 33.38 billion in 2023.

b. The global contact center software market is expected to witness a compound annual growth rate of 23.9% from 2023 to 2030 to reach USD 149.58 billion by 2030.

b. North America dominated the contact center software market with a share of 35.90% in 2022. This is attributable to the presence of a large number of contact center software vendors in the region.

b. Some key players operating in the contact center software market include Avaya, Inc.; Cisco Systems, Inc.; Five9, Inc.; Genesys; Microsoft Corporation; NEC Corporation; Mitel Corporation; SAP SE; Nice Systems Ltd.; and Huawei Technologies Co., Ltd., among others.

b. Key factors that are driving the contact center software market growth include increasing demand for the automation of contact center solutions, the growing emphasis on enhancing customer experience through omnichannel solutions, and the surging adoption of cloud-based contact centers.

Table of Contents

Chapter 1. Contact Center Software Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.4. Information Analysis

1.4.1. Market Formulation & Data Visualization

1.4.2. Data Validation & Publishing

1.5. Research Scope and Assumptions

1.6. List of Data Sources

Chapter 2. Contact Center Software Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. Contact Center Software Market: Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Impact Analysis

3.3.1.1. Growing demand for automating customer care services

3.3.1.2. Growing emphasis on enhancing customer experience through omnichannel solutions

3.3.1.3. Growing preference for cloud-based contact center solutions

3.3.2. Market Challenge Impact Analysis

3.3.2.1. Inability to achieve Average Speed of Answer (ASA) and low First Call Resolution (FCR)

3.4. Impact of COVID-19 Pandemic

3.5. Industry Analysis Tools

3.5.1. Porter’s Analysis

3.5.2. PESTEL Analysis

Chapter 4. Contact Center Software Market: Solution Estimates & Trend Analysis

4.1. Solution Movement Analysis & Market Share, 2022 & 2030

4.2. Contact Center Software Market Estimates & Forecast, By Solution

4.2.1. Automatic Call Distribution

4.2.2. Call Recording

4.2.3. Computer Telephony Integration

4.2.4. Customer Collaboration

4.2.5. Dialer

4.2.6. Interactive Voice Response

4.2.7. Reporting and Analytics

4.2.8. Workforce Optimization

4.2.9. Others

Chapter 5. Contact Center Software Market: Service Estimates & Trend Analysis

5.1. Service Movement Analysis & Market Share, 2022 & 2030

5.2. Contact Center Software Market Estimates & Forecast, By Service

5.2.1. Integration & Deployment

5.2.2. Support & Maintenance

5.2.3. Training & Consulting

5.2.4. Managed Services

Chapter 6. Contact Center Software Market: Deployment Estimates & Trend Analysis

6.1. Deployment Movement Analysis & Market Share, 2022 & 2030

6.2. Contact Center Software Market Estimates & Forecast, By Deployment

6.2.1. Hosted

6.2.2. On-premise

Chapter 7. Contact Center Software Market: Entertprise Size Estimates & Trend Analysis

7.1. Enterprise Size Movement Analysis & Market Share, 2022 & 2030

7.2. Contact Center Software Market Estimates & Forecast, By Enterprise Size

7.2.1. Large Enterprise

7.2.2. Small & Medium Enterprises

Chapter 8. Contact Center Software Market: End Use Estimates & Trend Analysis

8.1. End Use Movement Analysis & Market Share, 2022 & 2030

8.2. Contact Center Software Market Estimates & Forecast, By End Use

8.2.1. BFSI

8.2.2. Consumer Goods & Retail

8.2.3. Government

8.2.4. Healthcare

8.2.5. IT & Telecom

8.2.6. Travel & Hospitality

8.2.7. Others

Chapter 9. Contact Center Software Market: Regional Estimates & Trend Analysis

9.1. Contact Center Software Market: Regional Outlook

9.2. North America

9.2.1. North America contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.2.2. U.S.

9.2.2.1. U.S. contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.2.3. Canada

9.2.3.1. Canada contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.3. Europe

9.3.1. Europe contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.3.2. U.K.

9.3.2.1. U.K. contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.3.3. Germany

9.3.3.1. Germany contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.3.4. France

9.3.4.1. Germany contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.3.5. Spain

9.3.5.1. Spain contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.4. Asia Pacific

9.4.1. Asia Pacific contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.4.2. China

9.4.2.1. China contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.4.3. India

9.4.3.1. India contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.4.4. Japan

9.4.4.1. Japan contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.4.5. South Korea

9.4.5.1. South Korea contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.4.6. Australia

9.4.6.1. Australia contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.5. Latin America

9.5.1. Latin America contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.5.2. Brazil

9.5.2.1. Brazil contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.5.3. Mexico

9.5.3.1. Mexico contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.6. Middle East & Africa

9.6.1. Middle East & Africa contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.6.2. Kingdom of Saudi Arabia (KSA)

9.6.2.1. Kingdom of Saudi Arabia (KSA) contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.6.3. UAE

9.6.3.1. UAE contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

9.6.4. South Arica

9.6.4.1. South Africa contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Chapter 10. Competitive Landscape

10.1. Company Categorization

10.2. Participant’s Overview

10.2.1. 8X8, Inc.

10.2.2. ALE International

10.2.3. Altivon

10.2.4. Amazon Web Services, Inc.

10.2.5. Ameyo

10.2.6. Amtelco

10.2.7. Aspect Software

10.2.8. Avaya, Inc.

10.2.9. Avoxi

10.2.10. Cisco Systems, Inc.

10.2.11. Enghouse Interactives, Inc.

10.2.12. Exotel Techcom Pvt. Ltd.

10.2.13. Five9, Inc.

10.2.14. Genesys

10.2.15. Microsoft Corporation

10.2.16. NEC Corporation

10.2.17. SAP SE

10.2.18. Spok, Inc.

10.2.19. Talkdesk, Inc.

10.2.20. Twilio, Inc.

10.2.21. UiPath

10.2.22. Unify, Inc.

10.2.23. VCC Live

10.3. Financial Performance

10.4. Product Benchmarking

10.5. Company Market Positioning

10.6. Company Market Share Analysis, 2022

10.7. Company Heat Map Analysis

10.8. Strategy Mapping

10.8.1. Expansion

10.8.2. Collaborations

10.8.3. Mergers & Acquisitions

10.8.4. New Product Launches

10.8.5. Partnerships

10.8.6. Others

List of Tables

Table 1 Contact center software market - Industry snapshot & key buying criteria, 2017 - 2030

Table 2 Global contact center software market, 2017 - 2030 (USD Million)

Table 3 Global contact center software market, by region, 2017 - 2030 (USD Million)

Table 4 Global contact center software market, by solution, 2017 - 2030 (USD Million)

Table 5 Global contact center software market, by service, 2017 - 2030 (USD Million)

Table 6 Global contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 7 Global contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 8 Global contact center software market, by end use, 2017 - 2030 (USD Million)

Table 9 Vendor landscape

Table 10 Benefits of business process automation in companies across the globe, 2018 (%)

Table 11 Impact of omnichannel customer experience, 2017 (%)

Table 12 Cloud adoption rates comparison (%)

Table 13 Elements of customer satisfaction (%)

Table 14 Global number of contact centers, 2017 - 2030

Table 15 Global number of contact centers, by region, 2017 - 2030

Table 16 Global number of agent positions, 2017 - 2030 (In Million)

Table 17 Global number of agent positions, by region, 2017 - 2030 (In Million)

Table 18 Global number of agent positions, by type, 2017 - 2030 (In Million)

Table 19 Global number of in-house agent positions, by region, 2017 - 2030 (In Million)

Table 20 Global number of outsourced agent positions, by region, 2017 - 2030 (In Million)

Table 21 List of prominent players - North America

Table 22 List of prominent players - Europe

Table 23 List of prominent players - Asia Pacific

Table 24 List of prominent players - Latin America

Table 25 List of prominent players - MEA

Table 26 Global contact centers with 1000+ agents’ size

Table 27 ACD contact center software market, 2017 - 2030 (USD Million)

Table 28 ACD contact center software market, by region, 2017 - 2030 (USD Million)

Table 29 Call recording contact center software market, 2017 - 2030 (USD Million)

Table 30 Call recording contact center software market, by region, 2017 - 2030 (USD Million)

Table 31 CTI contact center software market, 2017 - 2030 (USD Million)

Table 32 CTI contact center software market, by region, 2017 - 2030 (USD Million)

Table 33 Customer collaboration contact center software market, 2017 - 2030 (USD Million)

Table 34 Customer collaboration contact center software market, by region, 2017 - 2030 (USD Million)

Table 35 Dialer contact center software market, 2017 - 2030 (USD Million)

Table 36 Dialer contact center software market, by region, 2017 - 2030 (USD Million)

Table 37 IVR contact center software market, 2017 - 2030 (USD Million)

Table 38 IVR contact center software market, by region, 2017 - 2030 (USD Million)

Table 39 Reporting & analytics contact center software market, 2017 - 2030 (USD Million)

Table 40 Reporting & analytics contact center software market, by region, 2017 - 2030 (USD Million)

Table 41 Workforce optimization contact center software market, 2017 - 2030 (USD Million)

Table 42 Workforce optimization contact center software market, by region, 2017 - 2030 (USD Million)

Table 43 Other contact center software market, 2017 - 2030 (USD Million)

Table 44 Other contact center software market, by region, 2017 - 2030 (USD Million)

Table 45 Contact center software integration & deployment service market, 2017 - 2030 (USD Million)

Table 46 Contact center software integration & deployment service market, by region, 2017 - 2030 (USD Million)

Table 47 Contact center software support & maintenance service market, 2017 - 2030 (USD Million)

Table 48 Contact center software support & maintenance service market, by region, 2017 - 2030 (USD Million)

Table 49 Contact center software training & consulting service market, 2017 - 2030 (USD Million)

Table 50 Contact center software training & consulting service market, by region, 2017 - 2030 (USD Million)

Table 51 Contact center software managed service market, 2017 - 2030 (USD Million)

Table 52 Contact center software managed service market, by region, 2017 - 2030 (USD Million)

Table 53 Hosted contact center software market, 2017 - 2030 (USD Million)

Table 54 Hosted contact center software market, by region, 2017 - 2030 (USD Million)

Table 55 On-premise contact center software market, 2017 - 2030 (USD Million)

Table 56 On-premise contact center software market, by region, 2017 - 2030 (USD Million)

Table 57 Contact center software market in large enterprises, 2017 - 2030 (USD Million)

Table 58 Contact center software market in large enterprises, by region, 2017 - 2030 (USD Million)

Table 59 Contact center software market in small & medium enterprises, 2017 - 2030 (USD Million)

Table 60 Contact center software market in small & medium enterprises, by region, 2017 - 2030 (USD Million)

Table 61 Contact center software market in BFSI, 2017 - 2030 (USD Million)

Table 62 Contact center software market in BFSI, by region, 2017 - 2030 (USD Million)

Table 63 Contact center software market in consumer goods & retail, 2017 - 2030 (USD Million)

Table 64 Contact center software market in consumer goods & retail, by region, 2017 - 2030 (USD Million)

Table 65 Contact center software market in government, 2017 - 2030 (USD Million)

Table 66 Contact center software market in government, by region, 2017 - 2030 (USD Million)

Table 67 Contact center software market in healthcare, 2017 - 2030 (USD Million)

Table 68 Contact center software market in healthcare, by region, 2017 - 2030 (USD Million)

Table 69 Contact center software market in IT & telecom, 2017 - 2030 (USD Million)

Table 70 Contact center software market in IT & telecom, by region, 2017 - 2030 (USD Million)

Table 71 Contact center software market in travel & hospitality, 2017 - 2030 (USD Million)

Table 72 Contact center software market in travel & hospitality, by region, 2017 - 2030 (USD Million)

Table 73 Contact center software market in other end use, 2017 - 2030 (USD Million)

Table 74 Contact center software market in other end use, by region, 2017 - 2030 (USD Million)

Table 75 North America contact center software market, 2017 - 2030 (USD Million)

Table 76 North America contact center software market, by solution, 2017 - 2030 (USD Million)

Table 77 North America contact center software market, by service, 2017 - 2030 (USD Million)

Table 78 North America contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 79 North America contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 80 North America contact center software market, by end use, 2017 - 2030 (USD Million)

Table 81 U.S. contact center software market, 2017 - 2030 (USD Million)

Table 82 U.S. contact center software market, by solution, 2017 - 2030 (USD Million)

Table 83 U.S. contact center software market, by service, 2017 - 2030 (USD Million)

Table 84 U.S. contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 85 U.S. contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 86 U.S. contact center software market, by end use, 2017 - 2030 (USD Million)

Table 87 Canada contact center software market, 2017 - 2030 (USD Million)

Table 88 Canada contact center software market, by solution, 2017 - 2030 (USD Million)

Table 89 Canada contact center software market, by service, 2017 - 2030 (USD Million)

Table 90 Canada contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 91 Canada contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 92 Canada contact center software market, by end use, 2017 - 2030 (USD Million)

Table 93 Europe contact center software market, 2017 - 2030 (USD Million)

Table 94 Europe contact center software market, by solution, 2017 - 2030 (USD Million)

Table 95 Europe contact center software market, by service, 2017 - 2030 (USD Million)

Table 96 Europe contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 97 Europe contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 98 Europe contact center software market, by end use, 2017 - 2030 (USD Million)

Table 99 Germany contact center software market, 2017 - 2030 (USD Million)

Table 100 Germany contact center software market, by solution, 2017 - 2030 (USD Million)

Table 101 Germany contact center software market, by service, 2017 - 2030 (USD Million)

Table 102 Germany contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 103 Germany contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 104 Germany contact center software market, by end use, 2017 - 2030 (USD Million)

Table 105 U.K. contact center software market, 2017 - 2030 (USD Million)

Table 106 U.K. contact center software market, by solution, 2017 - 2030 (USD Million)

Table 107 U.K. contact center software market, by service, 2017 - 2030 (USD Million)

Table 108 U.K. contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 109 U.K. contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 110 U.K. contact center software market, by end use, 2017 - 2030 (USD Million)

Table 111 Spain contact center software market, 2017 - 2030 (USD Million)

Table 112 Spain contact center software market, by solution, 2017 - 2030 (USD Million)

Table 113 Spain contact center software market, by service, 2017 - 2030 (USD Million)

Table 114 Spain contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 115 Spain contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 116 Spain contact center software market, by end use, 2017 - 2030 (USD Million)

Table 117 Asia Pacific contact center software market, 2017 - 2030 (USD Million)

Table 118 Asia Pacific contact center software market, by solution, 2017 - 2030 (USD Million)

Table 119 Asia Pacific contact center software market, by service, 2017 - 2030 (USD Million)

Table 120 Asia Pacific contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 121 Asia Pacific contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 122 Asia Pacific contact center software market, by end use, 2017 - 2030 (USD Million)

Table 123 China contact center software market, 2017 - 2030 (USD Million)

Table 124 China contact center software market, by solution, 2017 - 2030 (USD Million)

Table 125 China contact center software market, by service, 2017 - 2030 (USD Million)

Table 126 China contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 127 China contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 128 China contact center software market, by end use, 2017 - 2030 (USD Million)

Table 129 India contact center software market, 2017 - 2030 (USD Million)

Table 130 India contact center software market, by solution, 2017 - 2030 (USD Million)

Table 131 India contact center software market, by service, 2017 - 2030 (USD Million)

Table 132 India contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 133 India contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 134 India contact center software market, by end use, 2017 - 2030 (USD Million)

Table 135 Japan contact center software market, 2017 - 2030 (USD Million)

Table 136 Japan contact center software market, by solution, 2017 - 2030 (USD Million)

Table 137 Japan contact center software market, by service, 2017 - 2030 (USD Million)

Table 138 Japan contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 139 Japan contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 140 Japan contact center software market, by end use, 2017 - 2030 (USD Million)

Table 141 Latin America contact center software market, 2017 - 2030 (USD Million)

Table 142 Latin America contact center software market, by solution, 2017 - 2030 (USD Million)

Table 143 Latin America contact center software market, by service, 2017 - 2030 (USD Million)

Table 144 Latin America contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 145 Latin America contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 146 Latin America contact center software market, by end use, 2017 - 2030 (USD Million)

Table 147 Brazil contact center software market, 2017 - 2030 (USD Million)

Table 148 Brazil contact center software market, by solution, 2017 - 2030 (USD Million)

Table 149 Brazil contact center software market, by service, 2017 - 2030 (USD Million)

Table 150 Brazil contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 151 Brazil contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 152 Brazil contact center software market, by end use, 2017 - 2030 (USD Million)

Table 153 MEA contact center software market, 2017 - 2030 (USD Million)

Table 154 MEA contact center software market, by solution, 2017 - 2030 (USD Million)

Table 155 MEA contact center software market, by service, 2017 - 2030 (USD Million)

Table 156 MEA contact center software market, by deployment, 2017 - 2030 (USD Million)

Table 157 MEA contact center software market, by enterprise size, 2017 - 2030 (USD Million)

Table 158 MEA contact center software market, by end use, 2017 - 2030 (USD Million)

List of Figures

Fig. 1 Contact center software market segmentation

Fig. 2 Information procurement

Fig. 3 Data analysis models

Fig. 4 Market formulation and valudation

Fig. 5 Data validating & publishing

Fig. 6 Market snapshot

Fig. 7 Segment snapshot

Fig. 8 Competitive landscape snapshot

Fig. 9 Parent Market Value, 2022 (USD Million)

Fig. 10 Contact center software market - Industry value chain analysis

Fig. 11 Contact center software market dynamics

Fig. 12 Contact center software market: Porters’s analysis

Fig. 13 Contact center software market: PESTEL analysis

Fig. 14 Contact center software market, by solution: key takeaways

Fig. 15 Contact center software market, by solution: market share, 2022 & 2030

Fig. 16 Contact center software market estimates & forecasts, by automatic call distribution, 2017 - 2030 (USD Million)

Fig. 17 Contact center software market estimates & forecasts, by call recording, 2017 - 2030 (USD Million)

Fig. 18 Contact center software market estimates & forecasts, by computer telephony integration, 2017 - 2030 (USD Million)

Fig. 19 Contact center software market estimates & forecasts, by customer collaboration, 2017 - 2030 (USD Million)

Fig. 20 Contact center software market estimates & forecasts, by dialer, 2017 - 2030 (USD Million)

Fig. 21 Contact center software market estimates & forecasts, by interactive voice response, 2017 - 2030 (USD Million)

Fig. 22 Contact center software market estimates & forecasts, by reporting and analytics, 2017 - 2030 (USD Million)

Fig. 23 Contact center software market estimates & forecasts, by workfroce optimization, 2017 - 2030 (USD Million)

Fig. 24 Contact center software market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 25 Contact center software market, by service: key takeaways

Fig. 26 Contact center software market, by service: market share, 2022 & 2030

Fig. 27 Contact center software market estimates & forecasts, by intergation & deployment, 2017 - 2030 (USD Million)

Fig. 28 Contact center software market estimates & forecasts, by support & maintenance, 2017 - 2030 (USD Million)

Fig. 29 Contact center software market estimates & forecasts, by training & consulting, 2017 - 2030 (USD Million)

Fig. 30 Contact center software market estimates & forecasts, by managed services, 2017 - 2030 (USD Million)

Fig. 31 Contact center software market, by deployment: key takeaways

Fig. 32 Contact center software market, by deployment: market share, 2022 & 2030

Fig. 33 Contact center software market estimates & forecasts, by hosted, 2017 - 2030 (USD Million)

Fig. 34 Contact center software market estimates & forecasts, by on-premise, 2017 - 2030 (USD Million)

Fig. 35 Contact center software market, by enterprise size: key takeaways

Fig. 36 Contact center software market, by enterprise size: market share, 2022 & 2030

Fig. 37 Contact center software market estimates & forecasts, by large enterprise, 2017 - 2030 (USD Million)

Fig. 38 Contact center software market estimates & forecasts, by small & medium enterprise, 2017 - 2030 (USD Million)

Fig. 39 Contact center software market, by end use: key takeaways

Fig. 40 Contact center software market, by end use: market share, 2022 & 2030

Fig. 41 Contact center software market estimates & forecasts, by BFSI, 2017 - 2030 (USD Million)

Fig. 42 Contact center software market estimates & forecasts, by consumer goods & retail, 2017 - 2030 (USD Million)

Fig. 43 Contact center software market estimates & forecasts, by government, 2017 - 2030 (USD Million)

Fig. 44 Contact center software market estimates & forecasts, by healthcare, 2017 - 2030 (USD Million)

Fig. 45 Contact center software market estimates & forecasts, by IT & telecom, 2017 - 2030 (USD Million)

Fig. 46 Contact center software market estimates & forecasts, by travel & hospitality, 2017 - 2030 (USD Million)

Fig. 47 Contact center software market estimates & forecasts, by others, 2017 - 2030 (USD Million)

Fig. 48 Contact center software market revenue, by region, 2022 & 2030, (USD Million)

Fig. 49 Regional marketplace: key takeways

Fig. 50 North America contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 51 U.S. contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 52 Canada contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 53 Europe contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 54 U.K. Contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 55 Germany contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 56 France contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 57 Spain contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 58 Asia pacific contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 59 China contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 60 India contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 61 Japan contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 62 South Korea contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 63 Australia contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 64 Latin America contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 65 Brazil contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 66 Mexico contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 67 Middle East & Africa contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 68 Kingdom of Saudi Arabia (KSA) contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 69 UAE contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 70 South Africa contact center software market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 71 Key company categorization

Fig. 72 Company market positioning

Fig. 73 Company market share analysis, 2022

Fig. 74 Strategic frameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Contact Center Software Solution Outlook (Revenue, USD Billion; 2017 - 2030)

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Contact Center Software Service Outlook (Revenue, USD Billion; 2017 - 2030)

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Contact Center Software Deployment Outlook (Revenue, USD Billion; 2017 - 2030)

- Hosted

- On-premise

- Contact Center Software Enterprise Size Outlook (Revenue, USD Billion; 2017 - 2030)

- Large Enterprise

- Small & Medium Enterprise

- Contact Center Software End Use Outlook (Revenue, USD Billion; 2017 - 2030)

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Contact Center Software Regional Outlook (Revenue, USD Billion; 2017 - 2030)

- North America

- North America Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- North America Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- North America Contact Center Software Market, by Deployment

- Hosted

- On-premise

- North America Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- North America Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- U.S.

- U.S. Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- U.S. Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- U.S. Contact Center Software Market, by Deployment

- Hosted

- On-premise

- U.S. Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- U.S. Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- U.S. Contact Center Software Market, by Solution

- Canada

- Canada Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Canada Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Canada Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Canada Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Canada Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Canada Contact Center Software Market, by Solution

- North America Contact Center Software Market, by Solution

- Europe

- Europe Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Europe Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Europe Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Europe Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Europe Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Germany

- Germany Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Germany Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Germany Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Germany Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Germany Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Germany Contact Center Software Market, by Solution

- U.K.

- U.K. Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- U.K. Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- U.K. Contact Center Software Market, by Deployment

- Hosted

- On-premise

- U.K. Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- U.K. Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- U.K. Contact Center Software Market, by Solution

- Spain

- Spain Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Spain Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Spain Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Spain Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Spain Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Spain Contact Center Software Market, by Solution

- France

- France Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- France Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- France Contact Center Software Market, by Deployment

- Hosted

- On-premise

- France Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- France Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- France Contact Center Software Market, by Solution

- Europe Contact Center Software Market, by Solution

- Asia Pacific

- Asia Pacific Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Asia Pacific Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Asia Pacific Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Asia Pacific Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Asia Pacific Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- China

- China Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- China Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- China Contact Center Software Market, by Deployment

- Hosted

- On-premise

- China Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- China Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- China Contact Center Software Market, by Solution

- India

- India Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- India Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- India Contact Center Software Market, by Deployment

- Hosted

- On-premise

- India Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- India Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- India Contact Center Software Market, by Solution

- Japan

- Japan Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Japan Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Japan Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Japan Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Japan Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Japan Contact Center Software Market, by Solution

- South Korea

- South Korea Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- South Korea Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- South Korea Contact Center Software Market, by Deployment

- Hosted

- On-premise

- South Korea Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- South Korea Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- South Korea Contact Center Software Market, by Solution

- Australia

- Australia Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Australia Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Australia Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Australia Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Australia Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Australia Contact Center Software Market, by Solution

- Asia Pacific Contact Center Software Market, by Solution

- Latin America

- Latin America Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Latin America Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Latin America Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Latin America Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Latin America Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Brazil

- Brazil Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Brazil Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Brazil Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Brazil Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Brazil Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Brazil Contact Center Software Market, by Solution

- Mexico

- Mexico Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Mexico Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Mexico Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Mexico Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Mexico Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Mexico Contact Center Software Market, by Solution

- Latin America Contact Center Software Market, by Solution

- MEA

- MEA Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- MEA Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- MEA Contact Center Software Market, by Deployment

- Hosted

- On-premise

- MEA Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- MEA Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Kingdom of Saudi Arabia (KSA)

- Kingdom of Saudi Arabia (KSA) Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- Kingdom of Saudi Arabia (KSA) Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- Kingdom of Saudi Arabia (KSA) Contact Center Software Market, by Deployment

- Hosted

- On-premise

- Kingdom of Saudi Arabia (KSA) Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- Kingdom of Saudi Arabia (KSA) Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- Kingdom of Saudi Arabia (KSA) Contact Center Software Market, by Solution

- UAE

- UAE Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- UAE Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- UAE Contact Center Software Market, by Deployment

- Hosted

- On-premise

- UAE Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- UAE Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- UAE Contact Center Software Market, by Solution

- South Africa

- South Africa Contact Center Software Market, by Solution

- Automatic Call Distribution (ACD)

- Call Recording

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialer

- Interactive Voice Responses (IVR)

- Reporting & Analytics

- Workforce Optimization

- Others

- South Africa Contact Center Software Market, by Service

- Integration & Deployment

- Support & Maintenance

- Training & Consulting

- Managed Services

- South Africa Contact Center Software Market, by Deployment

- Hosted

- On-premise

- South Africa Contact Center Software Market, by Enterprise Size

- Large Enterprise

- Small & Medium Enterprise

- South Africa Contact Center Software Market, by End Use

- BFSI

- Consumer Goods & Retail

- Government

- Healthcare

- IT & Telecom

- Traveling & Hospitality

- Others

- South Africa Contact Center Software Market, by Solution

- MEA Contact Center Software Market, by Solution

- North America

Contact Center Software Market Dynamics

Surging Demand for Automating Customer Care Services

One of the most important factor that is driving the contact center software market growth is the rising demand for automating customer care services. Customer care executives are presently accountable for building stronger relationships with customers to offer long-term value for the business. As such, they are also needed to emphasize on retaining existing customers to guarantee brand loyalty. This is encouraging organizations to choose automation to decrease the time required to address regular customer queries and utilize the time for resolving intricate issues and enticing new customers.

Organizations are actively executing Artificial Intelligence (AI) and machine learning technologies for improving customer experience. AI and machine learning technologies are letting companies offer personalized solutions to customers’ concerns. For example, AI-based chatbots paired with social media management tools can assist in customers to find solutions to their issues on their own effortlessly.

Increasing Significance of Enhancing Customer Experience Through Omnichannel Solutions

Contact center technologies have advanced quickly over the past decade, encouraging numerous organizations to integrate these technologies into their business processes. Organizations are producing large volumes of data, which, if incorporated on a single channel efficiently, can lead to augmented workforce productivity, decrease average call time per customer, and improved customer experience.

It is being witnessed that customer retention is getting progressively challenging for organizations. At this stage, omnichannel contact centers are anticipated to elevate customer experience, as they can allow switching across multiple channels to access the same contextual information across all channels. The unification of customer communication is also helping organizations in resolving issues quicker than before and helping sales representatives in pursuing better prospects for future marketing.

Restraint: Incompetence to Achieve Average Speed of Answer (ASA) and Low First Call Resolution (FCR)

Numerous factors such as decreased customer satisfaction, lowered agent satisfaction, high abandonment rates, surged handle time, and risen contact center costs are a result of low FCR and high ASA. Though numerous contact center solution providers are undertaking numerous measures to confirm that customer inquiries are handled within the stipulated time, there is still a substantial gap between the number of incoming phone calls attended and the number of queries resolved in the first call. This can be measured by contact center metrics such as ASA and FCR, which decide the performance of contact centers.

While customers’ expectations have been growing consistently, organizations have not been able to match the desired level of customer services. Contact center metrics recommend that customers should not be waiting in a call queue for more than 20 seconds. In other words, the ASA cannot be more than 20 seconds. If the customer waiting time surpasses 20 seconds, call volume, which is the number of calls attended on a day, is negatively impacted.

What Does This Report Include?

This section will provide insights into the contents included in this contact center software market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Contact center software market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Contact center software market quantitative analysis

-

Market size, estimates, and forecast from 2017 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance