- Home

- »

- Homecare & Decor

- »

-

Countertops Market Size And Share, Industry Report, 2033GVR Report cover

![Countertops Market Size, Share & Trends Report]()

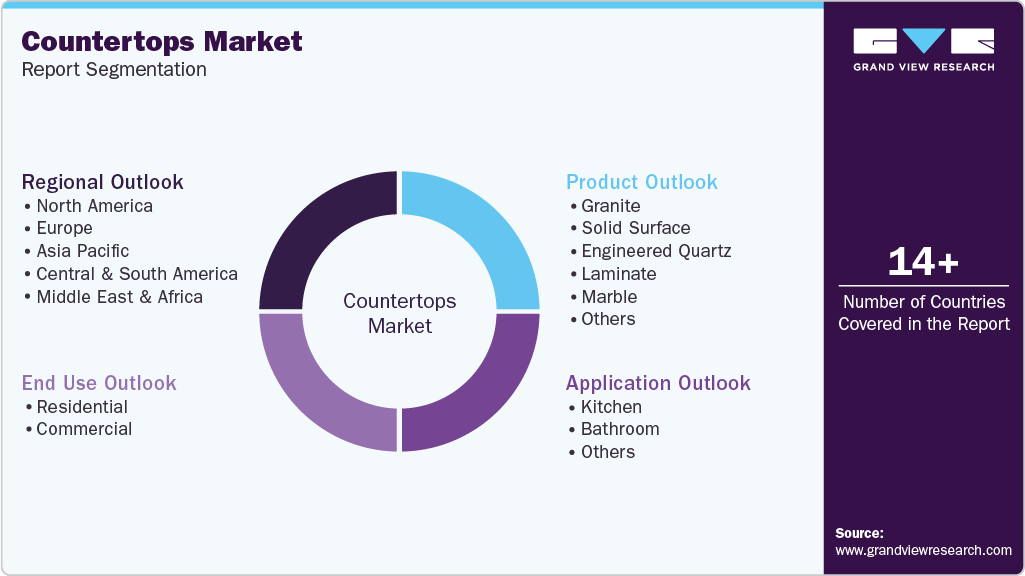

Countertops Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Granite, Solid Surface, Laminate), By End Use (Residential, Commercial), By Application (Kitchen, Bathroom), By Region, And Segments Forecasts

- Report ID: GVR-4-68040-029-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Countertops Market Summary

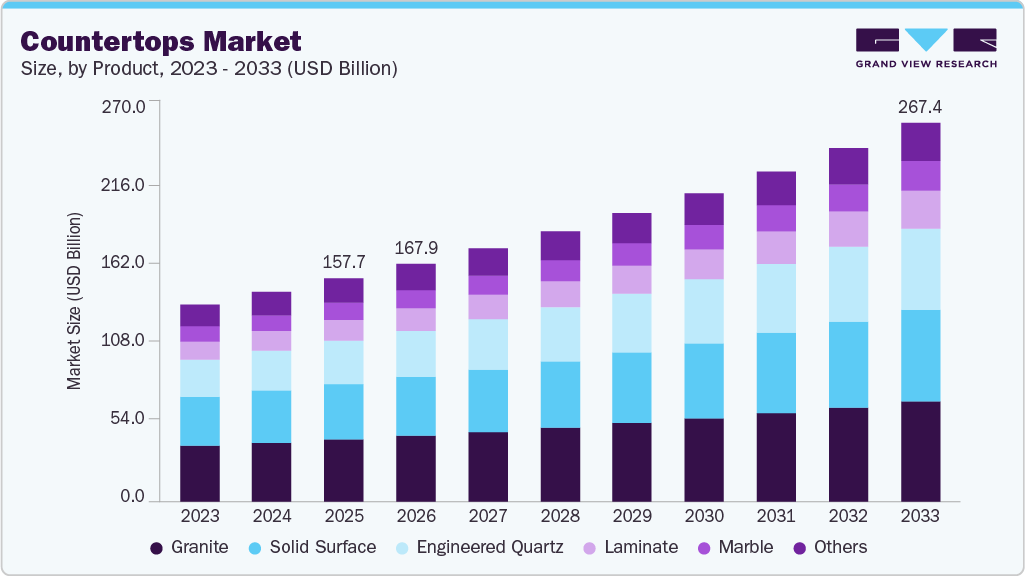

The global countertops market size was estimated at USD 157.74 billion in 2025 and is projected to reach USD 267.38 billion by 2033, growing at a CAGR of 6.8% from 2026 to 2033. The market has evolved in close alignment with long-term trends in urbanization, housing development, commercial construction, and changing interior design preferences.

Key Market Trends & Insights

- By region, Asia Pacific led the market with a share of 37.5% in 2025.

- By product, granite countertops led the market and accounted for a share of 28.0% in 2025.

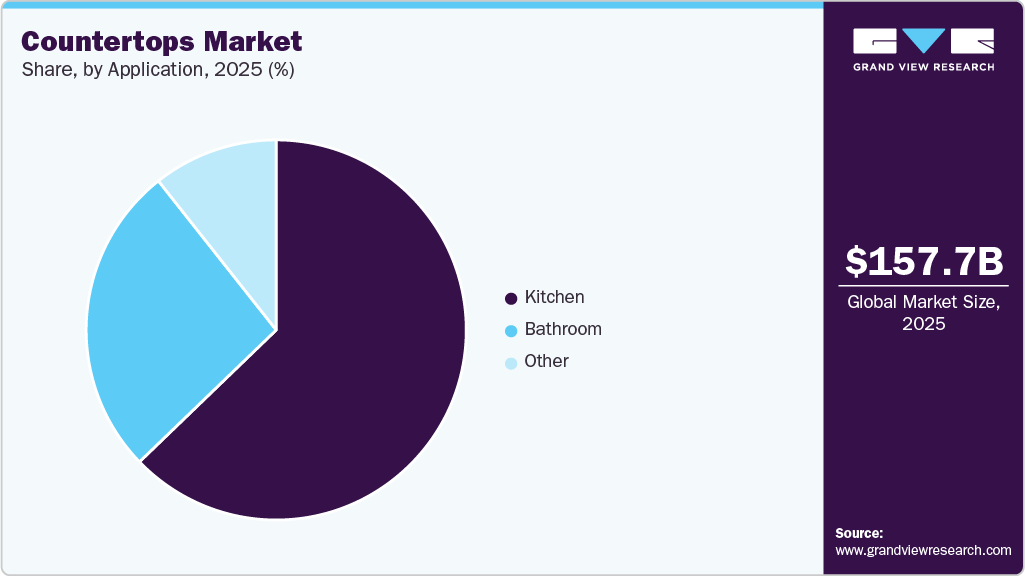

- By application, kitchen led the market and accounted for a share of 62.8% in 2025.

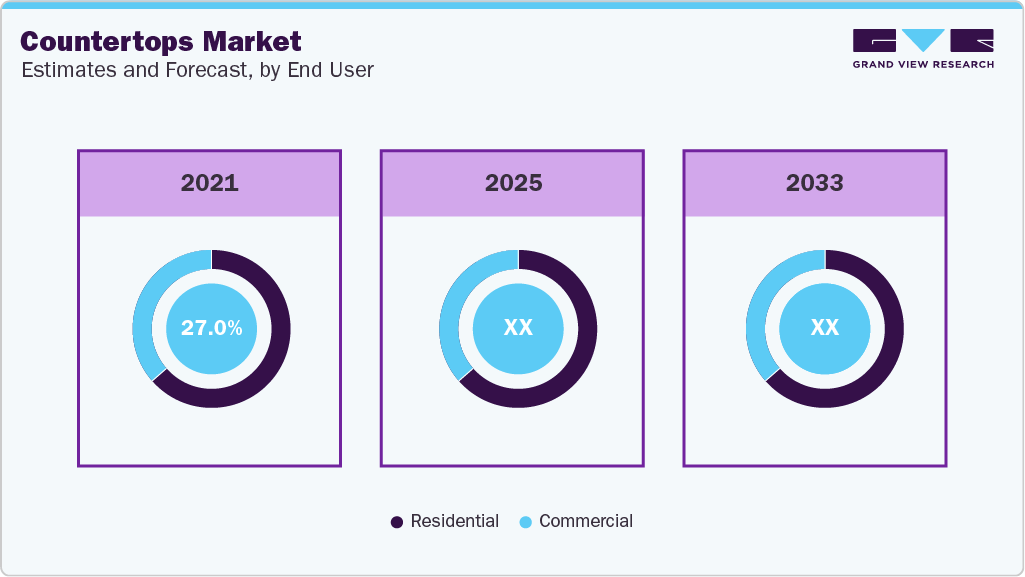

- By end use, residential led the market and accounted for a share of 72.3% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 157.74 Billion

- 2033 Projected Market Size: USD 267.38 Billion

- CAGR (2026-2033): 6.8%

- Asia Pacific: Largest market in 2025

Its lineage can be traced to post-war residential expansion in North America and Europe, where the standardization of kitchens and bathrooms created sustained demand for durable work surfaces. Over time, countertops transitioned from purely functional building components to design-led architectural elements, reflecting broader shifts in consumer lifestyles and real estate values. Growth in the market is fundamentally linked to construction activity and the expansion of the housing stock. According to the United Nations Department of Economic and Social Affairs (UN DESA), the global urban population increased from 55% in 2018 to over 57% in 2023, with urban residents expected to reach 68% by 2050, directly increasing demand for residential units and interior fittings such as countertops.

Renovation and remodeling activity has become an equally important demand pillar. In the U.S., the Joint Center for Housing Studies of Harvard University reported that, on average, homeowner improvement spending registered USD 4,700 in 2023, a 9% increase from the previous market boom in 2007, driven by aging housing stock and value-add renovations, particularly kitchens and bathrooms, where countertops represent a core upgrade category.

The material lineage within the countertops market highlights a gradual shift from traditional stone to engineered and composite surfaces. Natural stone, such as granite and marble, gained prominence due to its durability and availability, particularly following quarry expansions in countries like China, India, Brazil, and Italy. These countries collectively account for the majority of reported global dimension stone output, supported by extensive reserves, mechanized extraction, and export-oriented processing infrastructure. In parallel, international trade data indicate sustained cross-border movement of natural stone, with the European Union alone importing a significant amount of natural stone products annually, underscoring the role of established supply chains in serving construction and interior surface applications.

In parallel, engineered surfaces such as quartz composites and solid surfaces gained traction as manufacturers responded to demand for uniform appearance, lower porosity, and ease of maintenance. The development of solid surface materials in the late 1960s marked a structural shift in the market, enabling seamless installations in healthcare, hospitality, and commercial interiors.

Design and specification trends further reinforce this shift. The Design Survey of Decorative Materials (DSDM 2022) indicates that engineered stone and quartz alternatives are increasingly preferred in kitchens and bathrooms due to lower porosity, stain resistance, and easier maintenance, particularly in high-use households.

From a manufacturing standpoint, scalability has become a decisive advantage. Engineered stone production supports automation, digital printing, and high-yield slab fabrication, reducing waste and enabling faster project execution. Printed and digitally enhanced engineered stones are also allowing manufacturers to replicate natural veining patterns at scale, narrowing the aesthetic gap with quarried stone.

Parameters

Natural Stones (Granite/Marble)

Engineered Stone (Quartz)

Production Model

Design Consistency

Fabrication Lead Time

Material Yield

Suitability for Multi-site Projects

Maintenance Profile

Craft-based, Slab-dependent

High natural variation

longer, project specific

Moderate

Limited

Periodic scaling required

Industrial, Scalable

High repeatability

Shorter, standardized

High

High

low maintenance

Source: Stone World; Natural Stone Institute; Republic Elite DSDM

Sustainability considerations are also influencing material transitions. Engineered surfaces allow optimized raw material utilization and, in some cases, the incorporation of recycled content, aligning with green building objectives.

Product Insights

Granite countertops accounted for the largest market share of 28.0% in 2025. The demand for granite countertops continues to grow since many buyers prefer natural materials that are strong, heat-resistant, and long-lasting. Granite is still viewed as a premium option, especially for kitchen applications, where homeowners believe it enhances both the appearance and the value of their home. The wide range of colors and natural patterns allows customers to choose designs that feel unique, while better cutting and finishing methods have improved quality and reduced installation time.

Engineered quartz countertops are expected to grow at a CAGR of 8.2% from 2026 to 2033. The growth of engineered quartz countertops is driven by their durability, easy maintenance, and wide range of designs. Quartz surfaces are non-porous, resistant to stains, scratches, and heat, and do not require sealing, making them attractive for both homes and commercial spaces. Besides, they are available in many colors and patterns, allowing homeowners and designers to get the look of natural stone with more consistent quality. According to the National Kitchen & Bath Association’s 2026 Kitchen Design Trends report, 78% of industry professionals surveyed believe quartz will be the most popular countertop material.

End Use Insights

Countertops for residential accounted for the largest market revenue share of 72.3% 2025. The residential countertops market is steered by an increase in home renovations and new housing projects. Homeowners are increasingly replacing existing countertops in kitchens and bathrooms with durable, low-maintenance materials. Products such as granite, quartz, marble, and solid surfaces are gaining preference due to their strength, stain resistance, and variety of colors and finishes. This allows alignment with contemporary interior design trends. In addition, consumers seek materials that can withstand daily wear and tear while maintaining their appearance over time. The growing availability of pre-fabricated and customizable options also makes it easier for homeowners to install countertops that fit specific dimensions and design preferences.

Countertops for commercials are expected to grow at a CAGR of 7.5% from 2026 to 2033. The market for commercial countertops is expanding due to several key factors. A large number of offices, restaurants, hotels, and retail spaces are being built. This is creating demand for surfaces that are strong, long-lasting, and can handle heavy use. Urban growth and new infrastructure projects are also increasing the need for countertops that are both functional and visually appealing. Many businesses are also seeking countertops that complement the overall design and style of their space. Additionally, businesses choose commercial countertops mainly for practical benefits. In restaurants and hotels, surfaces must be easy to clean and maintain hygiene standards while withstanding daily wear and tear.

Application Insights

Countertops for the kitchen held the largest revenue share, accounting for a share of 62.8% in 2025. Rising investments in home remodeling, driven by an aging housing stock, hybrid work lifestyles, and increased time spent at home, are prompting homeowners to upgrade durable, high-impact surfaces that enhance both aesthetics and long-term value. Consumers are favoring materials such as quartz, granite, and engineered stone due to their durability, stain resistance, hygiene, and low maintenance requirements. In addition, the influence of design-led trends, including open-plan kitchens, social media inspiration, and real estate value optimization, has positioned kitchen countertops as a priority upgrade that delivers an immediate visual transformation with a relatively high return on investment.

Countertops for bathrooms are expected to register a growth rate of 7.8% over the forecast period. Homeowners are investing in durable and moisture-resistant materials such as quartz, solid surface, and engineered stone, which offer improved hygiene, stain resistance, and low maintenance compared to traditional laminates. The rising trend of bathroom remodeling, driven by aging housing stock, higher home equity, and lifestyle upgrades, has further accelerated demand for premium countertops, particularly in primary bathrooms and powder rooms.

Regional Insights

The countertop industry in North America accounted for a 25.5% share of the global market in 2025. The growth is closely linked to ongoing home renovation activity and steady new housing construction. Homeowners are increasingly updating kitchens and bathrooms with countertops that are durable, easy to maintain, and suitable for everyday use. As open kitchen layouts become increasingly common, countertops have assumed a larger role in overall home design, resulting in higher spending on upgrades and replacements.

U.S. Countertops Market Trends

The countertop industry in the U.S. is expected to grow at a CAGR of 5.7% from 2026 to 2033. Homeowners increasingly view countertops as both a functional surface and a design statement, prioritizing durability, ease of maintenance, and aesthetics. Rising home renovation activity, open-concept kitchens, and higher expectations for hygiene and longevity have accelerated demand for materials such as quartz, granite, and solid surfaces. Besides, countertops are seen as a high-impact upgrade that enhances resale value, making them a preferred investment in both new construction and remodeling projects.

Europe Countertops Market Trends

The countertop industry in Europe is expected to grow at a CAGR of 6.3% from 2026 to 2033. The consumers in Europe are purchasing countertops mainly for practical reasons. Homeowners seek surfaces that are easy to clean, durable, and align with current interior design preferences. Commercial buyers prioritize durability, hygiene, and low maintenance to minimize operating costs. There is also a growing preference for responsibly sourced and environmentally compliant materials, which has supported demand for engineered surfaces and certified natural stone. Overall, functionality, reliability, and suitability for modern living and working environments are driving countertop purchases in the European market.

Asia Pacific Countertops Market Trends

The countertop industry in the Asia Pacific accounted for a share of 37.5% in 2025. Region-specific construction and usage trends drive the growth of the countertops. Large housing developments in countries such as China, India, and Indonesia are increasing demand for kitchen and bathroom countertops, especially in apartments and high-rise buildings. These homes require countertops that are durable, standardized, and easy to install. At the same time, the rapid expansion of restaurants, cafés, shopping centers, and mixed-use projects across Southeast Asia and Australia is creating steady demand for commercial countertops that can handle frequent use.

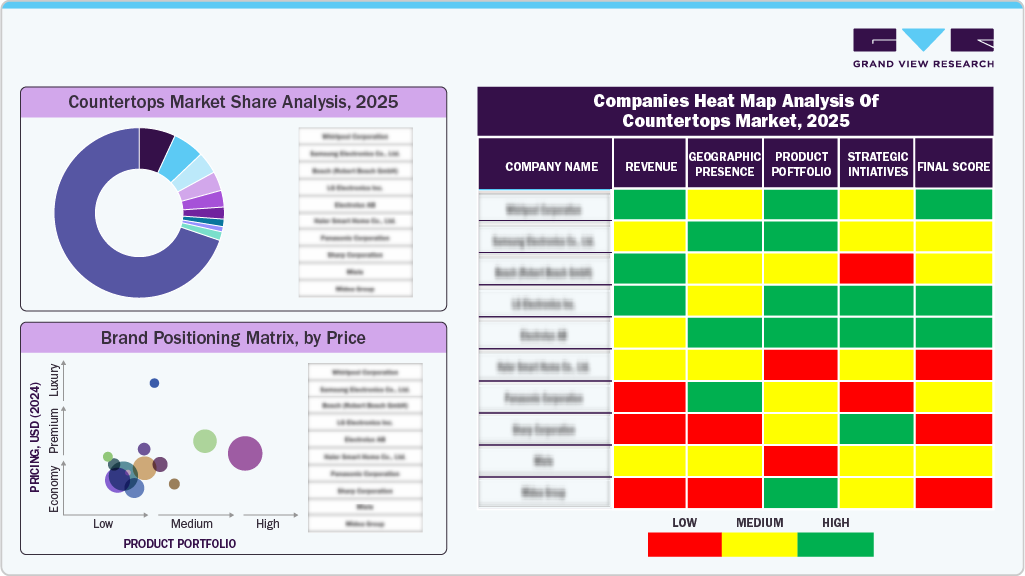

Key Countertops Company Insights

The countertops industry is characterized by intense competition, driven by a mix of established global players and regional manufacturers striving to cater to diverse consumer preferences and applications. Leading companies in the sector, such as Cosentino Group, Caesarstone, and Wilsonart, dominate through their extensive product portfolios, innovative designs, and a strong focus on sustainability. These players are heavily investing in research and development to introduce advanced materials such as engineered quartz, eco-friendly composite stones, and antimicrobial surfaces, which address evolving consumer needs for durability, hygiene, and aesthetics.

-

In December 2025, ILKEM Marble & Granite introduced a premium line of modern kitchen countertops, offering customized solutions in marble, quartz, granite, and quartzite that blend durability with high-end aesthetics for contemporary homes. The company emphasizes helping homeowners understand material properties, such as appearance, maintenance, and resistance, before choosing surfaces. It provides a guided, step-by-step installation process to ensure precise and long-lasting results.

-

In January 2024, Panasonic and Fresco expanded their partnership, announced at CES 2024, to integrate Fresco’s AI-powered cooking assistant into Panasonic’s HomeCHEF 4‑in‑1 multi-oven and app, helping home cooks customize recipes, substitute ingredients, and optimize cooking settings for healthier, easier, and more reliable meals while better using the ovens’ full capabilities.

Key Countertops Companies:

The following are the leading companies in the countertops market. These companies collectively hold the largest market share and dictate industry trends.

- Cosentino

- Levantina

- LX Hausys

- Corian

- Cambria

- LG Hausys (Viatera)

- Wilsonart

- EGGER

- Polycor

- Antolini

Countertops Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 167.92 billion

Revenue forecast in 2033

USD 267.38 billion

Growth rate

CAGR of 6.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segmentation covered

Product, end use, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Cosentino; Levantina; LX Hausys; Corian; Cambria; LG Hausys (Viatera); Wilsonart; EGGER; Polycor; Antolini

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Countertops Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global countertops market report on the basis of product, end use, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Granite

-

Solid Surface

-

Engineered Quartz

-

Laminate

-

Marble

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Kitchen

-

Bathroom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global countertops market was estimated at USD 157.74 billion in 2025 and is expected to reach USD 157.74 billion in 2026.

b. The global countertops market is expected to grow at a compound annual growth rate of 6.8% from 2026 to 2033 to reach USD 267.38 billion by 2033.

b. Countertops for residential accounted for the largest market revenue share of 72.3% 2025. The residential countertops market is steered by more home renovations and new housing projects. Homeowners are increasingly replacing existing countertops in kitchens and bathrooms with durable, low-maintenance materials.

b. Some key players operating in the countertops market include Arborite, Cambria, ARISTECH SURFACES LLC, Wilsonart LLC, Caesarstone, Formica, Cosentino SA, M S International Inc., Daltile, ROSSKOPF + PARTNER AG, and Masco Corporation.

b. Key factors driving the countertop market growth include the increasing preference for multiple bathrooms and spacious kitchens, the growing demand for engineered and natural stone in the construction of new buildings, and major countertop manufacturers concentrating on producing a variety of materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.