- Home

- »

- Next Generation Technologies

- »

-

Content Intelligence Market Size, Share, Growth Report 2030GVR Report cover

![Content Intelligence Market Size, Share & Trends Report]()

Content Intelligence Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-premise), By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-131-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Content Intelligence Market Summary

The global content intelligence market size was estimated at USD 1.15 billion in 2022 and is expected to reach USD 10.09 billion by 2030, registering a CAGR of 31.5% from 2023 to 2030. This market growth is driven by the escalating production and consumption of content, the imperative for data-driven decision-making, and the widespread adoption of artificial intelligence (AI) and machine learning (ML).

Key Market Trends & Insights

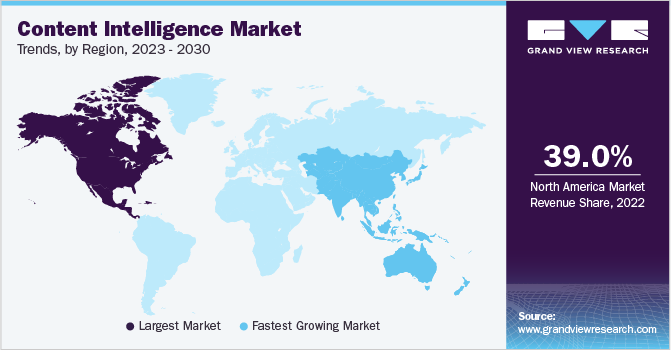

- The North America dominated the market in 2022 with a revenue share of over 39.0%.

- By enterprise size, the large enterprises segment dominated the market with the revenue share of over 69.0% in 2022.

- By end-use, the media & entertainment segment dominated the market and accounted for a revenue share of over 22.0% in 2022.

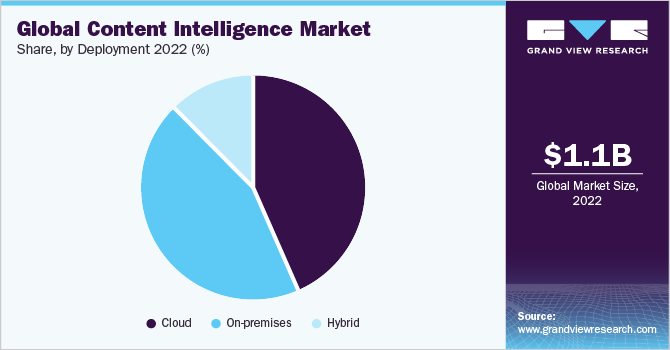

- By deployment, the cloud segment dominated the market with the revenue share of over 43.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.15 Billion

- 2030 Projected Market Size: USD 10.09 Billion

- CAGR (2023-2030): 31.5%

- North America: Largest Market in 2022

Content intelligence platforms empower organizations to automate content categorization, metadata generation, and relevant information extraction from vast content pools. This valuable data enhances content discovery, personalization, and content marketing strategies while optimizing various business processes such as sales, marketing, customer support, and product development.

For instance, in September 2022, Messagepoint Inc., a cloud-based CCM software solutions provider, introduced Semantex, a division offering an AI-driven content intelligence platform. Semantex aids developers in addressing intricate content-related tasks by providing services such as intelligent content extraction, classification, analysis, outlier detection, and enrichment.

Companies are increasingly investing in content intelligence platforms because they can enhance content effectiveness for target audiences and improve the return on investment in content marketing. In addition, they save valuable time and resources by automating various content-related tasks. These platforms offer insights into content performance, helping businesses understand how their content impacts their operations. For instance, prominent companies such as Adobe and M-Files provide platforms such as Adobe Analytics and M-Files Enterprise Information Platform. These solutions empower businesses to streamline content management and analysis, optimizing their content marketing strategies and overall efficiency.

Content marketing methods fuel the growth of the market by enabling businesses to create more relevant and engaging content, optimize it for search engines, and measure the effectiveness of their marketing campaigns. Content intelligence tools assist in identifying audience interests, preferred topics, and keywords, allowing for creating content that resonates with potential customers. These tools aid in SEO optimization, leading to improved search engine rankings, increased website traffic, and enhanced lead generation and sales opportunities. In addition, content intelligence tools provide valuable insights for tracking and improving the performance of content marketing campaigns, ultimately boosting overall marketing effectiveness.

Content intelligence leverages artificial intelligence (AI) and machine learning (ML) to analyze content and performance data, offering businesses valuable insights for creating relevant, engaging content, optimizing marketing campaigns, and measuring content impact. It enables automated content generation, freeing up creators for strategic tasks while facilitating content personalization for individual users enhancing engagement and conversions. Furthermore, AI and ML aid in content optimization for better search engine and social media visibility, expanding a business's reach. Thus, these technologies provide comprehensive content performance measurement, enabling businesses to identify their most effective content and refine marketing strategies accordingly.

Component Insights

The software segment led the market and accounted for a revenue share of over 76.0% in 2022. This dominance is attributed to the extensive capabilities of software solutions, empowering organizations to manage and optimize their content efficiently. The software facilitates content identification, classification, performance analysis, task automation, quality enhancement, and personalized content delivery for diverse audiences. The surge in digital channel adoption and the escalating content volume creation fuels the demand for content intelligence software as organizations seek tools to harness their content effectively and achieve their business objectives.

The service segment is predicted to foresee significant growth in the forecast years due to the increasing complexity of content intelligence solutions, the growing imperative for organizations to maximize their content investments, and the shortage of skilled content intelligence professionals. These services encompass training and education to equip employees with effective content intelligence skills and support for seamless solution implementation that includes troubleshooting, data integration, and security. In addition, they offer consulting expertise for the development and execution of content intelligence strategies and the option to outsource solution management to providers. Thus, organizations increasingly prioritize comprehensive services to maximize the benefits of content intelligence.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for a revenue share of over 69.0% in 2022. The segment's rise can be attributable to the substantial content volumes managed by large enterprises, compelling them to prioritize content strategy optimization. Their objectives encompass enhancing the quality and effectiveness of content marketing campaigns, gaining deeper insights into target audience preferences, and crafting personalized and relevant content experiences. Furthermore, they focus on measuring content performance for refinement and streamlining cost-effective content creation and management processes. Thus, the content intelligence platform plays a vital role in addressing the multifaceted needs of large-scale enterprises.

The SME segment is poised for significant growth in the coming years due to the increasing availability of cost-effective cloud-based content intelligence solutions tailored for SMEs, raising awareness of the benefits of content intelligence such as improved customer engagement and higher conversion rates, and heightened competition in the SME market, prompting investments in innovative technologies. SMEs are increasingly turning to content intelligence to create more effective marketing campaigns, enhance website performance through SEO optimization, and measure the ROI of their content efforts. Moreover, vendors are offering SME-specific content intelligence solutions, known for their affordability and user-friendly nature compared to enterprise-grade alternatives.

End-use Insights

The media & entertainment segment dominated the market and accounted for a revenue share of over 22.0% in 2022. The segment's growth is attributable to its constant generation of new content and the imperative to comprehend and analyze it for effective marketing campaigns, content strategy enhancement, and performance measurement. Content intelligence solutions enable media and entertainment companies to identify trends and patterns in their content, assess its performance across various channels, gauge its impact on the audience, and streamline content creation and distribution processes. Thus, the need to identify trends, gauge content performance across diverse channels, measure audience impact, and optimize content creation and distribution processes drives the segment's growth in the market.

The retail and consumer goods sector is poised for substantial growth due to the escalating importance of content within the industry. Content serves as a crucial tool for informing and engaging customers, driving sales, and fostering brand loyalty. As a result, companies in this sector are increasingly investing in content creation and distribution, with content intelligence playing a pivotal role in shaping effective content strategies. In addition, there is a surging demand for customer insights to tailor products and services to meet customer preferences, and content intelligence is instrumental in providing valuable insights into customer behavior and interests. Thus, with the rapid expansion of e-commerce, the ability to create and distribute digitally optimized content is paramount, and content intelligence offers valuable insights into online content performance.

Deployment Insights

The cloud segment dominated the market and accounted for a revenue share of over 43.0% in 2022. The segment's growth can be attributed to its inherent scalability, ideal for organizations dealing with seasonal demand fluctuations, coupled with cost-effectiveness, as it eliminates the need for significant hardware and software investments. Cloud solutions also boast ease of deployment and maintenance, with cloud providers managing underlying infrastructure. Moreover, their accessibility from anywhere with an internet connection makes them a preferred choice for organizations with remote workforces and global operations, solidifying their pivotal role in the evolving landscape of content intelligence.

The hybrid segment is expected to witness the fastest CAGR over the forecast period. Hybrid deployments allow organizations to scale their content intelligence capabilities without significant upfront investments in on-premise infrastructure. They also address security and compliance concerns by enabling the retention of sensitive data on-premise while leveraging the cloud's scalability and flexibility. In addition, hybrid deployments give organizations greater control over their content intelligence environment and performance, thus offering a balanced and adaptable approach to content intelligence solutions.

Regional Insights

North America dominated the content intelligence market in 2022 with a revenue share of over 39.0%. The region's growth is attributable to the North American businesses that proactively adopted content intelligence technologies, giving them a competitive edge in leveraging data-driven insights. In addition, the region's engagement of large enterprises investing in cutting-edge solutions further fueled the market's growth. Moreover, North America's robust ecosystem of content intelligence vendors played a pivotal role, ensuring a strong presence and a wide array of offerings in the market. For instance, in February 2023, M-Files, a U.S.-based company, acquired Ment, a no-code document automation company, to enhance its content intelligence capabilities. M-Files will integrate Ment's automation features into its platform, offering a holistic solution for document automation, management, and collaboration, improving productivity and efficiency for its users.

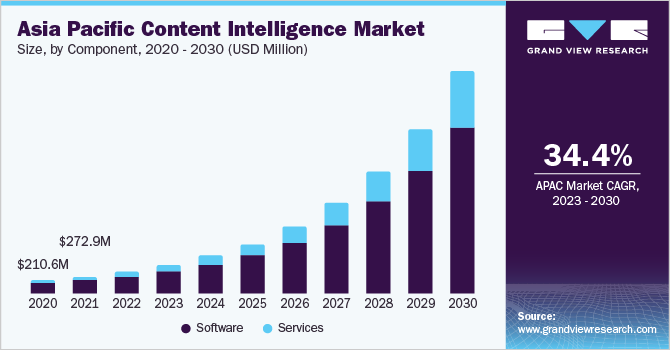

Asia Pacific is expected to witness a lucrative market opportunity in the coming years. Rapid economic growth in the region has led to a heightened demand for content intelligence solutions across businesses of varying sizes. Concurrently, the region is witnessing a substantial increase in digitalization, resulting in a surge in content creation and consumption, prompting the need for effective content management through content intelligence tools. Furthermore, there is a growing awareness of the advantages that content intelligence can bring, including enhanced customer engagement, increased sales, and cost reduction, further solidifying its potential in the Asia Pacific market.

Key Companies & Market Share Insights

Companies are proactively expanding their product offerings and forging strategic alliances to bolster their market presence. This indicates a competitive landscape where businesses focus on diversifying their solutions to meet evolving customer needs and stay ahead in the industry. Through the expansion of product portfolios, companies aim to offer comprehensive and innovative content intelligence solutions, ensuring they remain relevant and attractive to a wider client base. Moreover, strategic alliances enable them to share resources and tap into each other's strengths, thus enhancing their market position.

For instance, in March 2023, ChapsVision, a data processing specialist, acquired QWAM Content Intelligence. This strategic acquisition aims with ChapsVision's strategy to establish itself as a leading European player in natural language processing (NLP). QWAM Content Intelligence's specialized proficiency in textual data analysis will be seamlessly integrated into ChapsVision's suite of software solutions, complementing its powerful Argonos platform, which excels in processing diverse and large datasets. The acquisition would let ChapsVision strengthen its position in the market. Some prominent players in the global content intelligence market include:

-

ABBYY

-

Adobe.

-

Concured

-

Curata, Inc.

-

Emplifi Inc.

-

M-Files

-

Open Text Corporation

-

Progress Software Corporation

-

Scoop.it

-

Vennli, Inc.

Content Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.48 billion

Revenue forecast in 2030

USD 10.09 billion

Growth rate

CAGR of 31.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; UAE; KSA; South Africa

Key companies profiled

ABBYY; Adobe.; Concured; Curata, Inc.; Emplifi Inc.; M-Files; Open Text Corporation; Progress Software Corporation; Scoop.it; Vennli, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Content Intelligence Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global content intelligence market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

IT & Telecommunication

-

Manufacturing

-

Media & Entertainment

-

Retail & Consumer Goods

-

Travel & Hospitality

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global content intelligence market size was estimated at USD 1.15 billion in 2022 and is expected to reach USD 1.48 billion in 2023.

b. The global content intelligence market is expected to grow at a compound annual growth rate of 31.5% from 2023 to 2030 to reach USD 10.09 billion by 2030.

b. North America dominated the market in 2022, accounting for over 39% share of the global revenue. The region's growth is attributable to the North American businesses that proactively adopted content intelligence technologies, giving them a competitive edge in leveraging data-driven insights.

b. Some key players operating in the content intelligence market include ABBYY; Adobe.; Concured; Curata, Inc.; Emplifi Inc.; M-Files; Open Text Corporation; Progress Software Corporation; Scoop.it; Vennli, Inc

b. Key factors that are driving the content intelligence market growth include the rise of digital transformation and growing demand for data-driven decision-making.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.