- Home

- »

- Medical Devices

- »

-

COPD & Asthma Therapeutics Market, Industry Report, 2030GVR Report cover

![COPD And Asthma Therapeutics Market Size, Share & Trends Report]()

COPD And Asthma Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Anti-Inflammatory, Bronchodilators), By Device/Product (Inhalers), By Technology/Software, By Indication, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-589-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

COPD And Asthma Therapeutics Market Summary

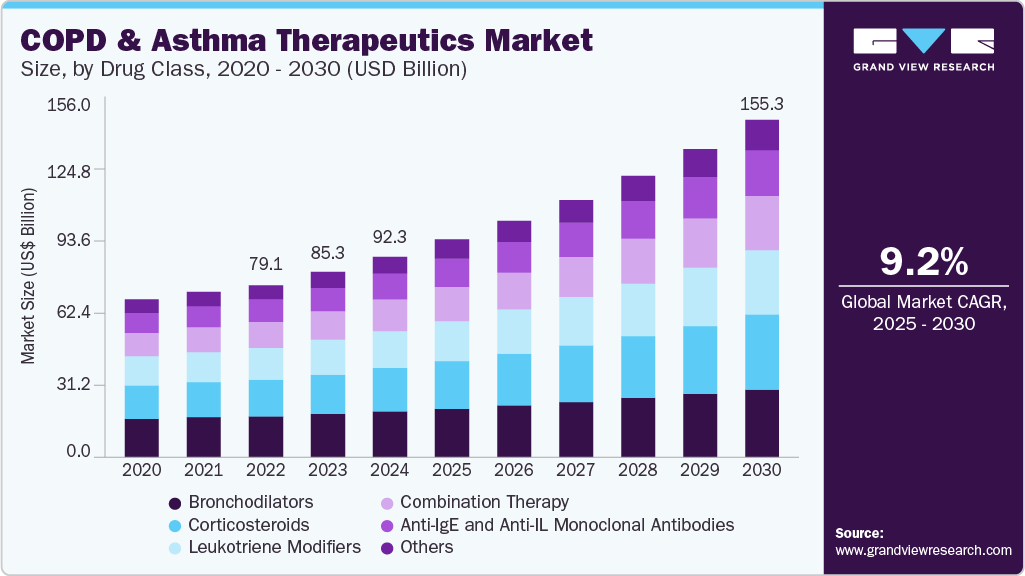

The global COPD and asthma therapeutics market size was valued at USD 92.30 billion in 2024 and is estimated to reach USD 155.25 billion by 2030, growing at a CAGR of 9.18% from 2025 to 2030. The increasing prevalence of chronic respiratory conditions, exacerbated by rising pollution levels, tobacco consumption, and aging populations, is significantly boosting demand for bronchodilators, corticosteroids, and combination therapies.

Key Market Trends & Insights

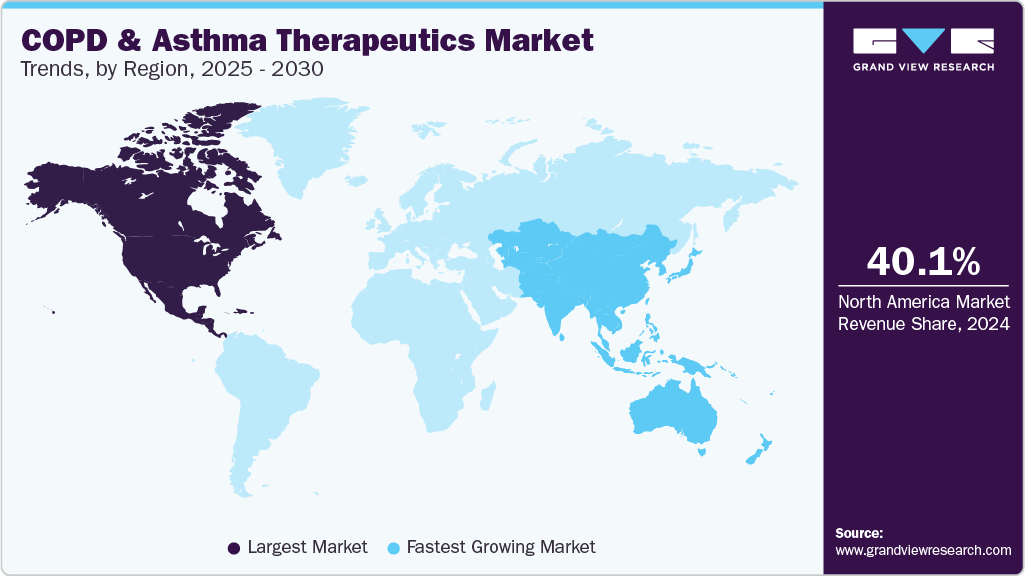

- North America COPD and asthma therapeutics and market held the largest revenue share 40.1% in 2024.

- The COPD and asthma therapeutics industry in the U.S. held the largest revenue share in 2024.

- Based on drug class, the Anti-IgE and Anti-IL monoclonal antibodies segment dominated the market with a revenue share of 22.72% in 2024.

- Based on device/product, the inhalers segment accounted for the largest revenue share in 2024.

- Based on indication, the asthma segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 92.30 Billion

- 2030 Projected Market Size: USD 155.25 Billion

- CAGR (2025-2030): 9.18%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to the Global Initiative for Asthma (GINA), asthma affected over 262 million people globally in 2022, while the WHO reported that COPD was the third leading cause of death worldwide. In addition, a growing aging population coupled with increasing automotive and industrial exhaust gases remains the key driver for the global COPD and asthma therapeutics industry. Degrading air quality near industrial areas has led to an increased incidence of asthma. According to the European Environment Agency, air pollutant levels in 2021 significantly exceeded the levels specified by the World Health Organization's (WHO) air quality guidelines. Achieving these recommended levels could have prevented a significant number of deaths across EU Member States (EU-27), including 253,000 deaths linked to exposure to fine particulate matter (PM2.5) and 52,000 deaths caused by nitrogen dioxide (NO2) exposure. In addition, reducing short-term exposure to ozone (O3) could have reduced 22,000 attributable deaths.The COPD and asthma therapeutics market is also propelled by technological advancements in drug delivery devices, such as smart inhalers with Bluetooth connectivity and AI-based respiratory monitoring platforms, which enhance treatment adherence and enable remote patient management. Companies like Propeller Health and Teva have introduced FDA-approved smart inhalers that track medication usage and transmit data to clinicians in real time.

Moreover, the growing penetration of mobile health apps and telepulmonology solutions is improving access to care, especially in underserved areas. The expansion of online pharmacies and direct-to-consumer digital platforms is also streamlining therapy access, supporting the shift towards home-based disease management. Collectively, these advancements across therapeutic classes, delivery devices, and digital tools are expected to drive sustained growth in the COPD and asthma market through 2030.

Increasing healthcare expenditure, improved access to care in developing regions, and supportive government initiatives aimed at managing chronic respiratory conditions are further enhancing market potential. The rise of universal healthcare programs in countries such as India and China is expanding access to essential inhalers and diagnostics. For instance, China's Healthy China 2030 initiative focuses on four strategic pillars: equitable access and outcomes in health and healthcare, healthcare systems transformation, technology and innovation, and environmental and climate sustainability. Equity is the foundational goal, guiding efforts to reduce barriers in healthcare systems and improve health outcomes across the country.

The COVID-19 pandemic positively impacted the COPD and asthma therapeutics industry. Initially, disruptions in healthcare access, reduced pulmonary function testing, and delayed diagnoses led to a decline in treatment rates and prescription volumes. However, as the pandemic progressed, heightened awareness of respiratory health and the increased risk of severe COVID-19 outcomes in patients with chronic lung diseases drove greater adherence to maintenance therapies. The shift toward home-based care, telemedicine, and digital health tools, such as smart inhalers and remote monitoring, supported continued treatment and patient engagement. While the market faced short-term setbacks, the pandemic ultimately reinforced the importance of proactive respiratory care, leading to long-term growth opportunities.

AI in COPD And Asthma Therapeutics Market

Artificial Intelligence (AI) is playing an increasingly transformative role in the COPD and asthma therapeutics industry by enabling more personalized, predictive, and proactive disease management. AI-powered tools can analyze large volumes of patient data to identify early warning signs of exacerbations, optimize treatment plans, and support remote monitoring, thereby improving clinical outcomes and reducing hospitalizations. For instance, FindAir, a Finland-based med-tech company, offers AsthmaAI, an advanced AI-driven solution that uses real-world data from connected inhalers to predict asthma attacks and personalize therapy recommendations. By integrating data such as inhaler use patterns, environmental factors, and individual health metrics, AsthmaAI exemplifies how AI is enhancing the effectiveness of respiratory disease management. As AI continues to integrate with smart inhalers, mobile apps, and clinical decision support systems, it is set to revolutionize how COPD and asthma are treated and monitored globally.

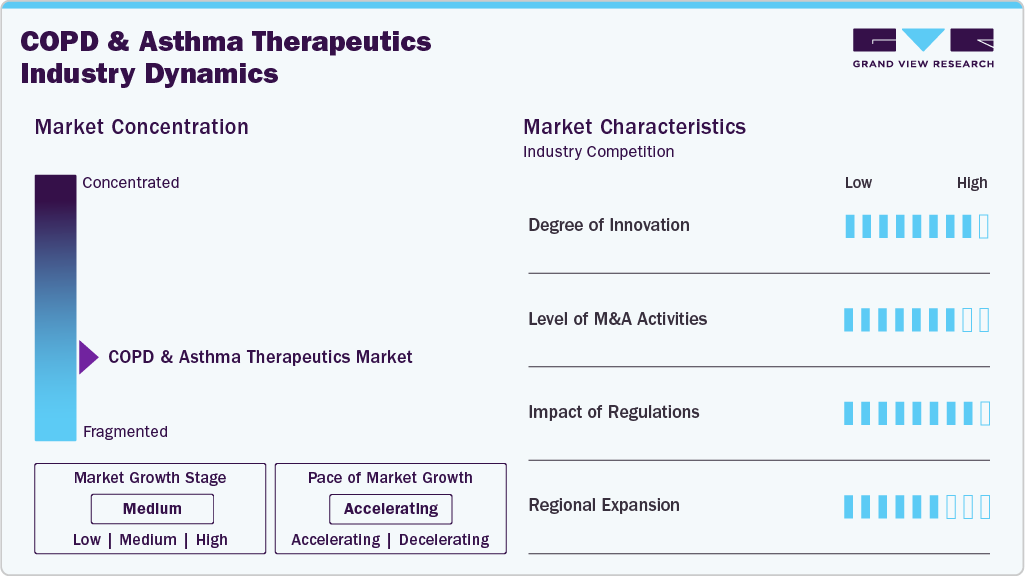

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the COPD and asthma therapeutics market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is moderate to high. The market is experiencing significant advances in certain areas, especially in biologics, drug-device combinations, and digital health technologies, while more traditional segments like inhaled generics remain relatively mature. In September 2024, the U.S. Food and Drug Administration (FDA) approved Dupixent (dupilumab) as the first-ever biologic medicine for patients with chronic obstructive pulmonary disease (COPD).

The level of partnerships & collaboration activities by key players in the industry is high to increase their capabilities, expand product portfolios, and improve competencies. In March 2024, AstraZeneca Pharma India Ltd partnered with Mankind Pharma to exclusively distribute its asthma medication, Symbicort, in India. This collaboration aims to enhance access to treatment across the country, leveraging Mankind Pharma's extensive distribution network.

"Our aspiration is to be pioneers in science and lead in specialist disease areas. We are focused on transforming outcomes for patients and contributing sustainably to people, society and the planet. The partnership with Mankind Pharma presents an opportunity to accelerate access and maximize the potential of our asthma drug as well as the turbuhaler which is a simple device2, efficient in consistently delivering a higher proportion of respirable particles than the other devices.

- Dr. Sanjeev Panchal, Country President and Managing Director, AstraZeneca India..

The impact of regulations on the market is high. Regulatory frameworks significantly shape the COPD and asthma therapeutics market, influencing drug approval timelines, market access, pricing, and device innovation. In developed markets like the U.S., the FDA’s stringent approval process ensures safety and efficacy, particularly for complex inhalation devices and combination therapies such as ICS/LABA and triple therapies. In Europe, the EMA mandates strong clinical evidence for approval, particularly for biologics, and has been a key player in setting environmental regulations on inhaler propellants, pushing a shift from hydrofluoroalkane (HFA)-based MDIs to eco-friendlier inhalers.

The COPD and asthma therapeutics industry's level of regional expansion is moderate. Regional expansion has become a key growth strategy for pharmaceutical companies in the COPD and asthma therapeutics industry, significantly broadening patient access, driving revenue, and diversifying product portfolios. For instance, in July 2023, Viatris Inc. launched Breyna, an FDA-approved generic version of AstraZeneca's Symbicort inhalation aerosol, in partnership with Kindeva Drug Delivery. This aerosol is used for treating COPD and asthma. This launch provides a more affordable treatment option for patients with COPD and asthma in the United States.

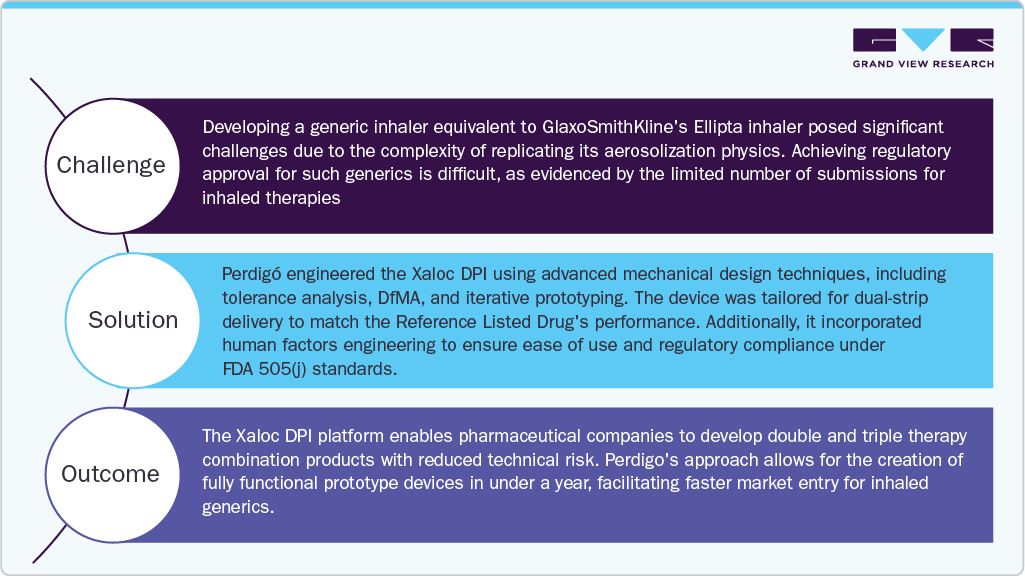

Case Study

This case study highlights Perdigó’s development of the Xaloc Dry Powder Inhaler as a high-performance, generic alternative to GSK’s Ellipta device.

Drug Class Insights

The Anti-IgE and Anti-IL monoclonal antibodies segment dominated the market with a revenue share of 22.72% in 2024. The segment's large share is attributed to its targeted and highly effective approach in managing severe and uncontrolled forms of COPD and asthma. These biologics, including agents like omalizumab (Anti-IgE), mepolizumab, and dupilumab (Anti-IL), are designed to modulate key inflammatory pathways that drive disease progression. Furthermore, these monoclonal antibodies are particularly beneficial for patients who do not respond adequately to standard treatments, offering improved symptom control, reduced exacerbation rates, and better overall quality of life. For instance, in April 2021, the FDA approved Xolair, a biologic, to treat moderate to severe persistent allergic asthma, Chronic Idiopathic Urticaria (CIU), and nasal polyps.

The combination therapy segment is expected to grow at the fastest CAGR during the forecast period due to its superior clinical efficacy, convenience, and growing adoption in both moderate and severe disease management. In addition, the availability of several fixed-dose combination inhalers has made combination therapy more convenient for patients, further contributing to its higher adoption. For instance, in June 2022, Glenmark Pharmaceuticals Limited introduced a new fixed-dose combination drug, Indamet, in India for uncontrolled asthma. As a result of these factors, combination therapy is expected to dominate the market in the coming years.

Device/Product Insights

The inhalers segment accounted for the largest revenue share in 2024. This can be attributed to several factors, such as their reliability, versatility, portability, and cost-effectiveness. Moreover, the increasing prevalence of COPD & asthma and the growing need for emergency treatment alternatives against sudden attacks have contributed to a significant market share of inhalers. The inhalers segment is expected to grow further due to the innovations in the existing products. For instance, in September 2020, GSK Plc. and Innoviva's triple therapy inhaler, Trelegy Ellipta, was approved in the U.S. for treating asthma and COPD.

The nebulizers segment is expected to register the fastest CAGR from 2025 to 2030. One of the primary drivers is ease of use, making nebulizers particularly suitable for children, elderly patients, and severe asthmatic patients who struggle with inhaler techniques. Moreover, an increase in the adoption of nebulizers in home healthcare and emergency medicine due to associated benefits, such as greater comfort, administration of large dosages facilitating sustained results, and favorable reimbursement scenarios, is expected to drive market growth. Furthermore, continuous advancements in nebulizer technology, such as portable and handheld devices, increase patient compliance and convenience. For instance, in July 2020, OMRON Corporation launched OMRON NE C106, a compressor nebulizer designed to deliver medication directly to the lungs in the form of a mist.

Indication Insights

The asthma segment accounted for the largest revenue share of the COPD and asthma therapeutics market in 2024. The dominance of the segment is attributed to the increasing prevalence of asthma among the population. According to WHO estimates, asthma affected 262 million patients globally, with inflammation and narrowing of the lungs being common. The segment has a strong research pipeline, with many candidates in late-stage or mid-stage development. Several double and triple combination inhalers for asthma are also in the last stages of development, with the objective of increasing medication adherence. For instance, in May 2022, PT027 (Albuterol/Budesonide Fixed-Dose Combo), developed through AstraZeneca and Avillion collaboration, displayed promising results in Phase III clinical trials and is accepted by the FDA as a new drug application filed by both companies.

The Chronic obstructive pulmonary disease (COPD) segment is expected to show lucrative growth during the forecast period. The growth of the segment is associated with the rising geriatric population, as a result of which the demand for COPD drugs is also expected to surge. Individuals aged over 65 years are at higher risk of developing COPD. The prevalence of COPD is lower than asthma; however, it leads to 5% of deaths globally. Overdiagnosis is also a factor associated with a high prevalence of COPD. The condition is more prevalent in low- and middle-income countries and has a high rate of mortality.

Technology/Software Insights

The smart inhalers with Bluetooth connectivity segment held the largest revenue share in 2024, attributed to their ability to enhance medication adherence, enable real-time monitoring, and support data-driven treatment decisions. These devices automatically track inhaler usage and transmit data to mobile apps or healthcare platforms, allowing patients and providers to manage respiratory conditions better. Further, in September 2020, Teva Pharmaceuticals launched ArmonAir Digihaler, an inhalation powder, and AirDuo Digihaler, an inhalation powder. These digital maintenance inhalers for asthma patients feature built-in sensors and Bluetooth connectivity to monitor usage and provide actionable insights. As digital health adoption grows, smart inhalers are becoming integral to personalized respiratory care, driving their widespread uptake in the market.

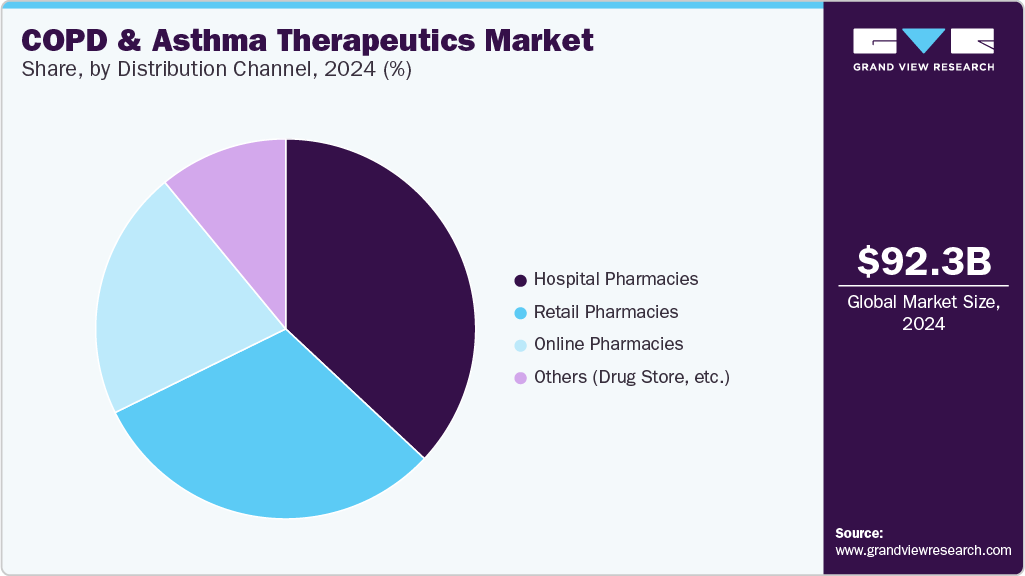

Distribution Channel Insights

The hospital pharmacies segment accounted for the largest revenue share in 2024. This can be attributed to high demand for immediate and specialized treatment during acute episodes that often require hospitalization or emergency care. Patients with moderate to severe asthma or COPD frequently experience exacerbations that lead them to hospital settings, where rapid access to bronchodilators, corticosteroids, and biologics is critical. Furthermore, significant rise in the number of hospital admissions for asthma and COPD patients. According to the Asthma and Allergy Foundation of America, asthma accounted for 94,560 discharges from hospital inpatient care and 986,453 emergency department visits in 2020.

The online pharmacies segment is expected to register the fastest CAGR from 2025 to 2030. This growth is driven by shifting consumer preferences, growing digital adoption, and the expanding reach of e-commerce in healthcare. The convenience of doorstep delivery, increased accessibility to medications, and availability of digital consultation services make online platforms particularly attractive for chronic disease patients who require regular and long-term medication management.

Regional Insights

North America COPD and asthma therapeutics and market held the largest revenue share in 2024, driven by increasing disease prevalence, an aging population, and rising healthcare expenditures. The region dominates the global market, supported by advanced healthcare infrastructure and growing adoption of innovative treatment solutions such as biologics and smart inhalers. Rising environmental pollution, especially in urban areas, continues to be a key driver of respiratory conditions, prompting demand for improved therapeutics and diagnostic tools.

U.S. COPD And Asthma Therapeutics Market Trends

The COPD and asthma therapeutics industry in the U.S. held the largest revenue share in 2024. According to the Centers for Disease Control and Prevention (CDC), asthma affects approximately 25 million people, including over 4.6 million children under 18, contributing to the market growth in this region. Further, the market is fueled by substantial R&D investments, public awareness campaigns, and government initiatives supporting COPD and asthma research. For instance, in 2022, the National Asthma Control Program received USD 30 million in federal funding, supporting CDC asthma programs, propelling market growth.

Europe COPD And Asthma Therapeutics Market Trends

The COPD and asthma therapeutics industry in Europeis anticipated to grow significantly over the forecast period. The primary factors driving this demand are environmental regulations and the adoption of sustainable healthcare practices. For instance, in March 2024, new legislation was introduced by the European Union (EU) to manage fluorinated gases and other ozone-depleting substances to completely phase out their use within the union by 2050, which is expected to significantly impact the asthma therapeutics and COPD market in Europe, as it drives the transition toward low-emission inhalers. This legislation can tend to limit the adoption of metered-dose inhalers owing to their hydrofluorocarbon content; however, it can also fuel the adoption of dry-powder and soft-mist inhalers in the region.

The UK COPD and asthma therapeutics market is influenced by the National Health Service's (NHS) emphasis on cost-effective treatments and environmental sustainability. The NHS has been encouraging the use of low-carbon inhalers, and pharmaceutical companies are responding by developing inhalers with reduced environmental impact. For instance, GSK, a UK-based pharmaceutical and biotechnology company, initiated Phase III trials for a low-carbon version of its Ventolin inhaler, aiming to reduce greenhouse gas emissions by approximately 90% through the use of a next-generation propellant. This development is a significant step towards GSK's net-zero climate targets, considering that the current inhaler accounts for nearly half of the company's carbon footprint.

The COPD and asthma therapeutics market in Germany is driven by a robust healthcare system and a strong emphasis on research and development. The country's focus on early diagnosis and comprehensive disease management programs contributes to effective treatment outcomes. Moreover, Germany's commitment to environmental sustainability is driving the adoption of eco-friendly inhalers, aligning with broader EU initiatives to reduce greenhouse gas emissions from medical devices.

Asia Pacific COPD And Asthma Therapeutics Market Trends

Asia Pacificis expected to witness the fastest growth over the forecast period. The region experiences growth in the COPD and asthma therapeutics industry, driven by increasing urbanization, pollution, and smoking rates. For instance, according to the World Health Organization, 3.1 million preventable deaths are caused due to Tobacco in South Asia out of 8 million deaths worldwide. The growing geriatric population and rising awareness about lung diseases are the major driving factors in this region. In Southeast Asia, asthma is reported as one of the most common non-communicable diseases and is responsible for nearly 73% of the visits to outpatient clinics. Moreover, developing healthcare infrastructure in Asia Pacific countries, such as Indonesia, China, & India, is expected to propel the market over the coming years.

The China COPD and asthma therapeutics market is expected to witness growth over the forecast period, due to the country’s significant burden of respiratory diseases. For instance, according to the World Health Organization, as of November 2023, around 100 million people in China are living with chronic obstructive pulmonary disease, which accounts for almost 25% of all global COPD cases. Further, Government initiatives, such as the national COPD screening program implemented in October 2021, aim to improve early diagnosis and treatment, contributing to the growth of the market in China.

The COPD and asthma therapeutics market in India is expected to grow significantly over the forecast period. The growing geriatric population, government initiatives supporting the country’s Health scenario, and growing strategic developments by key players in the region are contributing to the growth of the Indian asthma therapeutics and COPD market. For instance, in November 2023, Lupin launched Vilfuro-G, the fixed-dose triple combination drug for managing chronic obstructive pulmonary disease (COPD) in India.

Latin America COPD And Asthma Therapeutics Market Trends

Increasing awareness and healthcare access, expanding access to treatment, and greater awareness of chronic respiratory conditions are contributing to higher diagnosis and management rates across the region is driving the COPD and asthma therapeutics industry in Latin America. However, the region faces challenges like economic disparities and limited healthcare infrastructure in certain areas.

Middle East & Africa COPD And Asthma Therapeutics Market

The COPD and asthma therapeutics industry in the Middle East &Africais expected to grow significantly over the forecast period. Market growth is driven by urbanization and increasing pollution levels. Further, Countries like Saudi Arabia are expected to register the highest growth rates. However, challenges such as limited access to healthcare services and affordability issues persist, particularly in low-income regions.

Key COPD And Asthma Therapeutics Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key COPD And Asthma Therapeutics Companies:

The following are the leading companies in the COPD and asthma therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Merck & Co., Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Sanofi

- Koninklijke Philips N.V.

- BD

- Covis Pharma

- Findair Sp. z o. o.

- Novartis AG

- Cipla Ltd.

- Chiesi Air

Recent Developments

-

In January 2025, Cipla launched the CipAir mobile application, offering the first line of screening for asthma. This app assists in understanding the chances of having asthma, enabling timely diagnosis and treatment.

“At Cipla, our approach to healthcare is deeply rooted in innovation. By leveraging the power of next-gen technologies, we are developing solutions that are fundamentally transforming patient care and enabling better diagnostic, treatment, and management outcomes. Patient-centricity is at the heart of what we do, and CipAir's AI-led technology is yet another step forward in making personalised healthcare accessible and userfriendly, thereby empowering them to live fuller lives."

- Mr. Umang Vohra, Managing Director & Global CEO of Cipla

-

In October 2024, Modivcare Inc. partnered with Tenovi to deliver Adherium’s Hailie Smart inhalers, which enhance the care of patients with chronic respiratory diseases.

“Our partnership with Modivcare enables Tenovi to extend our remote monitoring capabilities into payor programs, where improving quality of care and reducing overall respiratory care costs is critical”.

- said Iftah Mashav, Chief Growth Officer at Tenovi

-

In August 2023, Teva UK launched GoResp Digihaler forasthma and COPD patients. This is an integrated device with sensors for detecting and recording data on the patient’s use and ability to use their inhaler, including inspiratory flow classification.

“Providing key insights from viewing and monitoring inhaler technique and usage will support patients and healthcare professionals in the management of appropriate patients with asthma and COPD and represents an important step forward.”

- Kim Innes, general manager of Teva UK & Ireland

-

In April 2021, Chiesi received European marketing authorization for its triple combination therapy inhalation powder delivered through NEXThaler, a single dry powder inhaler for adult COPD patients. NEXThaler consists of an extrafine formulation, triple fixed combination therapy.

“With the marketing authorisation for our triple therapy in a NEXThaler device in the EU, the Chiesi Group reinforces its commitment to providing a broad portfolio of formulations and devices to COPD patients and physicians”.

-Alessandro Chiesi, Chief Commercial Officer, Chiesi Group.

COPD And Asthma Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 100.06 billion

Revenue forecast in 2030

USD 155.25 billion

Growth rate

CAGR of 9.18% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, device/product, technology/software, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd.; GSK plc; Merck & Co., Inc.; F. Hoffmann-La Roche Ltd; AstraZeneca; Boehringer Ingelheim International GmbH; Sanofi; Koninklijke Philips N.V.; BD; Covis Pharma; Findair Sp. z o. o.; Novartis AG; Cipla Ltd.; Chiesi Air

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global COPD And Asthma Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global COPD and asthma therapeutics market report based on drug class, device/product, technology/software, indication, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Bronchodilators

-

Corticosteroids

-

Leukotriene Modifiers

-

Anti-IgE and Anti-IL Monoclonal Antibodies

-

Combination Therapy

-

Others

-

-

Device/Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Inhalers

-

Dry Powder Inhalers (DPI)

-

Metered Dose Inhalers (MDI)

-

Soft Mist Inhalers (SMI)

-

-

Nebulizers

-

Jet

-

Mesh

-

Ultrasonic

-

-

Oxygen Therapy Devices

-

-

Technology/Software Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Inhalers with Bluetooth Connectivity

-

AI-based Respiratory Monitoring Platforms

-

Mobile Apps for Symptom Tracking

-

Digital Adherence and Reminder Systems

-

Telepulmonology Solutions

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Asthma

-

COPD

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Drug Stores

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global COPD and asthma therapeutics market size was estimated at USD 92.30 billion in 2024 and is expected to reach USD 100.06 billion in 2025.

b. The global COPD and asthma therapeutics market is expected to grow at a compound annual growth rate of 9.18% from 2025 to 2030 to reach USD 155.25 billion by 2030.

b. Anti-IgE and Anti-IL monoclonal antibodies segment dominated the market with a revenue share of 22.72% in 2024. The segment's large share is attributed to its targeted and highly effective approach in managing severe and uncontrolled forms of COPD and asthma.

b. Some key players operating in the COPD and asthma therapeutics market include Teva Pharmaceutical Industries Ltd., GSK plc, Merck & Co., Inc., F. Hoffmann-La Roche Ltd, AstraZeneca, Boehringer Ingelheim International GmbH, Sanofi, Koninklijke Philips N.V., BD, Covis Pharma, Findair Sp. z o. o., Novartis AG, F. Hoffmann-La Roche Ltd, Cipla Ltd., Chiesi

b. Key factors that are driving the market growth include the increasing prevalence of chronic respiratory conditions—exacerbated by rising pollution levels, tobacco consumption, and aging populations significantly boosting demand for these therapeutics devices and solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.