- Home

- »

- Medical Devices

- »

-

Covered Stent Market Size, Share & Trends Report, 2030GVR Report cover

![Covered Stent Market Size, Share & Trends Report]()

Covered Stent Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Vascular Stent, Non-vascular Stent), By End Use (Hospitals, Ambulatory Care Centers (ACS), Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-421-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Covered Stent Market Summary

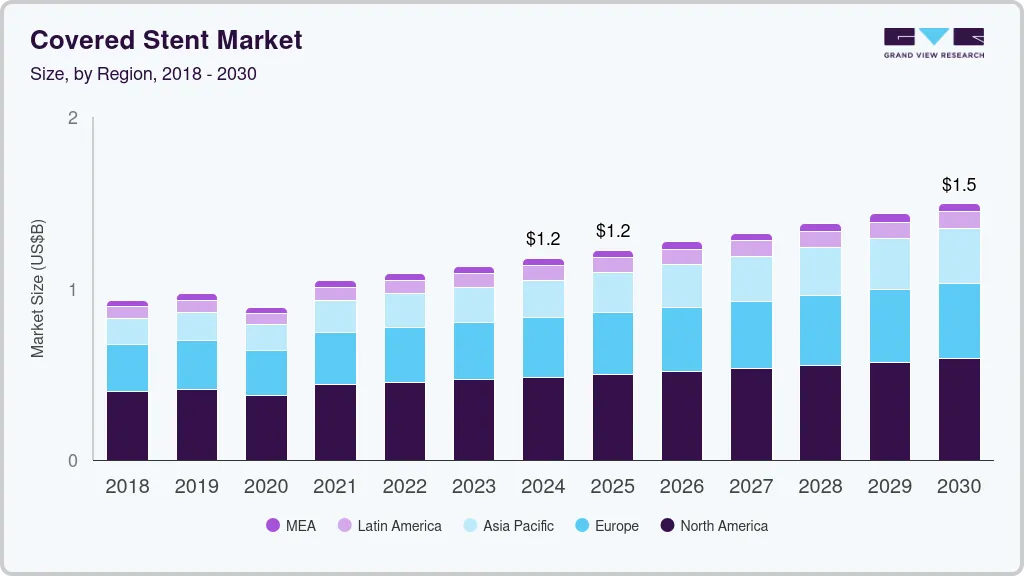

The global covered stent market size was estimated at USD 1.17 billion in 2024 and is projected to reach USD 1.50 billion by 2030, growing at a CAGR of 4.1% from 2025 to 2030. The market's growth is driven by the increasing prevalence of vascular diseases, advancements in covered stent technology, greater awareness and diagnosis, and the expanding range of applications and indications.

Key Market Trends & Insights

- North America dominated the market, with a share of 41.39% in 2023.

- The Asia Pacific region is expected to grow fastest during the forecast period 2024 to 2030.

- Based on product, the vascular stent segment held the largest share of over 64.16% in 2023.

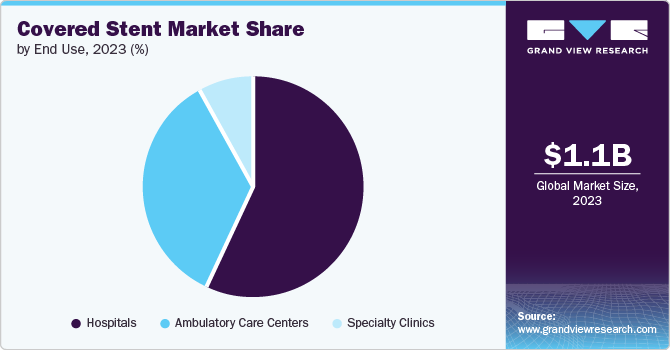

- Based on end use, the hospitals segment held the largest share of 57.35% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 1.17 Billion

- 2030 Projected Market Size: USD 1.50 Billion

- CAGR (2025-2030): 4.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

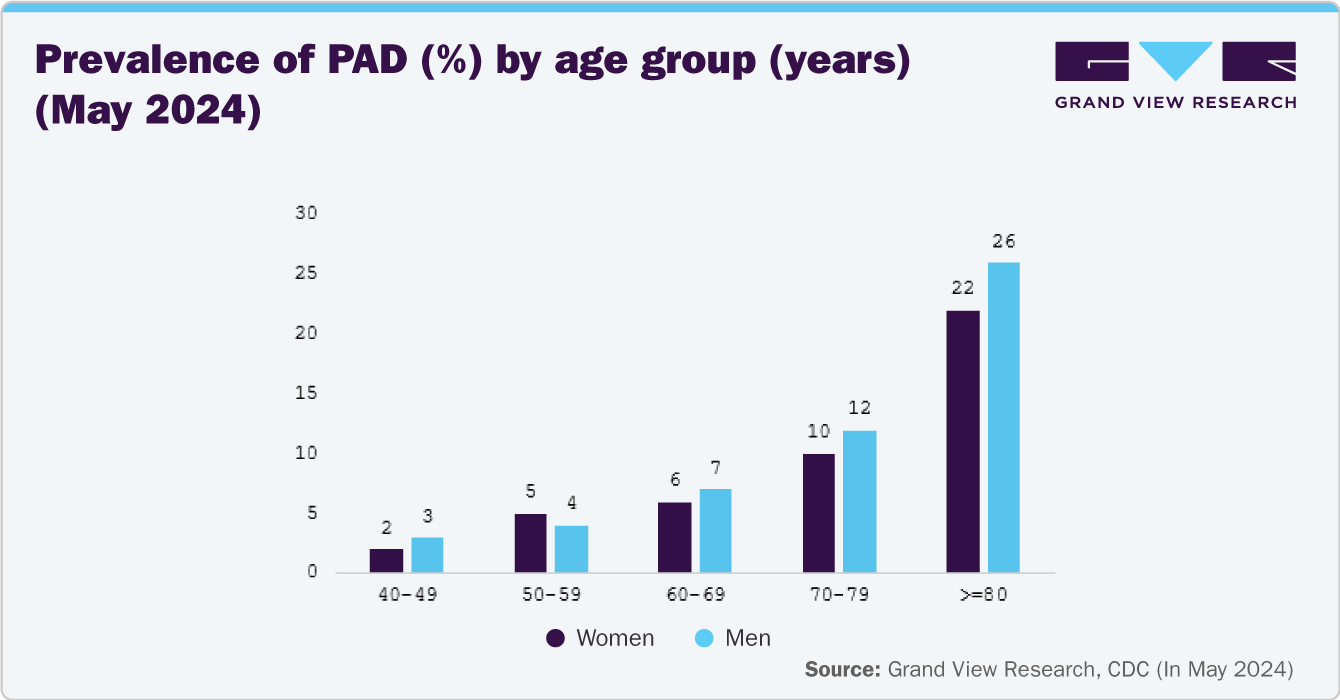

In April 2024, the American Heart Association, Inc. reported that the global prevalence of lower extremity peripheral artery disease (PAD), affecting between 116 and 230 million people, is a major factor driving the increased demand for covered stents. This high prevalence underscores the urgent need for effective vascular interventions, positioning covered stents as a critical solution for managing PAD and enhancing patient care worldwide.

Technological advancements in covered stents are propelling the market growth. A February 2023 article by MDPI highlights that covered stents are now being designed with advanced biocompatible polymers, such as polytetrafluoroethylene (PTFE). These materials serve as barriers to prevent tissue ingrowth, significantly reducing the risk of restenosis. Additionally, they are particularly effective in sealing off exposed inflammatory surfaces, which may help inhibit the development of neointimal hyperplasia.

Moreover, in November 2023, 3D printing technology is revolutionizing the creation of personalized covered stents tailored to match the unique anatomical structures of individual patients. This approach allows the production of stents with customized dimensions and mechanical properties, improving their performance and integration within the vascular system. Furthermore, the latest generations of covered stents incorporate drug-eluting capabilities, enabling localized delivery of anti-proliferative drugs to mitigate the risk of restenosis further. Ongoing research is exploring the sequential release of multiple drugs to optimize healing processes and minimize complications.

The superior efficacy of covered stents is a key driver of market growth. An article published by Elsevier Ltd. in April 2024 highlights the advantages of covered stents over bare-metal stents in treating chronic mesenteric ischemia. A study conducted across six centers in the Netherlands found that covered stents had significantly better long-term patency, with 81% maintaining primary patency at 24 months, compared to just 49% for bare-metal stents. This enhanced performance underscores the increasing preference for covered stents, fueling their adoption in vascular procedures.

Increased awareness and diagnosis are key factors driving market growth. According to a Yale School of Medicine article published in September 2023, September has been designated as National Peripheral Artery Disease (PAD) Awareness Month. This initiative aims to raise public awareness about PAD by educating people on its risk factors, symptoms, and the importance of early diagnosis. Throughout the month, various organizations conduct outreach efforts, provide educational materials, and encourage at-risk individuals to undergo vascular screenings. The primary goal is to emphasize the importance of early detection and treatment to prevent serious complications associated with PAD.

Additionally, international surveys conducted in March 2021 assessed public awareness of PAD in various countries, revealing that 57% of participants were unfamiliar with the condition, highlighting a significant knowledge gap. The surveys also identified variations in awareness between countries and across age groups, underscoring the need for targeted awareness initiatives. These findings aim to assist healthcare providers and policymakers in developing more effective educational campaigns to address the current shortcomings in PAD awareness.

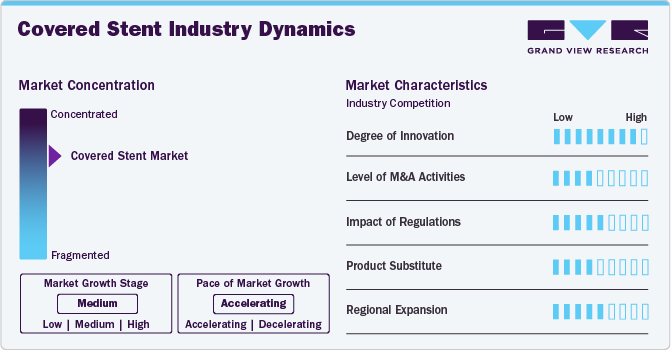

Market Concentration & Characteristics

The market is witnessing high innovation, with companies introducing stent technology and design advancements. These innovations drive improvements in stent performance, durability, and treatment outcomes. For instance, in October 2023, Getinge revealed that its iCast-covered stent system, designed for treating iliac arterial occlusive disease, is now commercially available in the U.S.

Several market players, such as Abbott Laboratories, B. Braun Melsungen AG, Biotronik SE & Co. KG, are involved in merger and acquisition activities. Through M&A activity, these companies employ key strategies such as product innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for minimally invasive cardiovascular interventions.

Regulations significantly impact the covered stent market by ensuring safety, efficacy, and quality standards. Stringent regulatory requirements can delay product approvals, affecting market entry and innovation. However, they also enhance patient confidence and device reliability, ultimately supporting the market's growth by ensuring that only safe and effective devices are available for clinical use.

Market players in the covered stent industry are broadening their reach by entering new regional markets, establishing strategic collaborations with local distributors, and customizing their products to meet the unique healthcare needs of different areas.

Product Insights

The vascular stent segment held the largest share of over 64.16% in 2023 due to ongoing product advancements, growing initiatives by key companies, product launches, and increasing product adoption. Vascular stents are commonly used in procedures to manage conditions like peripheral artery disease (PAD) and coronary artery disease (CAD). They help prevent vessel re-narrowing and support healthy blood circulation. In November 2023, Cordis announced that it had completed patient enrollment for the RADIANCY premarket clinical trial. The results from this study will contribute to the clinical evidence required for obtaining European CE Mark approval for the company's SMART Radianz vascular stent system.

The non-vascular stent segment is expected to show lucrative growth during the forecast period. Rising prevalence of CVD and peripheral artery disease and technological advancements drive the growth of the market. In September 2022, researchers at CSIR-NCL introduced a new type of self-expandable stent designed for non-vascular applications. This novel stent is cost-effective and removable, offering an innovative solution for conditions that require temporary stenting. The advancement aims to enhance patient outcomes by providing a more adaptable and affordable option for medical treatment.

End Use Insights

The hospitals segment held the largest share of 57.35% in 2023. The rising incidence of vascular diseases globally necessitates advanced solutions within hospitals to manage patient care effectively. Hospitals are increasingly becoming the central hub for placing covered stents due to their advanced infrastructure and specialized expertise in handling complex medical conditions. Equipped with cutting-edge technology and staffed by highly trained professionals, hospitals provide the ideal setting for performing sophisticated interventional cardiology and endovascular procedures.

The ambulatory care centers (ACS) segment is expected to show lucrative growth during the forecast period. This growth can be attributed to several factors, including the rising prevalence of peripheral artery disease, the rising demand for advanced diagnostic tools, and the expansion of healthcare infrastructure. The growing focus on outpatient care, driven by the need for cost-effective and efficient treatments, is enhancing the role of ambulatory care centers (ACCs) in the healthcare industry. These centers are well-positioned to accommodate the rising demand for minimally invasive procedures, including stent placements. ACCs can effectively handle stent procedures for conditions such as coronary and peripheral artery disease, contributing to the expansion of the covered stents market. According to the Journal of Vascular Surgery article published in June 2022, the study estimated that covered stents were utilized in 48.8% of procedures conducted at ambulatory or office-based centers, compared to 41.8% in inpatient hospital settings and 45.1% in outpatient hospital settings.

Regional Insights

North America dominated the market, with a share of 41.39% in 2023, owing to the rising prevalence of vascular diseases, technological advances, strategic initiatives by key players, regulatory approvals, and advanced healthcare infrastructure driving the demand for covered stents in North America.

The U.S. Covered Stent Market Trends

The U.S. accounted for the largest share of North America's market in 2023. The rising prevalence of peripheral artery diseases in the U.S. fuels the market's growth. According to a CDC article published in May 2024, In the U.S., around 6.5 million individuals aged 40 and older are affected by peripheral artery disease (PAD). This significant prevalence underscores the growing need for effective treatment options, including covered stents, to manage and improve vascular health in this population. The substantial number of PAD cases highlights the increasing demand for advanced stenting solutions to address the challenges associated with this condition, driving growth in the U.S. covered stents market.

Europe Covered Stent Market Trends

The market in Europe held the second-largest revenue market share in 2023. The high mortality rate from cardiovascular diseases boosts demand for covered stents in Europe. According to the WHO article published in May 2024, cardiovascular diseases (CVDs) are the leading cause of premature death and disability in the European Region, responsible for over 42.5% of all deaths annually.

Germany covered stent market dominated with the highest revenue share of 21.37% in 2023. The rising number of vascular diseases and technological advancements in covered stents fuel the market's growth. According to the Hogrefe. article published in October 2023, in Germany, the prevalence of peripheral artery disease (PAD) affects around 15-20% of the population, and this rate has increased over time. As the number of individuals diagnosed with PAD continues to grow, there is an increasing demand for advanced treatment options, including covered stents. This trend highlights the expanding market potential for covered stents in Germany, driven by the rising incidence of PAD and the need for effective vascular interventions.

UK covered stent market held the second-largest market share in 2023. The rise in cardiovascular disease-related deaths and the increasing number of PAD cases highlight the need for continued innovation and advancements in healthcare technology to reduce this trend effectively. According to a Guardian News & Media Limited article published in January 2024. the premature death rate from cardiovascular disease in the UK rose to 80 per 100,000 individuals in 2022. This represents a significant uptick from 2011 when the rate was 83 per 100,000.

The France covered stent market is anticipated to grow significantly during the forecast period. The rising prevalence of peripheral artery disease fuels the market growth. According to the Elsevier B.V. article published in June 2024, In France, Peripheral Artery Disease (PAD) affects up to 20% of the population. Previous estimates revealed that 12.2% of individuals with one or more cardiovascular risk factors were found to have asymptomatic PAD, as identified through ankle-brachial index assessments. This significant prevalence signals a growing demand for advanced treatment solutions, including covered stents, to better address and manage PAD nationwide.

Asia Pacific Covered Stent Market Trends

The Asia Pacific region is expected to grow fastest during the forecast period. Growing research and development (R&D) investments, a rising geriatric population, an increasing prevalence of vascular diseases, and technological advancements in covered stents are significant market expansion drivers. The increasing elderly population in the Asia Pacific region is another major factor contributing to the market growth. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, approximately 697 million individuals aged 60 years or older live in Asia and the Pacific region, constituting approximately 60% of the global older population.

China covered stent market accounted for the second largest share in the Asia Pacific region in 2023. The growing burden of peripheral artery disease in China fuels the demand for covered stent solutions. According to the NCBI article published in August 2023, over the past three decades, China has made significant strides in improving the accessibility and quality of medical care, now leading among middle-income countries. The nation's cardiovascular technologies are among the most advanced globally, and substantial progress has been made in addressing the "treatment difficulty" associated with cardiovascular diseases (CVD).In China, about 45.3 million individuals are affected by peripheral artery disease (PAD), highlighting an ongoing need for effective treatment solutions, including covered stents.

Japan covered stent market holds the largest market share in Asia. The rising geriatric population, which is more susceptible to CVD cases, increasing cardiac surgery patients, and technological advancements drive the growth of the market.

The India covered stent market is experiencing significant growth, driven by growing awareness of advanced cardiac care options, increasing incidence of cardiovascular disorders, rising prevalence of peripheral artery disease, expanding healthcare infrastructure and technological advancements. The increasing CVD burden in India is driving the market. According to the Economic Times article published in February 2024,the study indicates that India is experiencing a considerable cardiovascular disease (CVD) burden, with an age-standardized death rate of 272 per 100,000 people. This figure exceeds the global average of 235 per 100,000, highlighting a notably higher prevalence of CVD within the country.

Moreover, in August 2023, In India, peripheral artery disease (PAD) affects between 7.6% and 26.7% of the population. Although PAD is a significant atherosclerotic cardiovascular disease (ASCVD) comparable to coronary artery disease (CAD), it frequently receives less attention. This oversight is largely due to insufficient awareness among both the general population and healthcare providers. The lack of awareness about PAD highlights the need for improved educational efforts and effective treatment options, such as covered stents, to address this critical health concern.

Latin America Covered Stent Market Trends

Latin American market is growing due to several factors. Growing investments by key companies in the arrhythmia market, such as Medtronic, and Boston Scientific, and supportive regulations are among the key factors expected to contribute to market growth in Latin America over the forecast period.

Brazil covered stent market is expanding due to several distinct growth drivers. Rising healthcare expenditure and government initiatives aimed at improving cardiac care infrastructure. For instance, in September 2023, the Brazilian government and various institutions launched initiatives to enhance care and outcomes for cardiovascular disease (CVD) patients. An important example includes Mount Sinai's collaboration with the Brazilian Clinical Research Institute to advance cardiovascular disease research and medical education. These efforts reflect a concerted push towards improving healthcare standards, fostering innovation, and expanding knowledge in managing CVD within Brazil.

MEA Covered Stent Market Trends

MEA market is expected to grow at the lucrative growth. The rising prevalence of CVDs and the increasing adoption of advanced medical technologies in the region.

The Saudi Arabia covered stent market is growing significantly over the forecast period. Increasing peripheral artery disease cases, rising healthcare expenditures, and strategic initiatives by key players contribute to the market expansion. For instance, in May 2024, a recent study conducted in Saudi Arabia found that the prevalence of peripheral artery disease (PAD) was 11.7% among 471 patients.The high prevalence rate, especially in specific age groups, indicates an increased need for advanced treatment options like covered stents to manage and address PAD effectively.

Key Covered Stent Company Insights

Some of the key players operating in the industry include Medtronic and Boston Scientific Corporation. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences.

Key Covered Stent Companies:

The following are the leading companies in the covered stent market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Medtronic

- W. L. Gore & Associates, Inc.

- Cook

- Terumo Corporation

- B. Braun Interventional Systems, Inc.

- BD

- Getinge

- Biotronik

Recent Developments

-

In April 2024, Getinge entered into a commercial distribution agreement with Cook Medical to introduce the iCast Covered Stent System in the U.S.

-

In March 2024,Becton, Dickinson, and Company (BD) announced the enrollment of its initial patient in the Agility study. This clinical trial is designed to evaluate the safety and efficacy of the BD Vascular Covered Stent for treating peripheral arterial disease (PAD). The first patient was enrolled at Trinity Medical Center in Bettendorf, Iowa.

-

In January 2024, W. L. Gore & Associates, Inc. recently secured FDA approval for a more streamlined version of their GORE VIABAHN VBX Balloon Expandable Endoprosthesis (VBX Stent Graft). This advancement reflects their dedication to improving treatment options for patients with complex vascular diseases.

Covered Stent Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2030

USD 1.50 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Abbott Laboratories; GE HealthCare; iRhythm Technologies, Inc.; Medtronic; Koninklijke Philips N.V.; Spacelabs Healthcare (OSI Systems, Inc.); Fukuda Denshi Co., Ltd.; Boston Scientific Corporation; Nihon Kohden Corporation; Baxter; Zoll Medical Corporation (Asahi Kasei Corporation); Biotronik.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Covered Stent Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global covered stent market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vascular Stent

-

Non-vascular Stent

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers (ACS)

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global covered stent market size was estimated at USD 1.13 billion in 2023 and is expected to reach USD 1.17 billion in 2024.

b. The global covered stent market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 1.50 billion by 2030.

b. North America dominated the covered stent market with a share of 41.39% in 2023. This is attributable to the growth in R&D investments by the market participants and FDA approvals for covered stents.

b. Some of the key players operating in the market are Boston Scientific Corporation, Medtronic, W. L. Gore & Associates, Inc., Cook, Terumo Corporation, B. Braun Interventional Systems, Inc., BD, Getinge, Biotronik.

b. The key factors driving the covered stents market include the rising prevalence of vascular diseases, technological advancements in stent design, and increasing awareness and early diagnosis of conditions requiring vascular intervention.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.