- Home

- »

- Medical Devices

- »

-

Contrast Media Market Size, Share & Growth Report, 2030GVR Report cover

![Contrast Media Market Size, Share & Trends Report]()

Contrast Media Market Size, Share & Trends Analysis Report By Modality (Ultrasound, MRI), By Product (Microbubble, Gadolinium-based), By Application, By Route Of Administration, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-357-7

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Contrast Media Market Size & Trends

The global contrast media market size was estimated at USD 6.28 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.98% from 2024 to 2030. The growing prevalence of complex comorbidities and long-term diseases has led to an increase in diagnostic imaging tests including ultrasound, X-rays, and advanced imaging technology such as MRI & CT scans. In September 2022, Gadopiclenol, an MRI contrast agent with high relativity and lower gadolinium dosage for adults and pediatric patients two years of age and up, was approved by the U.S. FDA. A macrocyclic GBCA called gadopiclenol helps identify lesions in the brain, spine, abdomen, and other parts of the body that have aberrant vascularity. According to the National Association of Chronic Disease Directors, in 2022, nearly 45% of people in America were affected by multiple chronic conditions.

The adult population poses a greater risk of chronic conditions with multiple comorbidities. The National Council on Aging report suggests that nearly 80% of people aged 65 and above suffer from at least one chronic condition, with almost 70% of Medicare beneficiaries suffering from more than two chronic conditions, and nearly 77.0 million people in the U.S. are estimated to be aged 65 & above by 2034. According to a report by the American Heart Association, the incidence of heart failure is increasing in the U.S., and it is one of the leading causes of death in the country. In 2020, approximately 659,000 people died due to cardiovascular diseases in the U.S. By 2030, the number of people with heart diseases is estimated to increase by 46%.

The American College of Radiology (ACR), which signifies over 40,000 radiologists in the U.S., has issued advice that X-rays and CT scans should not be used as a first-line approach to diagnose or test for COVID-19 since it is exceedingly contagious. As a result, several radiology departments saw a significant decrease in the number of imaging cases. Except for the COVID-19 diagnosis, all diagnostic procedures exhibited a considerable fall in 2020, affecting the growth of the contrast media industry.

Market players adopt strategies that aid them in increasing their presence with a wider geographic reach and stronger portfolios. Disease indication extension is popular in this market as it enables firms to gain confidence in select population subsets. With approvals for specific indications, companies target niche patient cohorts and boost the adoption of products. In March 2022, the initial single-source photon-counting computed tomography (CT) scanner with a single detector acquired FDA 510(k) approval, according to NeuroLogica Corporation. Additionally, OmniTom Elite with PCD is capable of producing spectral CT pictures at various energy levels which are anticipated to boost market growth in the near future.

Furthermore, the introduction of digital solutions that aid in the management of contrast agents is anticipated to drive market growth. For instance, in January 2023, in response to the growing demand for medical imaging services in the face of a radiologists' shortage, Bayer confirmed its purchase of Blackford Analysis Ltd., a developer of imaging artificial intelligence platforms and solutions. This acquisition is in line with Bayer's strategic aim to promote innovation in radiology, which includes advancing AI's integration into clinical workflow. The company's priorities are improving patient care and solidifying its leadership in digital medical imaging.

End-use Insights

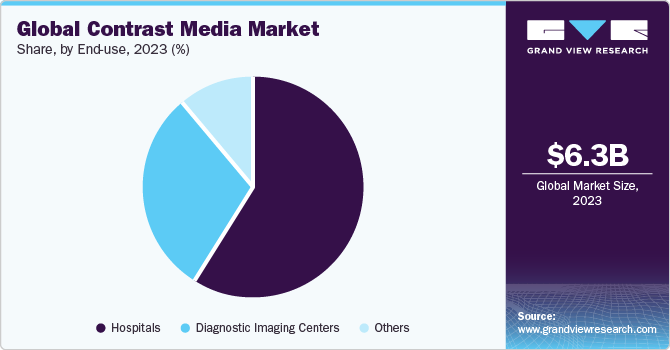

The hospital segment held the largest market share of 59.22% in 2023 as a result of an increase in patients' admissions with chronic illnesses. Growth in the segment is anticipated to be boosted by an increase in the number of MRI and CT scans performed in hospitals, as well as a growing trend among hospitals toward the digitization and automation of radiology patient workflow. According to the Organization for Economic Co-operation and Development, the number of MRI scans performed in the U.S. was 57.5 per 1,000 inhabitants in hospitals in 2022.

The subsequent increase in the number of patients across the globe, the launch of technologically advanced products, and favorable reimbursement policies are leading to a growing demand for hospital applications. The rising awareness about the availability & advantages of advanced medical facilities available at hospitals is expected to help this segment grow over the forecast period. Hospitals are also better equipped to handle any post-operative complications and they include facilities for physical rehabilitation post surgeries. Also, hospitals are widely preferred by patients owing to improving healthcare facilities and the availability of advanced equipment. Thus, these factors are significantly boosting the market growth.

Modality Insights

The X-ray/CT segment held the largest market share of around 69.64% in 2023. X-ray/CT contrast agents help produce high-resolution 3D images of structures. Barium-based and iodinated contrast media are used in X-ray & CT techniques. When barium and iodine contrast agents are administered/injected in the body, they block X-rays and do not allow the rays to pass through. As a result, the appearance of organs, blood vessels, and other body tissues, which temporarily contain barium-based or iodinated contrast agents, changes in images. X-ray and CT are widely used for multiple diseases which is expected to spur the market growth. According to OECD, nearly 44 CT machines per 1000,000 inhabitants were available in Denmark in 2022, thus the growing adoption of imaging technologies which in turn is expected to boost the demand for contrast media in the country.

The ultrasound segment is anticipated to witness the fastest growth rate over the forecast period. Contrast agents for ultrasound imaging have been developed for visualization of microcirculation in tissue. The agents employed for this modality are generally microbubbles that enhance echogenicity of blood and, hence, visualization and assessment of tissue vascularity, large vessels, & cardiac cavities. Ultrasound contrast agents offer many benefits over alternative imaging modalities which is anticipated to boost the market growth.

Moreover, ultrasonography is preferred in pediatric patients as it requires lower ionizing radiation and is a well-known modality for diagnosis of several diseases, such as heart, liver, and kidney. However, despite its high preference, ultrasound contrast agents segment holds a smaller market share. This can be attributed to the extended applications of second-generation ultrasound contrast agents that have recently been approved by regulatory agencies, such as the U.S. FDA.

Regional Insights

North America dominated the market in 2023 with the largest share of around 36.18%. Various strategic initiatives undertaken by key manufacturers targeting niche patient subsets in this space are projected to accelerate market growth. Key players in the market include Bayer, GE Healthcare, Guerbet, Lantheus, and Bracco Diagnostics. The presence of well-established healthcare facilities and easy availability of advanced technologies as well as high demand for diagnostic procedures, owing to disease screening initiatives and disease management, in this region are expected to increase the number of inpatient examinations. However, healthcare reforms for implementing criteria for appropriate use to curb unnecessary procedures may decrease the number of procedures.

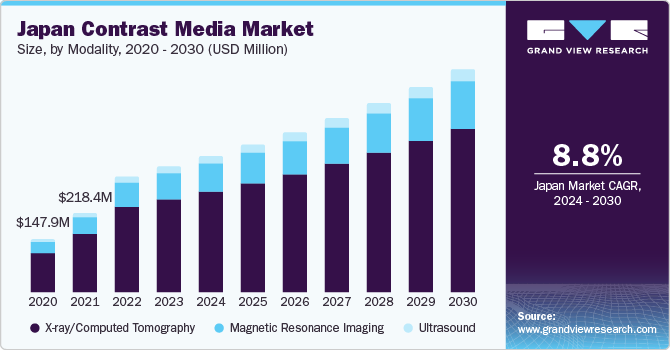

Asia Pacific is expected to grow at the highest CAGR over the forecast period. This can be attributed to the presence of established local as well as foreign manufacturers in the region. General Electric Pharmaceuticals (Shanghai) Co., Ltd. is a branch of GE in China and is one of the world's largest contrast media production bases of GE Healthcare. Market expansion is anticipated to be supported by the economic development of nations like China and India. In the Asia Pacific region, there is a great demand for treatment choices that are economical due to the region's enormous population base and low per capita income.

International businesses are eager to invest in APAC countries like India, which are still developing. Consequently, a large number of market participants are forming strategic alliances and cooperative partnerships with regional participants. The growing elderly population in the region, their increased vulnerability to chronic diseases, and the rising prevalence of chronic diseases generally are driving growth in the contrast media industry. Moreover, the market is anticipated to be driven over the projected period by advancements in healthcare infrastructure and a rise in the quantity of diagnostic imaging tests.

Product Insights

The iodinated contrast media segment held the largest market share of around 65.37% in 2023, which can be attributed to high penetration of X-ray and CT procedures as well as the availability of nonionic stable iodinated agents for improved diagnosis. Iodinated contrast media is generally administered intravenously, however, in some situations, they are replaced with barium-based contrast media for oral and rectal administration. Iodine-based contrast media are used to enhance CT and X-ray images.

They are used to enhance visualization of the GI tract, internal organs, arteries & veins, soft tissues, and the brain. Iodinated contrasted media are widely applicable in a broad number of indications including neurological, nephrological, gastrointestinal, cardiovascular, and musculoskeletal disorders as well as cancer. For instance, in June 2023, Bayer reported that the U.S. FDA had authorized the use of its Ultravist (iopromide), an iodine-based contrast agent, in CEM. This milestone allows it to be the single contrast agent authorized for this particular purpose. The device can be used to detect suspected or established breast cancers in adult patients, acting as a support for ultrasound and/or mammography exams.

The microbubble contrast media segment is anticipated to witness the fastest growth rate over the forecast period. Microbubble contrast media are minute bubbles of an injectable gas. They are most often administered for ultrasound imaging of the heart. Contrast agents for ultrasound imaging have been developed for visualization of micro-circulation in tissue. They enhance echogenicity of blood, and hence, enhance visualization and assessment of tissue vascularity, large vessels, and cardiac cavities.

Microbubble contrast media have the capability to reflect ultrasound waves causing structures to appear brighter on ultrasound. Contrast agents for ultrasound imaging can be used in a variety of healthcare settings (CT suite, operating room, bedside, echo lab, and others) and are the first-line imaging technique for several indications. Microbubble contrast media is a useful option for patients allergic to CT or MRI contrast media or for patients with kidney failure.

Application Insights

The neurological disorder segment held the largest market share of 28.59% in 2023. Diagnostic evaluation of CNS for neurological disorders boosts adoption of MRI contrast media, as they provide better images of neural structures than CT. For visualization of demyelinated, inflammatory, and neoplastic lesions, gadolinium-based contrast agents are utilized. Gadolinium-based contrast agents are used in one in three MRIs to enhance image clarity, which improves diagnostic accuracy by enhancing the visibility of blood vessels, inflammation, and tumors. Gadavist, Dotarem, and Prohance are the most widely used macrocyclic gadolinium-based contrast agents used in diagnosis of neurological disorders in the U.S. They are indicated for intravenous use in adults and pediatric patients, 2 years or above, to visualize lesions with abnormal vascularity in brain, spine, and associated tissues.

The cardiovascular disorders segment is anticipated to witness the fastest growth rate over the forecast period. Contrast-enhanced ultrasound imaging of the cardiovascular system or echocardiography is the most widely used modality for imaging of the cardiovascular system in adult and pediatric patients. Optison, Definity, and Lumason are the most widely used ultrasound contrast agents in the U.S. They are indicated in patients with suboptimal echocardiograms for opacifying the left ventricle and improving delineation of the left ventricular endocardial border. Ultrasound contrast media, Definity, Optison, and Lumason are no longer contraindicated for patients presenting with cardiac shunts in the U.S.

Route Of Administration Insights

The intravenous segment held the largest market share of 47.85% in 2023. An essential part of Computed Tomography (CT), which is widely used for assessing therapy response and evaluating disease severity, is intravenous iodinated contrast material. This IV contrast helps with improved tissue differentiation, which makes it easier to accurately characterize the different lesions that were seen during the scan. Its essential role in identifying lacerations affecting solid organs is especially notable. In fact, for most CT exams that target the belly and pelvis, the use of intravenous contrast media is essential and irreplaceable.

The segment is also anticipated to witness the fastest growth rate over the forecast period. In order to diversify their product offerings, major participants in the contrast media industry are additionally focusing on gaining regulatory clearance from numerous international authorities. They can launch new contrast agents, compositions, or indications into various markets and geographical areas because of this strategic strategy, which can significantly impact their revenue and market presence. In November 2021, Guerbet LLC, Guerbet's US affiliate, announced a notable increase in demand for DOTAREM (gadoterate meglumine) injection, the company's MRI contrast agent. This significant increase in demand happened in an era of continued supply chain disruptions and pandemic challenges.

Key Companies & Market Share Insights

The key players are focusing on growth strategies, such as new product launches, regulatory approvals, expansion, collaborations, acquisitions, partnerships, etc. In April 2023, GE HealthCare introduced Pixxoscan (gadobutrol), a macrocyclic gadolinium-based contrast agent (GBCA) for magnetic resonance imaging (MRI) that is non-ionic. With a marketing license now in place in Austria and several countries awaiting approval, Pixxoscan has undergone regulatory evaluation through a decentralized procedure (DCP) and will be made available in several European markets in 2023. This initiative was expected to boost the market for the contrast media industry during the forecast period.

Key Contrast Media Companies:

- Bayer AG

- General Electric Company

- Guerbet

- Bracco Diagnostic, Inc.

- Nano Therapeutics Pvt. Ltd.

- Lantheus Medical Imaging, Inc.

- iMax

- Trivitron Healthcare

Contrast Media Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.77 billion

Revenue forecast in 2030

USD 10.74 billion

Growth rate

CAGR of 7.98 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Modality, product, application, route of administration, end-use

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bayer AG; General Electric Company; Guerbet.; Bracco Diagnostic, Inc.; Trivitron Healthcare; Nano Therapeutics Pvt. Ltd.; iMax; Lantheus Medical Imaging, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contrast Media Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contrast media market report based on modality, product, application, route of administration, end-use, and region:

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrasound

-

Magnetic Resonance Imaging

-

X-ray/Computed Tomography

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Microbubble

-

Gadolinium-Based

-

Iodinated

-

Barium-Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Disorders

-

Neurological Disorders

-

Gastrointestinal Disorders

-

Cancer

-

Nephrological Disorders

-

Musculoskeletal Disorders

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous

-

Oral Route

-

Rectal Route

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global contrast media market size was estimated at USD 6.28 billion in 2023 and is expected to reach USD 6.77 billion in 2024.

b. The global contrast media market is expected to grow at a compound annual growth rate of 7.98% from 2024 to 2030 to reach USD 10.74 billion by 2030.

b. North America dominated the contrast media market with a share of 36.18% in 2023. This is attributable to the presence of well-established healthcare facilities, the availability of advanced technologies together, and demand for diagnostic procedures.

b. Some of the players operating in the contrast media market are Bayer, Lantheus Holdings, Inc. , Bracco Diagnostic, Inc. (Blue Earth Diagnostics, Inc.), Guerbet, Trivitron Healthcare, Cardinal Health, Telix Pharmaceuticals Limited, GE HealthCare, Others

b. Key factors that are driving the contrast media market growth include the increasing prevalence of long-term diseases and complex comorbidities, technological advancement, and label expansions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."