- Home

- »

- Advanced Interior Materials

- »

-

Corundum Market Size And Share, Industry Report, 2030GVR Report cover

![Corundum Market Size, Share & Trends Report]()

Corundum Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Jewelry, Abrasive, Refractory), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-915-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Corundum Market Size & Trends

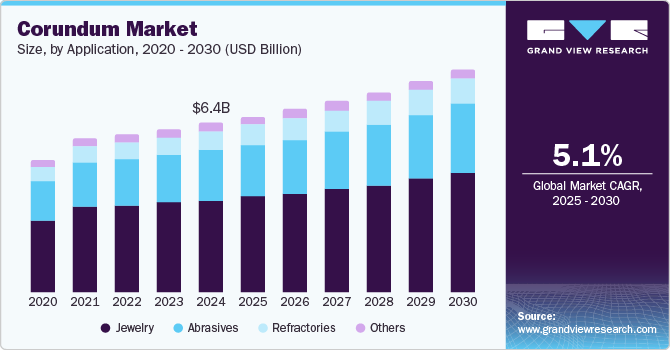

The global corundum market size was valued at USD 6.37 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2030. This growth can be attributed to the increasing demand for synthetic corundum in abrasive applications, as its exceptional hardness makes it ideal for grinding and polishing materials. In addition, the rising interest in artificial corundum within the jewelry sector, fueled by consumer preferences for gemstones such as sapphires and rubies, contributes to market expansion. Furthermore, advancements in technology and the growing applications of corundum in electronics and refractory materials enhance its market potential across various industries.

Corundum is a naturally occurring mineral known for its exceptional hardness and is widely used in various applications, including gemstones and industrial abrasives. The global corundum market is significantly influenced by its extensive use in jewelry, where it serves as a primary material for precious stones such as rubies and sapphires. This growing demand for vibrant gemstones drives market expansion, particularly in the luxury sector.

In addition, beyond the jewelry sector, corundum is utilized in numerous industrial applications, contributing to its market growth. Non-gemstone forms of corundum, such as black emery and brown corundum, are recognized for their hardness and are employed as abrasives in grinding, sandblasting, and cutting processes. White corundum finds its use in polishing applications where high-speed performance is required without excessive heat generation. While the jewelry market remains a primary driver, the industrial demand for corundum in abrasive applications ensures continued growth and diversification within the global corundum market.

Furthermore, the electronics industry is increasingly adopting corundum due to its scratch-resistant properties. It is used in applications such as protective windows for electronic devices and substrates for circuit boards. The expanding use of corundum in electronics reflects its versatility and durability, further bolstering market growth.

Application Insights

The jewelry application segment dominated the market and accounted for the largest revenue share of 53.7% in 2024. This growth can be attributed to the increasing popularity of gemstones such as rubies and sapphires. Corundum's exceptional hardness and vibrant colors make it a preferred choice for high-end jewelry, appealing to consumers seeking luxury and uniqueness. In addition, the rise of disposable income in emerging markets has further fueled demand for exquisite gemstone jewelry. Furthermore, the allure of rare varieties enhances market opportunities, allowing jewelers to cater to diverse consumer preferences and capitalize on trends in luxury goods.

The abrasives segment is expected to grow at a CAGR of 5.4% over the forecast period, owing to its superior hardness, making it an ideal material for various industrial uses. Corundum is widely utilized in grinding, polishing, and sandblasting applications due to its effectiveness in smoothing surfaces and enhancing finish quality. In addition, the growth of manufacturing and construction sectors globally contributes to the increasing need for high-performance abrasives. Furthermore, advancements in technology that improve corundum processing and production efficiency are expected to drive its adoption across diverse industries, solidifying its position in the abrasives market.

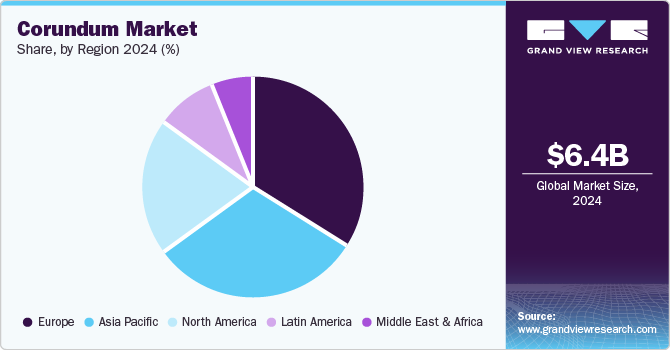

Regional Insights

Europe corundum market dominated the global market and accounted for the largest revenue share of 33.6% in 2024, driven by the increasing industrial demand for abrasives and refractory materials. The region's robust manufacturing sector, particularly in automotive and construction, drives the need for high-performance abrasives. In addition, the rising popularity of synthetic corundum in jewelry applications contributes to market expansion. Furthermore, European countries are also focusing on sustainability and innovation, leading to advancements in corundum processing technologies.

Germany Corundum Market Trends

The corundum market in Germany led the European market and accounted for the largest revenue share in 2024, primarily driven by its strong automotive and engineering sectors. The demand for high-quality abrasives in manufacturing processes, such as grinding and polishing, propels the use of corundum. Furthermore, Germany's emphasis on technological advancements and precision engineering enhances the need for durable materials such as corundum in various applications. Moreover, the country's commitment to sustainability also encourages the development of eco-friendly products, further supporting market growth within the region.

Middle East & Africa Corundum Market Trends

The Middle East and Africa corundum market is expected to grow at a CAGR of 5.9% over the forecast period, owing to increasing investments in infrastructure and construction projects. In addition, the region's growing industrial base drives demand for abrasives used in various applications, including manufacturing and mining. Furthermore, rising consumer interest in luxury goods, particularly gemstones such as sapphires and rubies, boosts the jewelry segment of the corundum market. Moreover, as economic development continues across multiple countries, the demand for high-quality corundum products is expected to rise significantly.

North America Corundum Market Trends

The corundum market in North America is expected to witness substantial growth, primarily due to strong demand from the jewelry sector and industrial applications. The region leads this trend, focusing on high-quality gemstones and abrasives used in manufacturing processes. In addition, the recovery of industries post-pandemic has revitalized demand for corundum products, particularly in electronics and construction. Furthermore, advancements in processing techniques are enhancing product quality and availability, further driving market expansion across North America.

The U.S. corundum market dominated the North American market and accounted for the largest revenue share in 2024, driven by robust demand from both the jewelry and industrial sectors. The country's strong consumer base for luxury goods drives interest in gemstones such as rubies and sapphires, while industrial applications require high-performance abrasives. In addition, the ongoing recovery from economic disruptions has led to increased investments in manufacturing and construction, further boosting demand for corundum products. Moreover, as technological advancements improve processing methods, the U.S. market is expected to grow steadily.

Asia Pacific Corundum Market Trends

The corundum market in the Asia Pacific is expected to grow significantly over the forecast period, primarily driven by rapid industrialization and urbanization. Countries such as China and India are witnessing increased demand for abrasives used in manufacturing processes across various sectors. Furthermore, the growing popularity of synthetic gemstones fuels interest in corundum within the jewelry market. As consumer preferences evolve towards unique and sustainable products, manufacturers are adapting their offerings to meet these demands, positioning Asia Pacific as a dominant force in the global corundum market.

Key Corundum Company Insights

Key players in the global corundum industry include RusAL, Greenland Ruby, Henan Sicheng Co., and others. These companies are implementing various strategies to enhance their market presence and competitiveness. These include diversifying product portfolios to cater to different applications, investing in research and development to innovate and improve processing techniques, and forming strategic partnerships to expand their reach. Furthermore, companies are focusing on technological advancements to increase production efficiency and reduce costs.

-

Greenland Ruby extracts and processes high-quality rubies and pink sapphires from its Aappaluttoq mine in southwest Greenland. The company focuses on providing a consistent supply of colored gemstones to the jewelry market, emphasizing transparency and ethical sourcing. Operating within the gemstone segment, the company utilizes advanced processing techniques to enhance the clarity and quality of its corundum products.

-

Henan Sicheng Co. produces and supplies various corundum-based products, including abrasives and refractory materials. The company operates within the industrial segment, offering synthetic corundum for grinding, polishing, and manufacturing applications. The company focuses on delivering high-quality materials that meet the needs of diverse industries. It leverages advanced production technologies to ensure efficiency and consistency in its product offerings.

Key Corundum Companies:

The following are the leading companies in the corundum market. These companies collectively hold the largest market share and dictate industry trends.

- Alteo

- MOTIM Electrocorundum Ltd.

- RusAL

- Greenland Ruby

- Henan Sicheng Co.

- Ltd, K. A Refractories Co., Ltd.

- Rubicon Technology

- Xingyang Jinbo Abrasive Co., Ltd.

- RSA LE RUBIS SA

- Zhengzhou Haixu Abrasives Co., Ltd.

Corundum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.61 billion

Revenue forecast in 2030

USD 8.47 billion

Growth rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, Germany, France, UK, and Brazil

Key companies profiled

Alteo; MOTIM Electrocorundum Ltd.; RusAL; Greenland Ruby; Henan Sicheng Co.; Ltd, K. A Refractories Co., Ltd.; Rubicon Technology; Xingyang Jinbo Abrasive Co., Ltd.; RSA LE RUBIS SA; Zhengzhou Haixu Abrasives Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corundum Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the corundum market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Jewelry

-

Abrasives

-

Refractories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.