- Home

- »

- Next Generation Technologies

- »

-

Core Banking Software Market Size, Industry Report, 2030GVR Report cover

![Core Banking Software Market Size, Share & Trends Report]()

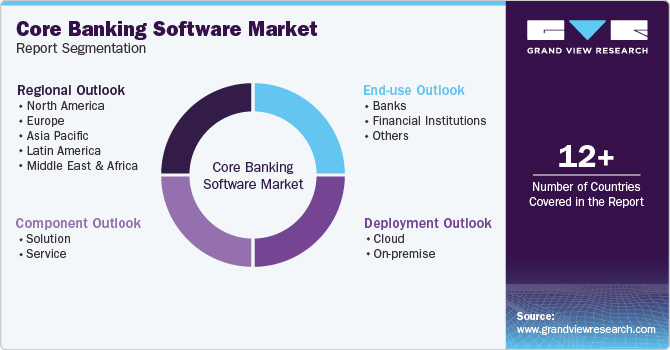

Core Banking Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment (Cloud, On-premise), By End-use (Banks, Financial Institutions), By Region, And Segment Forecasts

- Report ID: 978-1-68038-496-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Core Banking Software Market Summary

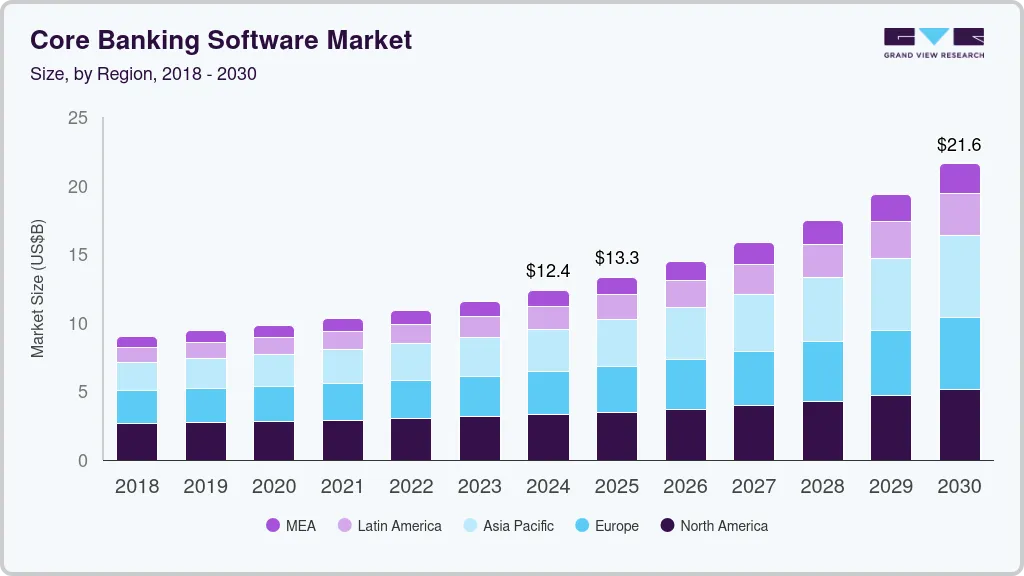

The global core banking software market size was estimated at USD 12.37 billion in 2024 and is projected to reach USD 21.61 billion by 2030, growing at a CAGR of 10.2% from 2025 to 2030. The increasing inclination of banking industry participants to incorporate advanced technologies, improved capabilities, and innovation primarily drives market growth.

Key Market Trends & Insights

- North America dominated the core banking software market with the largest revenue share of 26.6% in 2024.

- The core banking software market in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on components, the solutions segment led the market with the largest revenue share of 63.56% in 2024.

- Based on deployment, the on-premise segment accounted for the largest revenue share in 2024.

- Based on end use, the banks segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.37 Billion

- 2030 Projected Market Size: USD 21.61 Billion

- CAGR (2025-2030): 10.2%

- North America: Largest market in 2024

The financial services sector has been experiencing a major shift from traditional operations and service delivery to the digitization of processes and multiple business functions. The growing availability of tailored solutions and ease of accessibility to innovation-based software technologies is expected to generate lucrative growth opportunities for this market.

Recently, smartphone technology and other electronic devices have become integral to business. The growth experienced by the e-commerce industry, the emergence of concepts such as quick-commerce in developing countries such as India, and the growing penetration of web-based applications have driven the use of technology for financial transactions. The increasing use of smartphone devices, the emergence of technologies such as Unified Payments Interface (UPI), digital/mobile payments, etc., and the growing adoption of advanced technology tools associated with financial transactions have developed a need for improved banking software solutions. Banks and financial institutions rely heavily on customer data generated through transactions and across platforms.

In addition to providing customers with the ability to manage accounts remotely through online banking and mobile channels, core banking software has multiple other benefits. Core banking software solutions connect multiple branches to a centralized system, making them interconnected and allowing for efficient data search and comparison. Banks can leverage core banking software to analyze data and improve internal processes. Moreover, through transaction monitoring and screening, core banking solutions help detect and prevent money laundering.

Multiple banks and financial institutions focus on embracing advanced core technology infrastructure to ensure frictionless customer experience, onboarding, and more. Competition, cyber-attack threats, and changing customer requirements stimulate banks and financial institutions to adopt the latest technologies to prioritize improved technological capabilities. These aspects are expected to drive market growth. For instance, in March 2024, one of the Midwest regional banks, the Central Bank, selected TCS BaNCS by Tata Consultancy Services (TCS) to update and modernize its core technology capabilities. Central Banks operate through 150 locations across Missouri, Kansas, Illinois, and Oklahoma communities.

The pace of technological innovation and adoption has grown tremendously across sectors. Integrating the latest technologies, such as generative artificial intelligence in banking and financial activities, can help firms differentiate from the competition and gain a competitive edge; according to a study conducted by Accenture in March 2023, covering over 49,000 customers, 67% mentioned using branch services for very specific and complex problems that require physical presence. Moreover, the survey estimates that banks can boost revenue by up to 20% through better engagement with primary customers.

Component Insights

Based on components, the solutions segment led the market with the largest revenue share of 63.56% in 2024. This is attributed to the growing number of banks and financial institutions seeking solutions that enhance operational capabilities and ensure hassle-free customer experiences. Multiple banks and financial organizations have adopted new solutions and advanced technologies to add novel capabilities to existing infrastructure and networks. Core banking solutions for loans encompass a comprehensive set of digital tools designed to streamline and optimize the loan management process within a financial institution.

The loan solutions enhance operational efficiency, customer experience, and regulatory compliance throughout the lifecycle of loan products. Moreover, automation of the loan application and approval process, including data capture, credit scoring, and documentation verification, accelerates loan approval times and reduces manual errors. Solutions for the loans segment are expected to add lucrative opportunities.

The growth is also driven by the collaborations and partnerships among key technology industry participants to deliver advanced solutions associated with core banking. For instance, Temenos, one of the core banking solutions providers, and Deloitte, a global professional service company, announced that the two have partnered for the development and delivery of technology solutions designed for financial institutions in the U.S. that aim to accelerate core banking upgrades and payments modernization in the cloud.

The service segment is expected to experience at the fastest CAGR during the forecast period. Core banking software must be tailored to meet each financial institution's requirements and workflows. Professional service providers help banks customize the software to meet their business needs. The primary growth factor for the professional service segment is the increasing need for support services at each level of software deployment, such as the pre-implementation of scope and consulting, project management, and integration.

Deployment Insights

Based on deployment, the on-premise segment accounted for the largest revenue share in 2024. When building an on-premise system, businesses assume full responsibility for integration and any IT-related and security issues. Companies with legacy platforms often partner with IT service providers to recover data and reduce security concerns and operational costs. It provides more control over the operational infrastructure.

The cloud segment is anticipated to experience at the fastest CAGR from 2025 to 2030. This is attributed to financial institutions and banks with existing on-premise infrastructure focusing on adopting cloud-based solutions to compete against more innovative digital opponents. Cloud technology helps automate workflows and operations, increasing efficiency, cost savings, and security. Cloud-based core banking solutions are flexible and easy to expand or reduce on demand, thereby meeting the IT requirements of the target organization.

New collaborations and partnerships among banking industry participants and technology solution providers are expected to add novel growth opportunities to this segment. For instance, in June 2024, one of the key market participants in Canada’s banking sector, Haventree Bank, selected Temenos for assistance in its digital transformation.

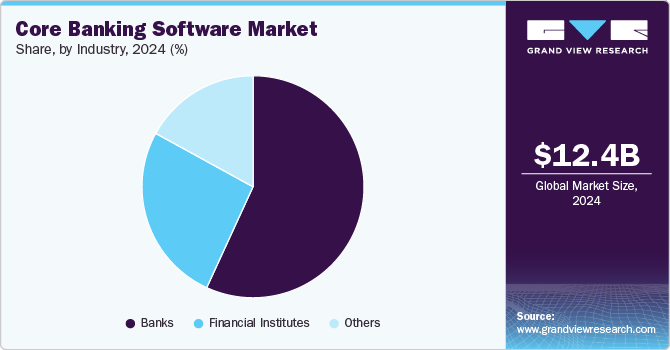

End Use Insights

Based on end use, the banks segment accounted for the largest revenue share in 2024. The segment's growth can be attributed to the rising investments in modern IT infrastructure. Automated systems ensure accurate data entry and processing, minimizing erroneous entries. Access to real-time data and advanced analytics enables banks to gain valuable insights into customer behavior, preferences, and financial trends, helping them make data-driven decisions.

The growing proactive approach among banking sector participants to collaborate and partner with banking IT solutions providers to upgrade existing technology capabilities is adding to the growth experienced by this segment. For instance, in July 2024, Siam Commercial Bank (SCB) partnered with Sunline (Shenzhen Sunline Tech Co., Ltd.) to refurbish its IT architecture for core banking system modernization to ensure improved delivery of processing performance associated with deposits and loans. This included enhancing efficiency, security, and scalability to address growing transactions.

The financial institutions segment is expected to grow at a significant CAGR over the forecast period. Financial institutions widely adopt core banking software with real-time banking facilities to prevent theft and fraud. The rising adoption rate can also be attributed to the need to fill the gap between customer expectations and traditional banks' operations. These factors are expected to create growth opportunities for the financial institutions segment.

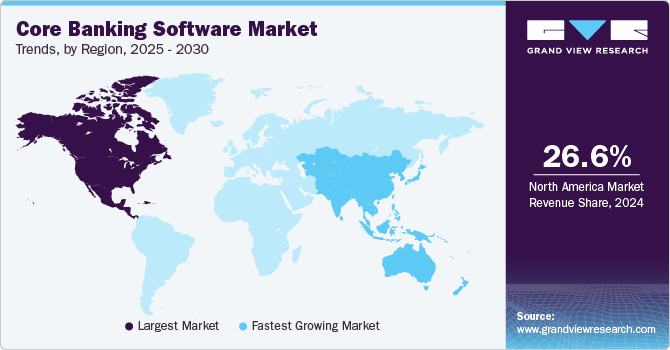

Regional Insights

North America dominated the core banking software market with the largest revenue share of 26.6% in 2024. This is attributed to the strong telecom & IT industry operating in the region, the presence of multiple banks focused on digital transformation, and the ease of availability driven by the accessibility to advanced technologies. The North American region is known for early technology adoption across sectors. For instance, in February 2023, Arvest Bank launched its first equipment financing product on cloud technology. The rising emphasis of prominent regional banks to modernize core infrastructure is expected to drive regional growth.

U.S. Core Banking Software Market Trends

The core banking software market in the U.S. accounted for the largest market revenue share in North America in 2024. This is attributed to the robust IT sector actively operating in the country, numerous banks and financial institutions seeking to modernize core banking capabilities, and multiple collaborations among solution providers and banks or financial institutions.

Europe Core Banking Software Market Trends

The core banking software market in Europe was identified as one of the key regions in 2024. This is attributed to the growing focus of multiple banks and financial organizations on digital transformation and modernizing existing core banking software technology to ensure improved processing performance and friction-free customer experiences. The availability of solutions delivered by expert IT companies worldwide adds lucrative growth opportunities to this market.

The Germany core banking software market accounted for the largest market revenue share in Europe in 2024. This market is mainly driven by the growing inclination among the banking and financial services industry to upgrade existing core banking technologies to enhance performance and improve customer engagement. Increasing demand for centralized account management and changing customer requirements have stimulated the modernization trend in the industry.

Asia Pacific Core Banking Software Market Trends

The core banking software market in Asia Pacific is anticipated to experience at the fastest CAGR during the forecast period. The increasing number of digital transactions primarily influences this market, consumers' growing use of digital technology, and the rising need for secure and scalable technologies associated with core banking. Entry of multiple global players from the banking and finance industry in the unexplored markets of this region is also adding to the growth.

The China core banking software market held the largest market revenue share in Asia Pacific in 2024. This is attributed to the growth experienced by the country's IT and telecom sector and growing partnerships among banks and IT solutions providers based in China. The rising adoption of online banking services and increasing use of digital platforms for financial services are expected to add growth opportunities to this market over the forecast period.

The core banking software market in India is witnessing rapid growth, driven by digital transformation and government initiatives. Programs like India Stack, which includes Aadhaar for biometric authentication and Unified Payments Interface (UPI), have accelerated the adoption of CBS solutions. In addition, regulatory requirements from the Reserve Bank of India (RBI), such as the Account Aggregator (AA) framework, push banks to modernize their IT infrastructure. Public Sector Banks (PSBs) are also undergoing digital transformation under reforms like EASE (Enhanced Access and Service Excellence), further driving the demand for core banking software.

Key Core Banking Software Company Insights

Some of the key companies operating in the core banking software industry are Capgemini, Finastra, Infosys Limited, Temenos, Fiserv, Inc., and others. To address growing competition and increasing demand, the key market participants are adopting different strategies such as partnerships, new product launches, and more.

-

Temenos, founded in 1993, provides advanced banking technology solutions to nearly 950 core banking and approximately 600 digital banking clients worldwide. One of the largest European software technology companies, it offers an extensive platform and solutions portfolio to multiple industries, including retail banking, corporate banking, business banking, wealth management, payments, funds, and others.

-

Capgemini is an IT services and consulting company that acts as a technology and transformation partner for multiple organizations. It offers many solutions and technology assistance services. Its service portfolio is mainly associated with cloud, cybersecurity, data and artificial intelligence, enterprise management, intelligent industry, sustainability, and more.

Key Core Banking Software Companies:

The following are the leading companies in the core banking software market. These companies collectively hold the largest market share and dictate industry trends.

- Capgemini

- Finastra

- FIS

- Fiserv, Inc.

- HCL Technologies Limited

- Infosys Limited

- Jack Henry & Associates, Inc.

- Oracle Corporation

- Temenos Group

- Unisys

Recent Developments

-

In March 2025, Payments and financial services technology provider Fiserv, Inc. acquired program management technology solutions provider Payfare Inc. The acquisition is expected to strengthen Fiserv, Inc.'s embedded financial solutions capabilities.

-

In February 2025, Al Rayan Bank selected Finastra to deliver a novel, tailored solution for core banking. One of the largest banks in Qatar, Al Rayan, is undergoing technology transformation and embracing advanced technologies to assist its customers with improved performances and hassle-free experiences.

Core Banking Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.32 billion

Revenue forecast in 2030

USD 21.61 billion

Growth rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Capgemini; Finastra; FIS; Fiserv, Inc.; HCL Technologies Limited; Infosys Limited; Jack Henry & Associates, Inc.; Oracle Corporation; Temenos; Unisys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Core Banking Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global core banking software market report based on component, deployment, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Deposits

-

Loans

-

Enterprise Customer Solutions

-

Others

-

-

Service

-

Professional Service

-

Managed Service

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Banks

-

Financial Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global core banking software market size was estimated at USD 12.37 billion in 2024 and is expected to reach USD 13.32 billion in 2025.

b. The global core banking software market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach USD 21.61 billion by 2030.

b. North America dominated the core banking software market with a share of 26.7% in 2024. This is attributable to the large-scale adoption of advanced core banking software by prime banks in the North American region.

b. Some key players operating in the core banking software market include Capgemini; Finastra; FIS; Fiserv, Inc.; HCL Technologies Limited; Infosys Limited; Jack Henry & Associates, Inc.; Oracle Corporation; Temenos; and Unisys.

b. Key factors that are driving the core banking software market growth include increasing customer demand for advanced banking technologies and growing demand for managing customer accounts from a single server.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.