- Home

- »

- Food Additives & Nutricosmetics

- »

-

Cosmetic Antioxidants Market Size & Share Report, 2030GVR Report cover

![Cosmetic Antioxidants Market Size, Share & Trends Report]()

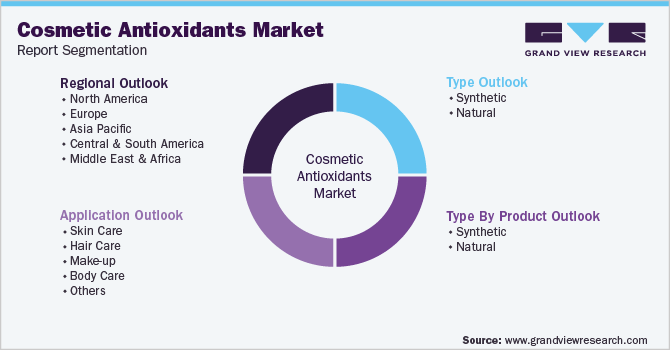

Cosmetic Antioxidants Market Size, Share & Trends Analysis Report By Type (Synthetic, Natural), Type By Product (Vitamins, BHA), By Application (Skin Care), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-010-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

Report Overview

The global cosmetic antioxidants market size was valued at USD 134.30 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. This is attributable to the growing utilization of antioxidants in cosmetic & personal care products such as skin care, hair care, fragrance, body care, and others. Increasing consumption of cosmetic products across all parts of the globe is the driving force behind the growth. The demand for cosmetic antioxidants is anticipated to escalate even further in future on the account of increasing awareness of the importance of personal care products among the global population. Antioxidants are treated as essential ingredients for the formulation of cosmetic products. Antioxidants help prevent skin damage caused by pollution, free radicals, and other environmental effects. It also protects the skin surface against oxidative damage which can harm the skin and cause many other problems such as infection, dryness, itching, and more. A reasonable amount of antioxidants in cosmetic products can reduce the risk of any such skin problem, thus, it is now widely utilized by cosmetic product manufacturers, globally.

The growing global population has been the key factor behind the increasing demand for cosmetic products. Cosmetic products are widely accepted as essential items and have an integral role in people’s daily life. People from all age groups tend to use at least one cosmetic product to protect their body, hair, skin, and others. Increasing environmental pollution due to urbanization, industrialization, population growth, mining, and exploration has made people aware of the benefits of using cosmetic products that have essential nutrients such as antioxidants. This factor is likely to propel the demand for cosmetic antioxidants in the forthcoming years globally.

In addition, the rise in brand recognition and increasing influence of cosmetic products through social media platforms is further anticipated to propel the market growth during the forecast period. Growing awareness regarding nutritional ingredients-based cosmetic products and their benefits on the human body further propels the inclination of consumers’ toward antioxidant-based cosmetic products. The aging population also contributes to the growth of the market as the aged people widely use a variety of hair color products and various anti-aging creams.

The outbreak of COVID-19 had a negative impact on the cosmetic antioxidants market due to the temporary shutdown of cosmetic products manufacturing plants as well as retail cosmetic stores resulted by the imposed lockdown in the wake of the pandemic, globally. Around 30.0% of the cosmetic industry was completely shut for near about six months. This had an adverse effect on the market. However, increasing health risk and growing awareness amid COVID-19 regarding the advantages of nutritional ingredients in cosmetic products is likely to contribute to market growth in the future.

Type Insights

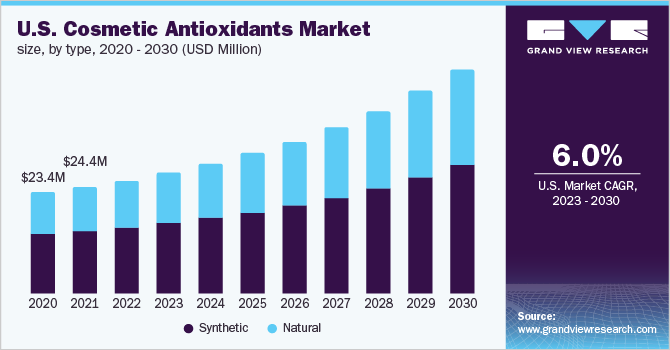

Synthetic type dominated the market with a revenue share of 60.0% in 2022. The growth is triggered by the increasing consumption of butylated hydroxytoluene (BHT), butylated hydroxyanisole (BHA), Propyl Gallate (PG), and Tert-butylhydroquinone (TBHQ) in the production of a wide variety of cosmetic products. Synthetic antioxidant is a mixed formulation of chemicals, and is made through a typical industrial operation. Thus, the governments of many countries tend to regulate its use in cosmetic products. Synthetic antioxidants are heavily used as an additive to enhance the shelf life and provide better color, texture, and fragrance to cosmetic products.

Natural antioxidants are extracted from natural sources such as plants, animals, fruits, herbs, spice. Natural antioxidants comprise vitamins carotenoids, polyphenols, and enzymes. The rising inclination towards consuming natural products has bolstered the consumption of natural antioxidants in cosmetic products. Growing awareness of health and the negative effects of chemicals is anticipated to fuel the demand for natural antioxidants during the forecast period.

Type By Product Insights

Tert-butyl hydroquinone (TBHQ) product of synthetic type dominated the market with a revenue share of 52.6% in 2022. The high share is driven by the excessive consumption of TBHQ in the formulation of a wide spectrum of cosmetic and personal care products. TBHQ is a synthetic cosmetic antioxidant, which is produced by the combination of numerous chemicals. Synthetic antioxidants contain all required nutrition and also come cheaper than natural antioxidants, thereby, being used extensively in the production of cosmetic products.

Vitamins product type of natural cosmetic antioxidants dominated the market with a revenue share of 54.2% in 2022. Its rising share is attributed to the consumption of natural antioxidants as an alternative option to chemically derived synthetic antioxidants. Vitamins can be extracted from fruits, vegetables, animals, and more. These antioxidants are natural and do not require additional chemicals for its formulation. Therefore, natural cosmetic antioxidants are anticipated to account a fostering growth during the foreseeable future.

Application Insights

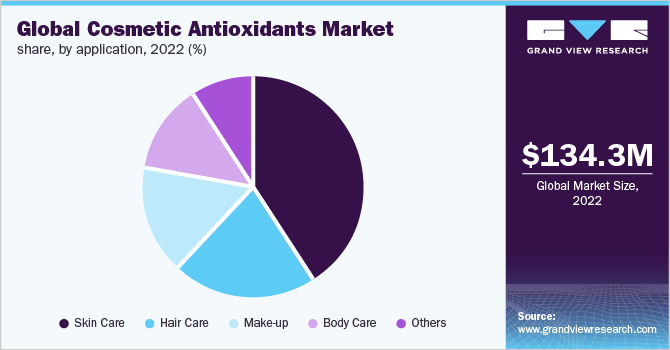

Skin care application dominated the segment with the highest revenue share of 41.1%in 2022. Its rising share is attributable to the growing aging population, easy availability of products, and increasing concerns regarding skin diseases. Population aged more than 30 years especially considers these products in their daily personal care routine. In addition, the easy availability of products at reasonable prices further propels the demand for cosmetic products, globally.

Skin care is an important practice to keep the skin soft and free from any negative environmental effects. Products containing nutritional ingredients such as antioxidants help to prevent free radicals’ generation and help improve skin. This is a triggering factor behind the rising demand of cosmetic antioxidants in skin care products.

Hair care is one of the key applications that are expected to fuel the demand for cosmetic antioxidants, globally. Hair care products are consumed by all age groups of people on regular basis. Rising concerns regarding hair fall is the major driving force behind the growing demand for nutrition-based hair care products. Antioxidant helps to promote healthy hair by providing essential nutrients to hair, which also reduce the chances of hair fall. Wide consumption of hair care products is anticipated to escalate the demand for hair care products during the forecasted years, globally.

Body care products comprise shower gel, soap, moisturisers, and more. These products are extensively used by people on daily basis. The rise in pollution due to industrialization and urbanization has spread the awareness to follow healthy practices for people to keep their bodies healthy and less vulnerable to external effects. Antioxidants are being widely used by body care product manufacturers to enhance the product’s nutritional ability. This is likely to be a contributing factor to the growth of the market in near future.

Regional Insights

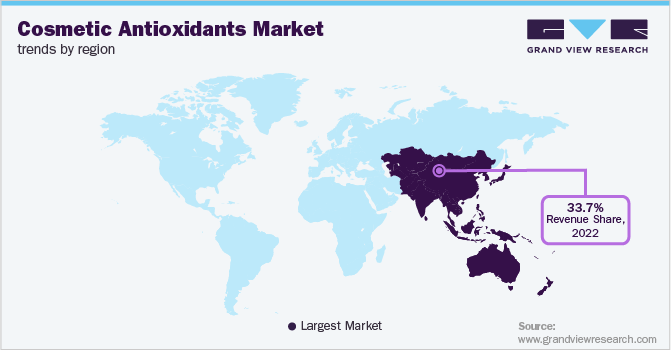

Asia Pacific dominated the cosmetic antioxidants market with the highest revenue share of more than 33.7% in 2022. This is attributed to the rising population in the countries like China, India, and Japan. Asia Pacific is the most populous region, with the highest share of 60% of the total global population, according to United Nations Population Fund (UNFPA). The growing population has bolstered the demand for cosmetic and personal care products across the Asia Pacific region, thereby, is likely to drive growth for the market during the forecast years.

North America holds lucrative opportunities for the growth of the market owing to the presence of multi-million cosmetic manufacturers such as The Estee Lauder Companies Inc., The Procter & Gamble Company, and more. Furthermore, the impact of COVID-19 in the U.S. has compelled people to consume healthy and nutritional-based cosmetic products. The growing retail sector in North America is also one of the drivers for the growth of cosmetic products in the region. This factor is anticipated to propel the demand for cosmetic antioxidants in North America in near future.

Europe is expected to report stable growth. The impact of COVID-19 has propelled the demand for antioxidants and many such nutrients in cosmetic products. The presence of cosmetic giants such as Unilever and L’Oreal S.A. is another reason behind the wide consumption of cosmetic products in Europe. The growing population coupled with rising individual disposable income is likely to trigger demand for cosmetic antioxidants in Europe in near future.

Key Companies & Market Share Insights

The competition among global players in cosmetic antioxidants is likely to grow in future on the account of rapid innovation by new and emerging players in the market. Manufacturers are aiming on improving their product portfolios, by designing and launching new products. This factor is expected to increase the competition among global manufacturers of cosmetic antioxidants. Some of the prominent players in the global cosmetic antioxidants market include:

-

BASF SE

-

Wacker Chemie AG

-

Evonik Industries AG

-

Kemin Industries, Inc.

-

Barentz International BV

-

Eastman Chemical Company

-

Ashland Global Holdings

-

BTSA Biotecnologias Aplicadas S.L.,

-

Koninklijke DSM N.V.

-

SEPPIC

Cosmetic Antioxidants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 141.26 million

Revenue forecast in 2030

USD 209.63 million

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, type by product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Indonesia; Brazil; Colombia; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Wacker Chemie AG; Evonik Industries AG; Kemin Industries, Inc.; Barentz International BV; Eastman Chemical Company; Ashland Global Holdings; BTSA Biotecnologias Aplicadas S.L.; Koninklijke DSM N.V; SEPPIC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cosmetic Antioxidants Market Segmentation

This report forecasts revenue growth at global, regional, and country levels along with provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cosmetic antioxidants market report based on the type, type by product, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Natural

-

-

Type By Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Butylated Hydroxyanisole (BHA)

-

Butylated Hydroxytoluene (BHT)

-

Tert-Butyl Hydroquinone (TBHQ)

-

Propyl Gallate (PG)

-

Others

-

-

Natural

-

Vitamins

-

Carotenoids

-

Polyphenols

-

Enzymes

-

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Hair Care

-

Make-up

-

Body Care

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cosmetic antioxidants market was valued at USD 134.30 million in 2022 and is expected to reach USD 141.26 million by 2022.

b. The global cosmetic antioxidants market is expected to grow at a compound annual growth rate of 5.7%% from 2022 to 2030 to reach USD 209.63 million by 2030.

b. Skin care segment emerged as the largest application segment in 2022 and accounted for a revenue share of around 41.1%.

b. key players operating in the food antioxidant market are BASF SE, Wacker Chemie AG, Evonik Industries AG, Kemin Industries, Inc., Barentz International BV, Eastman Chemical Company, Ashland Global Holdings, BTSA Biotecnologias Aplicadas S.L.,, Koninklijke DSM N.V., SEPPIC

b. Growing consumption of cosmetic products that contains nutritional ingredients is the key driving factor behind the growth of cosmetic antioxidants market. Rapid increase in global population is also a contributing factor for the growth of cosmetic antioxidants products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."