- Home

- »

- IT Services & Applications

- »

-

Contract Lifecycle Management Software Market Report 2030GVR Report cover

![Contract Lifecycle Management Software Market Size, Share & Trends Report]()

Contract Lifecycle Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Business Function (Legal, Procurement), By Deployment Mode, By Organization Size, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-600-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Contract Lifecycle Management Software Market Summary

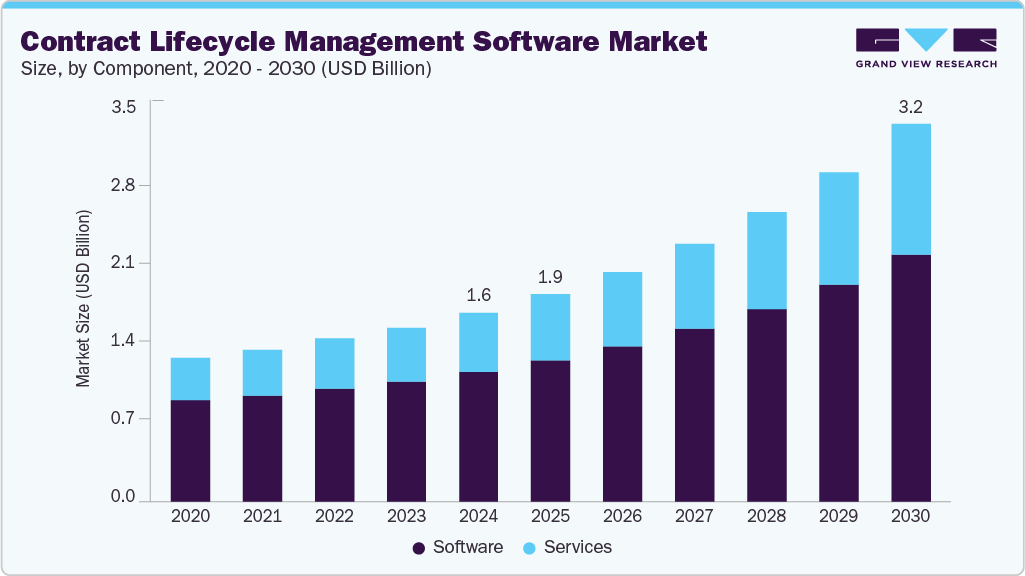

The global contract lifecycle management software market size was estimated at USD 1.62 billion in 2024 and is projected to reach USD 3.24 billion by 2030, growing at a CAGR of 12.7% from 2025 to 2030. The market is experiencing significant growth, driven by the increasing need for efficient contract management solutions across various industries.

Key Market Trends & Insights

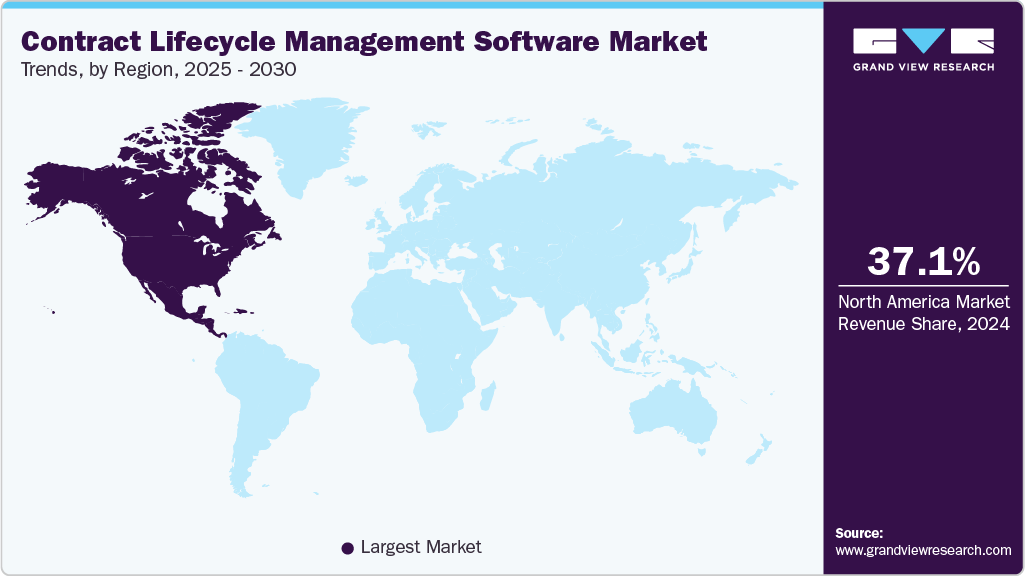

- North America dominated the contract lifecycle management software market in 2024 and held the largest revenue share of over 37.10%.

- The contract lifecycle management software industry in the U.S. is expected to grow significantly from 2025 to 2030.

- Based on component, the software segment held a market share of over 68.0% in 2024.

- Based on deployment, the cloud segment accounted for the largest market share of over 70.0% in 2024.

- In terms of end use, the BFSI segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.62 Billion

- 2030 Projected Market Size: USD 3.24 Billion

- CAGR (2025-2030): 12.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As organizations seek to automate and streamline their contract processes, the demand for CLM software has surged. The market is characterized by the adoption of cloud-based solutions, integration of advanced technologies like artificial intelligence (AI) and machine learning (ML), and a focus on compliance and risk management. As businesses grow and operate in increasingly dynamic and globalized environments, the volume and complexity of contracts ranging from vendor agreements and customer deals to regulatory and compliance documents have surged dramatically. This escalation makes it difficult for organizations to manage contracts manually without facing inefficiencies, delays, and risks. The stakes are high: missed deadlines, overlooked obligations, and non-compliance can lead to costly penalties or legal consequences. This growing complexity has made robust contract lifecycle management (CLM) software solutions a necessity rather than a luxury.

The rapid digital transformation underway across nearly all industries has encouraged the shift from traditional, paper-based contract management to cloud-based platforms. These solutions are not only more efficient but also scalable, allowing companies to manage thousands of contracts across multiple geographies and departments. Cloud-based CLM platforms offer remote accessibility, enabling legal, procurement, and sales teams to collaborate on contracts in real time, regardless of location a crucial capability in today’s hybrid and remote work environments. The market is expected to witness increased adoption across various industries, including healthcare, finance, manufacturing, and legal services, driven by the need for streamlined contract processes and regulatory compliance. Moreover, the growing trend of remote work and global collaborations will further propel the demand for cloud-based CLM solutions that offer accessibility and real-time collaboration.

A major restraint in adopting CLM software is internal resistance to change, especially from employees used to manual or traditional methods. Transitioning to digital solutions demands a significant cultural shift and thorough training, which can be both time-consuming and resource-intensive. This hesitation can delay implementation, reduce user adoption, and hinder the realization of the full benefits offered by automated contract management systems.

Component Insights

The software segment held a market share of over 68.0% in 2024. As organizations expand and operate across diverse markets, the volume and complexity of contracts they handle have grown substantially. These contracts often involve multiple stakeholders, international partners, and strict regulatory obligations, making manual management inefficient and risky. Navigating such complexity requires advanced contract lifecycle management software that can centralize and automate the end-to-end contract process. These solutions streamline the creation, negotiation, and execution of contracts while also ensuring compliance with evolving regulations. With built-in analytics and monitoring tools, CLM software helps organizations identify and mitigate potential risks, track obligations, and enhance overall contract visibility, making it essential for managing today’s increasingly complex contractual environments effectively and efficiently.

The services segment is anticipated to grow at a significant CAGR of 14.4% during the forecast period. Implementation and integration services play a crucial role in the successful adoption of CLM software. As organizations deploy these systems, they often require expert guidance to ensure compatibility with existing workflows, ERP, CRM, or procurement platforms. Service providers offer customized implementation strategies that align with business objectives, enabling a smooth transition. This ensures optimal performance, faster adoption, and maximized return on investment from the CLM software.

Business Function Insights

The legal segment held the largest market share in 2024. Traditionally known for their conservative approach to technology, legal departments are now increasingly embracing digital transformation to improve operational efficiency. As organizations digitize core functions, legal teams are adopting contract lifecycle management software to streamline contract-related processes. This shift helps automate contract creation, negotiation, approval, and storage, reducing manual workloads and turnaround times. CLM tools also enhance collaboration with other departments, ensuring legal input is integrated early in the contract lifecycle. By aligning with broader digital transformation initiatives, legal departments can better manage risks, ensure compliance, and gain greater visibility into contract obligations and performance, thereby becoming strategic enablers within the enterprise rather than just cost centers.

The sales segment is expected to register the fastest CAGR of 13.5% during the forecast period. Accelerated deal cycles are a major growth driver for CLM software in sales functions. By automating contract creation, routing, and approval workflows, CLM tools eliminate delays and reduce administrative bottlenecks. This allows sales teams to move deals through the pipeline faster, improving win rates and revenue realization. In fast-paced, competitive markets, this speed and efficiency provide a critical advantage, helping organizations close deals ahead of competitors.

Deployment Insights

The cloud segment accounted for the largest market share of over 70.0% in 2024. Cloud-based platforms enable organizations to adjust their contract management capacity based on changing business needs, whether handling a few contracts or managing thousands across global operations. The cloud infrastructure supports this dynamic scaling without requiring heavy investment in IT hardware or maintenance. Additionally, cloud CLM systems offer remote access to contract data, which is vital in today’s work environment where distributed teams and hybrid models are increasingly common. This anytime-anywhere accessibility fosters real-time collaboration among legal, sales, procurement, and other departments, streamlining workflows and improving overall contract lifecycle efficiency across organizational units.

The on-premises segment is expected to grow at a CAGR of 10.6% during the forecast period. Organizations in highly regulated sectors like finance, healthcare, and government often choose on-premises contract lifecycle management (CLM) solutions to ensure maximum control over sensitive contract data. On-premises systems allow data to remain within the organization’s secure infrastructure, helping meet strict regulatory and compliance requirements. This setup assures that contract information is protected according to internal policies and external legal standards, minimizing risks related to data breaches or non-compliance.

Organization Size Insights

The large enterprises segment held the largest market share in 2024. Large enterprises typically handle a vast number of contracts that span multiple departments, business units, and geographic regions. These contracts often involve intricate terms, regulatory considerations, and collaboration among numerous stakeholders. Managing such complexity manually can lead to inefficiencies, increased risk of non-compliance, and potential revenue leakage. Contract Lifecycle Management software addresses these challenges by offering centralized contract repositories, standardized workflows, and automated alerts. These features streamline contract creation, negotiation, and approval processes, ensuring consistency and visibility across the organization. By simplifying complex contract operations, CLM solutions enable large enterprises to reduce administrative burdens, enhance legal and regulatory compliance, and improve overall contract governance and lifecycle efficiency.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. As SMEs grow, their contract management demands become more complex, requiring flexible solutions. Cloud-based CLM systems provide scalability that adapts to rising contract volumes and changing business needs seamlessly. This eliminates the need for costly infrastructure upgrades, enabling SMEs to efficiently manage contracts while supporting expansion. The flexibility of cloud platforms ensures SMEs can handle evolving requirements smoothly, maintaining operational efficiency and agility during growth phases.

End Use Insights

The BFSI segment accounted for the largest market share in 2024. Improved contract visibility and transparency are crucial for BFSI institutions to maintain effective governance and informed decision-making. Contract Lifecycle Management solutions offer real-time access to comprehensive contract data, allowing stakeholders to easily review terms, conditions, and obligations. This constant visibility helps ensure all parties remain compliant with contractual requirements and regulatory standards. By monitoring contract performance and renewal timelines, organizations can proactively manage risks and avoid missed deadlines or penalties. Enhanced transparency fosters better collaboration across departments, supports strategic planning, and improves overall contract management efficiency, ultimately safeguarding the institution’s financial health and reputation.

The IT & telecommunications segment is expected to grow at a significant CAGR during the forecast period. Telecom companies handle complex contracts with multiple parties, such as vendors, service providers, and regulators. Contract Lifecycle Management software streamlines the creation, negotiation, and management of these agreements. It ensures that all parties fulfill their obligations by providing clear oversight and organized workflows. This reduces misunderstandings and disputes, improving contract accuracy and compliance across diverse stakeholders in the telecom ecosystem.

Regional Insights

North America dominated the contract lifecycle management software market in 2024 and held the largest revenue share of over 37.10%. The North American market leads due to rapid technological advancements and a complex trade environment with numerous contracts across industries. Both small and large enterprises are embracing digital transformation by shifting to cloud-based contract management systems. These cloud solutions provide scalable, efficient, and flexible contract management, catering to diverse organizational needs. This widespread adoption of cloud services is a key driver of market growth in the region.

U.S. Contract Lifecycle Management Software Market Trends

The contract lifecycle management software industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. leads the contract management software market due to high demand for transparency and compliance, driven by regulations like HIPAA. Major players such as Coupa, DocuSign, and Icertis fuel growth through AI and blockchain innovations, substantial R&D investments, and strategic expansions.

Europe Contract Lifecycle Management Software Market Trends

The contract lifecycle management software industry in Europe is expected to grow at a CAGR of 12.9% from 2025 to 2030. Europe's stringent data protection regulations, such as the General Data Protection Regulation (GDPR), necessitate robust contract management systems. CLM software helps organizations ensure compliance by automating compliance tracking and providing audit trails.

The UK contract lifecycle management software industry is expected to grow rapidly in the coming years. Sectors like BFSI, retail, and legal services in the UK are rapidly adopting CLM solutions to handle complex contracts and meet strict industry regulations. London's role as a major financial center intensifies this demand, driving the need for sophisticated contract management systems that enhance compliance and operational efficiency.

The Germany contract lifecycle management software industry held a substantial market share in 2024. Germany’s strong industrial base, representing over 40% of Europe’s manufacturing hubs, drives high demand for CLM solutions. These tools help manufacturers efficiently manage complex supplier contracts, ensure regulatory compliance, and streamline operations, supporting Germany’s position as a key market for advanced contract lifecycle management software in the region.

Asia Pacific Contract Lifecycle Management Software Market Trends

The contract lifecycle management software industryin Asia Pacific is expected to grow at the fastest CAGR of 14.1% from 2025 to 2030. Countries such as China, India, Japan, and Singapore are embracing digital transformation by adopting cloud-based CLM solutions. These platforms provide scalability, flexibility, and remote access, allowing organizations to efficiently manage contracts, automate workflows, and improve overall operational efficiency in an increasingly digital business environment.

The China contract lifecycle management software industry held a substantial revenue share in 2024. China’s rapid industrialization and booming e-commerce sector have significantly increased contract volumes. Contract Lifecycle Management software supports organizations by efficiently handling these contracts, ensuring regulatory compliance, reducing errors, and streamlining contract workflows. This improves operational efficiency and helps businesses keep pace with fast-growing market demands.

The Japan contract lifecycle management software industry held a substantial market share in 2024. Japanese businesses are increasingly adopting digital tools, including CLM solutions, to enhance operational efficiency. The integration of artificial intelligence (AI) and machine learning (ML) into CLM software is streamlining contract creation, negotiation, and management processes, aligning legal operations with broader organizational digital transformation goals.

The contract lifecycle management software industry in India is growing as the digital transformation is driving CLM adoption as businesses shift to paperless operations and enhanced internet access. Organizations in India are using CLM solutions to streamline contract workflows, boost accuracy, and maintain regulatory compliance, making contract management more efficient and reliable across various industries.

Key Contract Lifecycle Management Software Company Insights

The key market players in the global contract lifecycle management software industryinclude BravoSolution, Contracked, Contract Logix, Coupa Software, DocuSign, IBM, Icertis, Oracle Corporation, SAP SE, Zycus Infotech, SirionLabs, Ironclad, Infor, Summize, and Filevine. The companies are focusing on various strategic initiatives, including new Software development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2025, Summize unveiled its next-generation Contract Lifecycle Management (CLM) platform, integrating agentic AI through Summize Intelligent Agents (SIA). This multi-agent system enhances contract reviews by automating redlines, providing AI-driven summaries, and facilitating contract Q&A directly within Microsoft Word. The platform's integration with tools like Microsoft Outlook, Gmail, Microsoft Teams, Slack, Salesforce, and Jira streamlines workflows and accelerates contract processes. Legal teams can now oversee the entire process while delegating routine tasks, improving efficiency, and strategic focus.

-

In April 2025, Ironclad introduced new capabilities to help enterprises recapture millions in lost contract value. The platform's Obligation Management feature enables users to systematically track critical contract obligations, ensuring compliance and minimizing revenue leakage. By providing real-time visibility into contractual commitments, Ironclad empowers organizations to manage risks effectively and optimize contract performance. These enhancements aim to streamline contract workflows and enhance operational efficiency.

-

In May 2024, Icertis and Evisort announced a strategic partnership to enhance contract intelligence capabilities. By integrating Evisort’s AI engine with the Icertis Contract Intelligence platform, the collaboration aims to accelerate the ingestion and analysis of both legacy and new contracts. This synergy enables businesses to extract actionable insights more efficiently, improving decision-making and operational performance. The partnership underscores a commitment to leveraging AI for advanced contract lifecycle management.

-

In February 2024, PwC India formed a strategic alliance with Sirion, an AI-powered Contract Lifecycle Management (CLM) platform, to transform enterprise contract management. This collaboration combines PwC India's consulting expertise with Sirion's advanced CLM technology to enhance contract efficiency, reduce risks, and drive innovation. The partnership aims to streamline contract processes across sectors like power, infrastructure, and logistics, enabling organizations to make informed decisions and achieve better compliance and performance.

Key Contract Lifecycle Management Software Companies:

The following are the leading companies in the CLM software market. These companies collectively hold the largest market share and dictate industry trends.

- BravoSolution

- Contracked

- Contract Logix

- Coupa Software

- DocuSign

- IBM Corporation

- Icertis

- Oracle Corporation

- SAP SE

- Zycus Infotech

- SirionLabs

- Ironclad

- Infor

- Summize

- Filevine

Contract Lifecycle Management Software Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.78 billion

Market Size forecast in 2030

USD 3.24 billion

Growth Rate

CAGR of 12.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD billion and CAGR from 2025 to 2030

Report coverage

Market size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, business function, deployment mode, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

BravoSolution; Contracked; Contract Logix; Coupa Software; DocuSign; IBM; Icertis; Oracle Corporation; SAP SE; Zycus Infotech; SirionLabs; Ironclad; Infor; Summize; Filevine

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contract Lifecycle Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contract lifecycle management software market report based on component, business function, deployment mode, organization size, end use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Business Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Legal

-

Procurement

-

Sales

-

Finance

-

Operations

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Government and Public Sector

-

Consumer Goods and Retail

-

Healthcare and Life Sciences

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecommunications

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global contract lifecycle management software market size was estimated at USD 1.62 billion in 2024 and is expected to reach USD 1.78 billion in 2025.

b. The global contract lifecycle management software market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2030 to reach USD 3.24 billion by 2030.

b. The software segment accounted for a market share of over 68.0% in 2024. As organizations expand and operate across diverse markets, the volume and complexity of contracts they handle have grown substantially. These contracts often involve multiple stakeholders, international partners, and strict regulatory obligations, making manual management inefficient and risky.

b. Some of the companies operating in the contract lifecycle management software market include BravoSolution, Contracked, Contract Logix, Coupa Software, DocuSign, IBM, Icertis, Oracle Corporation, SAP SE, Zycus Infotech, SirionLabs, Ironclad, Infor, Summize, and Filevine.

b. The contract lifecycle management (CLM) software market is experiencing significant growth, driven by the increasing need for efficient contract management solutions across various industries. As organizations seek to automate and streamline their contract processes, the demand for CLM software has surged. The market is characterized by the adoption of cloud-based solutions, integration of advanced technologies like artificial intelligence (AI) and machine learning (ML), and a focus on compliance and risk management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.