- Home

- »

- Advanced Interior Materials

- »

-

Cork Building Materials Market Size, Industry Report, 2033GVR Report cover

![Cork Building Materials Market Size, Share & Trends Report]()

Cork Building Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cork Flooring, Cork Insulation Materials), By End Use (Non-residential, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-803-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cork Building Materials Market Summary

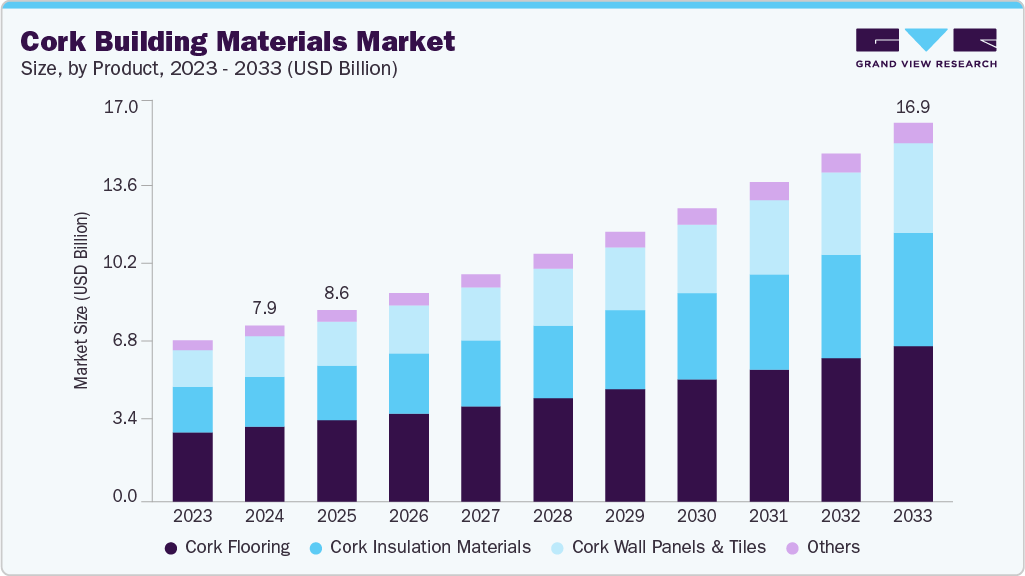

The cork building materials market size was estimated at USD 7.86 billion in 2024 and is projected to reach USD 16.92 billion by 2033, growing at a CAGR of 8.9% from 2025 to 2033. This growth is due to the rising emphasis on sustainable construction and the growing awareness of eco-friendly alternatives to synthetic materials.

Key Market Trends & Insights

- Asia Pacific dominated the cork building materials market with the largest revenue share of 40.2% in 2024.

- By product, the cork insulation materials segment is expected to grow at the fastest CAGR of 9.6% over the forecast period.

- By end use, the non-residential segment is expected to grow at the fastest CAGR of 9.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 7.86 Billion

- 2033 Projected Market Size: USD 16.92 Billion

- CAGR (2025-2033): 8.9%

- Asia Pacific: Largest and Fastest market in 2024

Cork, being a renewable and biodegradable resource, offers natural insulation and soundproofing benefits, making it ideal for green building certifications such as LEED and BREEAM. In addition, increasing energy efficiency requirements across residential and commercial sectors have boosted the adoption of cork-based flooring, wall panels, and insulation. The global trend toward carbon-neutral construction and reduced environmental footprint further supports market expansion.

Key drivers include the growing construction activities in developing economies, coupled with consumers’ preference for natural and non-toxic materials. Cork’s unique cellular structure provides excellent thermal and acoustic insulation, enhancing indoor comfort and energy efficiency. Moreover, its resistance to moisture, fire, and pests makes it suitable for both interior and exterior applications. Rising disposable incomes and the shift toward premium, aesthetically appealing interiors also contribute to demand. In addition, the tourism and hospitality industry’s emphasis on sustainable architecture is accelerating the use of cork in hotels, resorts, and eco-lodges.

Recent innovations include the development of composite cork materials that combine natural cork with resins or recycled polymers to enhance durability and application range. Manufacturers are introducing digitally printed cork panels and modular tiles for improved design flexibility. Automation and advanced cutting technologies are improving production efficiency and reducing waste. Furthermore, there is an increasing trend toward circular economic practices, with companies repurposing cork waste from the wine industry into construction-grade materials. The growing popularity of “biophilic design,” which integrates natural elements indoors, is another strong trend driving product innovation.

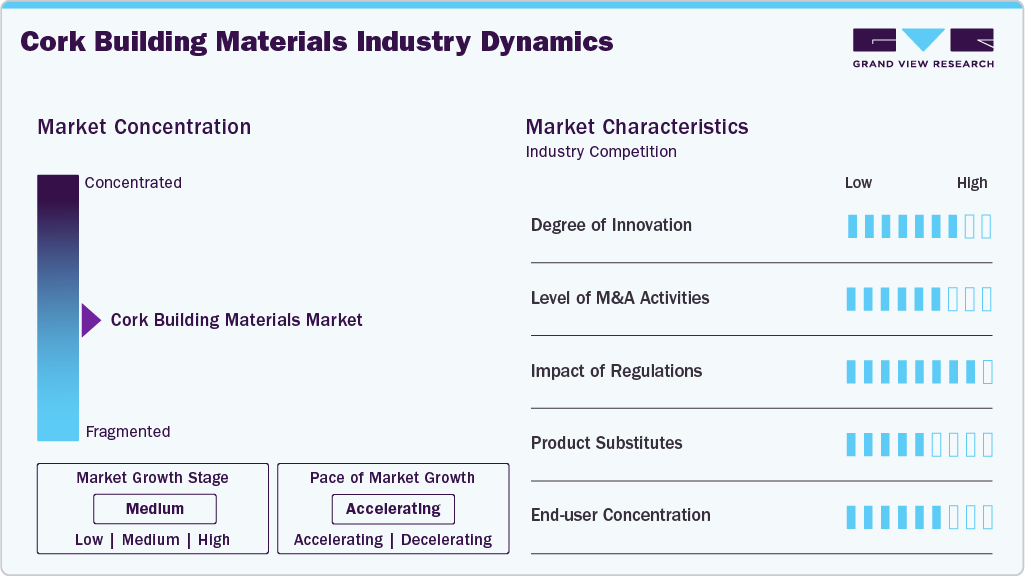

Market Concentration & Characteristics

The cork building materials industry is moderately concentrated, with a few leading players such as Amorim Cork Composites, Green Building Supply, Jelinek Cork Group, and Wicanders dominating the global supply. These firms benefit from vertical integration, ranging from cork harvesting to final product manufacturing, which ensures quality control and cost efficiency. However, regional manufacturers and new entrants focusing on niche architectural or decorative applications are emerging, especially in the Asia Pacific. Strategic collaborations and sustainability-driven branding are becoming key competitive tools, enhancing differentiation within the market.

Major substitutes for cork in building applications include synthetic foams, fiberglass, and polyurethane-based insulation materials. However, these alternatives lack cork’s sustainability and biodegradability advantages. Although polymers often offer lower initial costs and higher mechanical strength, the increasing regulatory focus on reducing carbon emissions and plastic waste is diminishing their long-term appeal. As sustainability becomes a core purchasing factor, cork’s renewable origin and recyclability are expected to mitigate the threat from substitutes, particularly in premium and green-certified construction segments.

Product Insights

The cork flooring segment held the highest revenue market share of 42.6% in 2024, driven by its superior comfort, durability, and aesthetic versatility. Its natural elasticity, noise reduction capability, and thermal insulation make it ideal for modern interiors. Consumers and builders are increasingly opting for cork flooring due to its eco-friendly nature and its ability to contribute to healthier indoor environments. The availability of a wide range of designs, textures, and finishes has enhanced its appeal in premium residential and commercial spaces, reinforcing its position as the leading product category within the market.

The cork insulation materials segment is expected to grow at a significant CAGR of 9.6% over the forecast period, driven by the increasing global emphasis on energy-efficient and sustainable construction. Their exceptional thermal and acoustic performance, coupled with moisture resistance and long lifespan, makes them ideal for green-certified buildings. Increasing government initiatives promoting low-carbon housing and the integration of eco-friendly insulation in renovation projects are further accelerating demand. As developers and homeowners seek sustainable solutions to reduce energy consumption, cork insulation is gaining widespread adoption across new construction and retrofitting applications.

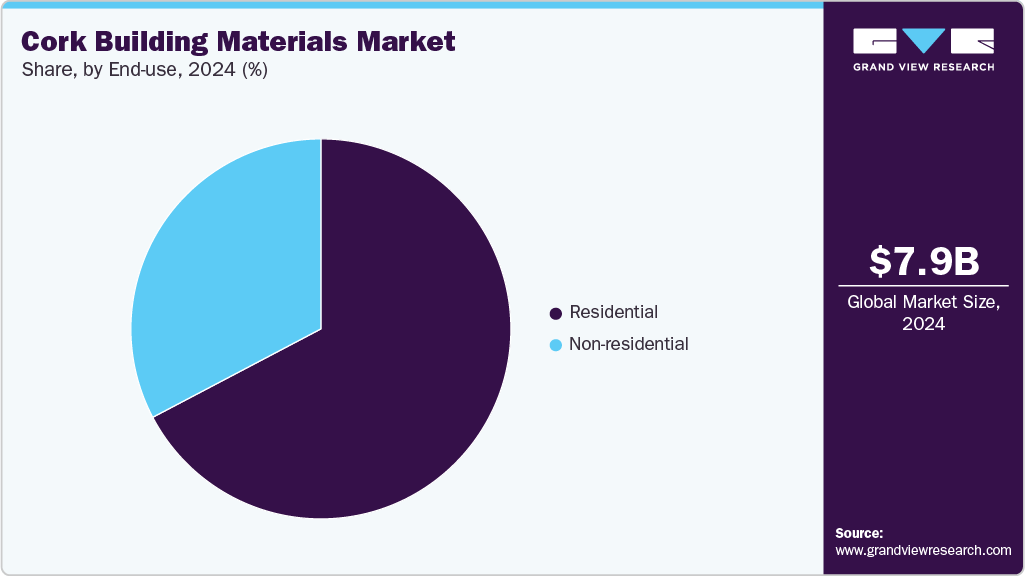

End Use Insights

The residential segment held the highest revenue market share of 67.3% in 2024, supported by increasing consumer awareness of sustainable living and indoor wellness. Homeowners are increasingly choosing cork flooring, wall panels, and insulation products for their natural warmth, comfort, and ability to maintain indoor air quality. The material’s resilience, easy maintenance, and stylish appearance make it a preferred choice for modern housing projects. Growing investments in green homes and urban housing development across regions have further reinforced cork’s dominance in the residential construction space.

The non-residential segment is expected to grow at a significant CAGR of 9.5% over the forecast period, as commercial, institutional, and hospitality projects embrace sustainable materials for enhanced energy performance and environmental compliance. Cork’s natural soundproofing, insulation, and anti-allergenic properties make it ideal for offices, hotels, educational institutions, and wellness centers. Architects and developers are integrating cork into large-scale projects to achieve LEED and BREEAM certifications while offering occupants superior comfort and design appeal. With increasing corporate sustainability goals and eco-conscious infrastructure development, cork materials are becoming a key component in the non-residential construction landscape.

Regional Insights

The Asia Pacific dominated the global cork building materials market, accounting for the largest revenue share of 40.2% in 2024, driven by rapid urbanization and increasing awareness of sustainable construction practices. Countries like India, China, Japan, and South Korea are implementing stricter building efficiency codes, driving demand for cork insulation and wall panels. The region’s expanding commercial real estate sector, along with government-backed green building programs, has led to increased adoption of cork. Import partnerships with European producers, particularly from Portugal, ensure a consistent quality supply.

China Cork Building Materials Market Trends

The cork building materials market in China is emerging as a promising market, supported by its strong commitment to sustainable urban development. The government’s “Green Building Action Plan” and efforts to reduce carbon emissions have led to growing interest in renewable materials, such as cork. Rising disposable income levels and the growth of the eco-luxury housing segment are driving the demand for cork flooring and acoustic panel installations. The country’s hospitality and office construction sectors are integrating cork to enhance indoor comfort and energy savings.

North America Cork Building Materials Market Trends

The cork building materials market in North America is experiencing robust growth, driven by the increasing popularity of green construction standards, including LEED and WELL certifications. Increasing investments in energy-efficient housing and commercial retrofitting projects have boosted demand for cork insulation and underlayment products. Consumer preferences are shifting toward sustainable and health-conscious materials, driving cork’s penetration in flooring and wall panels. The U.S. and Canada are also benefiting from improved import logistics from European cork producers and the development of local cork composite manufacturing units. Expanding awareness campaigns around natural materials and indoor air quality are supporting further market expansion.

The U.S. cork building materials market is experiencing growing demand for cork across both residential and commercial sectors, particularly for green-certified buildings. Cork’s hypoallergenic and antimicrobial properties make it an ideal choice for healthcare and educational facilities. Moreover, builders and architects are leveraging cork’s natural aesthetic and acoustic insulation benefits in open-plan offices and co-working spaces. State-level initiatives promoting sustainable materials and tax incentives for eco-friendly renovations are also driving the adoption of these practices. The remodeling and luxury housing segments are emerging as strong contributors to demand, with cork flooring gaining favor due to its resilience and comfort underfoot.

Europe Cork Building Materials Market Trends

The cork building materials market in Europe remains the world’s largest producer and consumer of cork building materials, driven by strict environmental policies and abundant cork resources. Portugal and Spain dominate production, while France, Italy, and Germany lead in consumption. The European Green Deal and regional sustainability directives have encouraged the use of renewable insulation and flooring solutions. Architectural projects increasingly feature cork for its carbon-negative profile and natural aesthetic appeal. In addition, the European market is witnessing growing export demand from Asia and North America, strengthening its global influence in sustainable construction materials.

Germany cork building materials market is characterized by high demand for energy-efficient and low-carbon construction materials. The country’s “Energy Efficiency Strategy for Buildings” promotes insulation materials that minimize heat loss, directly benefiting cork. Premium cork flooring and wall panels are gaining popularity in residential buildings for their modern design and eco-credentials. The growing adoption of prefabricated housing, which favors lightweight and thermally efficient materials, is further driving the use of cork. German manufacturers are also experimenting with cork composites and recycled cork blends to enhance performance and cost-effectiveness.

Central & South America Cork Building Materials Market Trends

The cork building materials market in Central & South America is expanding due to the region’s rising focus on sustainable housing and tourism infrastructure. Brazil, Chile, and Argentina are key growth markets, driven by increasing awareness of renewable materials and the availability of imported cork. The demand for cork flooring in premium residential projects and hospitality applications is growing steadily. Governments are introducing sustainability-focused construction policies that promote the use of natural materials to mitigate carbon emissions. Local distributors are forming partnerships with European suppliers to establish a stable supply chain and introduce advanced cork composite products.

Middle East & Africa Cork Building Materials Market Trends

The cork building materials market in the Middle East & Africa region is experiencing growing adoption of cork materials in luxury and sustainable construction projects, particularly within the UAE, Saudi Arabia, and South Africa. The push toward energy-efficient buildings to combat high regional temperatures has increased the use of cork insulation for thermal regulation. The hospitality and tourism sectors, driven by eco-tourism initiatives, are increasingly favoring natural materials like cork for resort and hotel interiors. Africa’s emerging economies are also integrating sustainable materials into low-cost housing schemes, presenting future opportunities for the adoption of cork. Moreover, government-led sustainability frameworks such as Saudi Vision 2030 are expected to strengthen the region’s cork demand outlook.

Key Cork Building Materials Company Insights

Some of the key players operating in the market include Amorim Cork Solutions S.A. and Green Building Supply.

-

Amorim Cork Solutions S.A. is a global leader in cork-based building materials, offering sustainable insulation, flooring, and acoustic solutions. With strong R&D and integrated production in Portugal, the company drives innovation in eco-friendly construction across global markets.

-

Green Building Supply is a U.S.-based distributor specializing in non-toxic, sustainable building materials. It plays a key market role by promoting cork flooring and insulation products for LEED-certified and wellness-focused construction projects.

-

iCork Floor and Capri Collections are some of the emerging market participants.

-

iCork Floor offers durable, eco-friendly cork flooring solutions designed for residential and light commercial spaces. Its products cater to consumers seeking renewable, low-maintenance, and comfortable flooring alternatives to vinyl and laminate.

-

Capri Collections provides design-oriented cork and rubber flooring solutions that blend sustainability with modern aesthetics. The brand targets premium interiors and hospitality projects, emphasizing natural materials and acoustic comfort.

Key Cork Building Materials Companies:

The following are the leading companies in the cork building materials market. These companies collectively hold the largest market share and dictate industry trends.

- Manton Cork

- Sustainable Materials

- iCork Floor

- Green Building Supply

- Wicanders

- Jelinek Cork Group

- Capri Collections

- Beach Bros Ltd

- Amorim Cork Solutions S.A.

- ThermalCork Solutions

Recent Developments

-

In December 2024, Corticeira Amorim announced the formation of the new business unit “Amorim Cork Solutions”, merging Amorim Cork Flooring, Amorim Cork Composites, and Amorim Cork Insulation.

Cork Building Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.56 billion

Revenue forecast in 2033

USD 16.92 billion

Growth rate

CAGR of 8.9% from 2025 to 2033

Actual estimates

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; CSA; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; China; Japan; India; South Korea; Saudi Arabia; UAE; Egypt; Kuwait; Qatar

Key companies profiled

Manton Cork; Sustainable Materials; iCork Floor; Green Building Supply; Wicanders; Jelinek Cork Group; Capri Collections; Beach Bros Ltd.; Amorim Cork Solutions S.A.; ThermalCork Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cork Building Materials Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cork building materials market based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cork Flooring

-

Cork Wall Panels & Tiles

-

Cork Insulation Materials

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Non-residential

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cork building materials market size was estimated at USD 7.86 billion in 2024 and is expected to reach USD 8.56 billion in 2025.

b. The global cork building materials market is expected to grow at a compound annual growth rate of 8.9% from 2025 to 2033 to reach USD 16.92 billion by 2033.

b. The cork flooring segment held the highest revenue market share of 42.6% in 2024, driven by its superior comfort, durability, and aesthetic versatility.

b. Some of the key players operating in the cork building materials market include Manton Cork, Sustainable Materials, iCork Floor, Green Building Supply, Wicanders, Jelinek Cork Group, Capri Collections, Beach Bros Ltd, ThermalCork Solutions, and Amorim Cork Solutions S.A.

b. Rising demand for sustainable, energy-efficient, and natural construction materials is driving the growth of the cork building materials market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.