- Home

- »

- Next Generation Technologies

- »

-

Control Tower Market Size & Share, Industry Report, 2030GVR Report cover

![Control Tower Market Size, Share & Trends Report]()

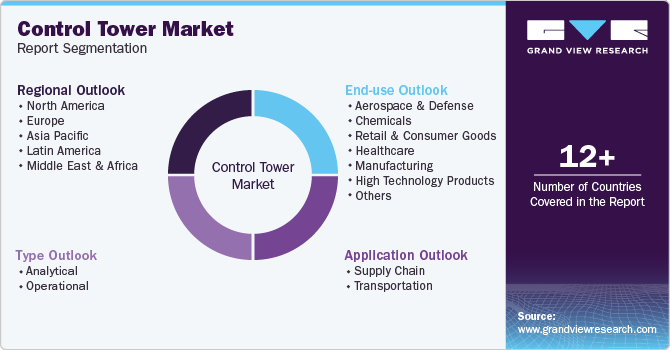

Control Tower Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Operational, Analytical), By Application (Supply Chain, Transportation), By End-use (Aerospace & Defense, Chemicals, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-087-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Control Tower Market Summary

The global control tower market size was estimated at USD 9,671.2 million in 2024 and is projected to reach USD 32,138.4 million by 2030, growing at a CAGR of 23.0% from 2025 to 2030. Rising business demands of contract manufacturers, retailers, and logistics providers to digitalize their supply chain activities are major factors contributing to the growth of the market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, the U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, operational accounted for a revenue of USD 6,945.6 million in 2023.

- Analytical is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9,671.2 Million

- 2030 Projected Market Size: USD 32,138.4 Million

- CAGR (2025-2030): 23.0%

- North America: Largest market in 2023

This is because control tower-based supply chain solutions provide organizations with increased visibility and help them make better decisions. Control towers are becoming more widespread in transportation and supply chain ecosystems because they let firms track deliveries in real time and increase delivery efficiency. Several transportation and logistics companies are leveraging control tower solutions to enhance their business solutions.

Control towers provide companies with centralized visibility, control, and coordination across their transportation networks, enabling them to optimize their supply chain and logistics activities. Control towers are becoming increasingly popular due to their connectivity with transportation management systems (TMS), enterprise resource planning (ERP), and warehouse management systems (WMS). Integration of control towers with TMS enhances transportation planning and execution. By connecting the control tower with TMS, transportation companies can have end-to-end visibility into their transportation network.

They can track shipments, monitor carrier performance, optimize routes, and manage freight costs more effectively. Moreover, integrating control towers with WMS systems provides improved warehouse visibility and optimization. Warehouse operations can benefit from the control tower's centralized monitoring and coordination capabilities, thereby contributing to the growth of the market.

Automation and artificial intelligence (AI) technologies are streamlining control tower operations, while remote tower systems offer cost savings and improved scalability. Advanced surveillance and sensor technologies provide enhanced situational awareness, while data analytics and predictive technologies enable proactive decision-making.

Integration with the Internet of Things (IoT) enhances real-time data exchange, and cloud computing facilitates scalable storage and processing of information. Furthermore, cybersecurity measures are being strengthened to protect critical systems and data. These technological trends are revolutionizing control towers, making air traffic management more efficient, safe, and connected.

While control towers offer numerous organizational benefits, the presence of data quality issues can impede market growth by compromising visibility. Data accuracy and reliability are essential for effective decision-making and operational optimization. Furthermore, enterprises implementing control towers face significant challenges in terms of data security.

The exchange of data and sensitive information among companies and their partners operating at different levels introduces the risk of data breaches and unauthorized access. In addition, the shortage of trained professionals capable of generating accurate insights poses a hindrance to the growth of the control tower industry. Skilled personnel are necessary to effectively analyze and interpret the data gathered by control towers, enabling organizations to make informed decisions and maximize the benefits of this technology.

Type Insights

Based on type, the operational segment dominated the market in 2024 with the largest revenue share of 83.04%. Operational control towers serve a dual purpose of analysis and implementation in managing operations. They promptly detect and notify any exceptions or issues as they occur, enabling authorized operators to take immediate action and address the problems in real time. Integration of advanced analytics and artificial intelligence (AI) capabilities is also contributing to segment growth.

Operational control towers are leveraging AI algorithms and machine learning techniques to analyze large volumes of data from various sources, enabling real-time insights and predictive capabilities. This technology allows control towers to optimize operational processes, identify bottlenecks, and proactively respond to disruptions. The adoption of Internet of Things (IoT) devices and sensors is transforming operational control towers. IoT devices provide real-time data on various parameters such as equipment performance, environmental conditions, and inventory levels. This data enables control towers to monitor and manage operations with greater precision and efficiency. It also facilitates predictive maintenance, ensuring optimal performance of critical assets.

The analytical segment is anticipated to register the fastest CAGR over the forecast period. Using real-time analytics, a purely analytical control tower can deliver important insights. It can aid in the coordination and oversight of decision-making and execution across departments and organizations to optimize the entire network. The expanding volume of data across supply chains, along with the continuous need for a unified cost-saving solution, is projected to increase demand for analytical control tower systems across industrial verticals. Based on previous data, an analytical control tower is utilized in the transportation sector to anticipate the most cost-effective truck routes.

Application Insights

Based on application, the supply chain segment dominated the market in 2024. The increasing emphasis on real-time data and visibility is a major factor contributing to the growth of the segment. Control towers are leveraging advanced technologies, such as IoT sensors and connected devices, to capture and analyze data throughout the supply chain in real time. This enables organizations to gain granular insights into inventory levels, transportation status, and production processes, facilitating proactive decision-making and rapid response to disruptions. Control towers focus on multi-enterprise supply chains, ensuring control and visibility throughout external and internal end-to-end processes and objectives. This encompasses various aspects such as sales and purchase orders, manufacturing operations, maintenance activities, and inventory management across external suppliers, as well as internal suppliers and repair operations.

The transportation segment is anticipated to register a significant CAGR over the forecast period. Control towers are leveraging technologies such as GPS tracking, telematics, and IoT sensors to capture and analyze data in real time, thereby contributing to the growth of the segment. This enables precise tracking of vehicles, improved route optimization, and proactive incident management. By harnessing advanced analytics, control towers can derive valuable insights from data, enabling them to make data-driven decisions, optimize transportation operations, and improve overall efficiency. Another emerging trend is the adoption of autonomous technologies. Control towers are exploring the use of autonomous vehicles, drones, and robotics to enhance transportation operations. Such factors bode well for the growth of the segment over the forecast period.

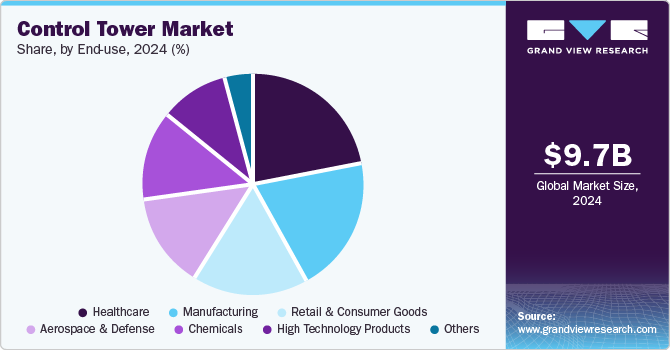

End-use Insights

Based on end-use, the healthcare segment held the maximum market share in 2024. Integration of digital health technologies and telemedicine is a significant factor contributing to the growth of the segment. Control towers are leveraging telehealth platforms, remote monitoring devices, and wearable technologies to enable virtual consultations, remote patient monitoring, and real-time health data collection. This enhances access to healthcare services, improves patient outcomes, and reduces the need for in-person visits. Another emerging trend is the adoption of data analytics and artificial intelligence in healthcare control towers. Advanced analytics tools are being employed to analyze large volumes of healthcare data, including electronic health records, medical imaging, and patient demographics.

The high-technology products segment is anticipated to register the fastest CAGR over the forecast period. Control towers are leveraging IoT sensors and devices embedded in high-tech products to collect real-time data on performance, usage patterns, and maintenance needs. This data enables proactive monitoring, predictive maintenance, and improved product lifecycle management. By harnessing IoT capabilities, control towers can optimize operations, enhance product quality, and deliver superior customer experiences. Another emerging trend is the adoption of artificial intelligence (AI) and machine learning (ML) in control towers for high-tech products. AI-powered control towers can analyze vast amounts of data, including customer feedback, production metrics, and market trends, to identify patterns and derive actionable insights.

Regional Insights

North America control tower market dominated globally with revenue share of 37.49% in 2024. In North America, organizations are increasingly adopting control tower systems to efficiently manage the increasing volumes of data or information generated from the value chains and use the information to gain business insights. Moreover, by integrating data from various sources, such as suppliers, production facilities, and logistics providers, control towers provide real-time visibility into the entire manufacturing process, enabling companies in North America to make better-informed decisions and respond quickly to changes in demand or supply chain disruptions.

U.S. Control Tower Market Trends

The U.S. control towers market is driven by the manufacturing companies in the U.S. preferring visual representation of supply chain data to simplify the complex nature of business operations. The growing demand from businesses in the country for ways of easily analyzing the current state of their supply chains from a data perspective and supporting their strategic decision-making ability is expected to drive the demand for control towers. Moreover, supply chain managers are faced with vast challenges arising from the complexity of supply chains and the volatility of the global business environment. Control towers help resolve these issues, especially in the transportation and supply chain ecosystem, by making it simple to track deliveries in real time and making the delivery process more efficient.

Europe Control Tower Market Trends

The Europe control tower market growth is attributed to European firms focusing on lowering costs, shortening lead times, and improving quality while decreasing supply chain risks and other operational inefficiencies. This is expected to enhance the demand for control towers in the European market. The single market strategy deployed by the European Commission enables goods & services, people, and capital to freely move within the region. It expands the geographical market for European companies and also provides greater scope for the adoption of control tower systems.

The control tower market in the UK is driven by the increasing popularity of supply chain control towers in the UK as organizations seek to enhance their supply chain visibility, agility, and resilience.Several supply chain control tower providers in the UK are moving away from traditional on-premise solutions and adopting cloud-based technologies. This allows organizations to access real-time data and analytics from anywhere, improving collaboration and decision-making. At the same time, supply chain control towers are now leveraging technologies such as Artificial Intelligence (AI) and Machine Learning (ML) to improve their capabilities for real-time data processing, analysis, and decision-making. This enables organizations to identify potential disruptions, predict demand patterns, and optimize their operations.

Germany control tower market is expected to offer the highest potential for the adoption of control tower systems owing to the presence of a large number of engineering and component manufacturing companies in the country. In Germany, last-mile delivery is still considered a challenge owing to issues related to allocation, inefficiency, lack of visibility, and speed of drivers. This is expected to drive the demand for control towers in the country to create an ecosystem that focuses on transparency and allows businesses to gain better visibility in real time.

Asia Pacific Control Tower Market Trends

Asia Pacific control tower market is anticipated to grow owing to the introduction of the ASEAN Economic Community (AEC), which is expected to play a significant role in the regional economic integration and creation of regulations for the development and growth of trade across the Asia Pacific region. Control tower systems are expected to play a significant role in the development of cross-border trade among APAC countries. Moreover, companies are increasingly adopting digital technologies to improve their supply chain operations, and supply chain control towers are a critical element of this transformation.

The control tower market in China is expected to play a significant role in the development of cross-border supply chains across other Asia Pacific countries. China is one of the world’s largest manufacturers of electronic components and devices, and all major international companies have manufacturing operations in the country. The products manufactured in China are shipped across the globe. Thus, to sustain global operations, the implementation of control tower systems is critical.

The India control tower market growth is attributed to organizations in India that are steadily adopting digitization and other advanced technologies. This is expected to drive the demand for control towers in the retail industry. The rapid increase in the number of Small & Mid-Size Businesses (SMBs) in India and their increased focus on the implementation of next-generation technologies are expected to drive regional and global businesses. This is expected to create growth opportunities for control tower market players in the country.

The control tower industry in Japan is driven by the increasing demand for control towers by several Japanese retail companies owing to their benefits, such as supply chain integrity, risk mitigation, and operational agility. With the growing emphasis on sustainability and reducing the carbon footprint of business operations, Japanese companies are leveraging supply chain control towers to monitor their environmental impact and implement more sustainable practices across their supply chains.

Key Control Tower Company Insights

Some of the key companies in the control towers industry include Blue Yonder Group, Inc., SAP, E2open, LLC, Coupa Software Inc., and others. Prominent players are employing strategies such as partnerships to augment their product offerings and deliver enhanced solutions to their customers. By leveraging strategic partnerships, they can harness complementary expertise and resources to further enhance the capabilities and features of their control towers. Key market players are also launching proactive controls for control towers that enable organizations to enhance operational efficiency and create improved work environments.

Companies in the control tower sector are actively pursuing the integration of advanced technologies like AI, blockchain, and others in their control towers. By incorporating these enhanced technologies, companies can enhance their competitive advantage and elevate the customer experience. The integration of blockchain technology within control towers brings forth a faster, more reliable, and highly agile supply chain network, bolstering operational efficiency and ensuring secure and transparent transactions.

-

Blue Yonder Group, Inc. provides a real-time platform with a single supply and demand view. The end-to-end platform enables logistic providers, retailers, and manufacturers to fulfill customer demand from planning to delivery. The company offers solutions to multiple end-use industries, including retail grocery, retail hardlines, retail softlines, consumer industries, automotive & industrial, high-tech & semiconductor, and third-party logistics.

-

Elementum provides a cloud-based supply chain automation platform that unifies manufacturing, procurement, inventory, and logistics operations. The company’s platform provides centralized information and communications to enable cross-ecosystem execution, drive rapid resolution of incidents, and ensure inventory products are available at the right time, cost, place, and quantity.

Key Control Tower Companies:

The following are the leading companies in the control tower market. These companies collectively hold the largest market share and dictate industry trends.

- Blue Yonder Group, Inc.

- E2open, LLC

- Elementum

- Infor

- Kinaxis

- Llamasoft

- One Network Enterprises

- PearlChain

- SAP SE

- Viewlocity Technologies Pty Ltd.

Recent Developments

-

In January 2025, FourKites, a leading supply chain solutions provider, announced the launch of its Intelligent Control Tower. This innovative tool is designed to autonomously manage complex supply chain operations, provide actionable insights, evaluate risks, and deliver prescriptive recommendations.

-

In May 2023, Amazon Web Services, Inc. introduced 28 new proactive controls within the AWS Control Tower. This launch significantly enhances the governance capabilities of AWS Control Tower, enabling the implementation of controls at scale across your multi-account AWS environments. These controls proactively block the provisioning of non-compliant resources for services like AWS Auto Scaling, AWS OpenSearch Service, Amazon SageMaker, Amazon RDS, and Amazon API Gateway. They assist in meeting control objectives such as data encryption at rest and limiting network access.

Control Towers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.41 billion

Revenue forecast in 2030

USD 32.14 billion

Growth rate

CAGR of 23.0% from 2025 to 2030

Base year of estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Blue Yonder Group, Inc.; E2open, LLC; Elementum; Infor; Kinaxis; Llamasoft; One Network Enterprises; PearlChain; SAP SE; Viewlocity Technologies Pty Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Control Tower Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global control tower market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Analytical

-

Operational

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Supply Chain

-

Transportation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Chemicals

-

Retail & Consumer Goods

-

Healthcare

-

Manufacturing

-

High Technology Products

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global control tower market was estimated at USD 9.67 billion in 2024 and is expected to reach USD 11.41 billion in 2025.

b. The global control tower market is expected to grow at a compound annual growth rate of 23.0% from 2025 to 2030 and is expected to reach USD 32.14 billion by 2030.

b. North America dominated the control tower market with a share of 37.49% in 2024, as several providers of control tower solutions are concentrated in the region.

b. Some key players operating in the control tower market include Blue Yonder Group, Inc.; E2open, LLC; Elementum; Infor; Kinaxis; Llamasoft; One Network Enterprises; PearlChain; SAP SE; Viewlocity Technologies Pty Ltd.

b. Key factors driving the control tower market growth are increasing adoption of big data and real-time analytics and need to enhance operational and supply chain efficiencies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.