- Home

- »

- Medical Devices

- »

-

Corneal Implants Market Size, Share & Growth Report, 2030GVR Report cover

![Corneal Implants Market Size, Share & Trends Report]()

Corneal Implants Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Corneal Ulcers, Fuchs Dystrophy), By Type (Human Cornea, Synthetic), By End-use (Hospitals, ASCs), By Surgery Method, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-655-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global corneal implants market size was estimated at USD 418.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030, Owing to the increased prevalence of ophthalmic diseases, such as keratoconus, Fuchs dystrophy, and infectious keratitis. According to a report published by the National Institutes of Health (NIH), approximately 10-15% of patients diagnosed with keratoconus require to undergo a corneal implant procedure at some point. Corneal blindness is the third-leading cause of blindness after glaucoma and cataract affecting 10 million people globally. According to an article published by the World Health Organization (WHO) in 2021, over 2.2 billion individuals worldwide had near or distant vision impairment in 2020, and 4.2 million people had corneal opacities.

In addition, it is estimated that around 200,000 corneal implant procedures are performed annually. Moreover, 12.7 million patients are waiting for corneal implants, which means only 1 in 70 of the total demand is satisfied. Therefore, a large gap between the demand and supply is expected to drive the industry growth over the forecast period. Corneal disease is the fifth leading cause of blindness worldwide. Rising healthcare expenditure with the development of new and innovative products in the pharmaceutical industry, government initiatives, and higher disposable income of the population are some of the factors fueling the market growth. Moreover, increasing awareness about the importance of eye donation is expected to boost industry growth.

In addition, improving eye care facilities, eye banking framework, and cornea trade protocols in developing countries are expected to contribute to the rising demand, thereby supporting market growth. The industry experienced a significant decline in sales during the COVID-19 pandemic. Factors, such as worldwide lockdowns and implementation of restrictions on the unnecessary movement of people, to curb the spread of this virus by the governments and shutting down of economic activities resulted in a temporary lag in product sales. There was a significant drop in the donation of the human cornea due to the pandemic.

For instance, according to a research article published in the British Journal of Ophthalmology, in 2022, procurements of human cornea tissue decreased in March, April, and May 2020 by 38%, 68%, and 41% respectively. However, the industry is recovering and is expected to flourish over the forecast period. The pandemic created a huge backlog in the corneal transplant procedures that were carried out in the last 2 years. This has created a huge gap between the number of donors and the number of patients that require a corneal transplant. Therefore, manufacturers are focusing on developing artificial corneas to fill up the demand and supply gap. This is expected to help the industry grow significantly over the forecast period.

Collagen-based bio-engineered artificial corneas have high demand in the market owing to their advantages, such as low cost, biocompatibility, and enhanced safety and effectiveness. There has been an increased focus of manufacturers to develop and launch new products. Currently, two products are in clinical trials and are expected to help the artificial cornea segment and overall industry growth. For instance, in 2022, Corneat Vision announced that its CorNeat KPro (artificial cornea) is undergoing clinical trials. This product is expected to receive marketing approval in 2024. As per the reports by the National Institutes of Health (NIH), approximately 4.9 million suffer from bilateral blindness, contributing to 12% of global blindness.

Common causes include anterior corneal pathologies, such as trachoma, infectious keratitis, and chemical injuries. In non-complex eyes, primary corneal transplantation has a high graft survival rate of 87% to 93% at one year and 72% to 73% at five years. Graft survival diminishes with recurrent transplantation, despite breakthroughs in keratoplasty procedures and more selective tissue transplantation. The technological advancements are owing to the upgradation of the procedure. Minimally invasive (MI) corneal transplantation techniques are being used to eliminate scarring, hasten healing, and lower the costs & length of hospital stays.

Type Insights

The human tissue segment dominated the market with the largest revenue share of 91.8% in 2022. Enhanced Visual Acuity (VA) outcomes and a high success rate of the human cornea, which is reported to be as high as 95% with minimal requirements of repeated follow-ups, are some of the factors contributing to the largest revenue share of this segment. The synthetic type segment is estimated to grow at the fastest CAGR of 7.3% during the forecast period. These implants are called artificial corneas and can be further classified as semi-synthetic (collagen-based) and purely synthetic (polymethyl methacrylate).

Moreover, the lack of human corneas coupled with an increasing prevalence of visual impairment due to corneal opacification is expected to drive segment growth during the forecast period. For instance, in December 2021, the Minister for Health and Medical Research Brad Hazzard announced the launch of BIENCO, a project that has secured grant funding from the Australian Government through the Medical Research Future Fund 2021 Frontier Health and Medical Research Initiative. This initiative aims to address the global issue of corneal blindness, which ranks as the third most prevalent cause of blindness worldwide. BIENCO is expected to undertake groundbreaking R&D efforts to combat this significant health challenge.

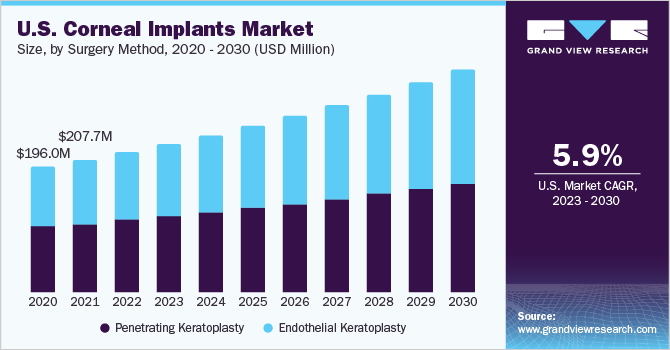

Surgery Method Insights

The penetrating keratoplasty segment dominated the market with the largest revenue share of 53.3% in 2022. Penetrating keratoplasty is the common procedure for corneal transplant owing to its known safety and efficacy. According to the Eye Bank Association of America, 46% of the cornea produced by the eye bank was used for penetrating keratoplasty. In recent times, its adoption rate has slowly failed due to the availability of alternative methods showing promising results. However, its relative advantages over newer approaches, such as avoiding stromal interface and efficiency in treating large central perforations, are expected to uphold its market share. The endothelial keratoplasty segment is expected to grow at the fastest CAGR of 7.1% over the forecast period.

Endothelial keratoplasty is the newest approach in corneal transplant where only the affected tissue is replaced, rather than the full thickness of the cornea. This helps in faster and better visual restoration with decreased risk of infection and accidents to the eye surface. Moreover, with the growing prevalence of Fuchs Dystrophy, the segment is expected to grow at a significant rate during the forecast period. For instance, the statistical report from the Eye Bank Association of America states that since the inception of endothelial keratoplasty in 2005, the number of surgeries has escalated to more than 30,000 in the U.S. in 2022. The patient’s post-operative outcomes have improved leading to fewer complications. The patients have experienced quicker recovery and better vision outcomes.

Application Insights

The Fuchs dystrophy segment dominated the market with the largest revenue share of 52.8% in 2022 and is expected to grow at the fastest CAGR of 6.7% over the forecast period from 2023 to 2030. The rising geriatric population, which is at a higher risk of developing Fuchs dystrophy, is expected to drive the growth of this segment. The incidence of Fuchs dystrophy, a condition affecting the cornea, is anticipated to escalate as the global population ages. This increasing prevalence underscores the growing necessity for treatment modalities like corneal implants. Moreover, the current reliance on donor corneas for conventional corneal transplantation poses challenges due to limited availability.

Corneal implants serve as a viable alternative, circumventing the reliance on donor supply and alleviating the shortage of corneas for Fuchs dystrophy treatment. Consequently, the demand for corneal implants is expected to rise in response to the evolving demographics and the need to address the scarcity of donor corneas. The keratoconus segment is expected to grow at a lucrative CAGR of 6.2% over the forecast period. According to the Cancer Research Foundation of America, 1 in 5 keratoconus patients’ progresses to a stage where a corneal implant is needed to restore normal vision.

In addition, the advent of advanced corneal implant procedures, such as Deep Anterior Lamellar Keratoplasty (DALK), and the availability of FDA-approved corneal implants are expected to boost the growth of this segment during the forecast period. The application of corneal implants in post-surgical cataract edema, congenital corneal opacity, and mechanical or chemical damage to the cornea is included in the other segment. The corneal ulcers segment is also expected to grow at a significant CAGR over the forecast period leading to rapid market growth for corneal implants worldwide.

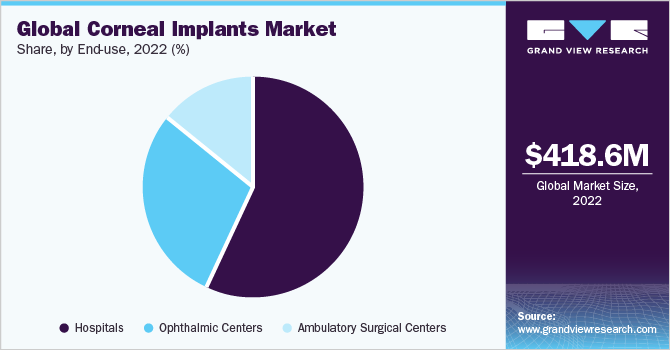

End-use Insights

The hospital's end-use segment dominated the market with the largest revenue share of 57.4% in 2022. The presence of highly skilled surgeons, the rising number of patients, and access to transnational eye banks are the factors expected to drive the segment growth. Rapid technological advancements are attributed to the developed infrastructure leading to the hospital segment growth. The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR of 7.1% over the forecast period. The growing popularity of ASCs is expected to help boost the growth of this segment over the forecast period. Corneal implant procedures are performed on an outpatient basis in most care settings.

Since it’s a single-day procedure, its adoption is anticipated to increase in ASCs. These centers are supported by several public and private funding projects. Over the last decade, ASCs have become a safe and effective alternative to surgery owing to less waiting time, reduced costs, lower risk of infection, and higher nurse-to-patient ratio. According to a report published by the Ambulatory Surgical Centers Association, more than 5,800 ASCs performed an estimated 30 million procedures in 2020. Ophthalmic centers accounted for the second-largest market share in 2022 and are expected to register a healthy CAGR over the forecast period. An increasing number of ophthalmologists entering practice, growing acceptance of keratoprosthesis, and shorter wait times are the factors expected to fuel the segment growth.

Regional Insights

North America dominated the market and accounted for the largest share of 58.4% in 2022. The presence of major market players, efficient reimbursement policies, and increasing R&D activities related to corneal implants are the factors expected to drive market growth in the region. For instance, CorneaGen announced a partnership with the Institute of Regenerative Medicine to develop corneas from the replication of stem cells. Asia Pacific is expected to grow at the fastest CAGR of 7.7% over the forecast period. The presence of several emerging markets and highly unmet clinical needs in countries, such as China, Indonesia, and the Philippines, are expected to drive the region’s growth.

For instance, in January 2023, a union hospital in China affiliated with the Tongji Medical College at Huazhong University of Science and Technology in Wuhan completed its first artificial cornea transplant surgery successfully in a 25-year-old female. These factors are expected to drive the region’s growth. Europe is expected to grow at a lucrative CAGR of 7.2% over the forecast period. Corneal implant procedures have improved over the years in European countries, especially in the UK, Germany, Italy, and Spain. The region has faced a shortage of corneal tissue due to a decreased number of corneal donations. Moreover, the procurement of cornea from other countries is expensive and should also match the home resources. Considering this situation, the Opt-out system of organ donation has been adopted across countries in the region to promote corneal donation, thereby driving market growth.

Key Companies & Market Share Insights

Major companies are implementing various business strategies, such as mergers & acquisitions and product launches, to strengthen their industry presence. As per the article published in August 2022, Indian researchers from LIV Prasad Eye Institute (LVPEI), IIT Hyderabad, and the Center for Cellular and Molecular Biology, collaborated to develop a 3D-printed cornea from the human corneal tissue. The product, which is free from synthetic ingredients & entirely natural was developed with the support of philanthropic organizations and the government. Some of the prominent key industry players operating in the global corneal implants market include:

-

Florida Lions Eye Bank

-

Alcon Inc.

-

Aurolab

-

CorneaGen

-

AJL Ophthalmic S.A.

-

DIOPTEX

-

Massachusetts Eye and Ear

-

San Diego Eye Bank

-

KeraMed, Inc.

-

Presbia PLC

Corneal Implants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 446.0 million

Revenue forecast 2030

USD 695.0 million

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, surgery, application, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, UAE, Kuwait

Key companies profiled

Florida Lions Eye Bank; Alcon Inc.; Aurolab; CorneaGen; AJL Ophthalmic S.A.; DIOPTEX; Massachusetts Eye and Ear; San Diego Eye Bank; KeraMed, Inc.; Presbia PLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corneal Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global corneal implants market report on the basis of type, surgery method, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Cornea

-

Synthetic

-

-

Surgery Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Penetrating Keratoplasty

-

Endothelial Keratoplasty

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Keratoconus

-

Fuchs Dystrophy

-

Infectious Keratitis

-

Corneal Ulcers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ophthalmic Centers

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global corneal implants market size was estimated at USD 418.68 million in 2022 and is expected to reach USD 446.06 million in 2023.

b. The global corneal implants market is expected to grow at a compound annual growth rate of 6.54% from 2023 to 2030 to reach USD 695.0 million by 2030.

b. North America dominated the global corneal implants market with a share of 58.3% in 2022. This is attributable to the well-established healthcare system and easy availability of products in the country along with the growing prevalence of eye disorders.

b. Some of the key player's global corneal implants market are Florida Lions Eye Bank, Alcon, Inc., Aurolab, CorneaGen, AJL Ophthalmic SA, DIOPTEX, Massachusetts Eye and Ear, San Diego Eye Bank, KeraMed, Inc., Alabama Eye Bank, Inc., Presbia Plc

b. Increasing prevalence of eye disorders, Increasing awareness regarding the importance of eye donation and expected launch of new synthetic corneas is driving the growth of corneal implants market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.