- Home

- »

- Clinical Diagnostics

- »

-

COVID-19 Antigen Test Market Size, Industry Report, 2030GVR Report cover

![COVID-19 Antigen Test Market Size, Share & Trends Report]()

COVID-19 Antigen Test Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Service (Reagents & Kits, Platforms, Services), By End-use (Home Care, Diagnostic Labs), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-389-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2020 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

COVID-19 Antigen Test Market Size & Trends

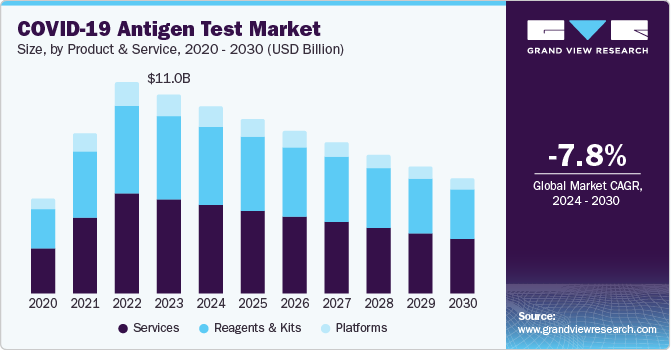

The global COVID-19 antigen test market size was valued at USD 11.01 billion in 2023 and is expected to decline at a CAGR of -7.8% from 2024 to 2030. As the pandemic continues to evolve, with new variants emerging and fluctuating case numbers, there is a pressing need for quick and efficient testing methods. Antigen tests provide results within 15 to 30 minutes, significantly faster than traditional PCR tests, which can take several hours to days. This speed is crucial for timely decision-making in clinical settings, workplaces, and public health responses.

Numerous antigen diagnostic tests have received Emergency Use Authorization (EUA) from agencies such as the U.S. Food and Drug Administration (FDA) and organizations worldwide. These approvals have encouraged manufacturers to innovate and expand their product offerings. Antigen tests are generally less expensive to produce and purchase, making them accessible for widespread use, particularly in low-resource settings or countries with underdeveloped healthcare systems. This affordability allows governments and organizations to implement mass testing strategies without straining financial resources.

The growing trend towards point-of-care (POC) testing proliferates the market. POC testing allows for immediate results at various locations outside traditional laboratory settings, including clinics, pharmacies, and even homes. This shift aligns with public health goals of increasing accessibility to testing services while reducing pressure on healthcare facilities during surges in COVID-19 cases. The convenience offered by self-administered home tests has also contributed to their popularity among consumers seeking quick results without professional assistance.

Product & Service Insights

Services dominated the market and accounted for a market revenue share of 47.3% in 2023. This can be attributed to the widespread utilization of rapid antigen tests at various end-use settings such as clinical laboratories, hospitals, and home care. With the growing need to curb the COVID-19 virus, various service providers started offering rapid antigen testing services. For instance, Boots Company PLC offers an in-store COVID-19 rapid antigen testing service in the U.K. This service is available for adults and children above five years old and delivers quick results required for reassurance. In addition, several CLIA-certified laboratories, such as Accel Diagnostics, offer these services to support segment growth.

Reagents & kits are expected to decline at a compounded annual rate of 7.3% during the forecast period. The use of antigen test kits has extended to workplaces, schools, and public events as part of routine screening programs. This broader application has amplified the demand for high-quality reagents and kits as organizations seek to maintain safety and continuity while minimizing disruptions caused by the virus. The flexibility and ease of antigen tests make them attractive for large-scale and frequent testing scenarios.

End-use insights

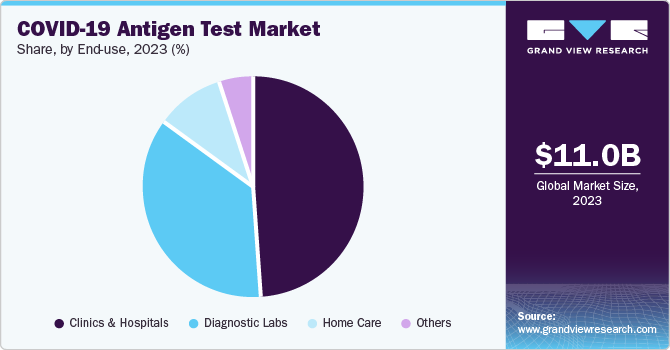

Clinics & hospitals accounted for the largest market revenue share in 2023. As healthcare systems worldwide grappled with the COVID-19 pandemic, tests were urgently needed to deliver results quickly to facilitate timely decision-making regarding patient care and public health measures. Clinics and hospitals became pivotal in administering these tests, as they are often the first point of contact for individuals seeking medical attention. The ability to provide immediate results not only aids in diagnosing COVID-19 but also helps manage resources effectively, enhancing patient throughput and overall operational efficiency.

Home care is expected to register a significant decline during the forecast period. As individuals sought to minimize exposure to the virus, there was a marked shift towards self-testing options that could be conducted in the comfort of one’s home. This trend was fueled by government initiatives and public health campaigns promoting self-testing to control outbreaks and facilitate quicker diagnosis. The convenience and privacy associated with home testing have made it an attractive option for many consumers, leading to a surge in demand for COVID-19 antigen tests designed for home use.

Regional Insights

North America COVID-19 antigen test market held a substantial market revenue share in 2023. Frequent and efficient testing has become a key strategy as organizations and educational institutions in the region reopen and resume normal operations. Antigen tests, with their ease of use and quick results, are ideal for implementing routine screening programs. This increased adoption in non-healthcare settings has significantly expanded the market as more entities seek to integrate regular testing into their safety protocols.

U.S. COVID-19 Antigen Test Market Trends

The U.S. COVID-19 antigen test market dominated the North America market in 2023. Through initiatives such as the CARES Act and various funding programs, the U.S. government has allocated resources to procure and distribute testing kits widely. Public health campaigns and media coverage have emphasized the importance of regular testing and the advantages of antigen tests, such as rapid results and affordability. As individuals and organizations become more informed about the role of testing in controlling the virus, demand for antigen tests has surged. This heightened awareness has driven both consumer and institutional uptake, further bolstering the antigen test market in the U.S.

Europe COVID-19 Antigen Test Market Trends

Europe COVID-19 antigen test market is expected to decline significantly during the forecast period. The varying severity of COVID-19 waves across European countries has created a continuous demand for effective testing solutions. As nations experienced surges in cases, rapid and accessible testing became imperative to manage outbreaks and protect public health. Antigen tests, known for their quick turnaround times, have been crucial in providing timely results, thus supporting efforts to control the virus's spread and driving market expansion.

The UK COVID-19 antigen test market is accounted for a significant market revenue share in 2023. The UK government launched several initiatives to scale testing capacity, including developing the National Testing Programme. This program involved extensive procurement and distribution of antigen tests to various sectors, including healthcare, schools, and workplaces. The government’s financial backing and strategic focus on enhancing testing infrastructure have significantly boosted the availability and accessibility of antigen tests nationwide.

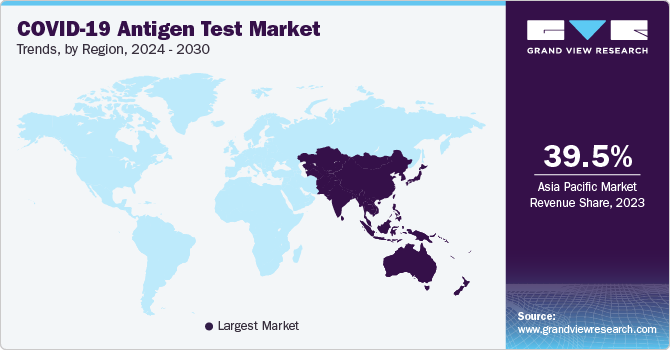

Asia Pacific COVID-19 Antigen Test Market Trends

Asia Pacific COVID-19 antigen test market accounted for the largest market revenue share of 39.5% in 2023. The presence of home-grown key players, actively developing SARS-CoV-2 antigen tests, and introducing several new products by emerging start-ups have contributed to the region's dominance. For instance, in May 2021, Pune-based Mylab Discovery Solutions Ltd. received approval from the Indian Council of Medical Research (ICMR) for its rapid antigen test kit. This kit delivers results within 15 minutes. Furthermore, in February 2021, the Ministry of Health, Indonesia announced using rapid antigen tests to screen SARS-CoV-2 infections. Such initiatives are expected to accelerate the usage of antigen tests in Asia Pacific.

India COVID-19 antigen test market held a substantial market revenue share in 2023. India’s healthcare infrastructure has seen substantial investments to enhance its capacity to deal with infectious diseases such as COVID-19. This includes upgrading laboratories and diagnostic centers with advanced technologies capable of efficiently conducting antigen tests. Expanding healthcare facilities in urban and rural areas ensures more people have access to rapid testing services.

Key COVID-19 Antigen Test Company Insights

Some of the key companies in the antigen test market include Abbott, Mylab Discovery Solutions Pvt. Ltd , SD Biosensor Inc., and others.

-

Abbott developed the BinaxNOW COVID-19 Ag Card, an antigen test designed to detect the SARS-CoV-2 virus rapidly. This test provides results in as little as 15 minutes and is intended for use in various settings, including schools, workplaces, and healthcare facilities. The BinaxNOW test utilizes a simple nasal swab sample. It employs lateral flow technology to detect specific proteins associated with the virus, making it a user-friendly option that does not require specialized laboratory equipment.

-

SD Biosensor Inc. offers COVID-19 antigen tests that utilize advanced technology to ensure accurate detection while maintaining user-friendliness. This rapid testing capability is essential for timely decision-making in various environments, including hospitals, schools, and workplaces. Additionally, SD Biosensor has been proactive in obtaining regulatory approvals across different regions to ensure its products meet safety and efficacy standards, reinforcing its commitment to public health during the pandemic.

Key COVID-19 Antigen Test Companies:

The following are the leading companies in the COVID-19 antigen test market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- SD Biosensor Inc.

- Mylab Discovery Solutions Pvt. Ltd

- GenBody Inc.

- F. Hoffmann-La Roche AG

- Access Bio., Inc.

- ADS biotech Inc.

- PerkinElmer, Inc.

- Princeton BioMeditech Corporation

- Becton, Dickinson, and Company

Recent Developments

-

In March 2023, the South African Medical Research Council (SAMRC) launched its first antigen self-test kit with the help of a mobile application, HealthPulse TestNow. This application is designed to empower individuals to test themselves for the virus conveniently at home. This initiative aims to enhance testing accessibility and encourage more people to monitor their health status regularly.

-

In July 2021, Abbott launched its Panbio COVID-19 Antigen Self-Test in India. This self-test facilitates easy and accessible COVID-19 testing for individuals at home, workplaces, and clinics. It aims to empower users to conduct tests conveniently, thus supporting timely diagnosis and reducing the burden on healthcare facilities.

COVID-19 Antigen Test Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.34 billion

Revenue forecast in 2030

USD 6.37 billion

Growth rate

CAGR of -7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2020 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Abbott; SD Biosensor Inc.; Mylab Discovery Solutions Pvt. Ltd; GenBody Inc.; F. Hoffmann-La Roche AG; Access Bio., Inc.; ADS biotech Inc.; PerkinElmer, Inc.; Princeton BioMeditech Corporation; Becton, Dickinson, and Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

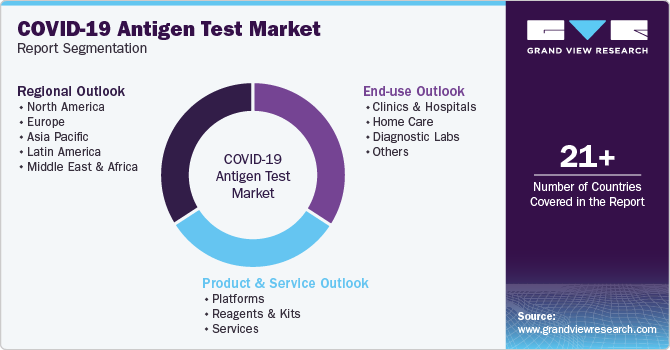

Global COVID-19 Antigen Test Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the global COVID-19 antigen test market report based on product and service, end-use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Platforms

-

Reagents & Kits

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics & Hospitals

-

Home Care

-

Diagnostic Labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The clinics and hospitals segment dominated the market for COVID-19 antigen tests and accounted for the largest revenue share of 49.3% in 2020.

b. Asia Pacific dominated the market for COVID-19 antigen tests and accounted for the largest revenue share of 37.0% in 2020.

b. The global COVID-19 antigen tests market size was estimated at USD 5.3 billion in 2020 and is expected to reach USD 8.8 billion in 2021.

b. The global COVID-19 antigen tests market is expected to grow at a compound annual growth rate of 6.7% from 2021 to 2027 to reach USD 8.3 billion by 2027.

b. The services segment dominated the market for COVID-19 antigen tests and accounted for the largest revenue share of 49% in 2020.

b. Some key players operating in the COVID-19 antigen tests market include Abbott, SD Biosensor, Mylab Discovery Solutions Pvt Ltd, Quidel Corporation, Laboratory Corporation Of America, PerkinElmer, F. Hoffmann-La Roche AG, and Becton, Dickinson and Company.

b. Key factors driving the COVID-19 antigen tests market growth include a rise in product approvals by regulatory bodies, rising cases coupled with the emergence of novel COVID-19 strains, and the key role of COVID tests in vaccine R&D and a paradigm shift towards Point-of-Care (POC) testing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.