- Home

- »

- Plastics, Polymers & Resins

- »

-

Corrosion Resistant Resin Market Size & Share Report, 2030GVR Report cover

![Corrosion Resistant Resin Market Size, Share & Trends Report]()

Corrosion Resistant Resin Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Epoxy, Polyurethanes), By Application (Coating, Composites), By End Use (Chemical, Marine), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-967-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Corrosion Resistant Resin Market Trends

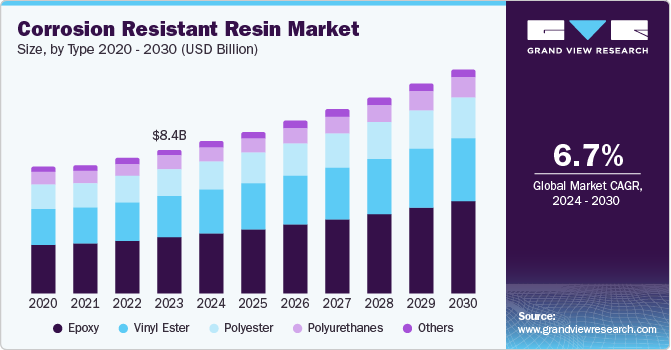

The global corrosion resistant resin market size was valued at USD 8.38 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. It is expected to witness significant growth on account of increasing demand for coatings from various end-use industries majorly oil & gas, chemical processing, marines, and others. The developing interest for corrosion resistant resins in the composites application is one of the major factors boosting the consumption of corrosion-resistant resin. Also, conventionally used metals, for example, carbon steel and aluminium are increasingly being replaced by composites owing to factors such as cost viability and low maintenance. As corrosion leads to significant revenue losses in the chemical industry, corrosion-resistant resin materials are expected to witness growing demand in the industry. Coatings are expected to be the largest application over the forecast period due to the anti-corrosive properties offered by the product, which not only provide protection but also extended life to metal parts that are exposed to harsh conditions.

The emergence of sectors such as oil & gas, chemicals, automotive, transportation, and others is fueling the market demand. The severe operating conditions in these sectors require corrosion-resistant materials such as pipelines, equipment, and storage tanks. Robust materials require exposure to corrosive substances, highlighting the importance of corrosion-resistant resins. The rising demand for preventing corrosion in vehicles is driving the corrosion-resistant resins in the automotive sector.

Corrosion-resistant resins are crucial elements in composite materials, providing lighter options than conventional metals. Composites are frequently chosen over metals due to their lower cost, leading to increased use. Furthermore, the continuous research and innovation are resulting in the development of resins that have improved corrosion resistance and additional characteristics. The improved application techniques is leading to enhanced longevity of resin coatings.

Type Insights

The epoxy segment dominated the market and accounted for the largest revenue share of 39.4% in 2023 due to its excellent corrosion resistance property, easy application, and reasonable cost. Epoxy coatings are generally used to counteract erosion in manufacturing equipment, tanks for destructive chemicals, underground storage tanks, industrial scrubbers, effluent management, and pressure transfer pipe.

The vinyl ester segment is expected to grow at a significant CAGR of 6.5% over the forecast years. It offers exceptional durability against various chemicals such as salts, acids, and alkalis. This makes vinyl ester suitable for challenging conditions in sectors such as chemical processing, marine, oil, & gas, and others. Vinyl ester resins are suitable for a range of uses, including composites, coatings, and adhesives. Its ability to adapt broadens its potential in the market.

Application Insights

The coating segment dominated the market and accounted for the largest revenue share in 2023. Coatings offer a cost-effective method for protecting underlying surfaces from corrosive conditions.Coating corroded components is generally a more cost-efficient option compared to replacing them. The increasing focus on unique aesthetics is driving the demand for coatings in the market. Oil and gas pipeline coatings offer various advantages such as abrasion resistance, corrosion protection, temperature resistance, and high levels of hardness.

The composites segment is expected to grow at the fastest CAGR over the forecast years. Composites provide considerable weight reduction as compare to metals, resulting in improved fuel efficiency and lowered overall system burden. It offers protection against moisture, chemicals, and corrosive agents. In numerous instances, composites present cost benefits because of decreased material consumption and efficient manufacturing processes.

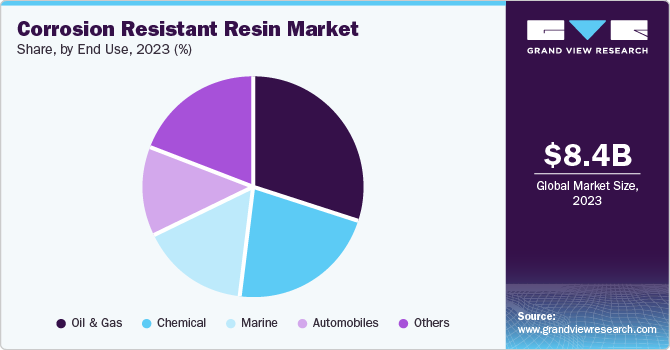

End Use Insights

The oil & gas segment dominated the market and accounted for the largest revenue share in 2023. Oil and gas production involves corrosive chemicals, and salts that speed up the deterioration of metals. Offshore drilling and production require strong protection for equipment due to exposure to corrosive saltwater. The oil and gas segment needs assets to have a long lifespan to optimize the return on investment. Resins that are resistant to corrosion help prolong the life of vital equipment, driving the segment growth.

The chemical segment is expected to grow at a significant CAGR over the forecast years. The demand for corrosion resistant resins in the chemical industry is increasing due to harsh conditions, strict regulations, and the requirement for durable, eco-friendly materials. Chemical plants manage a variety of extremely corrosive substances. The continuous development of new chemical formulations is leading to segment growth.

Regional Insights

The North America corrosion-resistant resin market held a market share of 18.6% in 2023. The growth can be attributed to the growing demand for lightweight and environmentally sustainable composite materials from the automotive industry. Various government regulations, such as CAFE Standards in the U.S. are pressurizing OEMs to incorporate lightweight materials to curb the overall vehicle weight, which in turn is expected to contribute toward the growth of the North America market.

U.S. Corrosion Resistant Resin Market Trends

The corrosion-resistant resin market in the U.S. experienced significant growth in 2023 due to the strict building codes that require the use of materials that resist corrosion. The emergence of oil & gas industry is resulting in higher demand for materials can resist corrosion in pipelines, refineries, and offshore structures.

Asia Pacific U.S. Corrosion Resistant Resin Market Trends

Asia Pacific corrosion-resistant resin market dominated the global market with a market share of 44.2% in 2023. The rapid growth of industrialization and GDP advancement is expected to drive the demand for corrosion-resistant resins in the region. The continuous growth in the construction industry in countries such as China and India are also attributed to the market growth.

The corrosion-resistant resin market in China is expected to grow significantly in the coming years due to the presence of established industries. The increasing composites and infrastructure sector in the country is driving the demand for a protective coating that prevents corrosion by creating a barrier on steel reinforcements.

Europe Corrosion Resistant Resin Market Trends

The Europe corrosion-resistant resin market is expected to grow at a CAGR of 5.2% over the forecast period. The region has an extensive system of old infrastructure, such as bridges, pipelines, and buildings that can easily corrode, this leads to an increase in demand for corrosion-resistant resins.

The corrosion-resistant resin market in the UK is expected to grow significantly in the coming years. The UK is one of the key players in the offshore wind energy industry. Resins that resist corrosion are necessary to build and upkeep wind turbines that endure tough conditions in marine surroundings. Thereby, increasing the demand for corrosion-resistant resin market.

Key Corrosion Resistant Resin Company Insights

Some of the key participants in the global corrosion-resistant resin market are Ashland, Huntsman International LLC., Hexion Inc., Reichhold LLC, and others. The manufacturers of corrosion-resistant resin are working to maintain their supply and production capabilities to meet the increasing demand by partnering with suppliers worldwide.

- Ashland offers specialty chemicals, technologies, and knowledge to assist customers in developing innovative products for the present and environmentally friendly solutions for the future.

Key Corrosion-Resistant Resin Companies:

The following are the leading companies in the corrosion-resistant resin market. These companies collectively hold the largest market share and dictate industry trends.

- Ashland

- Huntsman International LLC.

- Hexion Inc.

- Reichhold LLC

- Scott Bader Company Ltd.

- AOC

- Olin Corporation

- Sino Polymer Co., Ltd.

- SWANCOR

- Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt. Ltd

- TotalEnergies

- Allnex GMBH

- BASF SE

Corrosion-Resistant Resin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.90 billion

Revenue forecast in 2030

USD 13.10 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, South Korea, Vietnam, Indonesia, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Ashland; Huntsman International LLC.; Hexion Inc.;; Reichhold LLC; Scott Bader Company Ltd.; AOC ; Olin Corporation; Sino Polymer Co., Ltd.; SWANCOR ; Grasim Industries Limited (India) and Aditya Birla Chemicals (Thailand) Pvt. Ltd; TotalEnergies ; Allnex GMBH;BASF SE

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corrosion-Resistant Resin Market Report Segmentation

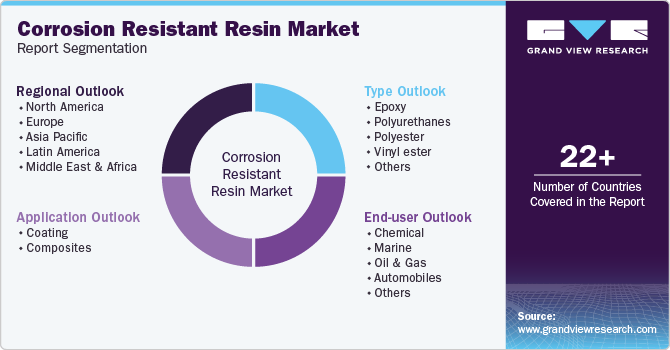

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global corrosion-resistant resin market report based on type, end use, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurethanes

-

Polyester

-

Vinyl ester

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coating

-

Composites

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Marine

-

Oil & Gas

-

Automobiles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.